The government aims to open more than 3 crore accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY) during the current financial year 2024-25

About Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

- Launch: The PMJDY was announced by the Prime Minister in his Independence Day address on 15th August 2014.

- Objectives:

- Ensure access of financial products & services at an affordable cost

- Use of technology to lower cost & widen reach

- Basic tenets of the scheme

- Banking the unbanked: Opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance & zero charges

- Securing the unsecured: Issuance of Indigenous Debit cards for cash withdrawals & payments at merchant locations, with free accident insurance coverage of Rs. 2 lakhs

- Funding the unfunded: Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit

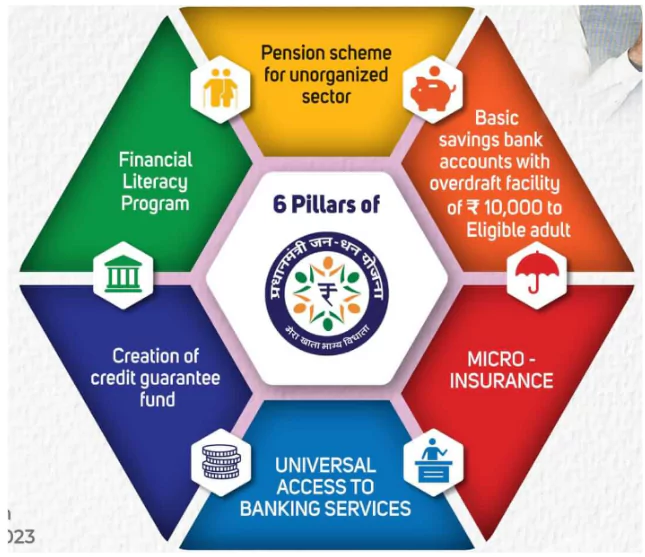

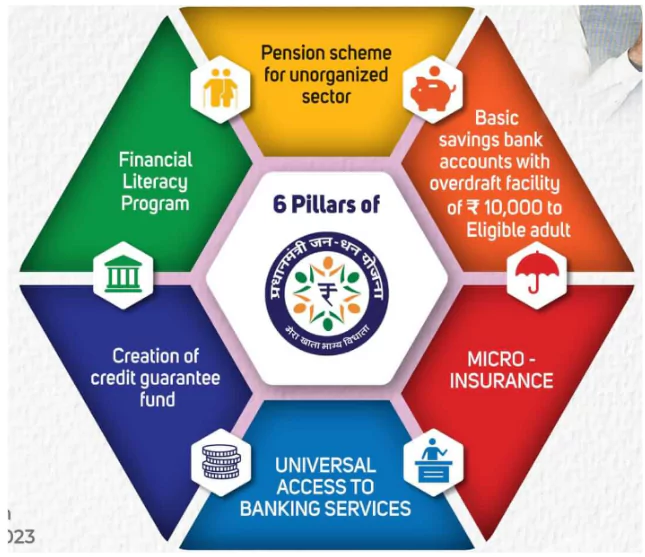

Initial Features of PMJDY: The scheme was launched based upon the following 6 pillars:

Initial Features of PMJDY: The scheme was launched based upon the following 6 pillars:

- Universal access to banking services – Branch and BC

- Basic savings bank accounts with overdraft facility of Rs. 10,000/- to every eligible adult

- Financial Literacy Programme: Promoting savings, use of ATMs, getting ready for credit, availing insurance and pensions, using basic mobile phones for banking

- Creation of Credit Guarantee Fund: To provide banks some guarantee against defaults

- Insurance: Accident cover up to Rs. 1,00,000 (increased to Rs. 2 lakhs) and life cover of Rs. 30,000 on account opened between 15 Aug 2014 to 31 January 2015

- Pension scheme for Unorganised sector

- Other Major Features: Under the PMJDY, there are no account opening charges, no account maintenance charges, and no minimum balance charges.

Enroll now for UPSC Online Classes

Achievements under Pradhan Mantri Jan Dhan Yojana

- PMJDY Accounts : There were more than 173 crore operative CASA accounts in the country out of which over 53 crore are operative PMJDY accounts.

