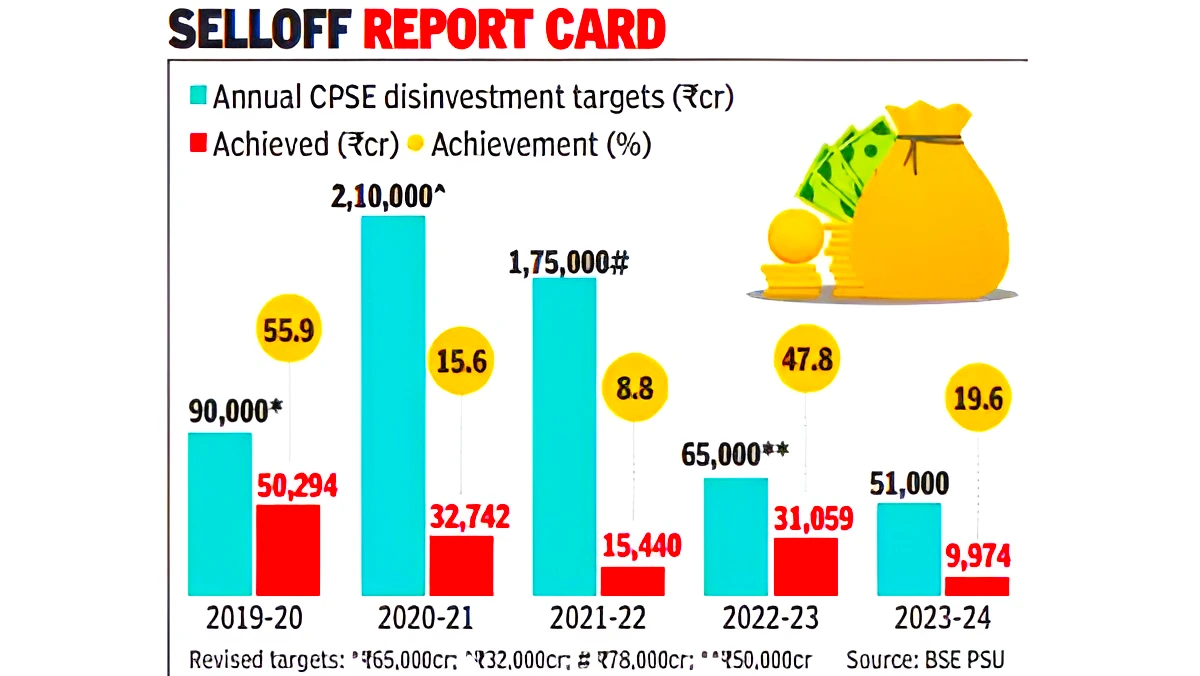

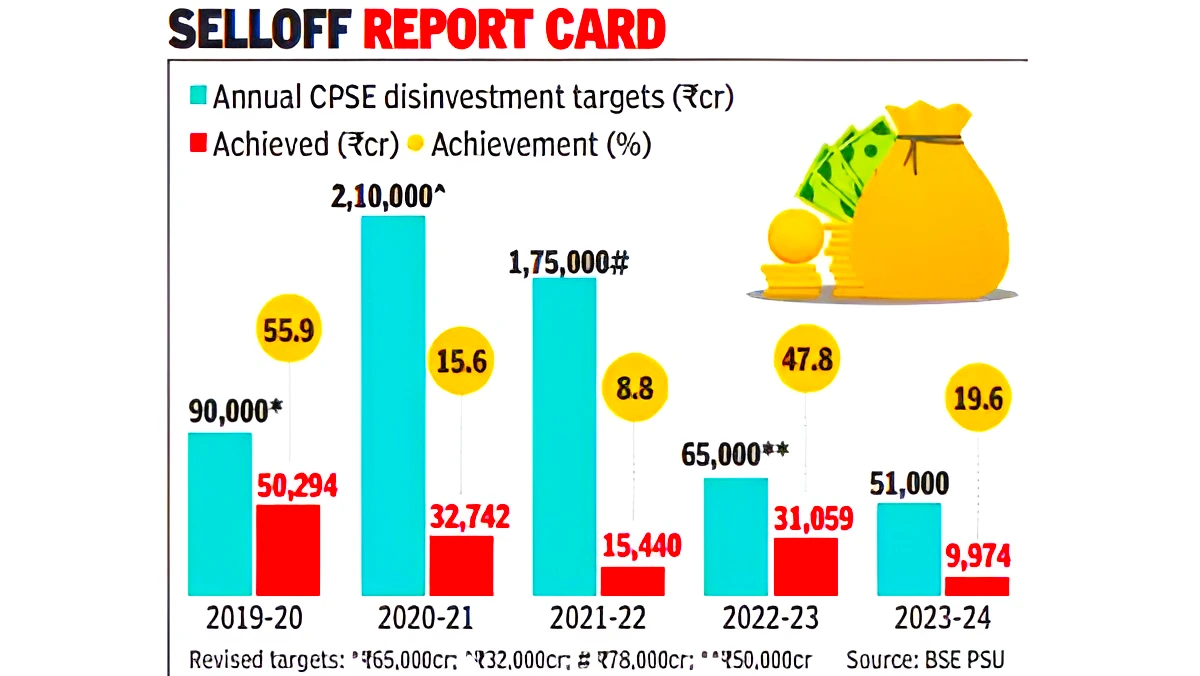

Context: Experts are predicting that the disinvestment target for the current fiscal year is again likely to be missed due to the upcoming General Elections.

India’s Disinvestment Targets

- Union Budget 2023-24 had set a target of Rs 51,000 crore from disinvestment. Of this, only about 20% or ₹10,049 crore has been collected.

Most of the collection this financial year has been through minority stake sales via IPO (Initial Public Offering) and OFS (Offer For Sale).

Most of the collection this financial year has been through minority stake sales via IPO (Initial Public Offering) and OFS (Offer For Sale).- Big Privatization plans have not taken off in this Fiscal Year.

- Privatization Targets Failing:

- Privatization plans like Bharat Petroleum Corporation Ltd (BPCL), Shipping Corporation of India (SCI) and CONCOR have been delayed, because of the upcoming elections.

- The government has canceled the privatization of Pawan Hans due to several legal cases.

- Strategic sales of a number of Central Public Sector Enterprises (CPSEs), including NMDC Steel Ltd, BEML and IDBI Bank, are in the pipeline.

- Delay Despite Approval:

- IDBI Bank: The bidding process started in Jan 2023, but the bidders are yet to get the required approval from the Government and RBI.

- Other Cases: Rashtriya Ispat Nigam Limited (RINL), Container Corporation of India (CONCOR) and subsidiaries of AI Asset Holding Ltd (AIAHL), which have ‘in principle‘ approval by Cabinet have not been taken up by DIPAM.

- Challenges:

- Employee Union: In the strategic sale of Rashtriya Ispat Nigam Ltd (RINL) and Vizag Steel, employee unions have opposed the move.

- Global Slowdown: Factors like extended regulatory processes, global economic volatility, political opposition and shifting government priorities have delayed the process.

- Trends in Raising Money:

- Minority Stake Sales: Out of the around ₹4.20 lakh crore raised in the last 10 years from disinvestments, ₹3.15 lakh crore was realised from minority stake sales

- Strategic Sale: Rs 69,412 crore came from strategic transactions in 10 CPSEs— HPCL, REC, DCIL, HSCC, NPCC, NEEPCO, THDC, Kamarajar Port, Air India and NINL.

