Recently, the minister for micro, small and medium enterprises (MSMEs) told the Lok Sabha that out of the million registered MSMEs, 49,342 have closed, resulting in the loss of 317,641 jobs.

About MSME

- Definition: MSME stands for Micro, Small and Medium Enterprises. MSMEs are businesses that produce, process, and preserve goods and commodities.

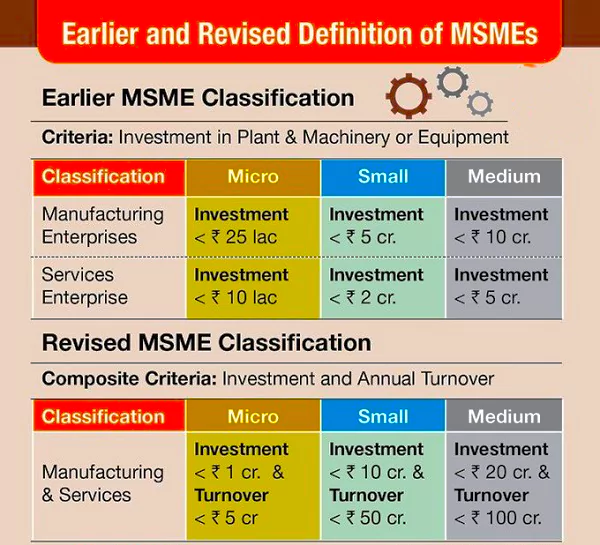

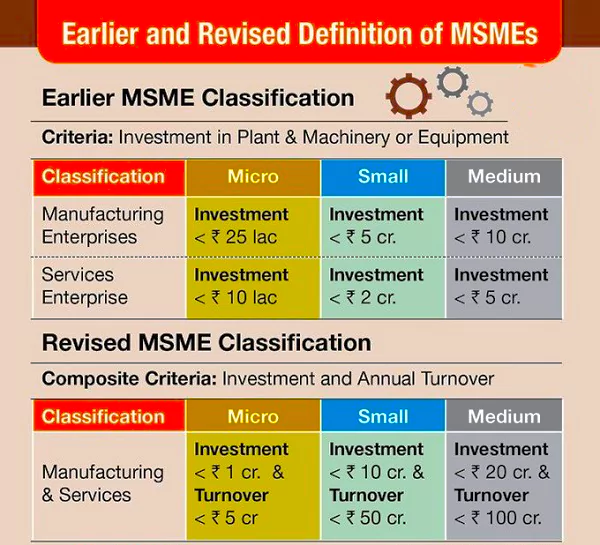

- These are broadly classified based on their investment in plant and machinery for manufacturing or equipment for service enterprises, as well as their annual turnover.

Division: By the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006 , the enterprises are classified into two divisions:

Division: By the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006 , the enterprises are classified into two divisions:-

- Manufacturing Enterprises: Engaged in the manufacturing or production of goods in any industry

- Service Enterprises: Engaged in providing or rendering services

- Manufacturing Enterprises and Enterprises rendering Services are classified as following:

- Micro-enterprises: The investment limit will be 1 crore and turnover 5 crores.

- Small enterprises: the investment limit will be 10 crores and the turnover 50 crores.

- Medium enterprise: the investment limit will be 50 crores and turnover 250 crores.

Enroll now for UPSC Online Course

Significance of MSME Sector

- Gross Value Added: The share of MSME GVA in all India GDP stood at 30.1 per cent in FY23, improving from 29.6 per cent in FY22 and 27.3 percent in FY21.

Gross Value Added

- According to the RBI, the GVA of a sector is defined as the value of output minus the value of its intermediary inputs.

- This “value added” is shared among the primary factors of production, labour and capital.

- By looking at the GVA growth one can understand which sector of the economy is robust and which is struggling.

|

- Manufacturing Output & Export: The share of MSMEs in all-India manufacturing output during the year FY22 was 35.4 per cent.