- Deposits under PMJDY accounts: Total deposit balances under PMJDY Accounts stand at Rs. 2,31,236 crore. Deposits have increased about 15 times with increase in accounts 3.6 times

- Average Deposit per PMJDY account : Average deposit per account is Rs. 4,352 .Avg. Deposit per account has increased 4 times

- Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habit among account holders

- Operative Accounts: Around 80 percent of PMJDY accounts are operative and 20 per cent inoperative.

- Towards ensuring smooth DBT transactions: Remarkable swiftness and seamlessness with which Direct Benefit Transfer (DBTs) have empowered and provided financial security to the vulnerable sections of society.

- DBTs via PMJDY accounts have ensured every rupee reaches its intended beneficiary and prevented systemic leakage.

- Jan-Dhan Aadhaar and mobile (JAM) trinity: With PMJDY as one of its pillars, has proven to be a diversion-proof subsidy delivery mechanism.

- Through JAM, under Direct Benefit Transfer, the government has successfully transferred subsidies and social benefits directly into the bank accounts of the underprivileged.

- Inclusivity: Of the total accounts opened under the scheme, about 66.6 per cent accounts are opened in rural and semi-urban areas.

- Women: Of the total 53.13 crore PMJDY accounts, 29.56 crore (55.6 percent) belong to women account holders.

- Today, 99.95 per cent of all inhabited villages have access to banking facilities within a 5-km radius through banking touch points

Jan Dhan Darshak App (JDD App)

- Jan Dhan Darshak App is a mobile application which provides a citizen centric platform for locating banking touch points such as bank branches, ATMs, Banking Correspondents (BCs), Indian Post Payment Banks etc. in the country.

- Over 13 lakh banking touchpoints have been mapped on the JDD App.

- The facilities under Jan Dhan Darshak App could be availed as per the need and convenience of common people..

- This app is also being used for identification of villages which are yet to be covered by banking outlets within 5 km radius.

- These identified villages are allocated to various banks by concerned SLBCs for opening of banking outlets.

- The efforts have resulted in a significant decrease in the number of uncovered villages.

|

PM Jan Dhan Yojana Challenges

- Low Balance: Though the scheme became very popular, it has around 8.4% of accounts with zero balances and approximately 20% of accounts were inactive.

- Multiple Accounts: Many cases have been detected where an individual has opened more than one account in various banks.

- Overdraft facility Issues: Overdraft facility needs to be properly regulated, as the same is the discretionary of the concerned banks.

- Many banks may decline to extend the overdraft facility therefore defeating the purpose.

- Misuse of Authority: Business correspondents if made to accomplish the objective may misuse the authority and thereby making the life of people below poverty line miserable.

- Private Banks levy hidden charges on the beneficiary which may become a deterrent for financial inclusion.

- Duplication issue: KYC norms are not insisted under this programme, therefore duplication is unavoidable.

- Lack of Infrastructure: Making every village a Swavalamban village is considered to be an advantage but the lack of infrastructure may become a major hurdle for the effective implementation.

- Bad Loans: It is a possibility that the overdraft facility could end up as bad loans for banks as the scheme does not spell out how the banks can collect debts.

Check Out UPSC NCERT Textbooks From PW Store

Suggestions

- KYC details: Duplication of accounts by single person shall be checked under KYC details.

- Effective Regulation: Public sector banks and India post can be pressed into action for the effective implementation of Jan Dhan Yojana. Private Banks shall be strictly warned not to levy hidden charges.

- Financial Literacy: More centers of financial literacy may be established to bring excluded people under financial inclusion.

- ATM: The ATM needs to be strengthened in terms of more Kiosks not only in urban but also in rural areas of India.

- Frill Account: No frill account should be encouraged by the banks in India otherwise the financial inclusion especially for the people who are deprived of banking services will have a backseat.

- Frill Account: It is a type of basic Savings Account that does not require you to maintain a minimum balance, as in the case of a regular Savings Account.

![]() 28 Aug 2024

28 Aug 2024

Initial Features of PMJDY: The scheme was launched based upon the following 6 pillars:

Initial Features of PMJDY: The scheme was launched based upon the following 6 pillars: