Recently, NITI Aayog released its report “Chemical Industry: Powering India’s Participation in Global Value Chains”.

What are Chemicals & Petrochemicals?

- A chemical substance is a form of matter having constant chemical composition and characteristic properties.

- Petrochemicals are chemical products obtained from petroleum by refining.

- They are also derived from other fossil fuels such as coal or natural gas, and renewable sources such as maize, palm fruit, or sugar cane.

India’s Chemical Industry geographical distribution

- The chemical industry in India is geographically concentrated in a few key states:

- Gujarat, Maharashtra, Odisha, Tamil Nadu, Andhra Pradesh, Uttar Pradesh, West Bengal.

- Factors Influencing the Geographical Distribution:

- Access to Raw Materials: States like Gujarat, Maharashtra, and Odisha have abundant petrochemical feedstock and other raw materials, crucial for manufacturing chemicals .

- Proximity to Ports: Gujarat and Maharashtra have easy access to major ports, such as Kandla and Mumbai, facilitating export and import of chemicals .

- Refining Capacity: Regions such as Gujarat, Maharashtra have substantial refining capacities, essential for the petrochemical industry, providing a steady feedstock supply for chemical production .

- Infrastructure: Advanced infrastructure in states like Gujarat, Maharashtra, and Andhra Pradesh supports large-scale manufacturing, ensuring efficient logistics and distribution networks .

- Government Support and Policies: The establishment of Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs) in Gujarat, Odisha, and Andhra Pradesh promotes cluster-based industrial development with dedicated infrastructure and policy support .

Current Position of India’s Chemical Industry

- Global Standing: India is the 6th largest producer of chemicals in the world and the 3rd largest in Asia.

- Contribution to GDP: The chemical industry contributes around 7% to India’s GDP, playing a vital role in the country’s economic growth.

- Market Size: In 2023, the domestic chemicals market was valued at approximately $220 billion.

- Global Chemicals Consumption: India accounted for only 3-3.5% of global chemical consumption in 2023, which is relatively low compared to its growing domestic market.

- Export and Import Imbalance:

- Trade Deficit: In 2023, India imported chemicals worth $75 billion, while exporting $44 billion, resulting in a trade deficit of around $31 billion .

- Rising Imports: Since the year 2000, India has shifted from having a net zero trade balance to a growing deficit due to increasing imports of chemicals such as plastics, inorganics, and petrochemicals .

- Key Import Partners: The highest volume of chemical imports comes from China (30-35%), followed by countries like the United States, Southeast Asia, and South Korea

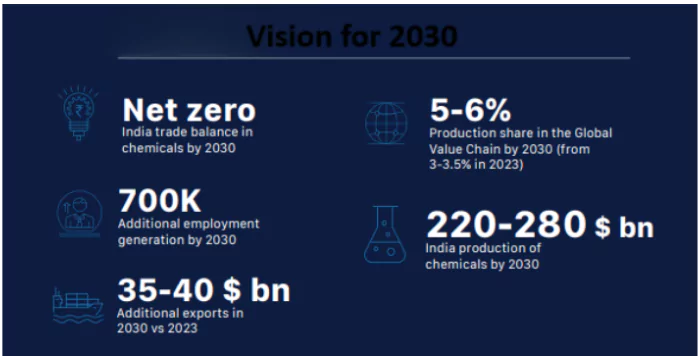

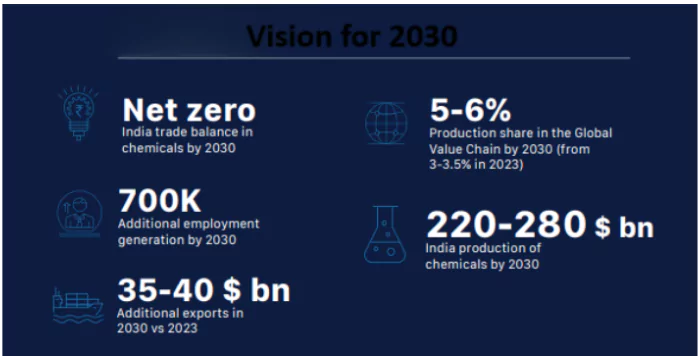

Growth Projections in the NITI Aayog Report (Vision 2030)

- Market Size and Growth:

- By 2030: The market is projected to grow to $400-450 billion, driven by increasing domestic consumption and global demand.

- By 2040: The industry is expected to reach $850-1,000 billion, with a compounded annual growth rate (CAGR) of 10-11%.

- India’s Share in Global Chemical Market:

- By 2030: This share is expected to increase to 5-6%.

- By 2040: India aims for a 10-12% share in the global chemical market.