- Export: The share of export of MSME-specified products in all-India exports in 2023-24 was 45.7 per cent.

- Employer: MSMEs contribute about 27% to India’s GDP and employ more than 110 million people, making it the second largest employer in the country, after agriculture.

MSME Worldwide

- Data: Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the global economy, accounting for 90% of businesses, 60 to 70% of employment, and 50% of GDP worldwide, according to the United Nations.

- Developmental Catalyst: These enterprises are the backbone of societies everywhere, contributing significantly to local and national economies and sustaining livelihoods, particularly among the working poor, women, youth, and vulnerable groups.

|

New Provisions Highlights In The Budget

- Support for Promotion of MSMEs : The budget provides special attention to MSMEs and manufacturing, particularly labour-intensive manufacturing.

Pooling of credit risk

- It refers to the process where multiple loans or financial assets are combined into a single portfolio to diversify and manage the risk associated with lending or investing.

- This technique is commonly used in finance to reduce the impact of any single loan’s default on the overall portfolio.

|

-

- Credit Guarantee Scheme for MSMEs in the Manufacturing Sector: A new credit guarantee scheme for term loans to MSMEs for machinery and equipment purchase without collateral.

- Self-financing guarantee fund: Credit guarantee scheme on pooling of credit risks of MSMEs as separately constituted — a self-financing guarantee fund will provide to each applicant guarantee covers up to ₹100 crore, while the borrower will have to provide an upfront guarantee fee and an annual guarantee fee on the reducing loan balance.

- New assessment model for MSME Credit

- About: A new assessment model for MSME credit will enable public sector banks to develop in-house capabilities for evaluating MSMEs instead of depending on external assessments.

- Credit Assessment Model: They will lead the creation of a credit assessment model that scores MSMEs based on their digital footprints.

- AIM: This approach aims to significantly enhance the traditional credit eligibility assessment, which typically relies on asset or turnover criteria, and will also include MSMEs lacking a formal accounting system.

- Credit Support During Stress: A new mechanism to ensure continued bank credit for MSMEs during periods of stress, particularly when they are in special mention accounts (SMA) due to circumstances beyond their control.

- This support aims to help MSMEs maintain operations and avoid transitioning to non-performing (NP) status.

- Credit availability will be backed by a guarantee from a government-promoted fund.

Check Out UPSC CSE Books From PW Store

Non Performing Assets (NPAs)

- It is a loan or advance for which the principal or interest payment remained overdue for 90 days.

- Non Performing Assets (NPAs) are a significant concern for banks and financial institutions as they can impact profitability, liquidity, and overall financial stability.

- Managing and reducing Non Performing Assets (NPAs) is crucial for maintaining the health of the banking sector and fostering sustainable economic growth

Special Mention Account

- SMA are those accounts that show symptoms of bad asset quality once the account is overdue or before its being identified as NPA.

- Three Types of SMA: The Special Mention Accounts are usually categorized in terms of duration as follows:

- SMA & NPA Categorization

| SMA Classification |

Basis For Classification |

| Standard Accounts |

- Loan where principal and interest payment are made timely

|

| SMA – NF |

- Non – Financial (NF) signs of stress.

|

| SMA 0 |

- Loan principal or interest is unpaid for 0 – 30 days from its due date

|

| SMA 1 |

- Loan principal or interest is unpaid for 31 – 60 days

|

| SMA 2 |

|

| NPA |

- Unpaid for more than 90 days.

|

|

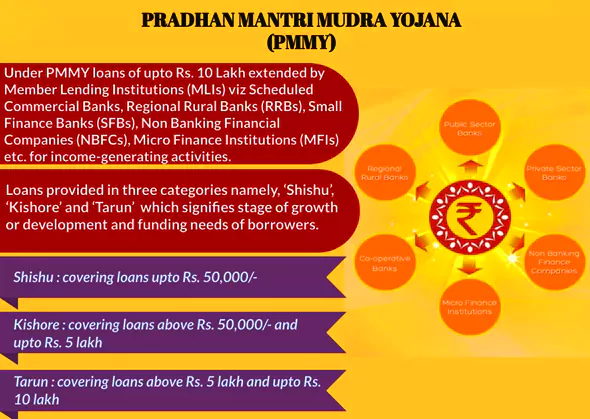

- Mudra Loans: The limit of Mudra loans will be enhanced to ₹ 20 lakh from the current ₹ 10 lakh for those entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category.

