Context:

Recently, the Parliament has passed the Mines and Minerals (Development and Regulation) Amendment Bill, 2023 to amend the Mines and Minerals (Development and Regulation) Act, 1957.

| PYQ:

Q. “In spite of adverse environmental impact, coal mining is still inevitable for development”. Discuss. (2017) |

Key Features of Mines and Minerals (Development and Regulation) Amendment Bill, 2023:

| Provision |

Mines and Minerals (Development and Regulation) Act, 1957 |

Mines and Minerals (Development and Regulation) Amendment Bill, 2023 |

| Exploration License for Specified Minerals: |

- The exploration license will be issued for 29 minerals specified in the Seventh Schedule which include gold, silver, copper, cobalt, nickel, lead, potash, and rock phosphate.

- It classifies the following minerals as atomic minerals:

- Beryl and beryllium

- Lithium

- Niobium

- Titanium

- Tantallium

- Zirconium.

|

- The Bill declassifies beryl and beryllium, (ii) lithium, (iii) niobium, (iv) titanium, (v) tantallium, and (vi) zirconium minerals from the category of atomic minerals.

- Upon removal of these minerals from the list of atomic minerals, exploration and mining of these minerals will be open to the private sector.

|

| Validity of exploration License: |

____ |

- The exploration license will be issued for five years.

|

| Auction of Certain minerals by the Central Government: |

- Under the Act, auction of concessions is undertaken by the state governments, except in certain specified cases.

|

- The Bill adds that auction for composite licence and mining lease for specified critical and strategic minerals will be conducted by the central government.

- These minerals include lithium, cobalt, nickel, phosphate, potash, tin, phosphate, and potash.

|

| Maximum area in which activities are Permitted: |

- Under the Act, a prospecting licence allows activities in an area up to 25 square kilometres, and a single reconnaissance permit allows activities in an area up to 5,000 square kilometers.

|

- The Bill allows activities under a single exploration license in an area up to 1,000 square kilometers.

|

| Incentive for exploration licencee: |

__ |

If the resources are proven after exploration, the state government must conduct an auction for mining lease within six months of the submission of the report by the exploration licencee. The licencee will receive a share in the auction value of the mining lease for the mineral prospected by them. |

Why did the need arise to amend the Mines and Minerals (Development and Regulation) Act, 1957?

- Enhance Private Sector Participation: The new Bill seeks to bring exploration processes in India at par with that of developed countries by getting private sector capacity into exploration.

- For Example: In Australia, private mining firms called junior explorers, engage in risk-taking by putting their expertise and limited financials into explorations to find potential mines and accelerate the pace of exploration.

Issues with the Bill’s proposals:

- Lack of Clarity: The explorer would not know how much revenue they will receive as the auction premium would be known only when a mine is successfully auctioned.

- Revenue Generation for Private Exploration Companies: The primary way of generating revenue for a private company that has an exploration license would be a share of the premium paid by the miner, which would come only after a successfully discovered mine is auctioned and operationalised.

