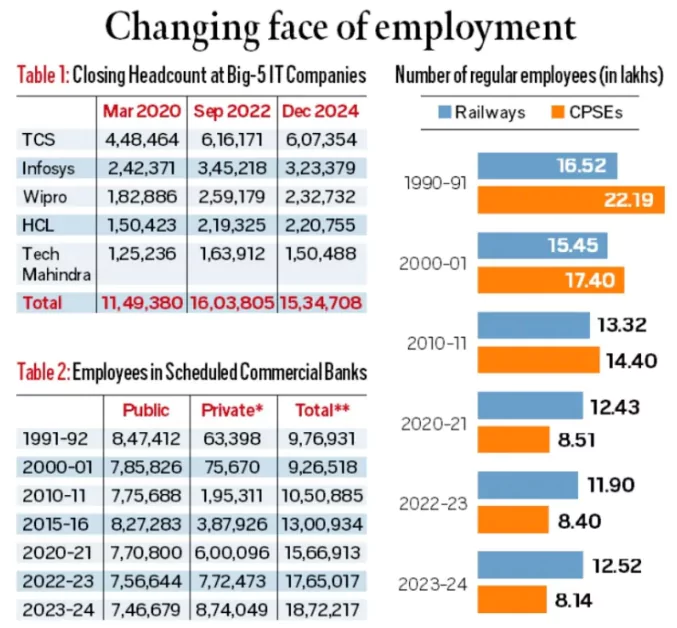

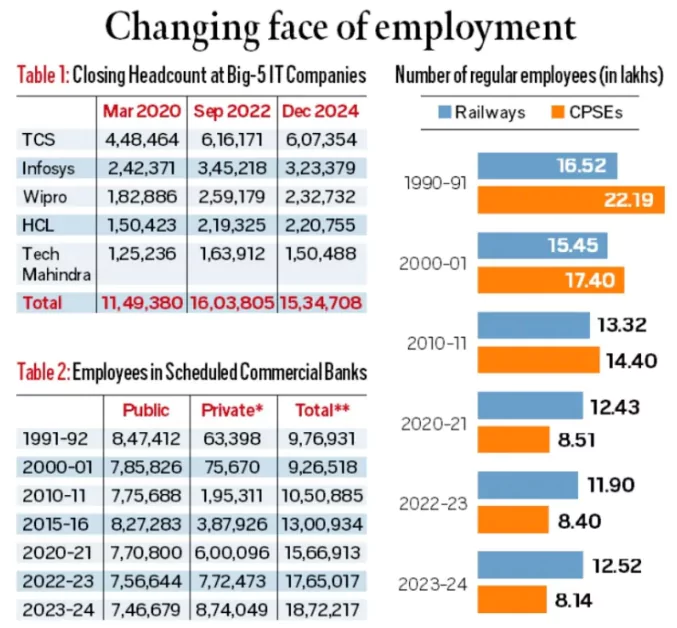

The top 5 IT firms (TCS, Infosys, Wipro, HCL and Tech Mahindra) employ more Indians today than the Railways or the armed forces.

Shift in Employment Patterns

- Declining public sector employment: Public sector jobs declined from 194.7 lakh (1995) to 176.1 lakh (2012).

- Organised private sector jobs increased from 80.6 lakh (1995) to 119.7 lakh (2012).

- Indian Railways jobs dropped from 16.5 lakh (1990-91) to 12.5 lakh (2023-24).

- Central Public Sector Enterprises (CPSEs) jobs fell from 22.2 lakh (1990-91) to 8.1 lakh (2023-24).

- Rise of private sector employment:

- IT industry expansion: The top 5 IT firms (TCS, Infosys, Wipro, HCL, Tech Mahindra) employed 15.34 lakh employees (2024), surpassing the Indian Railways (12.5 lakh) and armed forces (14.2 lakh).

- Banking sector shift: Private banks overtook public sector banks in employment by 2022-23.

- Private banks: 8.74 lakh (2023-24) vs Public sector banks: <7.5 lakh.

- Major private banks: HDFC (2.13 lakh), ICICI (1.41 lakh), Axis (1.04 lakh), Kotak Mahindra (0.78 lakh), Bandhan (0.75 lakh).

- Shift from Agriculture to Services (Without a Strong Manufacturing Base): India’s economy leapfrogged from agriculture to services rather than following the traditional agriculture → industry → services model seen in developed countries.

- Agriculture’s share in employment declined from 64% (1993-94) to 42.5% (2018-19) but increased to 46.2% (2023-24) due to pandemic-induced reverse migration (PLFS data).