About Pradhan Mantri MUDRA Yojana (PMMY)

- MUDRA, stands for Micro Units Development & Refinance Agency Ltd., is a financial institution set up by the Centre.

- MUDRA was initially formed as a wholly owned subsidiary of the Small Industries Development Bank of India (SIDBI) with 100% capital being contributed by it.

- Launch Year: 2015

- Objective: To provide loans up to 10 lakh to non-corporate, non-farm small and micro enterprises through Banks, Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs).

- MUDRA does not lend directly to micro-entrepreneurs/individuals.

- Loans under this scheme are collateral-free loans.

- Ministry: Ministry of Finance

|

- SIDBI branches in MSME clusters: SIDBI will open 24 new branches this year, expanding to 168 out of 242 major MSME clusters within 3 years.

- MSME Units for Food Irradiation, Quality & Safety Testing:

- Setting up of 100 food quality and safety testing labs with NABL accreditation will be facilitated.

- Financial support will be provided to establish 50 irradiation units in the MSME sector to enhance quality and safety testing.

- Testing Labs: Additionally, the setup of 100 NAB-accredited food quality and safety testing labs will be facilitated.

- E-commerce export hubs: It will be created through public-private partnerships to help MSMEs and traditional artisans sell their products in international markets.

- These hubs will operate under a seamless regulatory and logistical framework, offering trade and export-related services in one location.

- Emergency Credit Line Guarantee Scheme (ECLGS): This support has been significant through capital expenditure (capex) and initiatives like the Emergency Credit Line Guarantee Scheme (ECLGS).

Check Out UPSC NCERT Textbooks From PW Store

Emergency Credit Line Guarantee Scheme (ECLGS)

- Launch: It was launched in response to the economic downturn precipitated by the COVID-19 pandemic in the Union Budget 2020-21

- About: This scheme aimed to provide collateral-free loans to MSMEs, with a 100% guarantee coverage from the government to banks and NBFCs.

- Allocation: The initial allocation for ECLGS was ₹3 lakh crore, providing much-needed liquidity to around 45 lakh MSMEs affected by the pandemic.

- A 100% guarantee is provided by the National Credit Guarantee Trustee Company (NCGTC) to Member Lending Institutions (MLIs) – banks, financial institutions and Non-Banking Financial Companies (NBFCs).

- The credit product for which guarantee would be provided under the Scheme shall be named as ‘Guaranteed Emergency Credit Line (GECL)’.

|

- Trade Receivables Discounting System (TReDS):Lowering the turnover threshold for mandatory onboarding on the TReDS platform from ₹500 crore to ₹250 crore.

- This change will allow an additional 22 Central Public Sector Enterprises (CPSEs) and 7,000 companies to join the platform, and medium enterprises will also be included as suppliers.

- About Trade Receivables Discounting System (TReDS): TReDS is a digital platform that facilitates the discounting of MSMEs’ trade receivables through multiple financiers– Banks and NBFCs- to meet liquidity and working capital requirements.

Other Government Initiatives for MSMEs

The Government of India has implemented a robust array of initiatives aimed at bolstering the MSME sector, recognizing its pivotal role in the economy:

- PM Vishwakarma

- AIM: It aims to enhance the quality and reach of products and services by artisans and craftspeople, integrating them into domestic and global value chains.

- Announced in the 2023-24 Budget: This scheme seeks to provide comprehensive support to Vishwakarmas, improving their socio-economic status and quality of life.