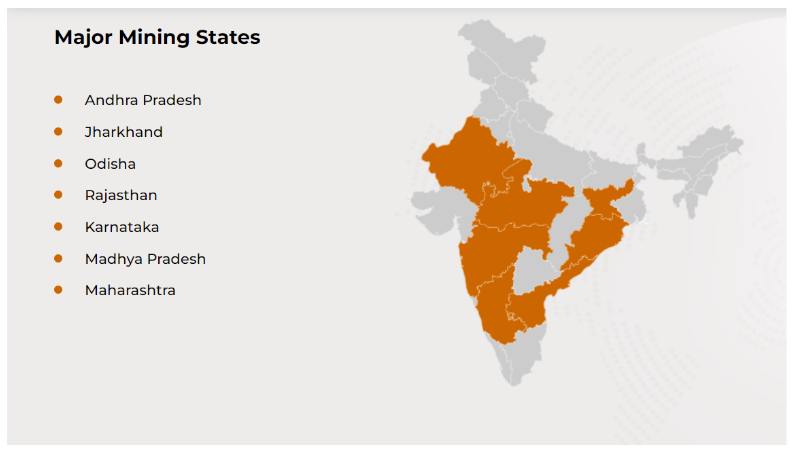

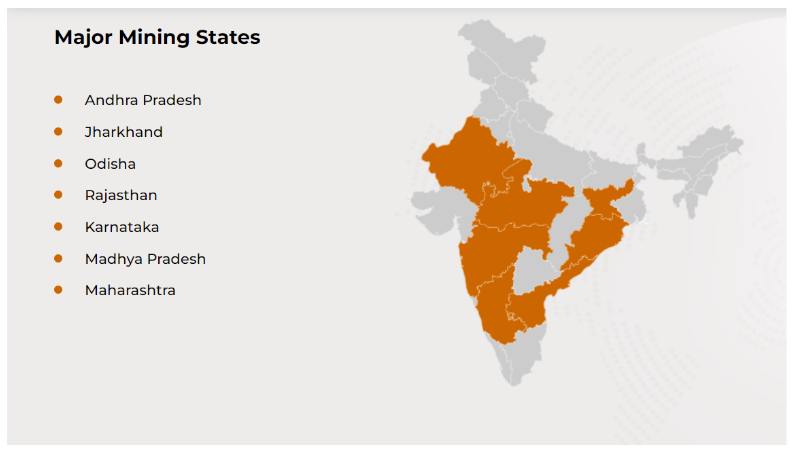

Mining Sector in India:

- Number of Mines: As of FY22, the number of reporting mines in India were estimated at 1,425, of which reporting mines for metallic minerals were estimated at 525 and non-metallic minerals at 720.

- Increase in Mining GDP: As per data from the Ministry of Statistics and Programme Implementation (MOSPI), India’s mining GDP increased from Rs. 739.90 billion (US$ 8.98 billion) in the fourth quarter of 2020 to Rs. 913.03 billion (US$ 11.09 billion) in the first quarter of 2021.

- Production of Various Minerals:

- Iron ore:India’s iron ore production stood at 250 MT in FY22, an increase of 23% compared with 204 MT in FY21.India ranks fourth globally in terms of iron ore production.

- Coal:India’s overall coal production has seen a quantum jump to 893.08 MT in FY23 as compared to 728.72 MT in FY19 with a growth of about 22.6%.

- Steel: India’s crude steel production stood at 71.3 MT in FY23

Image Credits:ibef

Image Credits:ibef

Government Initiatives:

- National Mineral Exploration Policy: It aims at making available geoscientific data of world standards in the public domain.

- The Mines and Mineral Development and Regulation Act (MMDR): It was amended in 2015 and then in 2016 to make the process of allocation of mineral blocks more transparent and competitive through auction.

- Mineral Conservation and Development (Amendment) Rules 2021: These rules are regarding conservation of minerals, systematic and scientific mining, and development of minerals in the country for environment protection.

- Production Linked Scheme: In 2022, PLI Scheme for domestic production of specialty steel has been approved with an outlay of Rs.6,322 crore (US$ 762.4 million) by the Cabinet.

- District Mineral Foundation (DMF): It has been established in 622 districts of 23 States and a total of Rs. 71,128.71 Crore (US$ 8.5 billion) has been collected till October 2022.

- At least 60 percent of the DMF funds are earmarked for high-priority areas, including: drinking water supply, environment preservation and pollution control measures, healthcare, education.

Challenges:

- Lack of Advanced Technology: Deep seated resources or minerals located in eco-sensitive areas have not been considered for mining due to lack of advanced and eco-sensitive technology.

- For example, the Jharia coal block, which has large coking coal resources that can help meet steel industry coking coal demand, is un-utilised due to the ongoing fire.

- Red Tapism: Long clearance time for different licenses and limitations like captive use also hamper mining output.

- For example, in India it takes 4+ years to get a mining lease, compared to less than a year for other major mining countries such as Brazil, Chile, the US and Canada.

- Global Market Fluctuations: The mining sector is influenced by global market demand and prices, making it susceptible to economic fluctuations and geopolitical events.

- Infrastructure Challenges: Many mining areas lack basic infrastructure such as electricity, water supply, and healthcare, affecting the quality of life for local communities.

- Skill Shortages: There is a shortage of skilled workforce in the mining sector, which impacts the efficiency and safety of operations.

- Social Issues: Mining areas may experience social issues such as labor disputes, inadequate working conditions, and conflicts with local communities over resource access and benefits.

Way Forward:

- Addressing the Skilled Labour Gap: Proactively address the mining skilled labor gap by augmenting capacity in educational institutions and partnering with industry, HRD ministry or the National Skill Development Council.

- Adherence to Laws: Mining companies need to understand the economic value of the resource and avoid any wastage of valuable minerals. It is critical to ensure that all the rules from exploration stage to mine closure stage are followed.

- Consistent Policy: For restoring investor confidence, the government should ensure that no retrospective changes are made in the policy of allotment, taxation and general administration.

- Collaboration with Stakeholders: Foster collaboration among government, industry, academia, and local communities to ensure holistic development and responsible mining practices.

- Community Engagement: Prioritize local community involvement, ensuring fair compensation, employment opportunities, and sustainable development in mining regions.

- Adoption of Sustainable Practices: Emphasize environmentally friendly mining practices, ensuring minimal ecological impact and proper land reclamation after mining activities.

News Source: The Hindu

![]() 8 Aug 2023

8 Aug 2023

Image Credits:ibef

Image Credits:ibef