- China: Shifted surplus labor from agriculture to manufacturing (30% of GDP), unlike India, where manufacturing stagnates at 16-17% of GDP (World Bank).

- Stagnation of Manufacturing Sector: Manufacturing sector failed to absorb surplus labor from agriculture, limiting structural transformation.

- Manufacturing’s share in employment: 10.4% (1993-94) → 12.6% (2011-12) → 11.4% (2023-24) (PLFS 2023-24).

- Make in India aimed to increase manufacturing’s GDP share to 25% by 2022, but it remains stagnant at 16-17%.

- Vietnam & Bangladesh: Focused on labor-intensive manufacturing (textiles, electronics) leading to higher industrial employment growth.

- Dominance of Service Sector (Job Polarization): Economic liberalisation (post-1991) led to the rise of IT, banking, finance, legal, healthcare, hospitality, real estate, and retail services.

- India became a “back office to the world” in IT, similar to how China became a global manufacturing hub.

- Services contribute 55-60% of GDP but provide fewer jobs compared to agriculture.

- IT & Financial services (high-paying) vs. gig economy jobs (low-paying).

- TCS, Infosys, Wipro, HCL, Tech Mahindra employ 15.34 lakh people, but gig work (Uber, Zomato, Swiggy) employs millions with low wages and no job security.

- Developed countries: Services boom occurred after strong industrialization (e.g., US, UK, Japan).

- Rise of Informal & Gig Economy Jobs: Formal employment has not kept pace with economic growth, leading to informal jobs and gig economy expansion.

-

- According to the Periodic Labour Force Survey (PLFS) 2023-24, approximately 90% of India’s workforce is employed in the informal sector.

- Uber: Over 10 lakh drivers (India Economic Impact Report 2024).

- Zomato: 4.8 lakh food deliverers, Swiggy: 5.43 lakh delivery partners (Oct-Dec 2024).

Middle Class in India

- The middle class is a socioeconomic group with incomes between the working class and the wealthy.

- They have moderate disposable income, allowing for savings, home ownership, and access to education and healthcare.

- Typically involved in white-collar jobs, small businesses, and skilled professions.

Definitions of Middle Class

- Income-based definition:

- World Bank (2011): Earning $10–$50 per day per capita.

- People Research on India’s Consumer Economy (PRICE) (2021): Economically secure households with little chance of falling into poverty or vulnerability, earning Rs. 500,000 to Rs. 3,000,000 per household per annum (2021 PPP-adjusted terms).

- Self-identification: Many people perceive themselves as middle class regardless of income.

- Government definition: No standard classification, but income tax brackets are often used as reference.

Emergence of Middle Class in India

- Pre-Independence Period (Before 1947): Limited & Elite Middle Class

- Small middle class concentrated in colonial administration, law, education, and trading.

- Primary groups: Landlords, professionals (lawyers, doctors, teachers), traders.

- British policies favored zamindars, bureaucrats, and Western-educated Indians.

- Population of India in 1941: 318 million (Census).

- Middle class estimated at less than 5% of the total population.

- Post-Independence Period (1947-1991): Public Sector Driven Growth

- State-led economic policies & industrialization expanded the middle class.

- Government jobs, PSUs, & regulated industries provided stable employment.

- Land reforms & Green Revolution (1960s-70s) boosted rural prosperity.

- Population growth:

- Indian middle class in 1950s: ~10-15 million (3-5% of the population).

- Public sector employment: From 194.7 lakh (1995) to 176.1 lakh (2012) (Labour Ministry).

- Urbanization: From 17% (1951) to 31% (2011 Census).

- Post-Liberalization Period (1991-Present): Private Sector Boom (Middle Class 2.0)

- 1991 economic reforms opened IT, banking, telecom, & private sector growth.

- Decline of public sector jobs, rise of private employment in corporate & startups.

- India became a service-driven economy, skipping large-scale manufacturing growth.

- Rapid urbanization & consumerism fueled middle-class aspirations.

- Economic reforms led to the rise of private sector employment, IT boom, and urbanization.

- Shift from Middle Class 1.0 (public sector jobs) to Middle Class 2.0 (private sector-driven growth).

- Rapid expansion of services, finance, and IT created a new consumer class.

- Population growth:

- Middle class size: From 50 million (2000) to 432 million (2021) (~30% of population).

- Urbanization: 31% (2011); Expected to reach 40% by 2030 (According to a survey by the United Nations).

- IT sector workforce: 54.30 lakh (2024) (As per NASSCOM’s Strategic Review 2024).

- Banking employment: Private banks 8.74 lakh (2024) vs PSU banks’ 7.5 lakh.

- GDP Growth: 6-7% annual growth post-1991, boosting middle-class incomes.

- Future Outlook:

- Rising automation & AI-driven job transformations require reskilling.

- Need for industrial growth, better urban planning, & affordable education.

- Projected expansion due to the digital economy & startup ecosystem.

- The middle class is expected to be 41% of the population by 2025 (~600 million people) (McKinsey).

- India’s urban population is projected to reach 675 million by 2035 (UN).

- India’s middle-class consumption is expected to reach $10 trillion by 2030.

Key Growth Factors for the Middle Class in India

- Economic Liberalization & Private Sector Expansion: Post-1991 reforms opened opportunities in IT, banking, telecom, and services.

- Growth of startups & gig economy expanded employment.

- Example: IT sector employs 15.34 lakh people (TCS, Infosys, Wipro, HCL, Tech Mahindra), surpassing public sector jobs.

- Urbanization & Infrastructure Development: Metro cities drive middle-class expansion with job opportunities in corporate & industrial sectors.

- Growth of Tier-2 & Tier-3 cities (Ahmedabad, Pune, Hyderabad) boosting consumption.

- Example: India’s urban population is projected to reach 40% by 2030 (Census 2011).

- Rising Incomes & Consumption Growth: Higher disposable income boosts spending on real estate, automobiles, travel, and luxury goods.

- The middle class drives demand for education, healthcare, & digital services.

- Example: India’s middle class is projected to reach 41% of the population by 2025 (McKinsey).

- Growth of Service & Technology Sectors: IT, finance, e-commerce, and telecom have fueled white-collar job growth.

- Digital economy & remote work expanding job markets for professionals.

- Example: India is the global back office, with $200+ billion IT exports (NASSCOM, 2023).

- Financial Inclusion & Credit Access: Easy access to loans & EMIs enabling home ownership & consumer spending.

- Example: UPI & digital banking expanded financial access to 1 billion+ users.

- Education & Skill Development: Higher education enrollment (IITs, IIMs, private universities) increasing middle-class aspirations.

- Example: India’s gross enrollment ratio (GER) in higher education rose to 28% (2023).

- Government Policies & Social Welfare Programs: GST, direct tax reforms, Make in India, Digital India, PLI schemes boosting job creation.

-

- Social security schemes (EPFO, Ayushman Bharat) supporting financial stability.

- Example: PLI (Production-Linked Incentive) schemes in electronics & manufacturing expected to create 60 lakh jobs.

Middle Class 2.0 (The New Middle Class)

- Definition: A new segment of the middle class that emerged post-liberalization (1991), driven by private sector employment, IT, finance, and services.

- Key Characteristics:

-

- Digital Savviness: Heavy reliance on digital tools for work, shopping, and entertainment.

- Participation in the digital economy (e.g., freelancing, online businesses).

- Consumerism: Focus on branded goods, experiences (travel, dining), and an aspirational lifestyle.

- Education: Emphasis on quality education, skill-based learning, and international exposure.

- Private jobs: Increased reliance on private jobs, gig economy, and entrepreneurship.

- Urbanization: Predominantly urban, with access to better opportunities but higher living costs.

- Social Mobility: Strong drive for upward mobility through education, savings, and investments.

- Cultural Shift: Blend of Western influences with traditional values; growing social responsibility.

- Financially Independent: More financially independent but faces job insecurity & inflation.

Challenges for Middle Class 2.0 in India

- Job Insecurity & Private Sector Dependence: Unlike the old middle class, which had stable government jobs, Middle Class 2.0 relies on private sector jobs, startups, and gig work, which are more volatile.

- Startups struggle: Many startups, once hiring aggressively, have faced funding issues and layoffs (e.g., Byju’s, OYO, Paytm).

- Rising Cost of Living (Education, Healthcare, Housing): Inflation in essential sectors is making middle-class life unaffordable.

- Education: Private school fees rising at 10-15% annually, making quality education expensive.

- IIMs & IITs have hiked fees by 30-50% in the last 5 years.

- Healthcare: 70% of healthcare expenses in India are out-of-pocket, making medical emergencies financially draining.

Employment Schemes for Middle class

Prime Minister’s Employment Generation Programme (PMEGP)

- It is a credit-linked subsidy scheme by the Government of India,

- Launched in August 2008 by merging the Prime Minister’s Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP)

- Aimed at generating self-employment opportunities through the establishment of micro-enterprises in both rural and urban areas.

Atmanirbhar Bharat Rojgar Yojana (ABRY),

- Launched as part of the Aatmanirbhar Bharat 3.0 package,

- Incentivizes employers to create new jobs and restore employment lost during the COVID-19 pandemic, offering financial assistance through the EPFO.

Skill India Mission

- Also known as Pradhan Mantri Kaushal Vikas Yojana (PMKVY)

- Launched in 2015.

- It is a flagship scheme of the Government of India aimed at making youth employment-ready through skill development and entrepreneurship.

|

-

-

- Health insurance premiums rising due to lifestyle diseases & medical inflation.

- Housing crisis: Property prices in metro cities are beyond reach; Mumbai’s housing price-to-income ratio is 11x (global avg: 5x).

- High Tax Burden Without Social Security Benefits: Middle-class taxpayers pay high direct taxes but receive minimal benefits from government schemes.

- 15% tax rate starts at ₹12 lakh income, affecting disposable income.

- No universal social security system: Unlike European countries, India lacks free healthcare, pensions, or unemployment benefits for the middle class.

- Fuel taxes: High petrol & diesel prices increase commuting costs, impacting disposable income.

- Automation & AI Replacing Middle-Class Jobs: AI & automation are eliminating routine jobs, making job security a concern for Middle Class 2.0.

- IT industry: TCS, Infosys, and Wipro replacing entry-level jobs with AI-based automation.

- Demand for AI & data science professionals rising, but many traditional IT workers lack skills to transition.

- Retail & Banking: Banks are reducing clerical staff due to digitalization & automation.

- Retail jobs declining as e-commerce (Amazon, Flipkart) expands.

- Dependence on EMIs & Rising Household Debt: Middle Class 2.0 relies on loans for homes, cars, education, and healthcare, leading to high financial stress.

- Household debt-to-GDP ratio has risen to 37.6% in 2023, reflecting increased borrowing.

- Interest rate hikes (2023-24) have raised EMI payments on home & car loans.

- Many families struggle to repay education loans, especially if job market conditions worsen.

- Housing Affordability & Urban Infrastructure Issues: Real estate prices are too high, and urban living is becoming unsustainable due to traffic congestion & poor infrastructure.

- Rent inflation in cities: Housing rents in metros have increased by 20-30% post-COVID.

- Traffic congestion: Bangalore, Mumbai, and Delhi have some of the worst traffic congestion globally. Commuting times in metros have doubled in the last decade.

- Lack of reliable public transport: Forces higher dependency on private vehicles & cab services, increasing costs.

- Work-Life Balance & Mental Health Issues: Increased work pressure, long working hours, job stress, and remote work burnout are affecting the well-being of Middle Class 2.0.

- IT & Finance employees report high burnout: Employees in tech, banking, and corporate sectors work 60+ hours a week, affecting work-life balance.

- Mental health concerns rising: WHO estimates that 15% of India’s working-age population suffers from anxiety or depression.

Way Forward for Middle Class 2.0 in India

- Tax Relief & Social Security Expansion: Lower income tax rates for the ₹10-50 lakh bracket to increase disposable income.

- Introduce universal health insurance & pension schemes to reduce financial stress.

- Strengthening Employment & Job Security: Encourage formal employment & labor law protections in private sector jobs.

- Expand PLI (Production-Linked Incentive) schemes to create stable jobs in manufacturing.

- Affordable Housing & Urban Infrastructure Development: Invest in mass housing projects to make metro city housing affordable.

- Improve public transport & reduce commute costs.

- Skilling & Reskilling for the Digital Economy: Introduce tech & AI-focused skilling programs to counter automation job losses.

- Expand NSDC (National Skill Development Corporation) initiatives.

- Financial Stability & Debt Management: Reduce home & education loan interest rates for middle-class borrowers.

- Promote financial literacy programs to prevent overdependence on EMIs & loans.

- Promoting Entrepreneurship & Startup Ecosystem: Create low-interest credit & tax incentives for middle-class entrepreneurs.

- Support gig economy workers with employment benefits & legal protections.

- Strengthening Public Services (Education & Healthcare): Improve affordable private school regulations & public school quality.

- Expand Ayushman Bharat coverage for middle-class families.

Conclusion

Middle Class 2.0 has emerged as a dynamic, private sector-driven workforce, benefiting from economic liberalization, digital transformation, and globalization. However, challenges like job insecurity, rising costs, automation, and financial stress require policy interventions in taxation, social security, skill development, and urban planning to ensure its sustainable growth.

![]() 17 Feb 2025

17 Feb 2025