- Central Sector Scheme: It is fully funded by the Government of India

- Collateral Free Credit: Registered applicants will undergo a 5-day ‘Basic Training’ program, and those opting for credit support will receive collateral-free credit.

- Enhancing the flow of bank credit to MSMEs through formalisation

- Priority Sector Lending Guidelines: All bank loans to MSMEs conforming to the conditions prescribed therein qualify for classification under priority sector lending.

- Registration of MSMEs on Udyam Portal:

- Objective: Udyam Registration Portal was launched in 2020 to facilitate registration for existing enterprises across the country.

- Enterprises previously registered under the erstwhile Udyog Aadhaar Memorandum and Entrepreneurship Memorandum-II are also encouraged to migrate to the new Udyam Registration system.

- Free of Cost: This online portal is free of cost, paperless, and based on self-declaration, eliminating the need for document uploads.

- Challenge with URP: It was the registration of Informal Micro Enterprises (IMEs) which are sizeable in number.

- No PAN/GST: Since IMEs do not have a PAN/GST, they cannot register on URP and avail themselves of the benefits of Government programmes.

- Launched UAP: To formalise such enterprises, the Ministry of MSME, in collaboration with the Small Industries and Development Bank of India (SIDBI), launched the Udyam Assist Platform (UAP)

- Udyam Assist Platform: In 2023, the Government introduced the Udyam Assist Platform to integrate informal micro-enterprises into the formal sector.

- AIM: This initiative aims to enable these enterprises to access benefits under Priority Sector Lending, thereby enhancing their growth and sustainability.

- Prime Minister’s Employment Generation Programme (PMEGP)

- About: It is a credit linked subsidy scheme for providing employment opportunities through establishment of micro-enterprises in the non-farm sector.

- Under the Scheme, Margin Money (Subsidy) is provided to beneficiaries availing loan from banks for setting up new enterprises.

- Subsidies under PMEGP vary by category:

- Special Categories: It includes SC, ST, OBC, Minorities, Women, Ex-Servicemen, Transgenders, Differently-abled individuals, NER, Aspirational Districts, and Hill and Border areas, are eligible for a subsidy of 25% in urban areas and 35% in rural areas

- General Category applicants are eligible for a subsidy of 15% in urban areas and 25% in rural areas.

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

- AIM: The Scheme was launched in 2005-06 and aims towards organizing traditional artisans into collectives/clusters for product development and diversification through value addition and to promote traditional sectors and increase income of artisans in a sustainable manner. The scheme was revamped in 2014-15.

- Objective: The main objective of the scheme is to organize the artisans and traditional industries into clusters for better competitiveness, for enhancing employment opportunities and to increase marketability of products of such clusters.

- Public Procurement Policy for Micro and Small Enterprises

- About: The Ministry of MSME, Government of India notified the Public Procurement Policy for Micro and Small Enterprises (MSEs), Order, 2012, which mandates 25%, including 4% from MSEs owned by SC/ST and 3% from MSEs owned by Women entrepreneurs. A total of 358 items are reserved for exclusive procurement from MSEs.

- India International Trade Fair (IITF), 2023

- Launch: “MSME pavilion” under the theme “PM Vishwakarma” was inaugurated at 42nd India International Trade Fair (IITF), 2023.

- 195 stalls were allocated to Micro and Small Enterprises (MSEs), with participation from 29 States/UTs. First Timers: More than 85% of stalls were allocated to first time participants.

- Free of Cost: Stalls were allocated free of cost to women, SC/ST, NER, Aspirational District beneficiaries.

Challenges

- Share of MSME GVA in GDP yet to hit the pre-pandemic level: The share of MSME GVA in all India GDP stood at 30.1 per cent in FY23, improving from 29.6 per cent in FY22 and 27.3 percent in FY21.

- The share of MSME Gross Value Added (GVA) in India’s GDP stood at 29.7% in 2017-18, increasing to 30.5% in both 2018-19 and 2019-20.

- Decline in Exports: the percentage share of exports of MSME-related products in all India exports dropped from 49.73 per cent in FY20 to 49.35 per cent in FY21, 45.03 per cent in FY22 and 43.59 per cent in FY23. As of May 2024, the share was 45.79 per cent.

- Unemployment: Over 300,000 people were made jobless due to the closure of nearly 50,000 small businesses in the last 10 years

- Maharashtra saw the most closures, with 12,233 MSMEs shutting down,

- Out of the million registered MSMEs, 49,342 have closed, resulting in the loss of 317,641 jobs.

- The estimated unemployment rate for persons aged 15 years and above was 4.2% in 2020-21, 4.1% in 2021-22, and 3.2% in 2022-23

- Export Underperformance: MSMEs contribute about 45% to the country’s total exports. But Exports remain an under-utilized opportunity for MSMEs, even as they are called the powerhouse of the Indian economy and contribute significantly to employment generation, exports, and overall economic growth.

- NITI Aayog report: Citing data from the Udyam portal NITI Aayog report said that despite the opportunity for MSMEs to pursue exports, only 0.95% of MSMEs are engaged in it.

- Out of the 15.8 million MSMEs registered on Udyam, only over 150,000 units claimed to export their goods and services.

- MSME exports through the e-commerce route: India significantly lags a comparable economy like China

- In 2022, MSMEs in China exported goods worth over $200 billion through e-commerce platforms, while India’s e-commerce export is barely $2 billion that year.

- Lack of Finance

Enroll now for UPSC Online Classes

Way Forward

- Introduce Separate Micro-MSME division: It will provide targeted support and policies to help micro enterprises grow and transition into small and medium enterprises.

- Bridging The Gap Between Integrated And Non-Integrated Firms (E-Commerce Platforms): It will require investments in technology, digital skills, information, enhancing the capabilities and productivity of MSMEs.

- This can be achieved by providing them with infrastructure services, financial services, managerial and business skills and enterprise support and training.

- Study by Institute of Governance, Policies and Politics shows that 1 per cent rise in imported digital services production inputs by MSMEs results in a 0.4-0.8 per cent rise in MSME employment, 0.1-0.2 per cent rise in MSME value addition and a 0.04-0.08 per cent rise in labour productivity.

- Initiate Support For Women-Owned MSMEs: Implementing policies that promote women entrepreneurship.

- Providing dedicated support, such as access to capital, training, and networking opportunities, will empower women-led micro MSMEs and contribute to inclusive economic growth.

- Improve Ease Of Doing Business: Simplified and streamlined regulatory processes specifically designed for micro-MSMEs can help reduce their compliance burden, allowing them to focus on their core business activities.

- Streamline The Rules Of Financial Regulation For Exports: Reduce the burden on MSMEs and give them the flexibility to price their products dynamically.

- Implementing a one-stop trade portal that brings together all information and processes related to exporting, and places it into a single, streamlined workflow.

- Digitalisation: There is a need for replicable digital solutions adapted for MSMEs, including digital enhancements for machinery and equipment currently in use.

- Initiatives such as the Digital Saksham and the interlinking of the Udyam, Atmanirbhar Skilled Employee-Employer Mapping (ASEEM) portals have shown commendable results.

Conclusion

- Micro, Small, and Medium Enterprises (MSMEs) are vital engines of economic growth and development in India.

- With their immense contribution to employment, production, and innovation, MSMEs are crucial for achieving inclusive and sustainable development.

- As the government continues to implement supportive policies and initiatives, nurturing the MSME sector will remain imperative for fostering entrepreneurship, driving industrialization, and realizing India’s economic potential.

![]() 27 Jul 2024

27 Jul 2024

Division: By the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006 , the enterprises are classified into two divisions:

Division: By the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006 , the enterprises are classified into two divisions: