Multiple audits by the Comptroller and Auditor General have revealed that urban local bodies (ULBs) across states are struggling with weak financial management, generating only 32% of their revenue from internal sources.

Comptroller and Auditor General

Constitutional Provisions

- Article 148: Establishes the independent office of CAG.

- Article 149: Outlines CAG’s duties and powers, defined by Parliamentary laws.

- Security of Tenure: Holds office for six years or until age 65. Removal is akin to Supreme Court judges.

Appointment and Selection

- Appointed by the President of India under their warrant and seal.

- Salary and conditions set by Parliament, with protection from disadvantageous changes.

Roles and Responsibilities

- Audits accounts of Consolidated Funds of India, states, and UTs.

- Examines expenditure, ensuring legality, efficiency, and economy (proprietary audit).

- Submits reports to the President (for Parliament) and Governors (for state legislatures).

- Certifies net tax proceeds and advises on government accounting.

|

About the CAG Report On Urban Local Bodies

- The CAG released a compendium of audit reports into the implementation of the 74th amendment in 18 states.

- It covered 393 urban local self-governments (ULSGs) across 18 States.

Enroll now for UPSC Online Course

Key Highlight of the CAG Report on Urban Local Bodies

- Resource-Expenditure Gap: ULBs in 18 states face a significant 42% gap between available resources and actual expenditure.

- Funding Sources: Only 32% of ULB revenue is internally generated, with the remaining funds coming from state and central government transfers.

- Property Tax Collection: ULBs are only able to realize 56% of their total property tax demand.

- Unrealistic Budgeting: ULBs in 13 states display significant budget variances, with Himachal Pradesh reporting a 403% variance in receipts and 274% in expenditure.

- Other high-variance states include Odisha, Rajasthan, and Punjab.

- Staff Shortages: ULBs have an average vacancy rate of 37%, severely affecting their capacity to function effectively.

- Recruitment Autonomy: ULBs in 16 states have limited or no power over their own recruitment processes.

- Low Fund Utilisation: On average, ULBs in 11 states utilised only 61% of their available funds, indicating inefficiency that potentially impacts service delivery.

- Development Spending: Only 29% of ULB spending goes towards programmatic and development work, while the majority is used for administrative and operational expenses.

- Recommendation: The CAG recommends increased involvement of ULBs in essential areas like planning to enhance their functionality and decision-making capacity.

Subjects under XIIth Schedule of the Constitution of India

- Urban planning including town planning;

- Regulation of land use and construction of buildings;

- Planning for economic and social development;

- Roads and bridges;

- Water supply for domestic, industrial, and commercial purposes;

- Public health, sanitation, conservancy, and solid waste management;

- Fire services;

- Urban forestry, protection of the environment, and promotion of ecological aspects;

- Safeguarding the interests of weaker sections of society, including the handicapped and mentally retarded;

- Slum improvement and up-gradation;

- Urban poverty alleviation;

- Provision of urban amenities and facilities such as parks, gardens, and playgrounds;

- Promotion of cultural, educational, and aesthetic aspects;

- Burials and burial grounds, cremations and cremation grounds, and electric crematoriums;

- Cattle ponds, prevention of cruelty to animals;

- Vital statistics including registration of births and deaths;

- Public amenities including street lighting, parking lots, bus stops, and public conveniences; and

- Regulation of slaughterhouses and tanneries.

|

Issues regarding Devolution of Power highlighted by CAG

- Limited Autonomy: Despite the amendment, only four functions have been fully devolved to ULBs by the 74th Constitutional Amendment with complete autonomy across 18 states, showing weak compliance with the amendment’s “in-spirit reading.”

