Despite major investments in carbon credit projects to protect the Amazon, a Reuters investigation revealed that many of these efforts are benefiting individuals and firms previously fined for illegal deforestation.

- Of 36 conservation projects in the Amazon offering voluntary carbon offsets, at least 24 involved landowners, developers or forestry firms fined by Brazil’s environmental agency Ibama for illegal deforestation.

What are Carbon Credits ?

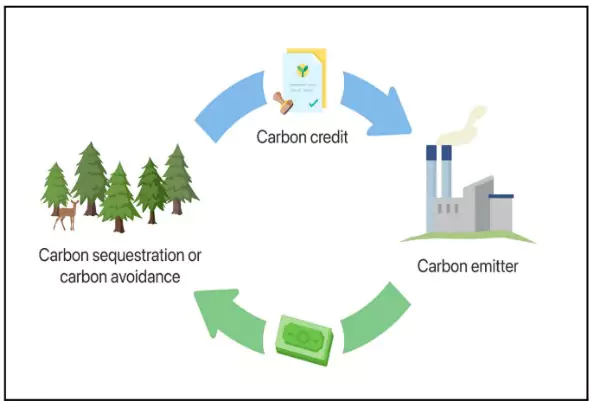

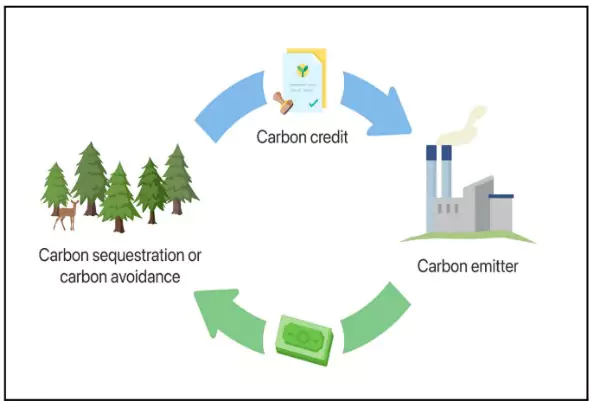

- Carbon credit, refers to reduction or removal of greenhouse gas emissions, measured in tonnes of carbon dioxide equivalent (tCO₂e). Each credit permits the emission of one tonne of CO₂ or its equivalent.

- Introduced under the Kyoto Protocol (1997) and reinforced by the Paris Agreement (2015), carbon credits aim to curb global emissions through carbon trading systems.

How Are Carbon Credits Generated?

- Credits are created by projects that either reduce emissions or remove CO₂ from the atmosphere, such as:

- Renewable energy (e.g., wind or solar farms)

- Energy efficiency improvements

- Reforestation or afforestation

- Methane capture from landfills or industrial operations

- These projects are verified and certified by international standards like the Verified Carbon Standard (VCS) and the Gold Standard.

Carbon Markets

- Carbon markets provide a platform for buying and selling carbon credits and are key to global emissions reduction strategies.

- Carbon markets transfer resources from the private sector to the State.

- Article 6 of the Paris Agreement allows countries to transfer carbon credits from one to another to meet national climate goals collaboratively.

- Market Types:

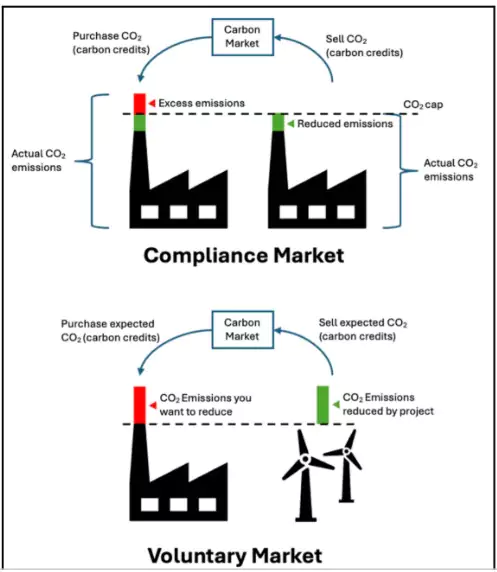

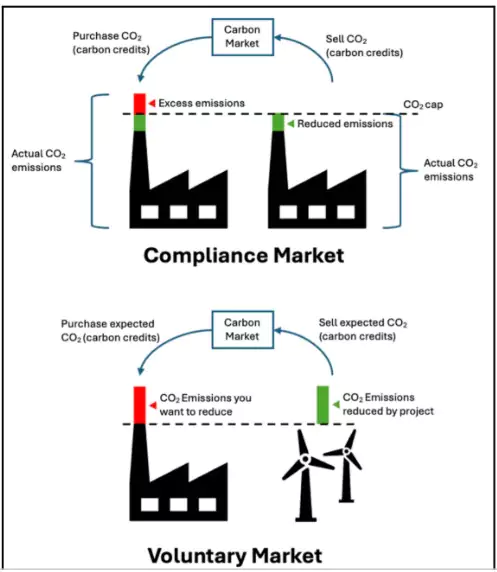

-

- Compliance Markets: Regulated systems where participants must meet legal emission targets (e.g., EU ETS).

- Voluntary Markets: Allow organizations to offset emissions voluntarily for CSR or net-zero goals, without legal obligation.

Examples of Carbon Markets

Compliance Markets

- The EU Emissions Trading System (EU ETS), launched in 2005, is the first carbon market and one of the largest. It covers all EU countries, plus Iceland, Liechtenstein, and Norway, regulating emissions from around 10,000 energy, manufacturing, and aviation facilities.

- China’s Emissions Trading System (ETS), introduced in 2021, is currently the largest by volume of emissions covered. It initially targets around 2,000 power sector companies, with plans to expand to other industries.

- The Clean Development Mechanism (CDM), established under the 1997 Kyoto Protocol, is another key example of a global compliance-based carbon market.

Voluntary Markets:

Major platforms include Xpansiv CBL in the United States and ACX (formerly AirCarbon Exchange) in Singapore, where carbon credits are traded outside regulatory mandates. |

Mechanism of Carbon Credits

- Setting Emission Caps: Governments set emission limits for sectors or companies.

- Generating Credits: Projects demonstrating verifiable GHG reductions are awarded carbon credits after certification.

- Trading Credits: Credits are bought and sold on platforms such as the EU ETS or voluntary exchanges, creating economic incentives for emissions reductions.

- Offsetting Emissions: Companies can purchase credits to compensate for their emissions and work toward carbon neutrality.

Benefits of Carbon Credits

- Environmental Protection: Promotes adoption of cleaner technologies and preservation of ecosystems.

- Economic Incentives: Rewards innovative and sustainable practices.

- Flexibility: Offers cost-effective compliance solutions.

- Global Cooperation: Enables countries and organizations to collaborate in climate action.

Concerns with Carbon Credits

- Greenwashing: Companies may use credits to appear sustainable without reducing actual emissions, undermining market credibility.

- Lack of Transparency: Insufficient oversight, real-time tracking, and audits can lead to problems like double-counting and reduced trust in the system.

- Inequitable Access: Developing nations may lack the resources or infrastructure to participate effectively, reinforcing global inequalities.

India’s Initiatives Related to Carbon Credits

- Nationally Determined Contributions (NDCs): In 2023, India updated its NDCs to include the creation of a domestic carbon market as part of its climate action plan under the Paris Agreement.

- Energy Conservation (Amendment) Act, 2022: This Act provides the legal basis for the Carbon Credit Trading Scheme (CCTS), enabling the government to establish a national carbon market and authorize agencies to issue carbon credit certificates (CCCs).

- Perform, Achieve and Trade (PAT) Scheme: Launched by the Bureau of Energy Efficiency (BEE), PAT promotes energy efficiency in large industries by allowing them to trade Energy Saving Certificates (ESCerts).

- Carbon Credit Trading Scheme (CCTS): The CCTS is a market-based mechanism under the Indian Carbon Market (ICM) that enables trading of carbon credits to price and reduce GHG emissions.

- It marks a shift from the PAT scheme, which focused on energy efficiency, to a broader approach targeting emission intensity.

- Under CCTS, Carbon Credit Certificates (CCCs) are issued for every tonne of CO₂ equivalent reduced.

- Renewable Energy Certificates (REC): RECs are market instruments that certify electricity generated from renewable sources. One REC represents one megawatt hour of green energy fed into the grid.

- Green Credit Programme (GCP): Introduced under the LiFE initiative, GCP incentivizes voluntary environmental actions by individuals, businesses, and communities through a market-driven credit system.

- Monitoring and Verification Mechanism: The BEE and the National Steering Committee for Indian Carbon Market (NSCICM) oversee the accuracy of carbon credits through strict monitoring, reporting, and verification protocols.

![]() 8 Jul 2025

8 Jul 2025