As India seeks to expand its manufacturing and technological capability, critical minerals will become vital to fulfil this ambition.

- To address India’s mineral security challenge, which is aimed at reducing its strategic vulnerability, New Delhi has started an attempt to engage in mineral diplomacy.

About Critical Minerals

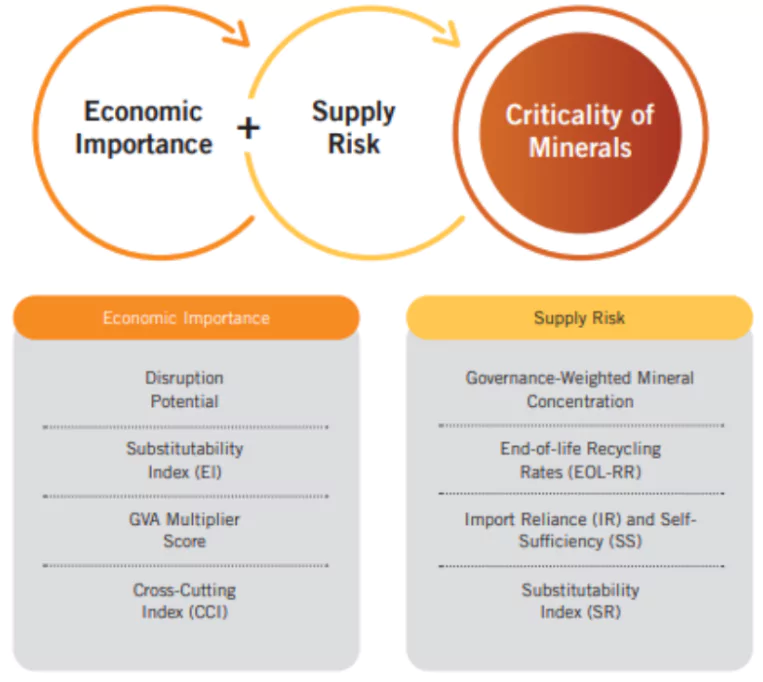

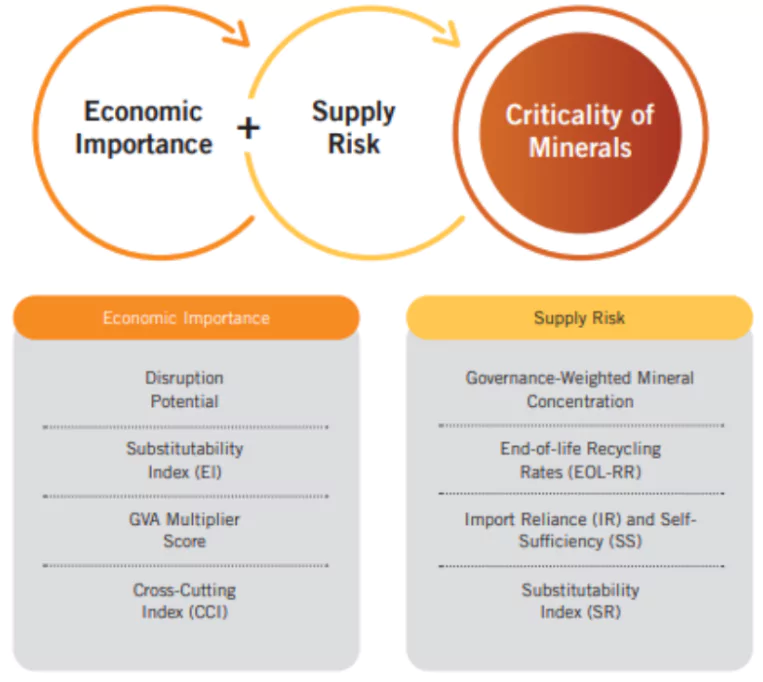

- Definition: These are the minerals which are essential for economic development and national security but the scarcity and limitation of its geographical availability leading to supply chain vulnerability and disruption constitute its criticality.

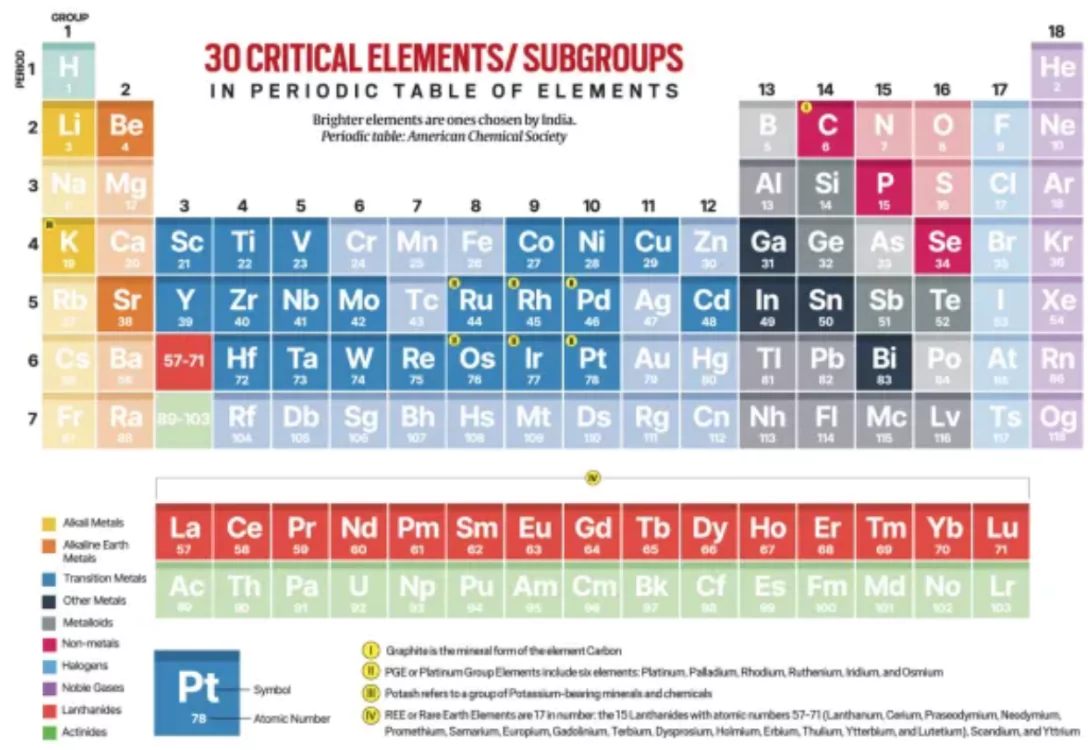

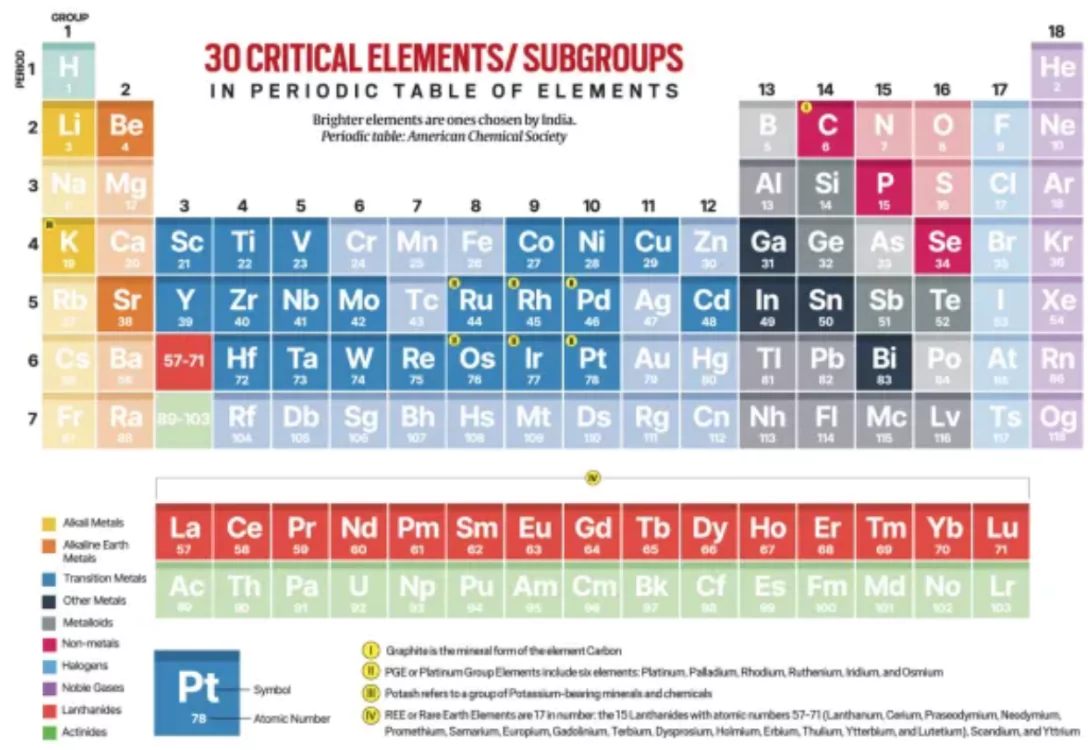

Major Critical Minerals: The Report of the Committee on Identification of Critical Minerals constituted by Ministry of Mines has identified 30 critical minerals,

Major Critical Minerals: The Report of the Committee on Identification of Critical Minerals constituted by Ministry of Mines has identified 30 critical minerals,

- Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, Graphite, Hafnium, Indium, Lithium, Molybdenum, Niobium, Nickel, PGE, Phosphorous, Potash, REE, Rhenium, Silicon, Strontium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Vanadium, Zirconium, Selenium and Cadmium.

- Top Producers: According to the International Energy Agency, the major producers of critical minerals are China, Congo, Chile, Indonesia, South Africa, and Australia.

- China has global dominance in terms of processing.

Enroll now for UPSC Online Course

- Usage:

- Advanced Electronics: They are critical for making semiconductors and high-end electronics manufacturing.

- Clean Energy Technology: These minerals are an essential component in many clean energy technologies, from wind turbines and solar panels to electric vehicles.

Transport and Communications: They are also used in manufacturing fighter jets, drones, and radio sets, Aircrafts and mainly power the transition to Electric Vehicles

Transport and Communications: They are also used in manufacturing fighter jets, drones, and radio sets, Aircrafts and mainly power the transition to Electric Vehicles- Diverse Sectors: To manufacture advanced technologies in diverse sectors such as mobile phones, tablets, electric vehicles, solar panels, wind turbines, fibre optic cables, and defence and medical applications.