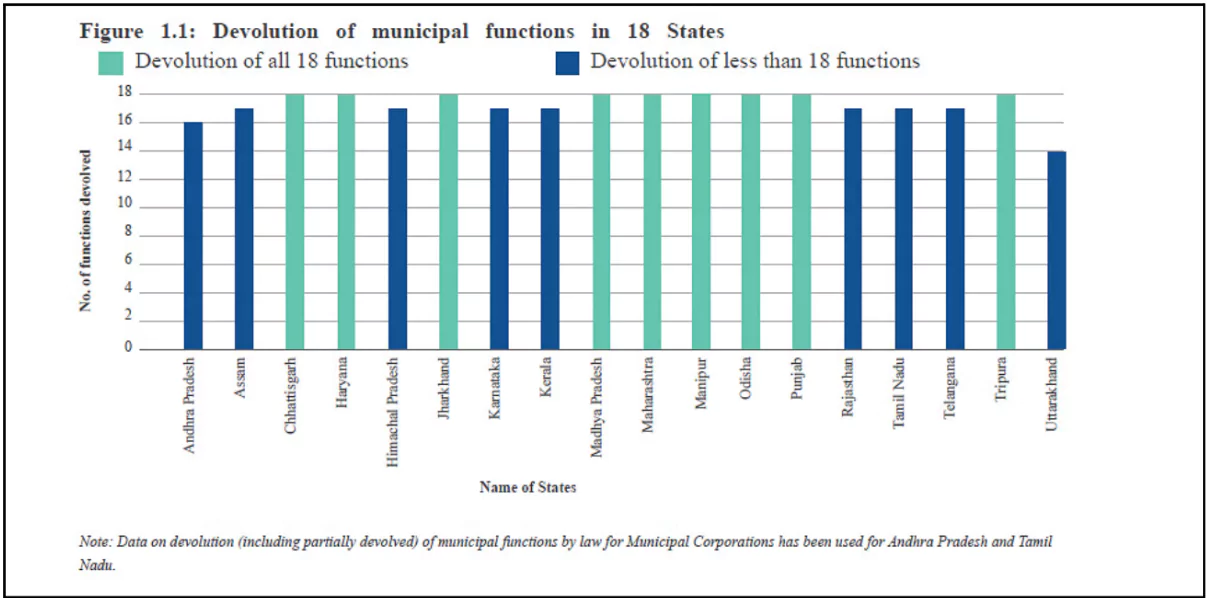

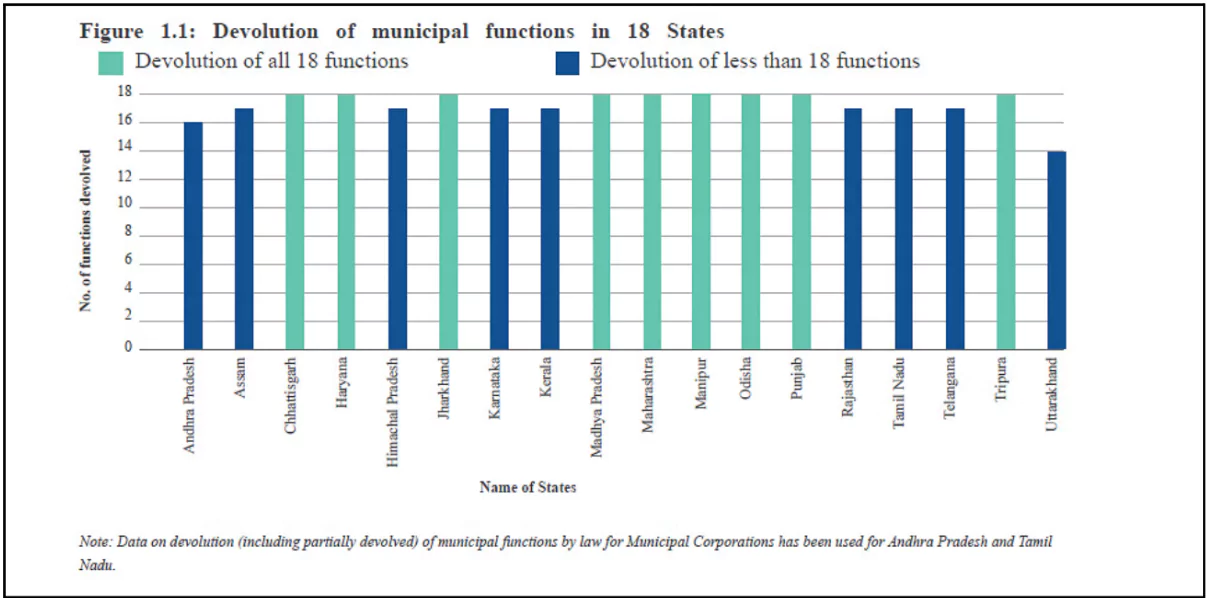

- Progress on Devolution: On average, 17 of the 18 functions listed under 18 subjects specified in the XIIth Schedule of the Constitution of India have been devolved across the states.

- Complete Devolution: Nine states, including Chhattisgarh, Haryana, Jharkhand, Madhya Pradesh, Maharashtra, Manipur, Odisha, Punjab, and Tripura, have devolved all 18 functions.

Least Devolved Functions:

Least Devolved Functions: -

- Urban planning and fire services are the least devolved functions.

- Call for Stronger Urban Governance by CAG:

- Future Urban Population: With 50% of India’s population expected to reside in cities by 2050, robust urban governance structures are crucial for sustainable urban development.

