Answer:

| Approach:

Introduction

- Briefly introduce the concept of microfinancing for women SHGs.

Body

- Discuss its potential role in breaking the vicious cycle of gender inequality, poverty, and malnutrition.

Conclusion

- Write a relevant conclusion.

|

Introduction:

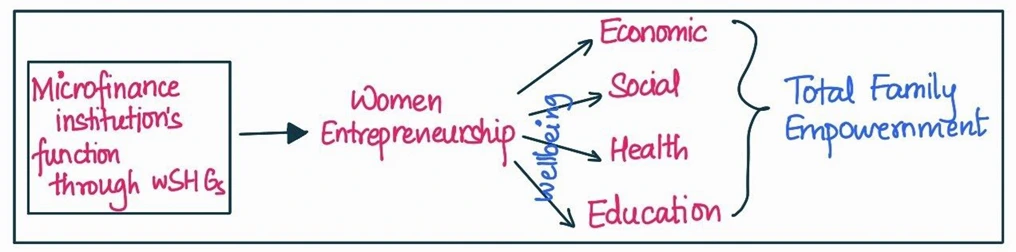

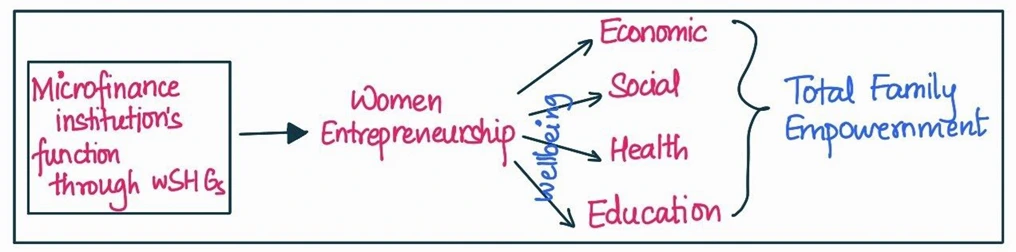

Microfinancing of women Self-Help Groups (SHGs) has emerged as a powerful tool for empowering women and addressing various socio-economic challenges, such as gender inequality, poverty, and malnutrition. By providing women with access to financial resources and promoting economic independence, microfinancing can play a significant role in breaking the vicious cycle.

Body:

- Microfinance and Breaking the Cycle of Poverty:

- A prominent example in India is the Bandhan Bank, which started as a microfinance institution providing small loans to poor women. Bandhan, meaning ‘bond’, has been particularly successful in rural and semi-urban areas of Eastern and North Eastern India.

- With access to microcredit, women have been able to engage in income-generating activities, ranging from small scale farming to setting up micro-enterprises.

- This increased access to financial resources has enabled them to better support their families, invest in their children’s education, and seek necessary healthcare services.

- Thus, Bandhan’s microfinance initiatives have played a significant role in breaking the cycle of poverty in these regions.

- Microfinance and Tackling Malnutrition:

- In the Indian context, the Tamil Nadu Women’s Development Project, also known as the Mahalir Thittam, is an example of how microfinance can indirectly influence nutritional outcomes.

- This project, initiated in 1989, included the formation of women’s SHGs, which were provided with microcredit to start small businesses.

- Alongside the provision of microcredit, the program also included training sessions on various aspects of health and nutrition.

- With an improved financial status and enhanced understanding of nutrition, women in these SHGs have been able to make better nutritional choices for their households, thereby helping in tackling the problem of malnutrition.

- Economic empowerment: Microfinancing enables women to access credit and other financial services, allowing them to start or expand income-generating activities.

- Decision-making and gender equality: As women become economically independent through microfinancing, they often gain more decision-making power within their households and communities. This can lead to a shift in traditional gender roles and contribute to greater gender equality.

- Example: SEWA (Self-Employed Women’s Association) in India has empowered women through microfinancing, leading to increased participation in household and community decision-making.

- Improved access to education and healthcare: With increased income and decision-making power, women are more likely to invest in their family’s education and healthcare, contributing to better overall well-being and breaking the cycle of malnutrition.

- Example: Studies have shown that women who participate in SHGs with access to microfinance are more likely to send their children to school and seek timely medical care.

- Social empowerment and networking: Women SHGs create a platform for members to come together, share experiences, and support each other. This social empowerment and networking can lead to collective action against social issues such as gender discrimination, domestic violence, and child marriage, further breaking the cycle of gender inequality.

- Example: The Kudumbashree program in Kerala, India, has successfully used microfinancing for women SHGs to address various social issues and promote women’s empowerment.

- Multiplier effect: The economic and social empowerment of women through microfinancing can have a multiplier effect on the community, as women are more likely to reinvest their income in their family’s well-being, leading to reduced poverty and improved health and nutrition.

- Example: Research has shown that in countries where microfinance initiatives target women, there is a noticeable improvement in the overall socio-economic conditions of the community.

Conclusion:

Through the successful implementation of microfinancing programs, such as the Grameen Bank, SEWA, and Kudumbashree, women have been able to overcome barriers and transform their lives and communities, demonstrating the transformative power of microfinancing in addressing these complex socio-economic challenges.