- Other Sources: With direct tax and GST collections remaining buoyant, the focus has been less intense on privatization.

- Impact on Economy: Experts say that as long as the government is meeting its fiscal targets and there isn’t a shortfall, missing divestment targets is fine.

What is Disinvestment?

- Definition: Disinvestment is the action of the government of selling or liquidating an asset or subsidiary like a Public Sector Company.

- Meaning: Disinvestment means the sale of Government Assets to generate financial resources and improve the Returns on Investment (RoI).

- The three basic methods of disinvestment are:

- Majority Disinvestment: Government transfers the control and management to the private company while holding on to a portion of the company. Eg the sale of Modern Foods to Hindustan Lever, BALCO to Sterlite.

- Minority Disinvestment: Here the government keeps a majority stake in the business (typically more than 51%) ensuring managerial control. Eg- Power Grid Corp. of India Ltd., Rural Electrification Corp. Ltd., NTPC Ltd., NHPC Ltd.

- Complete Privatization: The private company receives complete ownership of the business. Eg- 8 hotel properties of ITDC and 3 hotel properties of HCI.

Policy for Strategic Disinvestment

Two-fold classification of economic sectors, to guide the policy for Disinvestment:

- Strategic Sector: Bare minimum presence of the public sector in these sectors to anchor these strategic sectors. Following 4 sectors to come under it :

- Atomic energy, Space and Defence

- Transport and Telecommunications

- Power, Petroleum, Coal and other minerals

- Banking, Insurance and financial services

- Non- Strategic Sector : In this sector, CPSEs will be privatized or merged with other players.

Must Read: Viksit Bharat @2047: Voice Of Youth Workshop

Source: The Hindu

![]() 26 Dec 2023

26 Dec 2023

Most of the collection this financial year has been through minority stake sales via IPO (Initial Public Offering) and OFS (Offer For Sale).

Most of the collection this financial year has been through minority stake sales via IPO (Initial Public Offering) and OFS (Offer For Sale).