- Policy Recommendations: The CAG emphasises that state governments should create policies, laws, and institutional mechanisms to strengthen ULBs, allowing them to deliver a high quality of life to urban residents.

- Stakeholder Involvement: Empowering ULBs should be a national priority and there is need for better collaboration across government, civil society, and academia to drive meaningful urban governance reforms

- Revenue Autonomy Constraints: ULBs have limited authority over key taxes and user charges such as property tax, profession tax, water charges, and solid waste management fees.

- Property Tax Limitations: Though ULBs are authorised to collect property tax, state governments control rates, assessment methods, exemptions, and collection processes, hindering ULBs’ revenue potential.

Check Out UPSC CSE Books From PW Store

About Urban Local Bodies (ULBs) in India

- ULBs are the lowest tier of urban governance, responsible for managing urban areas and delivering essential services.

- They function as self-governing institutions aimed at improving infrastructure, public services, and the overall quality of life in urban centres.

Historical Background of ULBs in India

- Ancient Times: Cities were managed by local councils responsible for trade, order, and public utilities like water and waste management.

- British Era: Introduced local self-government in urban areas.

- The first municipal corporation was established in Madras (1688), followed by Bombay and Calcutta.

- Post-Independence: Continued the system of local self-governance, with reforms to address the democratic needs of a free India.

- The 74th Constitutional Amendment Act, 1992, gave constitutional recognition to ULB.

74th Constitutional Amendment Act (CAA), 1992

- Added Part IXA and the XIIth Schedule to the Constitution, establishing ULBs as the third tier of governance.

- Introduced three types of ULBs:

-

- Municipal Corporations for large cities.

- Municipal Councils for medium-sized cities.

- Nagar Panchayats for transitional towns.

- Mandated the devolution of 18 functional responsibilities to ULBs, including urban planning, water supply, sanitation, and public health.

- Called for the creation of State Finance Commissions to ensure financial stability.

Constitutional and Legal Framework

- Articles 243P-243ZG: Provide the constitutional framework for ULBs.

- XIIth Schedule : Lists 18 functional areas for ULB governance, such as urban planning, public health, and slum improvement.

- State Municipal Acts: Define the structure, powers, and functions of ULBs in individual states.

Check Out UPSC NCERT Textbooks From PW Store

Structure of Urban Local Bodies (ULBs) in India

| Type of Urban Local Body |

Description |

Characteristics |

| Municipal Corporation |

Found in large cities (e.g., Delhi, Mumbai, Kolkata, Bangalore). |

Higher autonomy, elected representatives, and led by a Mayor. |

| Municipality |

Present in smaller cities, also known as Municipal council, Municipal committee, or Municipal board. |

Elected representatives perform basic urban functions, led by a Chairman. |

| Notified Area Committee |

Established in rapidly developing towns or towns lacking basic amenities. |

Members and Chairman are nominated by the State government;

They have no elected representatives. |

| Town Area Committee |

Found in small towns with limited authority. |

Manages basic services like street lighting, drainage, roads, and conservancy. |

| Cantonment Board |

Formed for civilian populations in military cantonments. |

Created by and operates under the central government, with representation from civilians and defence. |

| Township |

Provides basic facilities to staff and workers near industrial plants. |

No elected members;

Administered as an extension of the bureaucratic structure. |

| Port Trust |

Set up in port areas (e.g., Mumbai, Chennai, Kolkata) to manage ports and provide civic amenities. |

Governs port activities and provides basic civic services to nearby residents. |

| Special Purpose Agency |

Agencies established to perform specific functions or services (e.g., transportation, water supply, urban planning). |

Functions independently of municipal bodies, focusing on designated areas or projects. |

Functions of ULBs

- Urban Planning and Development: Town planning, economic development.

- Public Services: Water supply, waste management, and public health.

- Infrastructure: Roads, bridges, and urban amenities like parks and lighting.

- Welfare Programs: Focus on urban poverty alleviation and slum improvement.

Sources of Income for Urban Local Bodies (ULBs) in India

Urban Local Bodies (ULBs) in India primarily rely on a combination of own-source revenue and grants from the Central and State governments to fund their operations.

- Own-Source Revenue:

- Property Tax: A major source of revenue for ULBs, levied on properties within their jurisdiction.

- Professional Tax: Tax on professions, trades, callings, and employments carried on within the ULB’s area.

- User Charges: Fees collected for services provided by ULBs, such as water supply, sewerage, and solid waste management.

- Other Taxes and Fees: Taxes on advertisement hoardings, entertainment, toll taxes, etc., and fees for licenses and permits.