- Exports: The report aims for an increase of $35-40 billion in chemical exports by 2030, particularly driven by specialty chemicals.

- Employment: The chemical sector is projected to generate between 700,000 to 1 million jobs by 2030.

- Trade Balance: By 2030, India aims to achieve a net-zero trade balance in chemicals, reducing reliance on imports and becoming self-sufficient.

Key Segments of India’s Chemical Industry

- Petrochemicals: This is the largest segment, including polymers, synthetic fibers, and performance plastics.

- Consumption Value: Estimated at $65-75 billion in 2023.

- Focus: Primarily commodity-grade products, but there is a need to diversify into more advanced, value-added products.

- Specialty Chemicals: These are high-value chemicals with lower production volumes, including agrochemicals, paints, coatings, and surfactants.

- Market Size: Estimated to be $40-45 billion.

- Contribution: Over 50% of India’s total chemical exports come from this segment.

- Growth: A highly research-intensive sector, driving innovation in various end-use industries like pharmaceuticals and agriculture.

Inorganic Chemicals: Chemicals used for industrial applications such as construction, water treatment, and food processing (e.g., ammonia in fertilizers).

Inorganic Chemicals: Chemicals used for industrial applications such as construction, water treatment, and food processing (e.g., ammonia in fertilizers).-

- Market Size: Estimated at $15-20 billion.

- Importance: These chemicals are fundamental to India’s industrial base and are critical in sectors like manufacturing and agriculture.

- Other Chemicals (non-core): Fertilizers, pharmaceuticals (vaccines, injectables), medical devices, and personal care products (e.g., soaps, shampoos, toothpaste).

- Market Contribution: This category contributes around $90 billion in market consumption.

- Variety: Includes chemicals across diverse sectors, from healthcare to personal care and industrial goods.

Proposed Interventions by NITI Aayog for Growth in Chemical sector

- Establish World-Class Chemical Hubs in India: Revamp existing clusters and create new ones.

- Empowered central committee to manage the chemical hub and fund infrastructure development.

- Develop Existing Port Infrastructure: Create a Chemical Committee for ports to address gaps in chemical trading.

- Develop 8 high-potential chemical clusters.

- Introduce Opex Subsidy Scheme for Chemicals: Incentivize incremental production based on import bills, export potential, and other key factors.

- Provide incentives for selected participants on incremental sales for a fixed period.

- Develop and Access Technologies to Enhance Self-Sufficiency and Foster Innovation: Disburse R&D funds for innovation through industry-academia collaboration.

- Foster partnerships with MNCs to access foreign technologies.

- Fast-Track Environmental Clearance with Transparency and Accountability: Simplify and expedite the environmental clearance process with an audit committee under DPIIT for monitoring and reporting.

- Securing FTAs to Support Industry Growth: Negotiate FTAs that include provisions like tariff quotas and duty exemptions for critical raw materials.

- Raise awareness of FTAs and simplify procedures for better utilization.

- Talent and Skill Upgradation in the Chemical Industry: Expand ITIs and specialized training institutes to meet skilled labor demands.

- Upgrade faculty training and foster industry-academia partnerships to introduce relevant courses in key areas like petrochemicals and industrial safety.

|

Indo-Japanese Free Trade Agreement (CEPA) (2011)

- The CEPA has led to increased imports from Japan, with a growing trade deficit in chemicals, especially petrochemicals and specialty chemicals.

- India’s import-to-export ratio with Japan has worsened, reflecting challenges for Indian exporters due to rules of origin and technical barriers.

- India needs to revise CEPA’s terms, especially rules of origin, to improve trade balance and boost exports.

|

Challenges Faced by India’s Chemical Industry

- High Dependence on Imports:

- Trade Deficit: In 2023, India faced a significant trade deficit of around $31 billion in chemicals.

- Heavy Reliance on Imports: India imports key feedstocks like propylene and ethylene, used in producing polyethylene and polypropylene, limiting domestic production capabilities.

- Limited Feedstock Availability:

- Concentrated Production: The industry focuses on bulk chemicals but lacks diversification into high-value, specialty chemicals, hindering global competitiveness.

- Feedstock Imbalance: India’s domestic production of key feedstocks, like propylene, is insufficient, with 95% used for polypropylene, compared to 70% globally.

- Infrastructure Gaps:

- Infrastructure Gaps: Inadequate storage, transportation, and port infrastructure result in high logistics costs, impeding efficient chemical trade.

- Lack of Common User Facilities: Insufficient shared infrastructure for industries in clusters leads to inefficiencies and higher costs.

- Regulatory Bottlenecks:

- Environmental Clearances: The environmental clearance process in India is often slow and cumbersome, which delays the setup of new plants and expansion efforts.

- Complex Regulatory Framework: Regulatory hurdles in areas such as safety, environmental compliance, and licensing create significant barriers for industry players.

- Skilled Labor Shortage:

- Talent Gap: The industry faces a 30% talent gap, particularly in areas like green chemistry and nanotechnology, restricting innovation.

- Lack of Industry-Relevant Training: Although there is a growing demand for specialized courses, there is insufficient vocational training tailored to industry needs.

- Low R&D Investment:

- R&D Funding: India’s investment in research and development (R&D) in the chemical sector is low, at 0.7% of total revenue, significantly below the global average of 2.3%.

- Innovation Constraints: Low R&D investment limits the development of specialty chemicals, with much innovation relying on external collaborations.

- Lack of Technological Advancements:

- Outdated Technology: Many chemical plants use outdated technology, reducing efficiency and hindering the shift to higher-value chemicals.

- Dependency on Imported Technologies: India’s chemical industry still depends heavily on foreign technology for manufacturing processes, limiting the scope for domestic technological innovation.

- Limited Backward Integration:

- Petrochemical Dependence: India’s reliance on imported petrochemical feedstocks like propylene and ethylene affects self-sufficiency and cost competitiveness.

About Green Chemistry

- Green chemistry is the design of chemical products and processes that reduce or eliminate the generation of hazardous substances, aiming to make the chemical industry more environmentally friendly and sustainable.

- Benefits of Green Chemistry:

- Human Health: Reduces the release of harmful chemicals into the environment, leading to cleaner air and water, and safer consumer products.

- Environmental Protection: Minimizes pollution by designing chemicals that either degrade into harmless substances or are recovered for further use.

- Cost Efficiency: Increases reaction yields, reduces waste, and improves energy efficiency, resulting in lower operational costs for manufacturers.

- Sustainability: Promotes the use of renewable feedstocks and recycling processes, reducing reliance on non-renewable resources and mitigating environmental damage.

- Economic Growth: Facilitates the development of eco-friendly products and processes, which can attract consumer demand and enhance business competitiveness.

|

Opportunities in India’s Chemical Industry

- Growing Domestic Demand:

- Rising Disposable Income: India’s disposable income is projected to contribute $1.5 trillion in household consumption growth by 2030.

- Urbanization and New Households: India is expected to witness 140 million new households entering the consuming class by 2030, with each household earning over $10,000 annually.

- Sector Growth: The chemical industry is essential to numerous downstream sectors like pharmaceuticals, automotive, textiles, and agriculture, which are themselves experiencing high growth.

- Increasing Global Demand:

- Supply Chain Diversification: Global supply chains are diversifying, especially post-pandemic and amid geopolitical uncertainties.

- India, with its strong manufacturing base, is well-positioned to become a critical supply chain partner for chemical products.

- Export Potential: As global companies shift their sourcing away from China, India can fill the gap by increasing specialty chemical exports such as dyes, paints, agrochemicals, and flavors/fragrances.

- Exports in specialty chemicals alone are expected to reach $45 billion by 2030.

- Feedstock Availability and Innovation:

- Shift to High-Value Products: India’s reliance on bulk chemicals is being replaced with an increasing focus on value-added chemicals. For example:

- 95% of India’s propylene is used for polypropylene (compared to just 70% globally).

- 75% of India’s ethylene is directed towards polyethylene (vs. 63% globally).

- R&D Investment: Investments in green chemistry and specialty chemicals are critical to enhancing self-sufficiency and fostering innovation.

- Skilled Workforce Development:

- Vocational Training Institutes: To address the shortage of skilled labor, especially in green chemistry, nanotechnology, and process safety, India is expanding vocational training institutes.

- Industry-Academia Collaboration: Industry-relevant courses in areas like petrochemicals, polymer science, and industrial safety are being introduced.

- Environmental and Sustainability Trends:

- Green Chemicals: With the rise of sustainable development, the demand for green chemicals (such as bio-based chemicals and biodegradable plastics) will grow. India’s chemicals sector can leverage this trend to expand its market share.

- Circular Economy: The Indian chemicals industry is adopting circular economy principles, such as recycling and reducing waste, to promote sustainability.

- Infrastructure Development:

-

- Chemical Hubs: The establishment of world-class chemical hubs with shared infrastructure will help reduce logistics costs and improve the efficiency of the chemicals supply chain.

- Port Infrastructure: Upgrading ports to handle chemicals more efficiently and the development of 8 high-potential chemical clusters will boost exports.

Global Case Studies

- Jurong Chemical Park, Singapore: Jurong Island is a global chemical hub, hosting over 100 chemical companies, with $40 billion investments in infrastructure and technology.

- Offers shared utilities, logistics, and sustainability initiatives like Carbon Capture and Storage (CCS), reducing operational costs.

- India can adopt Jurong’s integrated infrastructure and government support model to develop chemical hubs.

- Growth Story of China’s Chemicals Industry: China’s share in global chemicals production has grown from 6% to 33-35% since 2000, driven by massive investments in petrochemicals and plastics.

- Strong government support, domestic feedstock availability, and a robust focus on R&D helped China’s chemicals industry thrive.

- India should focus on investment in R&D, domestic feedstock, and policy support to enhance its competitiveness globally.

- Port of Antwerp, Belgium: The Port of Antwerp is a major chemical hub, handling 60 million tons of chemicals annually, with advanced chemical storage, handling, and transport facilities.

-

- The port integrates automated systems, green projects, and energy-efficient solutions to improve operations and sustainability.

- India can build specialized chemical infrastructure and focus on sustainability similar to Antwerp for efficient logistics and environmental responsibility.

|

Government Schemes and Initiatives for the Chemical Industry

- Chemical Promotion Development Scheme (CPDS 1997): Facilitates growth and development of the chemical industry through knowledge creation (studies, surveys, promotional material), seminars, conferences, and awarding innovations.

- Provides financial support to industry associations and organizations to conduct workshops, seminars, and studies to inform policy decisions.

- Revised: The scheme was revised in 2017 and 2019 to keep up with evolving industry trends.

- Umbrella Scheme: New Scheme of Petrochemicals:

- Setting up of Centre of Excellence (CoE): CoEs are established to develop new products, improve technologies, and innovate processes in petrochemicals, including biopolymers, recycling processes, and water treatment.

- Number of CoEs: 18 CoEs have been approved to help modernize the petrochemical industry.

- Scheme for Setting up of Plastic Parks: To set up plastic parks with state-of-the-art infrastructure and common facilities to consolidate the plastic processing industry.

- Funding: 50% of the project cost, up to Rs. 40 crore per project, is provided by the Government.

- Number of Parks: 10 Plastic Parks have been approved to increase investment, production, and exports in the plastic sector.

- Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs)

- PCPIR Policy, 2007: To attract investments and create employment in the petroleum, chemical, and petrochemical sectors through an integrated and environmentally friendly approach.

- Promotes cluster-based development with high-quality infrastructure, utilities, and logistics for business growth.

- Approved PCPIRs: Vishakhapatnam (Andhra Pradesh), Dahej (Gujarat), and Paradeep (Odisha) are the three approved PCPIRs to promote industrial development and investment in these sectors.

Way Forward for India’s Chemical Industry:

- Investment in R&D and Innovation: Focus on increasing investment in research and development for high-value specialty chemicals, green chemistry, and biopolymers to diversify production and enhance competitiveness globally.

- Infrastructure Development: Establish world-class chemical hubs with integrated infrastructure, including shared utilities, logistics, and ports, to streamline the production and export process.

- Strengthening Domestic Production: Reduce import dependence by improving feedstock availability and increasing domestic production capacity, particularly in petrochemicals and specialty chemicals.

- Skill Development: Address the skilled labor gap by expanding vocational training institutes, offering industry-relevant courses in fields like green chemistry, nanotechnology, and process safety, to ensure a future-ready workforce.

- Sustainability and Green Chemistry: Increase focus on sustainable practices, including recycling, energy efficiency, and bio-based chemicals, to align with global environmental trends and enhance the industry’s green credentials.

- Regulatory and Policy Reforms: Streamline regulatory processes, including environmental clearances, and introduce favorable policies that promote foreign investments, innovation, and exports.

- Global Market Expansion: Increase exports of specialty chemicals and plastics, leveraging global trade shifts and Free Trade Agreements (FTAs), positioning India as a key player in the global chemical supply chain.

Conclusion

India’s chemical industry holds significant potential to become a global leader, driven by a growing domestic market, increasing exports, and strategic government initiatives. By addressing challenges such as import dependency, infrastructure gaps, and skilled labor shortages, while focusing on innovation, sustainability, and regulatory reforms, India can enhance its global competitiveness and achieve its ambitious growth projections by 2030 and 2040.

![]() 5 Jul 2025

5 Jul 2025

Inorganic Chemicals: Chemicals used for industrial applications such as construction, water treatment, and food processing (e.g., ammonia in fertilizers).

Inorganic Chemicals: Chemicals used for industrial applications such as construction, water treatment, and food processing (e.g., ammonia in fertilizers).