![]() 24 Jan 2024

24 Jan 2024

English

हिन्दी

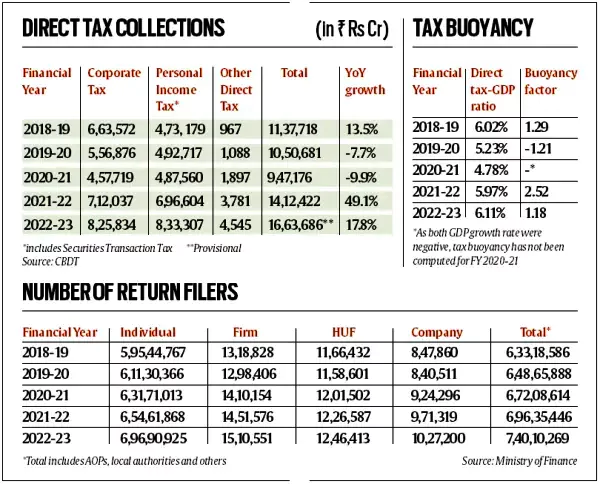

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance has released time-series data

Growth rate for taxes: It is 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Growth rate for taxes: It is 17.79 per cent in 2022-23, higher than 15.11 per cent nominal GDP growth.

Direct Tax

Indirect Tax

Who is a taxpayer?

|

|---|

News source: The Indian Express

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>