![]() 12 Feb 2026

12 Feb 2026

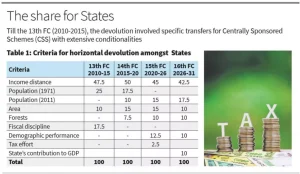

The Union Government has accepted 16th Finance Commission recommendations on the devolution of funds from the Centre to the States 2026–31.

| The Divisible Pool refers to the net proceeds of taxes referred to in Article 270 that are shareable with States. |

|---|

Concept of Devolution

|

|---|

Check Out UPSC CSE Books

Visit PW Store

<div class="new-fform">

</div>