Recently, World Bank Released Annual International Debt Report (IDR) 2024

About Annual International Debt Report

- It provides detailed information on external debt for low- and middle-income countries

| low- and middle-income countries: Criteria

The classification of countries is based on the Gross National Income (GNI) per capita.

- Low-Income Countries : GNI per capita: $1,145 or less

- Lower Middle-Income Countries: GNI per capita: Between $1,146 and $4,515

- Upper Middle-Income Countries: GNI per capita: Between $4,516 and $14,005

- High-Income Countries: GNI per capita: More than $14,005

|

Enroll now for UPSC Online Course

- Key Contributions of the IDR

- Data Insights: Tracks borrowing patterns and new lending methods.

- Debt Relief Impact: Assesses the outcomes of initiatives to reduce debt burdens.

- Transparency Promotion: Encourages accurate debt recording and reporting.

Key Findings of the International Debt Report 2024

The report highlights trends and developments in external debt for low- and middle-income countries (LMICs) over the past decade (2013–2023), with a focus on 2023.

- Trends in External Debt Stock (2013–2023)

- The total external debt stock of LMICs grew by 2.4% in 2023, reaching US$8.8 trillion.

- The increase in long-term debt was largely due to higher borrowing from multilateral creditors.

- Trends in External Debt Flows (2013–2023)

- Net debt flows (disbursements minus repayments) turned positive in 2023, totaling US$220.7 billion.

- This was a significant recovery (fivefold increase) compared to 2022 but remained lower than the levels seen between 2017 and 2021.

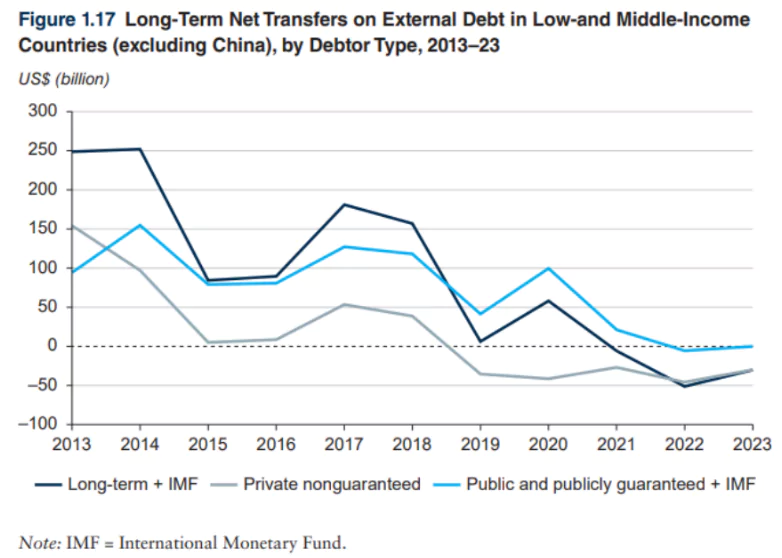

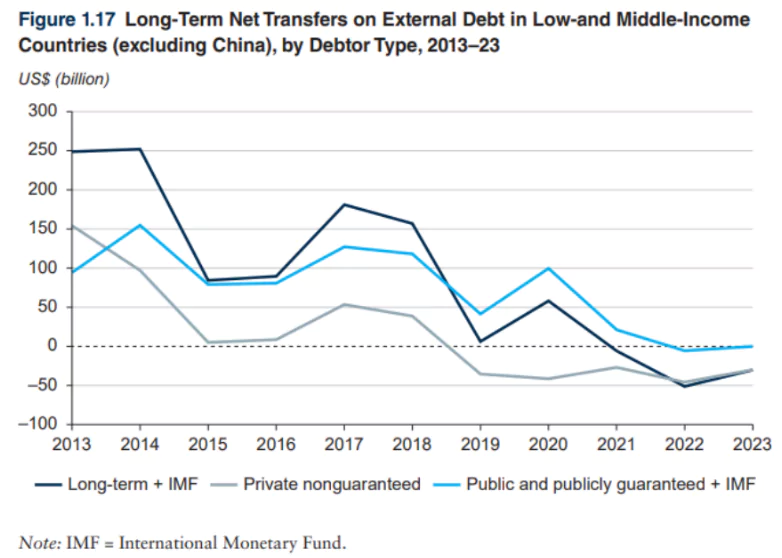

- Trends in Net Transfers on External Debt (2013–2023)

- Higher interest payments negatively impacted net debt transfers.

- Net debt transfers reflect the difference between the amounts borrowed (new disbursements) and the amounts repaid (interest and principal).

