Recently Finance Minister Nirmala Sitharaman addressed critical issues affecting the banking sector, and stressed the need for banks to actively utilize the Bad Bank to resolve distressed assets.

About Bad Bank

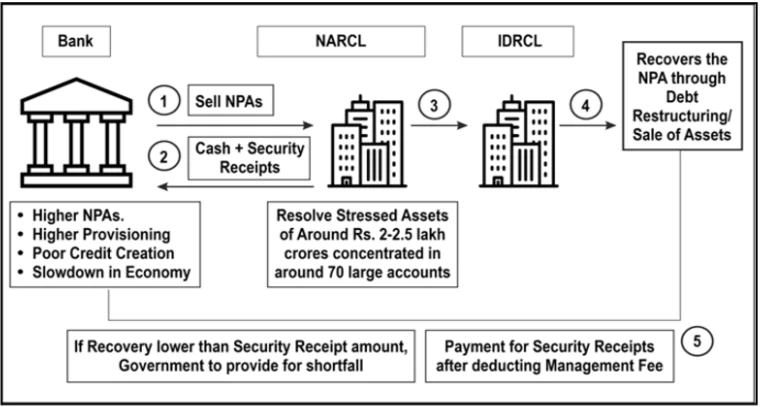

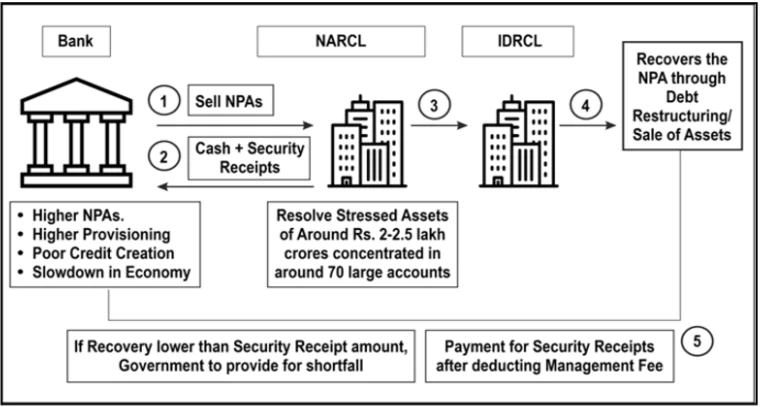

- A Bad Bank is a specialized Asset Reconstruction Company (ARC) that purchases Non-Performing Assets (NPAs) from commercial banks and restructures them.

- It is not involved in lending or deposit-taking, focusing solely on cleaning up banks’ balance sheets.

- Typically, it buys bad loans at a value below their book value, with subsequent recovery efforts aimed at maximizing returns.

Advantages of Bad Banks

- Centralised Management of NPAs: Provides a streamlined process for handling distressed assets across multiple banks.

- Capital Relief for Banks: By transferring NPAs, banks can free up capital held as provisions against bad loans.

- This facilitates increased lending to creditworthy borrowers, fostering economic growth.

- Stabilization of the Financial System: Helps restore banks’ financial health, boosting confidence in the banking system.

Enroll now for UPSC Online Classes

National Asset Reconstruction Company Limited (NARCL)

- Establishment: Proposed in the Economic Survey 2016; officially launched in 2021 as India’s first bad bank.

- Objective: Cleansing the financial system of distressed loans and stabilizing banks to foster a healthier economic environment.

- Key Roles of NARCL

- Purchase bad loans from commercial banks.

- Manage and recover value from these distressed assets.

- Payment Mechanism: 15% of the loan value is paid in cash and the remaining 85% is paid through government-backed security receipts.

- Ownership Structure: 51% stake held by state-owned banks and 49% stake held by private banks.

- NARCL along with the Government of India co-created IDRCL for resolving issues using bad banks.

India Debt Resolution Company Ltd. (IDRCL)

- IDRCL is entrusted with the responsibility of unlocking the value embedded in the large corporate distress assets (NPAs) of the Indian banking and financial system.

- IDRCL is owned by 14 of India’s largest private (51%) and public scheduled commercial banks(49%).

- It collaborates with NARCL to sell stressed assets in the market. It primarily focuses on resolution and value recovery from bad loans.

- NARCL: Primarily focuses on acquiring bad loans from banks.

- IDRCL: Works on resolving and selling the distressed assets acquired by NARCL.

- This dual-entity approach ensures efficient handling and resolution of stressed assets, enabling banks to focus on their core business of deposit mobilization and lending.

![]() 19 Nov 2024

19 Nov 2024