The BSE Sensex closed lower for the sixth consecutive day, reflecting a major sell-off among Foreign institutional investors/ Foreign Portfolio Investors (FIIs/FPIs).

- The market was impacted by mixed corporate earnings and concerns over the tightening of the U.S. tariff regime on imports.

About Bond Yield

- Bond yield refers to the return an investor earns from holding a bond until maturity.

- It is influenced by interest rates, market demand, and economic conditions.

Yield Curve and Variations

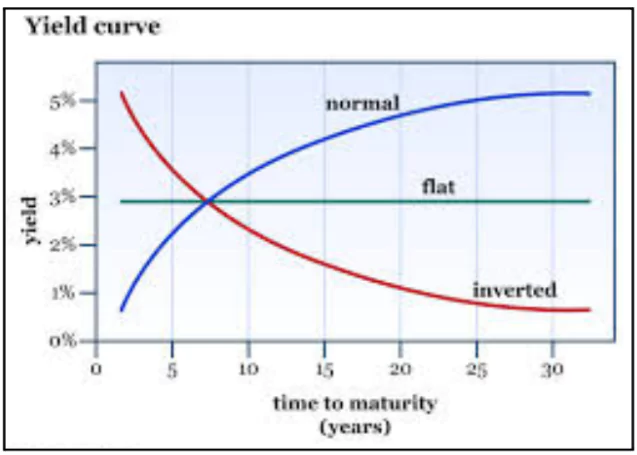

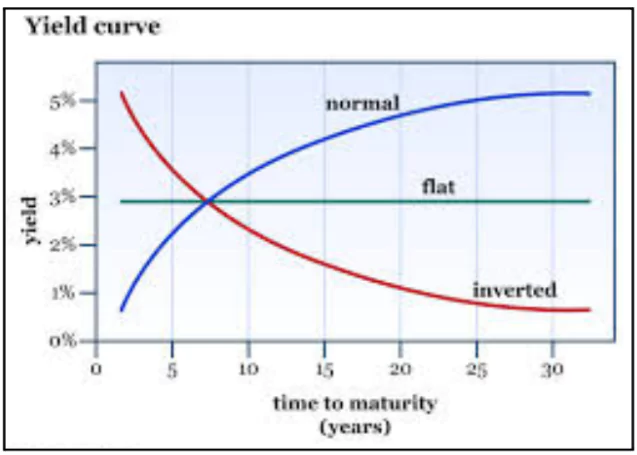

- The yield curve represents the relationship between bond yields and their maturity periods.

- Types of Yield Curves:

- Normal Yield Curve: Long-term bonds have higher yields than short-term bonds, indicating economic growth.

- Inverted Yield Curve: Long-term yields are lower than short-term yields, signaling a possible recession.

- Flat Yield Curve: Short-term and long-term yields are similar, reflecting economic uncertainty.

- Bond Price and Yield Relationship:

- When bond prices fall, yields rise.

- When bond prices rise, yields fall.

Difference Between Bond Yield and Interest Rates

| Aspect |

Bond Yield |

Interest Rate |

| Definition |

The return an investor earns from holding a bond, expressed annually. |

The percentage charged by a lender for borrowing money. |

| Application |

Relevant to fixed-income securities like bonds, where yield includes interest (coupon) payments. |

Applies to loans, bonds, and other debt instruments, determining borrowing costs. |

| Relationship to Market |

Inversely related to bond prices.

When bond prices rise, yields fall, and vice versa. |

Set by lenders or central banks (e.g.RBI) and affects overall borrowing costs. |

| Types |

Includes yield-to-maturity (YTM), which calculates total expected return on a bond. |

Includes nominal, real, and effective interest rates, considering inflation and compounding. |

| Example |

A bond with a 10% yield on a $1,000 investment provides a $100 annual return. |

A 10% interest rate on a $1,000 loan requires the borrower to pay $100 in interest per year. |

RBI’s Role in Managing Bond Yield

- Conducting Open Market Operations (OMO): RBI buys government securities from banks and investors via auctions. This increases demand for bonds, helping control rising yields.

