Context: Union Power Ministry aims to raise around ₹15,000 crore through asset monetization in FY24.

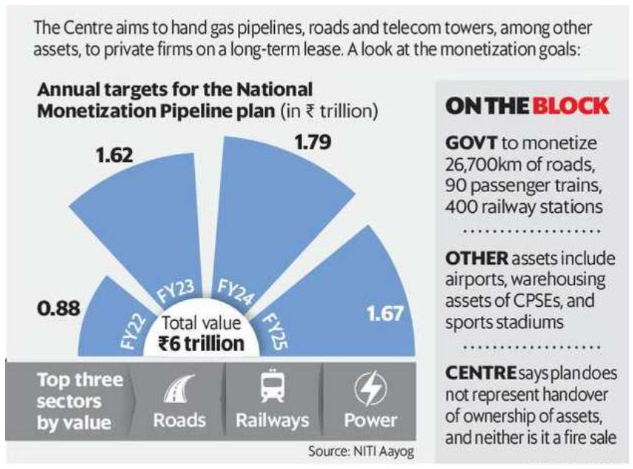

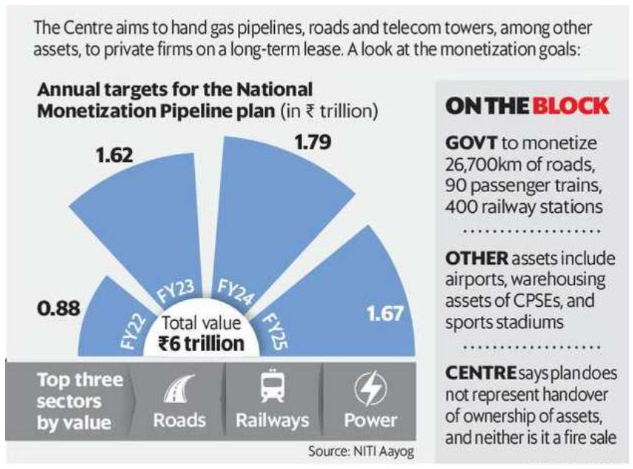

- The Indian Government has monetised assets worth ₹1.32 trillion in FY23, against a target of ₹1.62 trillion, while it has set a target of ₹1.79-trillion for FY 2023-24.

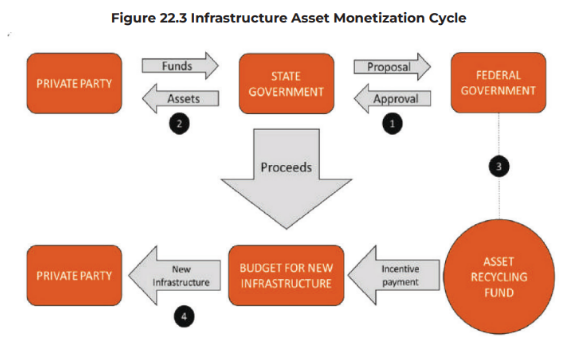

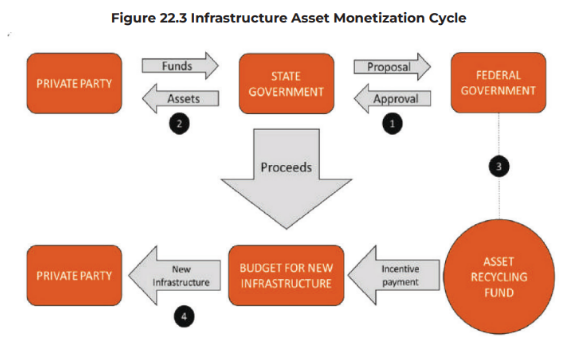

About Asset Monetization:

- It is the process of creating new/alternative sources of revenue by unlocking the economic value of underutilised public assets.

- A public asset can be any property owned by a public body, roads, airports, railways, stations, pipelines, mobile towers, transmission lines, etc., or even land that remains unutilised.

- It offers public infrastructure to the institutional investors or private sector through structured mechanisms.

- Aim: To innovate and enrich an asset which has remained unresponsive in terms of yielding economic value.

- Objective:

- Bring in private sector efficiency to enhance economic value.

- Create greater financial leverage through value engineering.

- Optimise risk allocation.

- Channelize funds to bridge the investment gap.

- Asset monetization does not necessarily mean disinvestment of the asset.

- It aims to tap the private sector investment for new infrastructure creation and to protect and unlock the value of assets to give healthy returns.

Enroll now for UPSC Online Course

Asset Monetisation Models:

- Direct Contractual models: Brownfield Public-private Partnership (PPP) Concessions

- Operate, Maintain & Transfer (OMT): A private entity is expected to maintain and operate an asset for a defined amount of time. Private investors invest in the operation and maintenance of roadways and recover their investment costs through toll taxes, land value capture income, etc.

- Toll, Operate & Transfer (TOT): Publicly funded operational projects, such as highways, are monetised for two years and put out to bid. The investors make a one-time lump-sum investment in exchange for a 15- to 30-year right to earn an appropriation fee.

- Operations, Maintenance & Development (OMD): The private sector raises money based on the strength of the existing assets and/or gets project financing in addition to equity contributions. The operational asset is leased to a private party for upgrading and O&M throughout the concession period.

- Rehabilitate Operate Maintain Transfer (ROMT): An existing asset should ideally be upgraded or augmented before operations and revenue collection can be resumed.

- Structure Financing Models

- Infrastructure Investment Trusts (InvITs): Infrastructure Investment Trusts (InvITs) use funds gathered from various investors to make direct investments in infrastructure.

- Real estate Investment Trusts (REITs): The firm owns, manages, or finances real estate and the capital is raised from investors, which is then invested.

Advantages of Asset Monetisation:

- New revenue sources for public-sector organizations: Monetization of underutilized public investments will help PSUs get financial resources and, in the long term, will lead to more effective use of these resources.

- Multiplier impact: Private owners increase productivity and decrease expenses. This scale impact of privatization will likely increase the volume of productive employment.

- Improved Efficiency: There will be a higher level of automation which will result in improved and quality services to customers.

- Better economic prosperity: As the Private sector is able to produce more resources, the economy will be revitalized, and revenues from monetized assets will contribute to the construction of new infrastructure and the complete recycling of future assets.

Asset Monetization in India:

- Vijay Kelkar Panel: In India, the idea of asset monetisation was first suggested by a committee led by Vijay Kelkar in 2012 on the roadmap for fiscal consolidation.

- It recommended monetisation to raise resources for further development and financing infrastructure needs.

- Union Budget 2021-22: Monetization of assets was highlighted as one of the three pillars for improved and sustainable infrastructure funding in the country.

- National Monetisation Pipeline (NMP): It is an asset monetisation programme, announced in budget 2021.

- Aim: To serve as a roadmap for the asset monetisation of several brownfield infrastructure assets across sectors including roads, railways, aviation, power, oil and gas, and warehousing.

- It could act as a land bank housing information about all assets that have been lined up for utilisation by strategic investors or private sector companies.

- It will assess the potential value of unused and underutilised government assets.

- Target of NMP: To raise Rs 6 trillion through asset monetisation of the central government, over a four-year period, from FY22 to FY25.

- Bringing in private capital for infra creation: NMP focuses on brownfield assets in which investments have already been made but are underutilised.

- Ownership of the assets will be retained by the Centre.

- Top five sectors in terms of contribution to NMP are roads (27%) followed by railways (25%), power (15%), oil and gas pipelines (8%), and telecom (6%).

Advantages of the National Monetization Pipeline (NMP):

- Augment Funding: It will help the government to further invest the amount in developing new public infrastructure, pay the debt, develop new means and schemes inviting more private sector investments, increase the efficiency in the performance of the assets to reduce the Incremental Capital Output Ratio (ICAR) and boost the GDP growth.