- Battery and Storage Technology: These minerals are critical to develop the storage technology in terms of advancements in battery technology like Lithium-Ion.

- Components of Value Chain:

- Geoscience and Exploration

- Upstream: Mining and Extraction

- Midstream: Processing, Refining and Metallurgy

- Downstream: Component Manufacturing and Clean Digital Advanced Technology production

- Example: Zero-Emission Vehicles (ZEV) Manufacturing, Semiconductors, chips etc.

- Material Recovery and Recycling

Importance of Critical Minerals

- Key Role in Green Energy Transition: Essential for technologies like batteries (lithium, cobalt), solar panels (silicon, silver), and wind turbines (rare earth elements).

- As per the International Energy Agency (IEA), lithium demand rose by 30% in 2023, while demand for nickel, cobalt, and graphite grew 8–15%.

- Global Climate Goals: Critical to achieving the net-zero emissions target and limiting global warming to 1.5°C.

- Projections: By 2040, demand is expected to increase:

- Lithium (8x), graphite (4x), cobalt, nickel, and rare earths (2x).

- Economic and Strategic Importance: Aggregate global value of critical minerals pegged at $325 billion in 2023.

- Crucial for manufacturing defense equipment, EVs, and semiconductors.

Reserves of Critical Minerals in India

- Graphite: India has 9 million tonnes of reserves, with production reported from 12 mines.

- Tamil Nadu was the leading producer of graphite in India in 2021-22, accounting for 63% of the total output. Odisha was the second leading producer.

- Arunachal Pradesh has the highest graphite reserves in India, with 43% of the country’s total resources.

