Context:

India has flagged concerns relating to confidential trade data of its exporters getting compromised while complying with the European Union’s Carbon Border Adjustment Mechanism (CBAM).

About Carbon Border Adjustment Mechanism (CBAM)

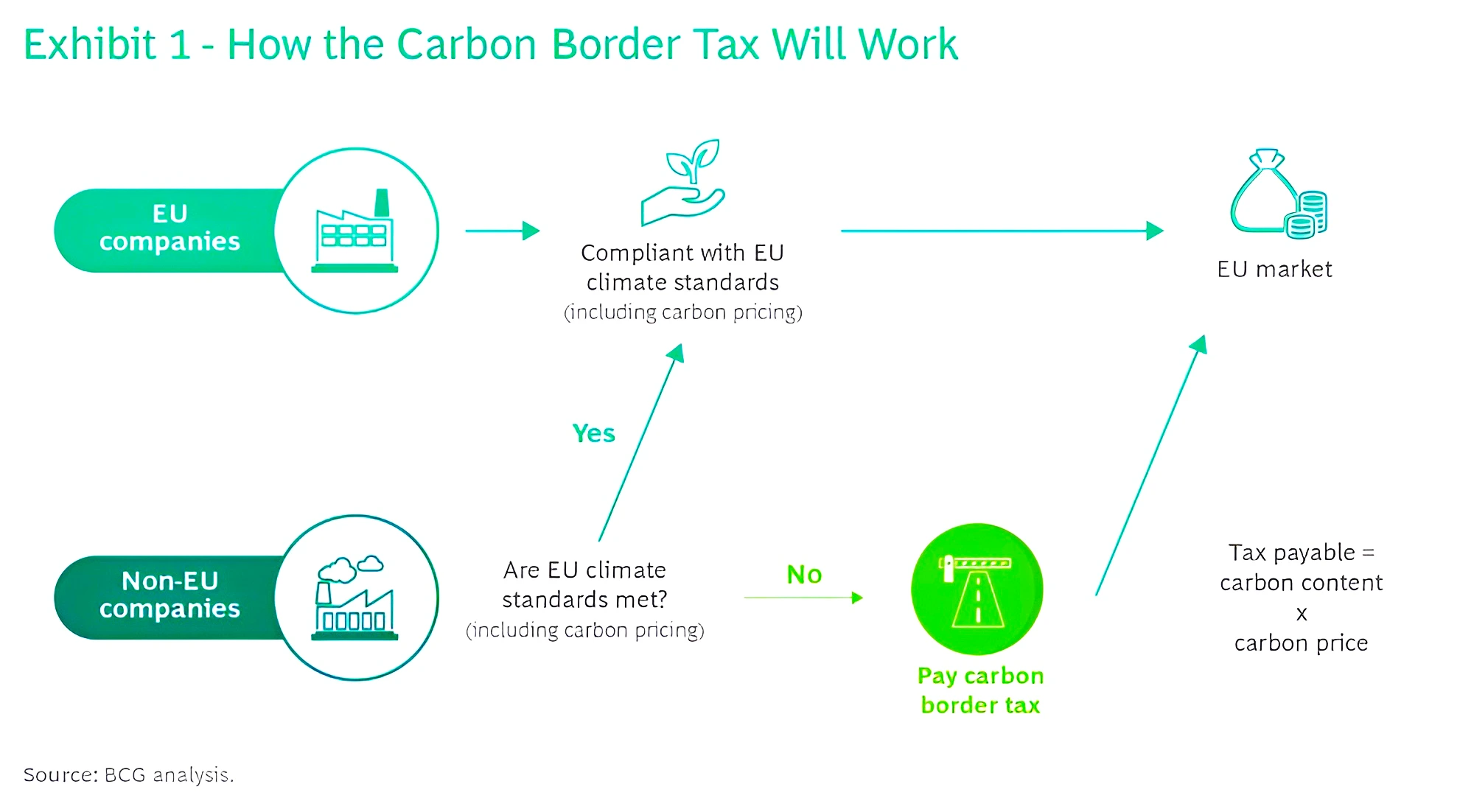

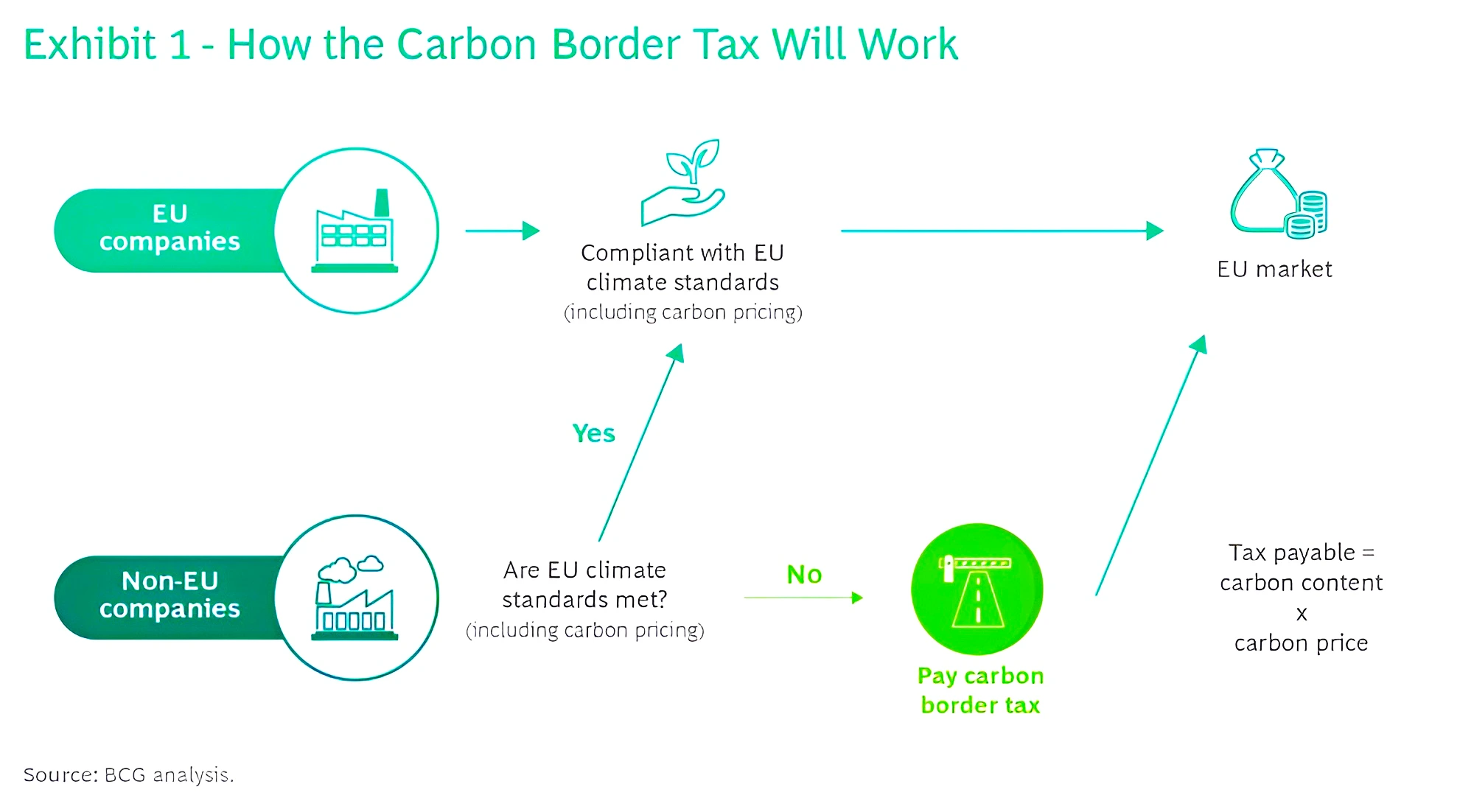

- The Carbon Border Adjustment Mechanism (CBAM) is a European Union regulation to put a ‘fair’ price on carbon emitted during the production of items identified as carbon-intensive in non-EU countries when they are imported into the bloc.

- It will be levied in the form of a carbon tax calculated on the basis of the embedded emissions.

- EU’s “Fit for 55 in 2030 package: It is a component of the EU’s “Fit for 55 in 2030 package,” which aims to comply with the European Climate Law by reducing greenhouse gas emissions by at least 55% by 2030 when compared to 1990 levels.

- Targeted Industries: Cement, iron and steel, aluminum, fertilizers, power, and hydrogen imports from nations with less strict climate regulations than the EU will be subject to the CBAM.

Significance of Carbon Border Adjustment Mechanism

- Carbon Border Adjustment Mechanism will encourage cleaner production in non-EU countries and to ensure that its own climate objectives are not undermined.

How Will the Carbon Border Adjustment Mechanism (CBAM) Affect India?

- Impact on India’s Energy-Intensive Exports: India’s exports of energy-intensive products, such as steel, aluminum, cement, and fertilizers, will be severely impacted.

- For Example: India exported 27% of its iron, steel, and aluminum products to the EU in 2022.

Conclusion

India must adopt a multipronged strategy that includes exploring bilateral agreements, expanding its export markets, encouraging greener production, and participating in international forums to resist CBAM.

Must Read: Green Credit Program (GCP): What Is It? And Its Significance

News Source: The Indian Express

![]() 11 Jan 2024

11 Jan 2024