- RBI decides the quantum of each OMO based on yield movements and liquidity conditions.

- Operation Twist : RBI buys longer-term bonds while selling shorter-term bonds simultaneously.

- This prevents excess liquidity while stabilizing longer-term yields.

- Intervening in Weekly Debt Auctions: The government borrows weekly via bond auctions where investors place bids. RBI can partially devolve securities on underwriters if yields exceed comfort levels.

- Extending Held-to-Maturity (HTM) Limits: RBI raised the HTM limit to 23% of banks’ deposits, insulating them from market depreciation losses.

- If yields rise further, RBI may extend the timeline to support bond demand.

- Strengthening the Retail Debt Market: RBI’s Retail Direct Scheme encourages direct investment in government securities.

- Enhancing awareness and accessibility could broaden the investor base and stabilize yields.

About Stock Market

- Definition of Stock Market: The stock market is a platform where shares of publicly listed companies are bought and sold.

- It allows investors to trade company stocks and enables businesses to raise capital.

- Global Stock Markets:

- New York Stock Exchange (NYSE): The world’s largest stock exchange.

- NASDAQ: National Association of Securities Dealers Automated Quotations is known for technology stocks like Apple, Microsoft, and Google.

- Indian Stock Markets:

- Bombay Stock Exchange (BSE): Asia’s oldest stock exchange.

- National Stock Exchange (NSE): India’s largest exchange, home to the NIFTY 50 index.

Impact of Rising Bond Yield in U.S. on Indian Market

- Higher Returns with Lower Risk: When U.S. bond yields increase, the risk-reward ratio of Indian equities declines. FIIs and FPIs reduce their equity exposure in emerging markets like India and move funds to safer U.S. bonds.

- Stronger U.S. Dollar : Rising U.S. bond yields increase demand for the U.S. dollar, strengthening it against other currencies.

- A weaker rupee makes Indian assets less attractive to foreign investors.

- FIIs sell Indian stocks and repatriate their funds, further weakening the rupee.

- Higher Borrowing Costs for Indian Companies: Higher global bond yields lead to increased domestic borrowing rates. Indian companies relying on foreign debt face higher interest costs.

- Corporate profitability declines, negatively impacting stock market sentiment.

Relation Between Bond Yield and Stock Market

- Stock Markets and Bond Yields Have an Inverse Correlation

- Rising Bond Yields leads to Bearish Stock Market

- Higher Borrowing Costs for Companies: Increased bond yields result in higher interest rates on loans and corporate bonds.

- Higher borrowing costs reduce corporate profits, leading to a decline in stock prices.

- Attractive Fixed-Income Returns: Higher bond yields make bonds more attractive than stocks.

- Investors shift money from equities to bonds, leading to a stock market sell-off.

- Inflationary Pressures: Rising bond yields often reflect higher inflation expectations.

- Higher inflation erodes future corporate earnings, making stocks less attractive.

- Tighter Monetary Policy: Rising bond yields suggest central banks (RBI, U.S. Fed) are tightening monetary policy.

- Higher interest rates slow economic growth, negatively affecting stock market performance.

- Falling Bond Yields leads to Bullish Stock Market

-

- Lower Borrowing Costs: Lower bond yields reduce interest rates, making borrowing cheaper for businesses.

- This boosts corporate profits, leading to stock market gains.

- Less Attractive Bonds: When bond yields fall, bonds provide lower returns.

- Investors move funds to riskier assets like stocks, increasing demand for equities.

- Economic Growth Expectations: Falling bond yields may indicate loose monetary policy, promoting economic expansion.

- This benefits stock markets by supporting higher earnings and valuations.

![]() 13 Feb 2025

13 Feb 2025