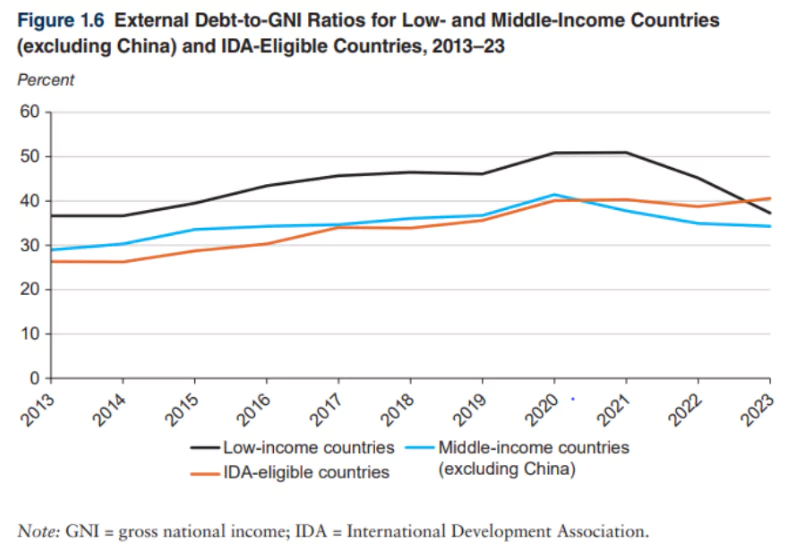

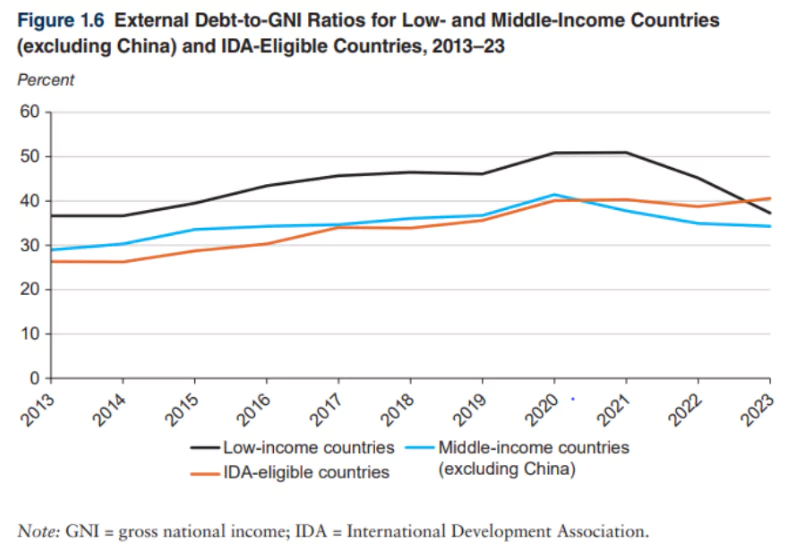

What is the debt-to-GNI ratio?

- It is a metric that compares a nation’s total external debt to its gross national income.

- A high ratio shows a high level of external debt relative to its income.

|

- Debt Ratios and Debt Resolutions

- The debt-to-GNI ratio for LMICs (excluding China) slightly decreased by 0.8 percentage points, standing at 34.4% in 2023.

- This ratio has been on a declining trend since reaching a two-decade high of 41.8% in 2020.

Debt Servicing Burdens (2013–2023)

Debt Servicing Burdens (2013–2023)

- LMICs faced record-high debt servicing costs of US$1.4 trillion in 2023 (principal and interest payments).

- For LMICs excluding China, debt servicing costs increased by 19.7%, reaching US$971.1 billion—almost double the amount recorded a decade ago.

- Role of Multilateral Lenders

- Multilateral lenders, such as the World Bank, IMF, and regional development banks, became the primary source of financial support for LMICs during the pandemic and beyond.

- Their support included emergency relief and balance-of-payments assistance.

- Borrowing from private creditors fell due to:

- Adverse market conditions.

- Reduced investments in emerging markets.

- A shift towards concessional loans from official creditors in IDA-eligible countries.

- Growth in Debt Stock from Official Lenders

- Long-term debt stock owed to the World Bank and IMF by LMICs has grown by 63.1% since the pandemic, compared to marginal growth in private lending.

- LMICs (excluding China) owed US$421.8 billion to the World Bank’s lending arms in 2023, accounting for 34% of all multilateral creditors’ debt.

- Rising Interest Rates and Costs

- Interest rates on new loans increased significantly in 2023:

- Official creditors: Rates rose by 2.1 percentage points to 4.09%.

- Private creditors: Rates increased by 1.37 percentage points to 6.0%, the highest since 2008.

Check Out UPSC CSE Books From PW Store

What is external debt?

- External debt is the money a country borrows from foreign sources like other governments, banks, or international organizations. It is divided into two types:

- Short-term debt: Needs to be repaid in a year or less.

- Long-term debt: Has a longer repayment period.

- Main Features of External Debt

-

- Types of External Debt:

- Public Debt: Borrowed by the government.

- Private Debt: Borrowed by private companies.

- Multilateral Debt: Loans from organizations like the World Bank and IMF.

- Bilateral Debt: Loans from one country to another.

- Commercial Loans: Borrowed from banks or investors.

- Why Countries Borrow:

- To build roads, schools, and hospitals.

- To manage financial crises.

- To cover gaps in government budgets.

- How Debt is Repaid:

- Countries pay back the principal amount and interest.

- Sometimes, they take new loans to repay old ones.

|

![]() 7 Dec 2024

7 Dec 2024

Debt Servicing Burdens (2013–2023)

Debt Servicing Burdens (2013–2023)