- Grants from Central Government:

-

- Central Finance Commission (CFC) Grants: Allocated by the CFC to ULBs based on various factors like population, urbanization, and fiscal performance.

- Centrally Sponsored Schemes (CSS): Funds provided by the Central Government for specific projects and programs implemented by ULBs.

- Grants from State Government:

- State Finance Commission (SFC) Grants: Allocated by the SFC to ULBs within the state.

- State-Specific Grants: Grants provided by the State Government for various purposes, such as urban development, infrastructure, and social welfare.

Composition of ULB Income

The composition of ULB income varies significantly across different states and cities.

- Own-Source Revenue: Typically contributes a smaller portion, often less than 25% of the total income.

- Central and State Grants: Together, they constitute a major portion of ULB income, often exceeding 75%.

Check Out UPSC Modules From PW Store

16th Finance Commission Recommendations for ULBs

- Enhanced Fiscal Autonomy: Granting ULBs more autonomy in decision-making regarding revenue generation and expenditure.

- Rationalisation of Tax Structure: Simplifying and rationalising the tax structure to improve compliance and collection efficiency.

- Strengthening Property Tax Administration: Modernising property tax assessment and collection systems.

- Promoting User Charges: Encouraging ULBs to implement fair and equitable user charges for services provided.

- Capacity Building: Providing training and technical assistance to ULB officials to improve their financial management skills.

- Increased Central and State Grants: Allocating adequate funds to ULBs to meet their growing needs.

|

Significance of Urban Local Bodies

- Efficient Public Service Delivery: ULBs cater to local needs, such as water supply, sanitation, and waste management.

- Bengaluru’s BBMP handles city-specific challenges like traffic and waste.

- Democratic Participation: Encourages citizens’ engagement in governance through ward committees and public forums.

- Gram Sabhas in Tamil Nadu ensure participatory decision-making.

- Socio-Economic Development: Implements plans for urban infrastructure and welfare. Pune Municipal Corporation’s smart city initiatives have brought significant socio-economic benefits for Communities around the city.

- Inclusion and Representation: Seats reserved for women, SCs, and STs promote equity.

- For example: Women-led municipal councils in Maharashtra have improved political awareness among women.

- Catalyst for Federalism: Strengthened decentralized governance at grassroots level will improve overall governance at state level.

Challenges of Urban Local Bodies (ULBs)

- Weak Financial Management: ULBs are overly reliant on central and state transfers. Example: Municipal revenue contributes only 1% of GDP, limiting their fiscal autonomy.

- Resource-Expenditure Gap: The gap between revenue and expenditure impacts service delivery. Example: Many ULBs in Bihar, face resource deficits due to delayed grants and outdated property tax systems.

- Low Fund Utilisation: Inefficient use of allocated funds hinders project execution. Example: Underutilization in urban development programs like AMRUT has been widely reported.

- Limited Autonomy: ULBs lack control over key areas like recruitment and planning. Example: State-appointed commissioners in Tamil Nadu wield executive power, overshadowing elected Mayors.

- Staff Shortages: Vacancies in skilled roles lead to inefficiencies. CAG report had highlighted Karnataka ULBs’ dependence on state-controlled recruitment, delaying essential staffing.

- Unrealistic Budgeting: Variances in financial planning lead to mismanagement. Example: Unrealistic budget estimates in states like Uttar Pradesh contribute to underperformance.

- Inadequate Devolution: Functions mandated by the 74th Amendment remain partially implemented. Karnataka’s BBMP Act grants limited taxation powers but retains key controls with the state government.

Enroll now for UPSC Online Classes

Way Forward

- Strengthen Revenue Autonomy: Empower ULBs to revise property taxes and set fair user charges to enhance internal revenue.

- Improve Fund Utilisation: Introduce robust planning and monitoring mechanisms for efficient resource allocation.

- Capacity Building: Train ULB staff in financial management and service delivery.

- Full Devolution of Powers: Ensure compliance with the 74th Amendment by granting ULBs complete autonomy over all listed functions.

- Collaboration: Foster partnerships among government, civil society, and private sectors to drive urban governance reforms.

-

- Indore is known for its cleanliness and efficient waste management practices achieved through collaboration.

- Many ULBs like Greater Noida Industrial Development Authority (GNIDA) have diversified their sources of income through innovations like WasteTo Wealth by easing entry barriers for waste management startups.

- Global Perspective: Empowered ULBs are essential for improving quality of life and fostering business-friendly cities, as seen in countries like Singapore and cities like New York where autonomous urban governance enables efficient service delivery.

![]() 15 Nov 2024

15 Nov 2024

Least Devolved Functions:

Least Devolved Functions: