Context: This article is based on the news “Why has the Indian government criticised the methodologies of global credit rating agencies?” which was published in the Indian Express. The Finance Ministry released a document titled “Re-examining Narratives: A Collection of Essays,” to present alternative perspectives on various aspects of economic policy.

|

Relevancy for Prelims: Global Credit Rating Agencies: Moody’s, Standard & Poor’s and Fitch, and Securities and Exchange Board of India (SEBI).

Relevancy for Mains: Global Credit Rating Agencies and How do they rate firms from developing countries?

|

Reforming Sovereign Credit Rating Process Need of the Hour

- Objective: The essay seeks to highlight concerns with the methodologies employed by the 3 main global credit rating agencies.

- It also tries to illustrate the adverse impact of these issues on India.

- Need to reform: The Chief Economic Adviser of the government emphasized on the need for credit rating agencies (CRA) to reform their sovereign rating process.

- This reform is essential to accurately represent the default risk of developing economies.

- India’s Rating: India, currently holds the lowest investment grade and has witnessed substantial improvements in its economic metrics since the onset of the pandemic.

- Thus, any enhancements in macroeconomic indicators may have minimal impact on a credit rating if qualitative parameters are deemed to require improvement.

- This holds significant consequences for the access of developing sovereigns to capital markets and their ability to borrow at reasonable rates.

About Credit Rating Agencies (CRAs)

- Credit Rating Agencies: They are rating agencies that assess the financial strength of companies and government entities, especially their ability to meet principal and interest payments on their debts.

Functions of Credit Rating Agencies:

Functions of Credit Rating Agencies:

- Credit rating agencies give investors information about bond and debt instrument issuers.

- Agencies provide information about countries’ sovereign debt.

Credit Rating Agencies in India: Currently there are seven registered Credit rating agencies in India viz. CRISIL, CARE. ICRA, SMREA, Brickwork rating, India rating, and research Pvt. Ltd. - Global Credit Rating Industry: It is highly concentrated, with three leading agencies viz. Moody’s, Standard & Poor’s, and Fitch.

- Different Credit Rating Scales:

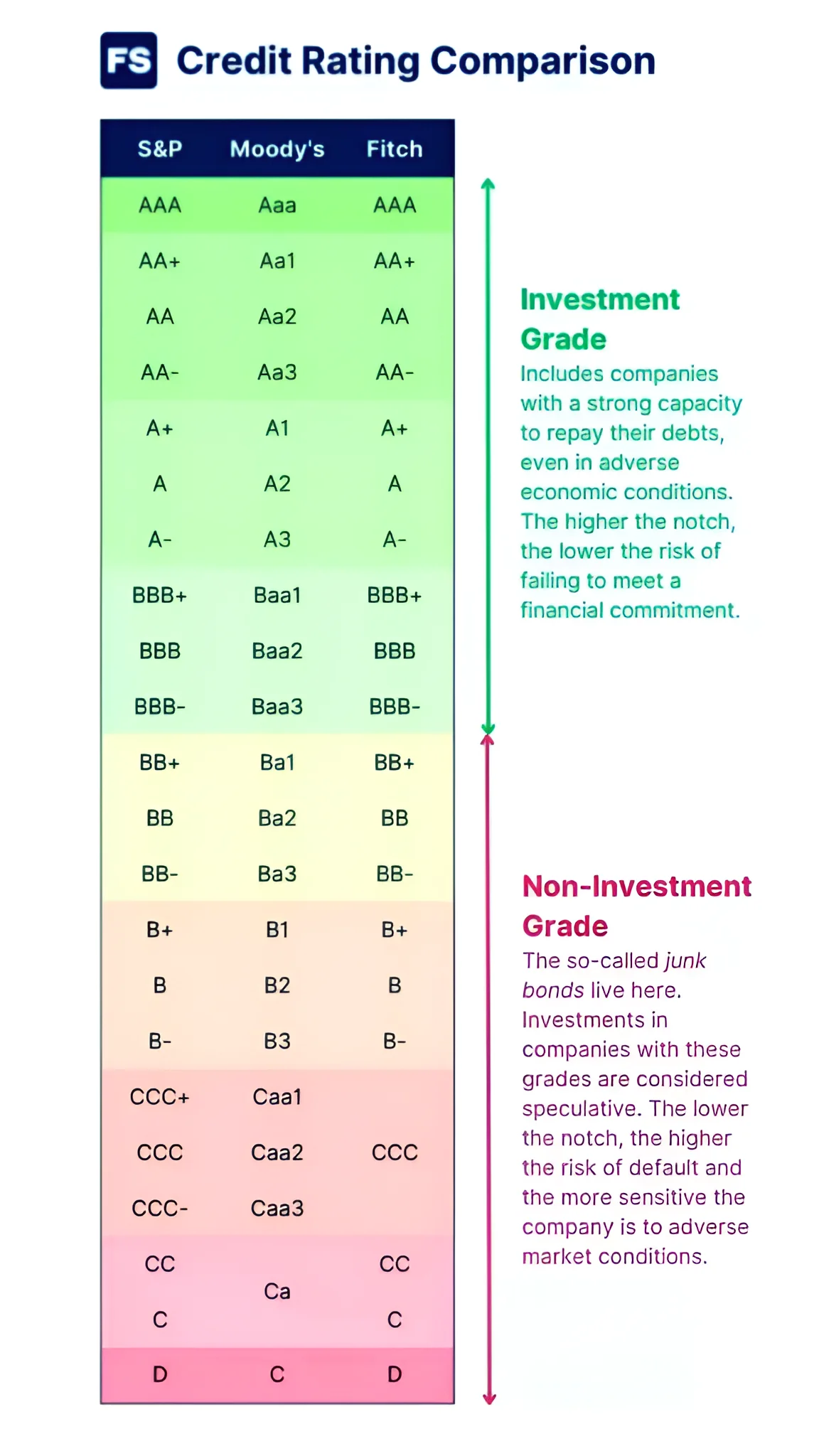

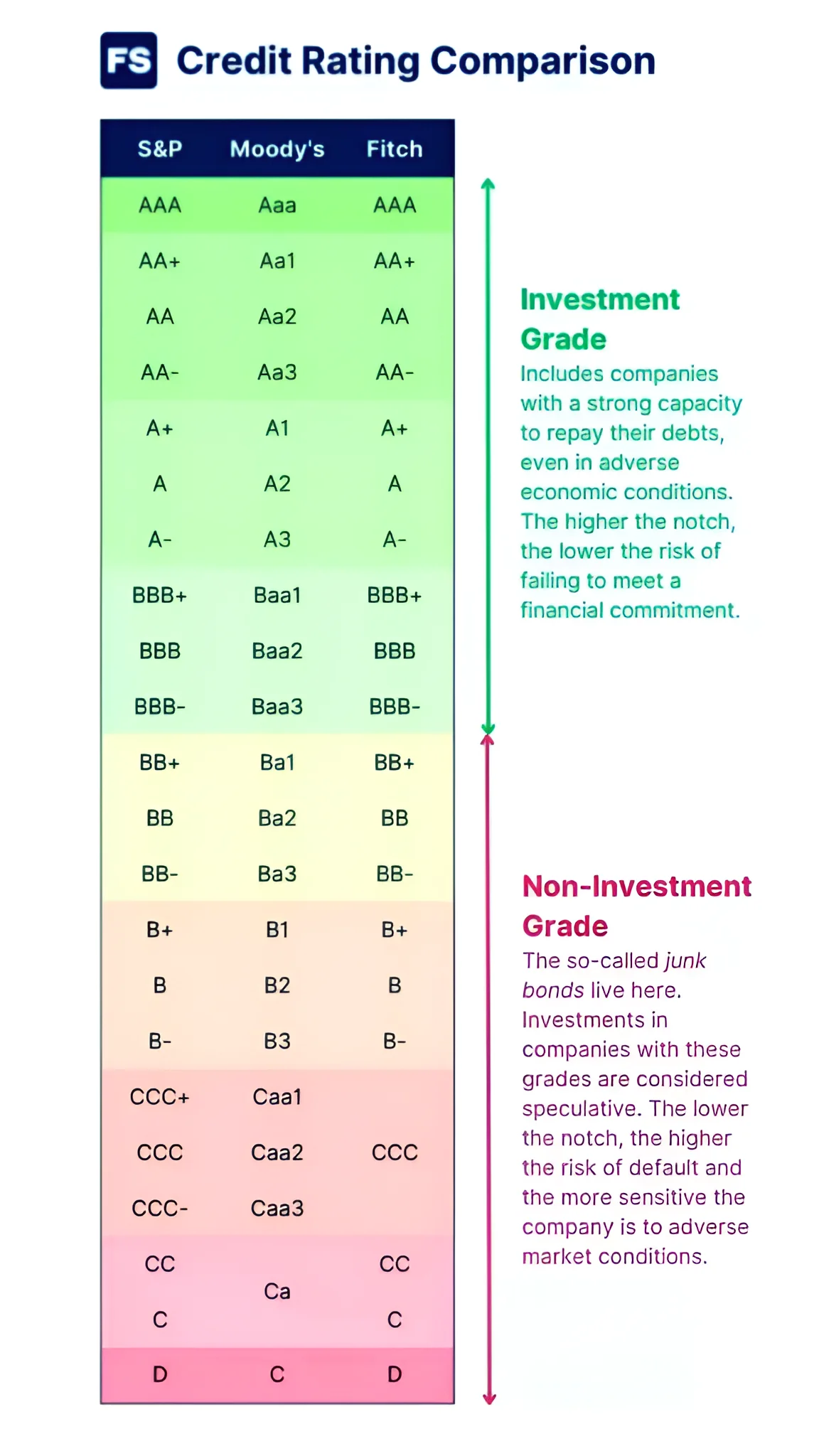

- Credit ratings use alphabetical symbols (AAA, AA, A, B, etc.) to assess the creditworthiness of corporate financial instruments.

- Higher ratings suggest a lower risk of default, with AAA being highly favourable, indicating strong financial capability.

- Ratings below BB are considered indicative of poor creditworthiness.

SEBI Regulations, 1999

- Regulation of Functioning: In India, the Securities and Exchange Board of India (SEBI) primarily regulates credit rating agencies and their functioning according to SEBI Regulations, 1999 of the SEBI Act, 1992.

- However, certain other regulatory agencies, such as the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority, and Pension Fund Regulatory and Development Authority also regulate certain aspects of credit rating agencies under their respective sectoral jurisdiction.

- Disclosure-based Regulatory Regime: The SEBI (Credit Rating Agencies) Regulations, 1999 provide for a disclosure-based regulatory regime, where the agencies are required to disclose their rating criteria, methodology, default recognition policy, and guidelines on dealing with conflict of interest.

|

About Sovereign Credit Rating

- Sovereign Credit Rating: It is a measurement of a government’s ability to repay its debt, with a low rating indicating high credit risk.

- Determinants for Rating: These include growth rate, inflation, government debt, short-term external debt as a percentage of GDP, and political stability.

- Sovereign Credit Rating of India: While S&P and Fitch rate India at BBB, Moody’s rates India at Baa3, which indicates the lowest possible investment grade.

- This is despite its progress from being the 12th largest economy globally in 2008 to the 5th largest in 2023, with the second-highest growth rate among all comparator economies during this period.

|

Also Read: SEBI To Introduce T+0 Trading Settlement System, here.

Significance of Credit Rating Agencies

- Assessment of Creditworthiness: Sovereign credit rating agencies assess the creditworthiness of governments, serving as an indicator for global investors regarding the ability and willingness of governments to repay debt.

- Impact on Borrowing Capacity: Sovereign ratings impact a country’s capacity to borrow funds from international investors.

- Governments with lower sovereign ratings have to pay higher interest rates when they borrow.

- Impact on Businesses: It is significant not only for the government but also for all businesses operating within a country.

- When a country’s government has a low sovereign rating, businesses in that country have to pay an increased interest rate when seeking loans from global investors.

- A poor sovereign rating inhibits the ability of poor countries to borrow money from rich investors.

Issues with the methodologies used by the rating agencies

- Discrimination against Developing Nations: As per the government, these assessments discriminate against developing countries, where the banking sector is primarily run by the public sector.

- The evaluations overlook the welfare and development functions of public sector banks in a developing country.

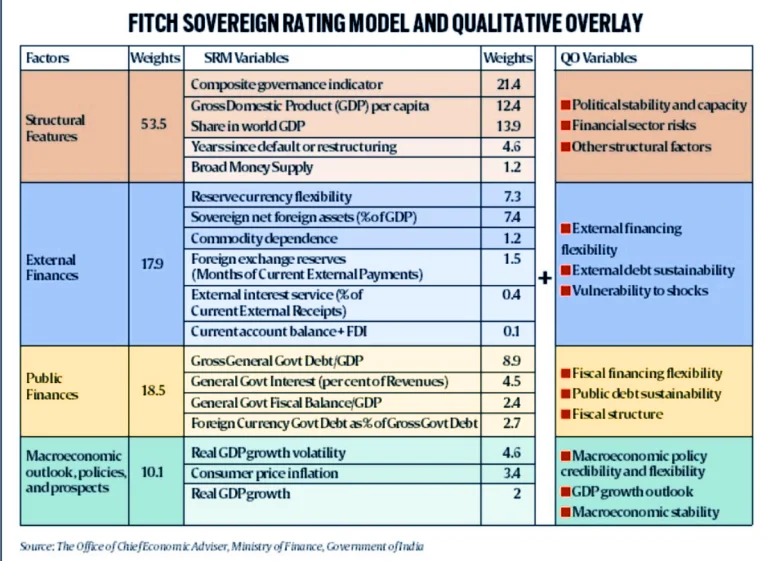

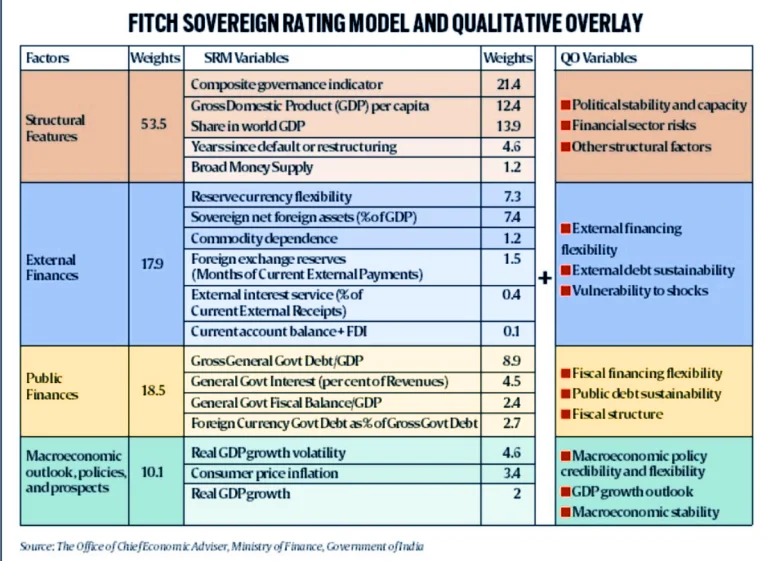

- Lack of Transparency in Assigning Weights: The rating agencies do not transparently communicate the specified weights assigned to each parameter under consideration.

- Although Fitch provides numerical weights for each parameter, it explicitly mentions that these weights are intended solely for illustrative purposes.

- The opaqueness in credit rating methodologies makes it challenging to quantify the impact of qualitative factors on credit ratings.

- Non-Transparent Selection of Experts for Assessment: The experts consulted for rating assessments are generally chosen in a non-transparent manner.

- Over Reliance on Subjective Assessments: Sovereign Risk Judgement by Fitch includes an excessive reliance on the World Bank’s Worldwide Governance Indicators (WGI); and the inclusion of Qualitative Overlay.

- The overreliance on qualitative factors in credit rating methodologies gives rise to cascading effects and cognitive biases reflected in various studies raising concerns about the credibility of credit ratings.

- Over half the credit ratings are determined by the qualitative component.

- Dominance of Perceived Institutional Strength: The impact of composite governance indicators and perceived institutional strength outweighs the combined impact of other macroeconomic fundamentals in determining an upgrade for developing economies.

- One-size-fits-all Approach: Achieving a credit rating upgrade for developing economies requires progress along subjective indicators derived from a collection of one-size-fits-all perception-based surveys.

Other Challenges Faced by Credit Rating Agencies

- Excess Competition: Globally, the credit rating industry is controlled by three agencies commanding 95 percent of the business.

- They are Moody’s Investor Services (Indian ICRA’s parent), Standard and Poor’s (S&P, which owns the majority of Indian agency Crisil), and Fitch Group, whose Indian subsidiary is Ind-Ra or India Ratings and Research.

- However, in India, there are a number of agencies competing with each other Ex- Brickwork, CARE, and SME Rating Agency of India.

- The competition between them has led to a decline in transparency and quality of product delivered.

|

About Infrastructure Leasing and Financial Services Limited (IL&FS) Crisis

- The credit rating agencies ignored the rising debt levels at IL&FS, and continued rating it AAA, indicating the highest level of creditworthiness.

- IL&FS is a major infrastructure development and finance company of systemic importance, with a debt obligation of Rs 91,000 crore.

|

- Communication of Fraudulent Data by Companies: Companies furnish fraudulent data to rating agencies due to which certain malpractices escape detection leading to the dissemination of inaccurate information.

- Ex- Grant Thornton’s forensic audit report revealed that favors and gifts provided to rating agency officials resulted in favorable ratings provided to IL&FS group.

- Concerns with Issuer Pays Model: Under this, a company getting rated pays the Rating Agency: This incentivizes the agency to ignore debtor’s capacity to repay debt.

- It also leads to a ‘conflict of interest‘ resulting in compromising the quality of analysis or the objectivity of the ratings assigned by the agencies.

Way Forward

- Improving Transparency in Working of Rating Agencies: While the government is obligated to maintain complete transparency, achieving a set of obligations, rating agencies need to disclose their processes transparently and refrain from making indefensible judgments.

- Credit Rating Agencies possess a comprehensive database of global best practices that they use to inform their evaluations.

- This knowledge should be shared with the countries they assess, enabling nations to take appropriate measures to enhance their creditworthiness.

- Regulatory Strengthening: The system needs to be revamped and a dedicated regulator needs to be established for rating agencies, especially with the current emphasis on revitalizing the corporate bond market.

- The regulator can be a specialist division of RBI or SEBI as well as a third party can be involved for monitoring the rating and routing payments to the agencies.

- Rotation of CRA: Under the current framework, there is no provision for the rotation of credit rating agencies.

- Mandatory rotation of rating agencies should be explored as it would aid in avoiding negative consequences of long-term associations between the issuer and the credit rating agency.

- Strict Penalties: There should be penalties for those involved in giving wrong ratings to AAA’.

- The highest rating has been given by agencies even a day before a company files for bankruptcy.

- Ex- The Securities and Exchange Board of India (SEBI) banned Rajesh Mokashi, the managing director of CARE Ratings Limited (CARE) for influencing the rating process for Dewan Housing Finance Limited (DHFL).

- It led to delays in the rating actions and was not disclosed to investors.

- Alternative Payment Models: SEBI, in consultation with RBI and credit rating agencies should determine the suitable rating fee structure payable by the issuer.

- There is a necessity to ensure that the entity being rated does not pay the rating agency.

Conclusion

The Indian government criticizes global credit rating agencies for biased methodologies, urging reforms and transparency to accurately assess developing economies and prevent conflicts of interest.

![]() 23 Dec 2023

23 Dec 2023

Functions of Credit Rating Agencies:

Functions of Credit Rating Agencies: