According to Bloomberg, for the first time, India become the world's fourth-largest stock market by market capitalisation.

According to Bloomberg, for the first time, India become the world’s fourth-largest stock market by market capitalisation.

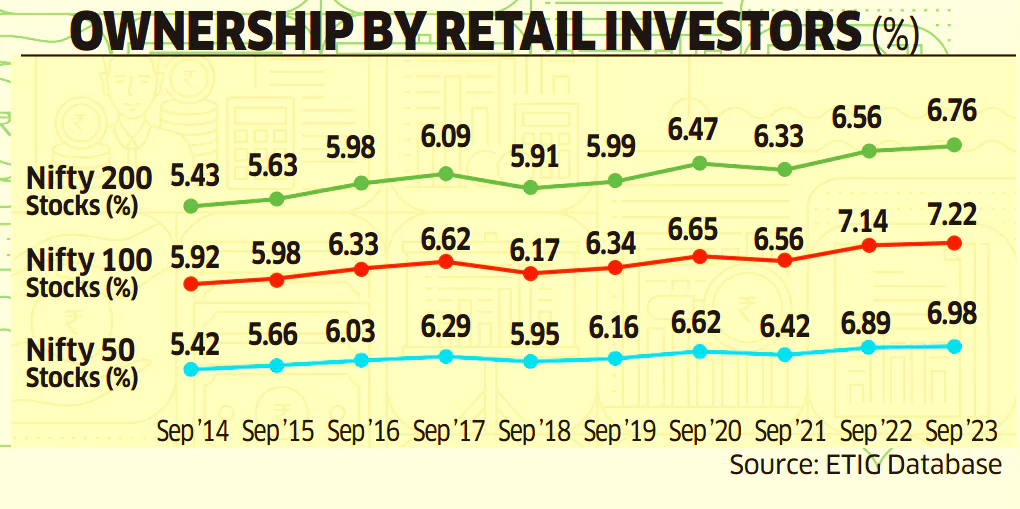

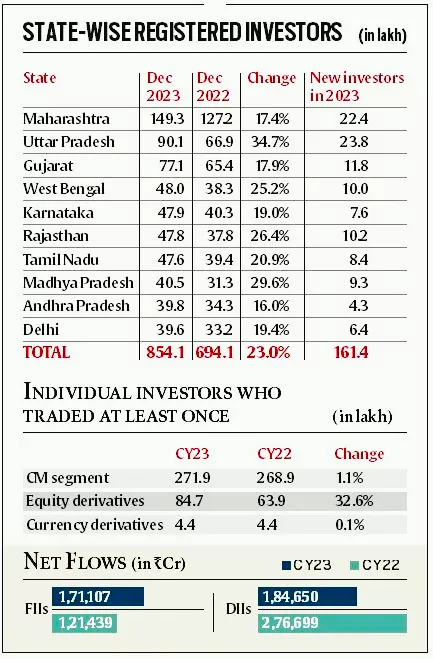

Growing Retail Investor Base: According to National Stock Exchange (NSE), number of stock market investors in India has surged past the 8 crore, registering a growth of 22.4% from the figure recorded on December 31, 2022.

As India solidifies its position as the world’s fourth-largest stock market, the outlook remains optimistic. India’s economic resilience, coupled with global investors’ confidence, positions India as a key player in the evolving global economic landscape.

Also Read:

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

India's market cap of $4.33 trillion surpassed Hong Kong's, securing the fourth position globally.

Robust economic fundamentals, growing retail investor base, sustained FII, and positive macroeconomic conditions fueled India's stock market growth.

India surpassed 8 crore investors, growing by 22.4% in 2023, with Maharashtra leading and Uttar Pradesh witnessing significant growth

India's stable political setup, consumption-driven economy, and attractive market conditions make it an appealing alternative to China.

Stringent anti-COVID measures, regulatory crackdowns, a property crisis, and geopolitical tensions eroded Hong Kong's appeal, causing a decline.

<div class="new-fform">

</div>