- Supporting NIP: Proceeds from the NMP are expected to account for about 14% of the total outlay for infrastructure under the National Infrastructure Pipeline (NIP).

- Employment Creation: The 360 degrees of growth will give rise to employment opportunities across the cities, towns and villages, leading to a better quality of life.

- Sustainable Debt: It allows an opportunity for debt reduction and improved performance of assets for various ministries.

- Attract FDI: It can help attract higher foreign institutional investments in the country through vehicles such as infrastructure investment trusts (InvITs).

Enroll now for UPSC Online Classes

Challenges Regarding Asset Monetisation:

- Regulatory Hurdles: Lack of clarity and stability of the regulatory environment affect the value realised from monetisation or in extreme cases, may make it infeasible to monetise an asset as in the case of passenger train privatisation.

- Monopoly: It would likely result in monopolization and inflation due to the disinvestment of critical infrastructures.

- Example: Experience of leasing out six airports for 50 years to a single bidder has created the apprehension of transferring of taxpayer-funded assets to a handful of business groups.

- Family Gold Concept: Public assets in sectors like airports, railways, roads, power, ports, gas pipelines, mining and telecom, which have been created with taxpayers’ money over the past 70 years, are being offered to private players via long term leases of 25-50 years.

- Profit Maximization: Private investors would be apprehensive in investing on leased assets more than what is needed to maximise their profits during the lease period.

- Example: Singapore had to nationalise its suburban trains and signaling systems because the main private operator had underinvested in maintenance, leading to frequent breakdowns and stranded, angry passengers.

- Consumer at Mercy: The successful bidder may raise the utility price steeply and the consumer ends up bearing the cost.

- Example: In New South Wales, electricity prices doubled in five years after poles and wires were privatised.

- Poor Previous Experience: Past experience of the government’s attempt to monetise brownfield assets has not been encouraging.

- For example, the Indian Railways initiated on July 1, 2020, the formal process of inviting private parties to run 150 trains.

- When bids were opened, there was no bidder for nine clusters while there were only two for three clusters.

- Poor Return Value: Residual life of the returned asset may not be long. In such cases, asset monetisation virtually amounts to sale.

- True Value of Asset: It is very difficult to get the correct valuation of asset right over a long-term horizon, say, 25 years due to the involvement of many uncertainties.

Way Forward:

- Policy Support: It will help make the policy makers more open and at the same time bring private investors forward to have trust and assurance in the system to invest in the progress and development of the State in long term infrastructure projects.

- Ensuring Accountability: Government could create a central body that could monitor the progress of monetisation of assets across industries, while also assisting various line ministries and departments in identifying and addressing hurdles in undertaking the process of monetisation.

- Centralised Body: It will enable to break the departmental silo and create overall priorities and decision enabling as a whole centrally.

- Identifying Assets: IT enabled support with initiative like ‘Asset Management Portal’, which brings all related Assets at one platform and make it transparent in terms of visibility and decision making to take the initiative forward to build on existing infrastructure.

- Innovative Financial Model: Bonds, like infrastructure debt funds, need to be given more considerationl to realise efficiency.

- Assurance to Investor: Provide reassurance to investors about the risk characteristics of their assets. Support from the central government – in the form of structured guarantees or creation of asset bundles that are a mix of central and state assets – could be beneficial.

- Infrastructure Investment Trusts (InvIT) route to monetisation may minimise the risks of incorrect valuation or an increase in price to the consumer.

- InvIT is akin to a mutual fund, which enables direct investment of small amounts of money from possible individual/institutional investors in infrastructure to earn a small portion of income as return.

- Alternative Dispute-Resolution Mechanism: Efficient and effective dispute resolution mechanisms will naturally and automatically accrue to the design and execution of the project.

News Source: Livemint

![]() 17 Jul 2023

17 Jul 2023