After averaging a growth rate of 8 per cent over the last three years, the economy slowed to just 5.4 per cent in the second quarter.

- Simultaneously, the inflation rate surged past the tolerance level of 6 per cent in October, largely driven by rising food prices.

Current Economic Slowdown and Growth Dynamics

- Recent Trends: The GDP growth rate slowed to 5.4% in the second quarter, marking the weakest growth in seven quarters.

- The RBI has revised the forecast for GDP growth for the fiscal year to 6.6%, down from the earlier estimate of 7.2%.

- Agricultural Sector: The agricultural sector recorded a growth of 3.5%, despite favorable monsoon conditions.

- The impact of erratic rainfall on the production of fruits and vegetables contributed to this limited growth.

- Key Contributing Factors: The slowdown in private and public consumption was primarily driven by elevated food prices and delays in capital expenditure following the elections.

- The Gross Fixed Capital Formation grew by just 1.3%, marking its lowest level in several quarters.

- Sectoral Performance: The growth rate of the manufacturing sector declined to 2%, even though the Purchasing Managers’ Index (PMI) indicated expansion during the quarter.

- The deceleration in mining (primary sector) and manufacturing (secondary sector) growth raises significant concerns.

- The construction sector, which had previously recorded double-digit growth, slowed to 7.1%.

Enroll now for UPSC Online Course

About Purchasing Managers Index (PMI)

- It measures the month-over-month change in economic activity within the manufacturing sector. It is an indicator of business activity, both in the manufacturing and services sectors.

- It summarizes whether market conditions as viewed by purchasing managers are expanding, neutral, or contracting.

- Types of Purchasing Managers Index: There are two types of PMI — Manufacturing PMI and Services PMI.

- It is calculated separately for the manufacturing and services sectors and then a composite index is also constructed.

- Headline PMI: The headline PMI is a number from 0 to 100.

- PMI above 50 represents an expansion when compared to the previous month.

- PMI under 50 represents a contraction.

- A reading at 50 à indicates no change.

|

- Policy Response: The Monetary Policy Committee (MPC) decided to maintain the policy rate but reduced the Cash Reserve Ratio (CRR) by 25 basis points in two tranches to address liquidity issues.

- The RBI aims to achieve its 4% inflation target only by the second quarter of 2025-26.

- The RBI has described the current situation as an “aberration in the growth-inflation trajectory.”

About Inflation

- Definition: It is the gradual rise in prices of goods and services within a particular economy wherein, the purchasing power of consumers decreases, and the value of the cash holdings erode.

- Inflation measures the average price change in a basket of commodities and services over time.

- Deflation: The opposite and rare fall in the price index of this basket of items is called deflation.

- Measurement: Inflation is measured as the annual percentage change in a price index such as the Consumer Price Index (CPI) or Gross Domestic Product (GDP) Deflator.

- In India, the Ministry of Statistics and Programme Implementation (MoSPI) measures inflation.

How is Inflation measured?

In India, inflation is primarily measured by two main indices WPI (Wholesale Price Index) and CPI (Consumer Price Index), which measure wholesale and retail-level price changes, respectively.

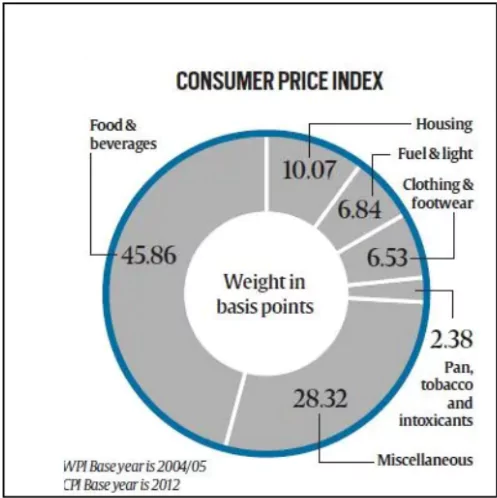

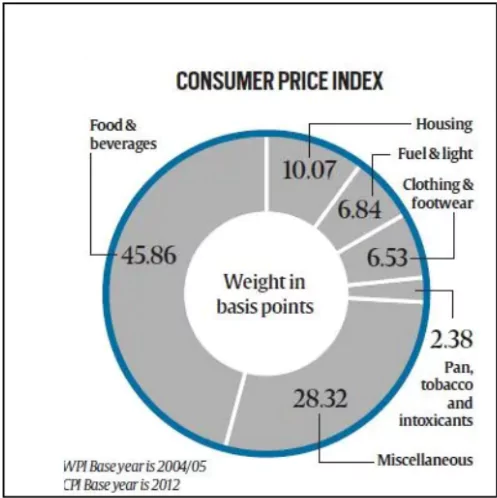

About Consumer Price Index (CPI) – Retail Inflation

- CPI Measures the change in the retail prices of goods and services with reference to a base year.

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).- Types of CPI:

- CPI for Industrial Workers (CPI-IW)

- Compiled by the Labor Bureau.

- Base year: 2016.

- CPI for Rural Laborers and Agricultural Laborers (CPI-AL & CPI-RL)

- Compiled by the Labor Bureau.

- Base year: 1986-87.

- New CPI (Rural, Urban, and Combined):

- Base year: 2012.

- Compiled and published by the Central Statistical Organisation (CSO) for all-India levels.

Consumer Food Price Index (CFPI)

- CFPI: It is a sub-component of CPI, measuring changes in retail prices of food items consumed by the population.

- Focus: Tracks price changes of food staples such as cereals, vegetables, fruits, dairy, meat, etc.

- Compiled by: Central Statistical Office (CSO), MoSPI (from May 2014), now under NSO (formed in 2019).

- Base year: 2012.

- Methodology: Calculated monthly, using the same methodology as CPI.

Check Out UPSC CSE Books From PW Store

Wholesale Price Index (WPI)

- WPI : It measures the average change in wholesale prices before the retail level.

- Coverage: It covers only goods, excluding services.

- Compiled by: Office of Economic Advisor, Ministry of Commerce and Industry (on a monthly basis).

- Base year: 2011-12.

- Weightage: Weights assigned to commodities are based on production value adjusted for net imports.

Types of Inflation

| Type of Inflation |

Definition |

Key Characteristics |

| Based on Rate |

| Creeping Inflation |

Gradual increase in prices at a rate of less than 3% annually. |

- Considered manageable.

- Encourages demand and investment.

- Reflects economic growth.

|

| Walking Inflation |

Moderate increase in prices, typically 3%–10% annually. |

- Acts as a warning for potential overheating.

- Can disrupt savings and investment patterns if unchecked.

|

| Galloping Inflation |

Rapid increase in prices, typically between 10%–50%.

Example: Inflation in developing economies during crises.

India experienced galloping inflation during 1973 and 1979 oil crises caused a sharp rise in global crude oil prices. |

- Severely disrupts economic stability.

- Reduces purchasing power and hampers income stability.

|

| Hyperinflation |

Extreme inflation with prices rising over 50% per month.

Example: Zimbabwe (2004–2009), Germany (Weimar Republic, 1920s). |

- Decimates currency value.

- Leads to a loss of public trust in money.

- Creates economic chaos.

|

|

Based on Causes

|

| Demand-Pull Inflation |

Inflation caused by excessive demand over supply.

Example: Inflation due to festive season demand. |

- Triggered by increased money supply or consumer spending.

- Common during economic booms.

|

| Cost-Push Inflation |

Inflation caused by rising production costs.

Example: Rising oil prices leading to increased transportation costs. |

- Driven by higher costs for raw materials, wages, or energy.

- Passes costs onto consumers.

|

| Structural Inflation |

Inflation caused by inefficiencies in the economic structure.

Example: Inflation in developing countries with rigid supply chains. |

- Arises from supply bottlenecks, monopolistic practices, or poor infrastructure.

|

| Built-in Inflation |

Inflation perpetuated by expectations of future inflation.

Example: Wage hikes in response to expected price increases. |

- Leads to wage-price spirals.

- Sustains inflationary pressures over time.

|

| Skewflation |

Inflation affecting only specific goods or sectors.

Example: Food price inflation while other prices remain stable. |

- Prices of selected goods rise, while others remain stable.

- Different from general inflation.

|

| Headline Inflation |

Measures inflation across all goods and services in an economy.

Example: CPI-based inflation in India. |

- Includes all items, including volatile food and energy prices.

- Reflects overall price changes.

|

| Core Inflation |

Inflation excluding volatile items like food and energy.

Example: Used by central banks to set monetary policies. |

- Highlights the long-term trend.

- Used for policy decisions.

|

| Reflation |

Deliberate inflation stimulation by the government to counter deflation.

Example: Government spending after a recession. |

- Aimed at reviving economic growth.

- Often involves fiscal stimulus or monetary expansion.

|

| Stagflation |

Simultaneous occurrence of high inflation and stagnant growth.

Example: U.S. in the 1970s. |

- Rare phenomenon.

- Contrary to the Phillips Curve.

- Difficult to address through conventional policies.

|

Positive and Negative Impact Rising Inflation

| Positive |

Negative |

| 1. Boosts Economic Activity: Moderate inflation encourages spending and investment as money loses value over time.

Example: Moderate inflation (~2%) is a target for many central banks, including the RBI and the US Federal Reserve, to promote economic growth. |

1. Erodes Purchasing Power: High inflation reduces consumers’ ability to buy goods and services.

Example: In 2024, India’s CPI inflation peaked at 6.2%, squeezing household budgets. |

| 2. Reduces Real Debt Burden: Borrowers benefit as the real value of debt decreases over time.

Example: During inflation, a loan with a fixed interest rate becomes cheaper in real terms. |

2. Reduces Savings Value: Inflation lowers the real returns on savings.

Example: If inflation exceeds fixed deposit returns (e.g., inflation at 7% vs FD at 5%), savings lose value. |

| 3. Encourages Production: Rising prices incentivize producers to increase output to meet demand.

Example: Increased agricultural production during high food prices to leverage profits. |

3. Income Inequality: Affects lower-income groups disproportionately.

Example: Food inflation in rural India reached over 9% in late 2024, affecting poorer households more. |

| 4. Benefits Equity Holders: Companies may earn higher profits, benefitting shareholders during inflation.

Example: Commodity companies like oil and gas firms see profit increases when input prices rise. |

4. Higher Interest Rates: Central banks often raise rates to control inflation.

Example: RBI’s repo rate hikes from 4% in 2022 to 6.5% in 2024 raised borrowing costs for businesses and households. |

| 5. Increases Tax Revenue: Inflation boosts nominal incomes, leading to higher tax collections for the government.

Example: During inflationary periods, income tax collections in India rose by 20% in 2022-23. |

5. Distorts Economic Planning: Unpredictable inflation complicates pricing and long-term business planning. |

Check Out UPSC NCERT Textbooks From PW Store

Challenges in Addressing Inflation in India

- Supply Chain Disruptions: Frequent disruptions due to geopolitical conflicts, natural disasters, or pandemics can lead to supply-side inflation.

- Example: High food and fuel prices in 2024 were partly driven by global supply chain constraints and volatile crude oil markets.

- Agricultural Dependence on Monsoon: India’s agriculture remains highly dependent on monsoon rainfall, making food prices vulnerable to erratic weather patterns.

- Example: Erratic rainfall in 2024 impacted the production of fruits and vegetables, contributing to food inflation.

- Global Energy Price Volatility: Dependence on imported crude oil exposes India to external shocks, leading to cost-push inflation.

- Example: Rising global crude oil prices in late 2023-2024 raised transportation and manufacturing costs domestically.

- Policy Trade-offs: Balancing inflation control with growth is a significant challenge for the RBI. Tightening monetary policy to control inflation may dampen economic growth and investment.

- Example: The Monetary Policy Committee (MPC) of RBI held steadfast in its battle against inflation amid weakening growth momentum to keep the policy repo rate unchanged at 6.50% for the eleventh bi-monthly review in a row.

- Structural Issues in Distribution and Storage: Inefficient storage facilities and distribution networks lead to wastage of perishable commodities, driving food inflation.

- Example: Lack of cold storage for vegetables and fruits exacerbates seasonal price volatility, as seen during high inflation periods.

Government Measures to Control Inflation

- Monetary Policy Measures (by RBI):

- Interest Rate Adjustments: The RBI raises the repo rate to curb liquidity and demand in the market.

- Example: In 2023-24, the RBI raised interest rates to control inflation exceeding the 6% threshold.

- Open Market Operations (OMOs): RBI sells government securities to reduce money supply in the economy.

- Cash Reserve Ratio (CRR): Increasing CRR compels banks to hold more reserves, reducing loanable funds.

- Fiscal Policy Measures:

- Reduced Government Spending: Curtailing non-essential expenditures to reduce aggregate demand.

- Increased Taxes: Raising direct and indirect taxes to reduce disposable income and lower consumption.

- Example: Increasing excise duty on luxury goods to curb demand.

- Subsidy Rationalization: Reducing subsidies on non-essential items to prevent fiscal imbalances that fuel inflation.

- Supply-Side Measures:

- Boost Agricultural Productivity: Investing in irrigation, fertilizers, and logistics to ensure food supply stability.

- Buffer Stock Management: Releasing buffer stocks of essential commodities like wheat and rice during shortages.

- Encouraging Imports: Reducing import duties on essential goods like pulses and edible oils to stabilize domestic prices.

- Trade Policy Measures: Temporarily banning or limiting the export of essential items to ensure adequate domestic supply.

- India restricted wheat exports in 2022 to control rising domestic prices.

Way Forward for Managing Inflation in India

- Focus on Supply-Side Measures: The government should prioritize addressing supply bottlenecks, especially for food and energy.

- Example: The government has readied stocks to release onions at a subsidized rate of ₹25 a kilogram to curb the escalating onion prices.

- Encourage Agricultural Reforms: Boost agricultural productivity by investing in irrigation, storage, and transportation infrastructure to minimize post-harvest losses.

- Introduce policies to ensure stable prices for protein-rich food items like pulses and meat, curbing protein inflation.

- Strengthen Monetary Policy Interventions: The RBI should continue monitoring headline inflation while ensuring adequate liquidity to support growth.

- Calibrated rate adjustments can maintain a balance between controlling inflation and fostering investment.

- Promote Energy and Renewable Sources: Reduce dependency on imported crude oil to tackle cost-push inflation caused by global fuel price volatility.

- Accelerate investment in renewable energy to mitigate long-term energy-related inflation risks.

- Fiscal Prudence and Targeted Subsidies: The government should practice fiscal prudence by rationalizing expenditure and focusing on infrastructure investments that stimulate supply-side growth.

- Provide targeted subsidies for essential commodities to shield vulnerable populations from the effects of inflation.

- Enhance Inflation Forecasting Mechanisms: Invest in real-time data collection and advanced forecasting tools to predict and respond to inflation trends more effectively.

- Strengthen collaboration between central and state governments to tackle inflationary pressures at regional levels.

Enroll now for UPSC Online Classes

Conclusion

Addressing inflation requires a multi-faceted approach, involving both immediate measures to manage demand-pull and cost-push pressures, and long-term structural reforms to enhance supply chain resilience and stabilize currency. A balanced economic policy framework is essential to manage inflation sustainably while promoting growth and investment.

![]() 14 Dec 2024

14 Dec 2024

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).