The Delhi high court has recently censured the state government for its failure to place 14 reports of the Comptroller and Auditor General (CAG) before the legislative assembly.

- The government is obligated to present these reports before the assembly for discussion. This ensures public funds are utilized effectively and transparently.

About the office of Comptroller and Auditor General (CAG)

Comptroller and Auditor General (CAG) is a constitutional authority responsible for auditing and reporting on the financial operations of the government at the Union and State levels.

- Established under Article 148 of the Indian Constitution, the CAG plays a critical role in ensuring transparency, accountability, and financial discipline in governance.

Enroll now for UPSC Online Course

Genesis of the Institution of Comptroller and Auditor General (CAG)

- Colonial Origins: The institution of the CAG in India originated during British rule, evolving from the office of the Accountant General, established in 1858 to audit colonial finances under the British East India Company.

- Pre-Independence Developments: The position of Auditor General of India was formalized under the Government of India Act, 1919, and later expanded under the Government of India Act, 1935, to ensure financial accountability in British India.

- Post-Independence Establishment: After India gained independence, the Comptroller and Auditor General of India was enshrined as a constitutional authority under Article 148 of the Constitution in 1950. Narahari Rao became the first CAG of independent India.

- Significance in the Constitution: The CAG was established as an independent entity to audit the accounts of the Union and States, ensuring financial transparency, and serving as the “guardian of the public purse” in India’s parliamentary democracy.

Key Functions of Comptroller and Auditor General (CAG)

- Audit of Government Accounts: Audits the receipts and expenditure of the Union and State governments, including public sector undertakings (PSUs).

- Reporting to the Legislature: Submits audit reports to the President (for Union accounts) or the Governor (for State accounts), which are then tabled in Parliament or State Legislatures.

- Audit of Public Enterprises: Examines the financial performance of government-owned companies.

- Custodian of the Consolidated Fund: Ensures that withdrawals from the Consolidated Fund of India or States are made only with proper legislative authorization.

- Special Audits: Conducts special audits on the request of the President or the Governor, especially in cases of irregularities.

How is CAG in India Different from the CAG in Britain?

| Aspect |

CAG in India |

CAG in Britain |

| Status |

Constitutional authority under Article 148. |

Appointed as part of the executive branch. |

| Role |

Independent auditor of public accounts and spending. |

Auditor and consultant to Parliament on public spending. |

| Reporting |

Reports directly to the President or Governors, who table them in Parliament or State Legislatures. |

Reports to the UK Parliament through the Public Accounts Committee. |

| Scope of Audit |

Audits all receipts, expenditures, and accounts of the Union, States, and Public Sector Enterprises. |

Primarily focuses on central government accounts, public corporations, and local bodies. |

| Tenure |

Fixed tenure of 6 years or until the age of 65, whichever is earlier. |

Tenure is not constitutionally fixed, depending on contractual terms. |

Check Out UPSC CSE Books From PW Store

Constitutional Provisions Related to Comptroller and Auditor General (CAG)

- Article 148: Establishes the CAG and defines its independence.

- Article 149: Specifies the duties and powers of the CAG.

- Article 150: Mandates the CAG to prescribe how accounts of the Union and States shall be kept.

- Article 151: Requires CAG reports to be submitted to the President or Governor, who will place them before the legislature.

- Third Schedule of Constitution: It includes the format of the oath that the CAG must take before assuming office. The oath emphasizes allegiance to the Constitution, faithful discharge of duties, and upholding the sovereignty and integrity of India.

Independence of Comptroller and Auditor General (CAG)

- Appointed by the President of India.

- Holds office for 6 years or until the age of 65, whichever is earlier.

- Removal is possible only through impeachment, similar to a Supreme Court judge.

Significant Contributions of Comptroller and Auditor General (CAG)

- 2G Spectrum Scam: Highlighted irregularities in the allocation of telecom licenses, leading to Supreme Court intervention.

- Coal Block Allocation: Exposed losses due to discretionary coal block allocations.

- Bharatmala Project (2023): Flagged delays and cost overruns in infrastructure development.

- Performance Audit of Ayushman Bharat (2023): Highlighted issues in healthcare delivery under India’s flagship health insurance scheme, including irregularities in beneficiary verification and delayed payments to hospitals.

- Public Distribution System (PDS) Audit: Identified large-scale inefficiencies in the distribution of food grains under the PDS, including diversion and leakage.

-

- These recommendations led to digitization of ration cards and better monitoring mechanisms.

| Vinod Rai, the former Comptroller and Auditor General (CAG) of India, suggested several reforms to strengthen the institution and enhance its effectiveness in ensuring transparency and accountability.

Key reforms include:

- Strengthening Financial Autonomy: Advocated for greater independence in financial matters to ensure the CAG operates without external pressures, safeguarding its role as an unbiased auditor.

- Performance Audits: Emphasized the need for performance-based audits instead of just financial compliance, focusing on the outcomes and effectiveness of government schemes and policies.

- Capacity Building: Suggested continuous training and upskilling of CAG staff to handle audits of complex and modern sectors like IT, telecom, and environmental policies.

- Timely Reporting: Proposed mechanisms to expedite audit report submissions, ensuring their relevance and impact during policy-making and parliamentary discussions.

- Use of Technology: Highlighted the importance of adopting advanced data analytics, AI, and IT tools to improve the accuracy and scope of audits in a rapidly digitizing economy.

These reforms aim to make the CAG more dynamic, proactive, and aligned with the challenges of modern governance. |

Check Out UPSC NCERT Textbooks From PW Store

Challenges Faced

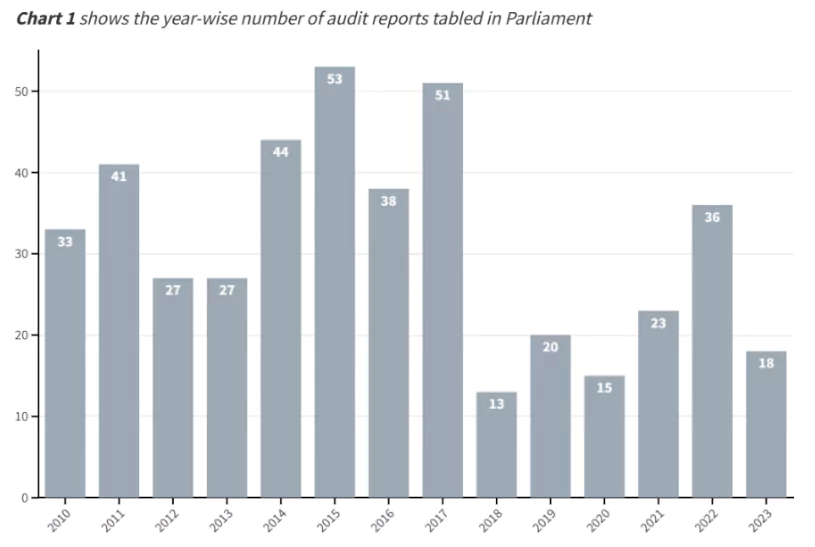

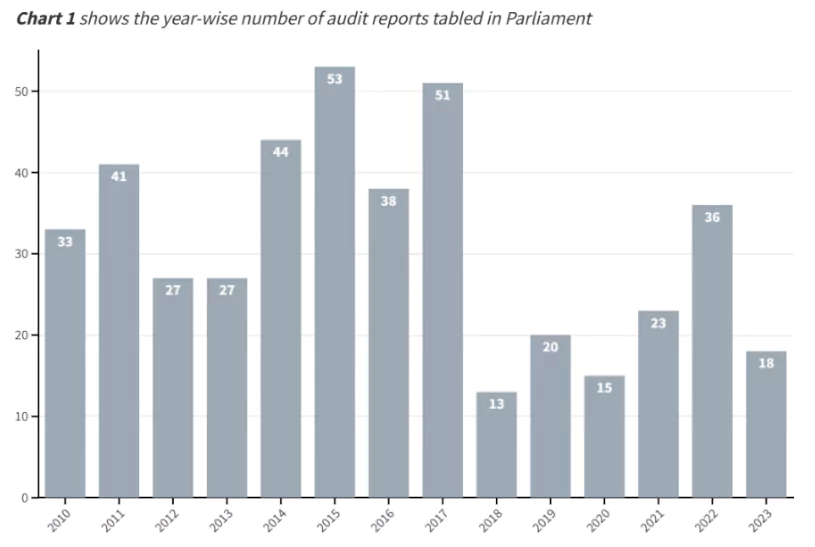

- Shrinking Parliamentary Time: The number of days Parliament meets has reduced over decades, leaving less time to debate critical reports like those from the CAG.

- Example: In the 2023 Monsoon Session, Parliament functioned for just 17 days, limiting discussion on significant issues.

- Politicization of Reports: CAG findings are often dismissed as politically motivated, especially when they highlight irregularities in flagship government schemes.

- Example: Debates on the CAG’s findings on coal block allocations (2012) became partisan, overshadowing substantive discussions.

- Public Apathy and Limited Awareness: Citizens often remain unaware of the significance of CAG reports, reducing pressure on lawmakers to act on their findings.

- Resource Constraints: The CAG’s limited resources and reliance on outdated methodologies hinder comprehensive audits in emerging areas like cybersecurity and environmental governance.

- Declining Staff Availability:

- As of 2021-22, the IA&AD had a staff strength of 41,675, a steady decline from the peak of 48,253 in 2013-14.

- The number of IA&AS officers employed came down to 553 in 2021-22 from 789 in 2014-15.

- The strength of the audit and accounting staff reduced from over 26,000 in 2013-14 to 20,320 in 2021-22.

- Lack of Follow-Up Mechanisms: Many recommendations from the Public Accounts Committee (PAC) and CAG reports remain unimplemented due to weak enforcement mechanisms.

- Data: 60% of CAG recommendations (2017-2021) are yet to see effective follow-up action.

- No ex-ante auditing powers:

- Unlike many other countries like Japan, New Zealand, Australia and France, the CAG in India mainly performs the function of ex-post auditing.

Way Forward

- Mandatory Parliamentary Debates: Establish protocols for mandatory discussion of key CAG reports in Parliament and state legislatures.

- Example: The United Kingdom’s Public Accounts Committee (PAC) ensures parliamentary discussions for every major audit finding.

- Modernization of CAG: Equip the CAG with tools for auditing emerging areas like artificial intelligence, climate finance, and data governance.

- Example: Canada’s Auditor General uses AI-based tools for auditing government digital systems.

- Enhanced Public Engagement: Make CAG reports more accessible through simplified summaries and outreach via social media and public forums.

- Example: The Australian National Audit Office (ANAO) publishes easy-to-read summaries to engage citizens.

- Collaboration with Civil Society and Media: Collaborate with think tanks, NGOs, and media to analyze and disseminate CAG findings for greater public awareness and accountability.

- Strengthening the Public Accounts Committee (PAC): Empower the PAC to enforce accountability by setting strict deadlines for action on audit recommendations.

- Data: The PAC handled 103 reports in 2022 but faced delays in follow-up implementation.

Relationship between Comptroller And Auditor General of India (CAG) and Public Accounts Committee (PAC):

- CAG’s Role in Auditing: The CAG conducts audits of government receipts, expenditures, and public undertakings and submits reports to Parliament, forming the basis of the Public Accounts Committee’s (PAC) discussions.

- PAC’s Role in Examination: The PAC examines CAG reports to ensure accountability of public funds, highlighting financial irregularities and inefficiencies in government spending.

- Mutual Dependence: While the CAG provides independent audit findings, the PAC ensures their parliamentary scrutiny, strengthening fiscal oversight.

- Case Example:

- The PAC’s investigation into the 2G spectrum case (2010) was based on the CAG report, which estimated a loss of ₹1.76 lakh crore to the exchequer.

- Data Accuracy and symbiotic relations: The PAC relies heavily on data of CAG’s detailed observations to ensure transparent governance, exemplified by the PAC’s review of CAG audits on defense spending, ensuring funds are used effectively.

|

Enroll now for UPSC Online Classes

Conclusion

CAG reports are essential tools for promoting transparency, accountability, and efficient governance. However, challenges like insufficient debate, lack of follow-up mechanisms, and public apathy hinder their impact. By drawing on global best practices and modernizing India’s audit the government can strengthen democratic accountability and ensure better utilization of public resources.

![]() 18 Jan 2025

18 Jan 2025