![]() 28 Mar 2024

28 Mar 2024

English

हिन्दी

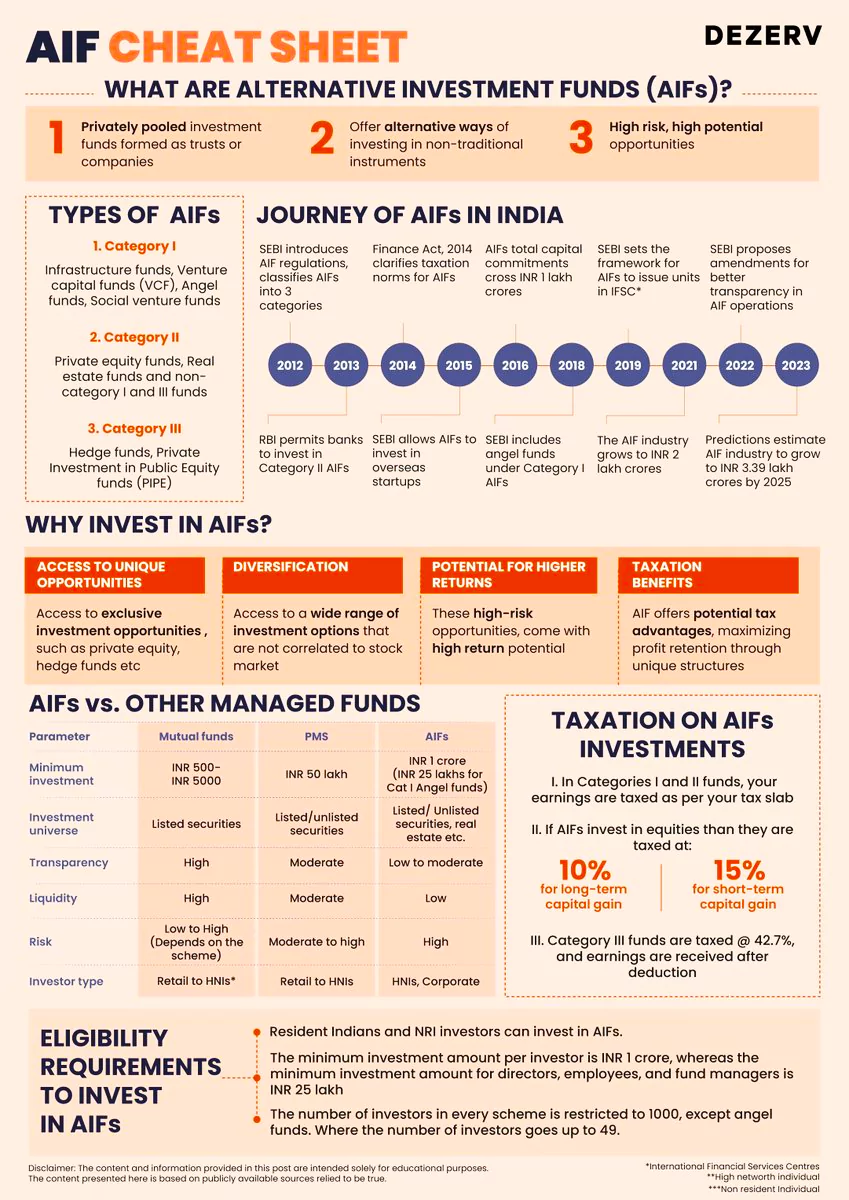

The Reserve Bank of India (RBI) has made revisions to regulations entities (REs) regarding their investments in Alternative Investment Funds (AIFs).

| Regulated Entity (RE)

This entity is the financial institution or organizations that follow specific rules and regulations set by regulatory authorities. |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>