Recently Atal Pension Yojana crossed 8 crore enrolments with 39 lakh new subscribers added in the current financial year.

- The Government of India launched the Atal Pension Yojana (APY) on 9th May 2015 and was operationalized from 1st June 2015.

About Atal Pension Yojana (APY)

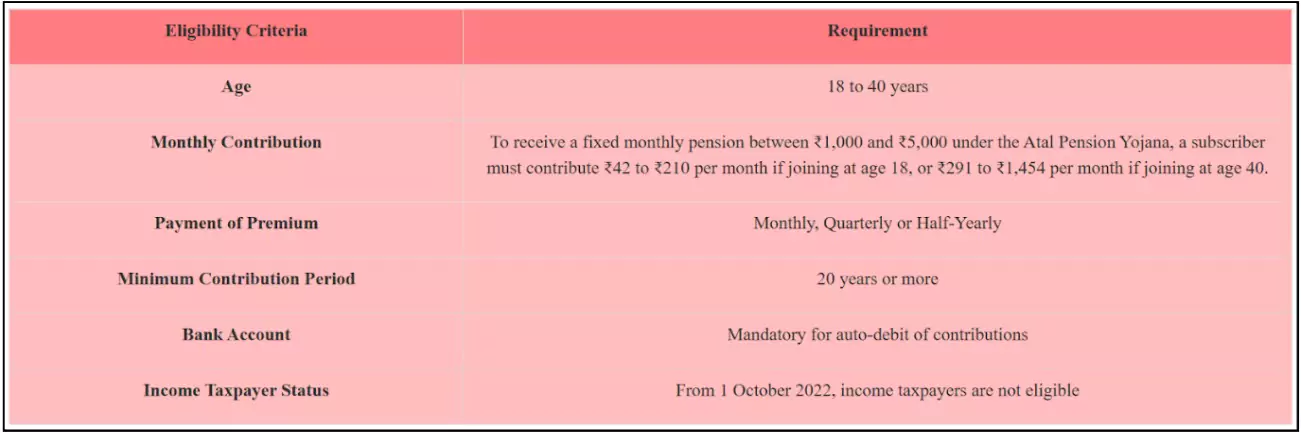

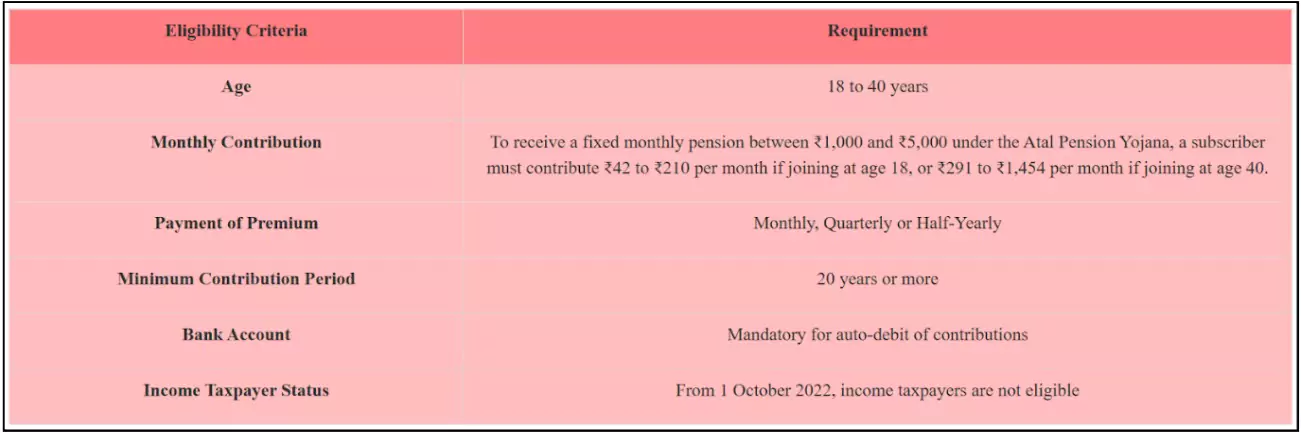

- APY was designed to encourage voluntary savings for retirement by offering defined pension benefits, linked to the age of joining and amount of contribution

- Administered by : Pension Fund Regulatory and Development Authority (PFRDA).

- Managed under the National Pension System (NPS) architecture.

- Objective: To build a universal social security system for all Indians, especially the poor, underprivileged, and unorganised sector workers.

- Nodal Ministry: Ministry of Finance

- Type: Central Sector Scheme

Key Features

- Guaranteed Pension: Ensures a monthly pension of ₹1,000 to ₹5,000 post-60 years of age.

- Pension slabs available: ₹1,000, ₹2,000, ₹3,000, ₹4,000, and ₹5,000 per month.

- Tax exemption: It is available on contributions made by individuals towards the Atal Pension Yojana under Section 80CCD of the Income Tax Act, 1961.

- Under Section 80CCD (1), the maximum exemption allowed is 10% of the concerned individual’s gross total income up to a limit of Rs. 1,50,000.

- Family Security: After the subscriber’s demise, the same pension is provided to the spouse, and the accumulated corpus is returned to the nominee after the death of both.

Major Achievements Over 10 Years

- Surpassing 8 Crore Enrolments: As of FY 2025-26, total gross enrolments have crossed 8 crore, with 39 lakh new subscribers added in FY26.

- Expanded Reach: Enrolment success attributed to coordinated efforts by banks, Department of Posts (DoP), State Level Bankers’ Committees (SLBCs), Union Territory Level Bankers’ Committees (UTLBCs), and outreach campaigns.

- Widespread Awareness: Growth driven by multilingual handouts, targeted media campaigns, and regular reviews and outreach conducted by PFRDA.

Persistent Challenges

- Exclusion of Taxpayers Reduces Coverage: Since income tax payers are excluded, many low-income formal sector workers remain outside its ambit.

- Low Awareness in Remote and Tribal Areas: Despite campaigns, awareness is still limited in far-flung rural and tribal regions, affecting potential enrolments.

- Inadequate Pension for Urban Retirees: The ₹1,000–₹5,000 monthly pension may be insufficient given the rising cost of living, especially in urban centres.

Way Forward

- Reassess Pension Slabs: Periodic revision of pension amount to align with inflation and urban cost-of-living requirements.

- Expand Eligibility with Safeguards: Reconsider the blanket exclusion of income tax payers, perhaps with graded contribution slabs to widen inclusion.

- Strengthen Last-Mile Delivery: Leverage Digital India platforms, panchayats, and SHGs for deeper penetration and real-time grievance redressal in rural and unorganised sectors.

Conclusion

As APY completes a decade, its role as a ‘Sampurna Suraksha Kavach’ for millions of Indians remains pivotal. Enhancing its coverage, adequacy, and sustainability is key to achieving true universal pension security.

![]() 28 Jul 2025

28 Jul 2025