- Lithium: India’s first lithium reserves were discovered in Jammu and Kashmir in 1999.

- The Geological Survey of India (GSI) also discovered lithium reserves in Rajasthan’s Degana, which are believed to be larger than the reserves in Jammu and Kashmir.

- Ilmenite (Titanium): India holds 11% of global deposits, yet imports $1 billion worth of titanium dioxide annually.

- Odisha is the leading producer of ilmenite in India, contributing 60% of the country’s total production in 2021-22.

- Kerala and Tamil Nadu are the second and third largest producers, respectively.

- Phosphorous: Rajasthan and Madhya Pradesh are the two states in India that produce the most phosphate rocks:

- Rajasthan: 31% of India’s total rock phosphate reserves and resources

- Madhya Pradesh: 19% of India’s total rock phosphate reserves and resources

- Potash: Rajasthan is the highest producer of potash in India, contributing 91% of the country’s total potash resources.

- The state has an estimated 2.4 billion tons of potash reserves, which is about 90% of India’s total estimated reserves.

- Other Major reserves are located in Madhya Pradesh (Panna district), and Uttar Pradesh (Sonbhadra and Chitrakoot districts).

- Rare Earth Elements (REE): India has an estimated 11.93 million tonnes of monazite from beach sand containing 55–65% rare earth oxides.

- Andhra Pradesh is the state in India with the highest resources of rare earth elements (REEs), with 3.69 million tonnes.

- Other states with REE resources include: Kerala, Tamil Nadu, Odisha.

- Platinum Group Elements (PGE): About 15.7 tonnes of PGE are located in Odisha (Nilgiri, Boula-Nuasahi, Sukinda) and Karnataka (Hanumalpura).

Check Out UPSC CSE Books From PW Store

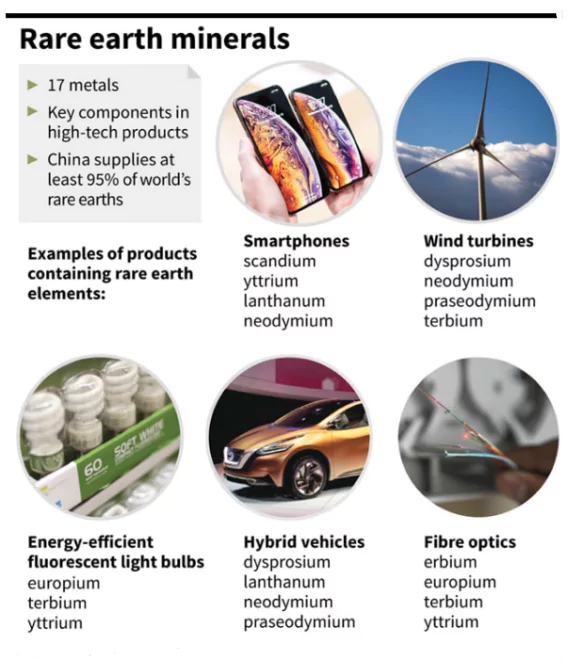

About Rare Earth (RE)

- Rare Earth (RE) are an essential part of many high-tech devices and comprises 17 elements which are classified as light RE elements (LREE) and heavy RE elements (HREE) including,

- The 15 Lanthanides: Atomic numbers 57 ( Lanthanum) to 71 in the periodic table

- Scandium (atomic number 21)

- Yttrium (39).

- Application In: Computer hard drives, cellular telephones, flat-screen monitors and televisions, and electric and hybrid vehicles.

- Availability: India has the world’s fifth-largest reserves of rare earth elements, nearly twice as much as Australia.

- LREEs available in India: Lanthanum, Cerium, Neodymium, Praseodymium and Samarium, etc.

- HREEs not Available in India: Dysprosium, Terbium, and Europium are not available in Indian deposits in extractable quantities.

|

Import Dependency of Critical Minerals

- Lithium: India is 100% import-dependent for lithium, primarily sourced from Chile, Russia, and China.

- Cobalt: Completely imported, with key sources being China, Belgium, and Japan.

- Nickel: 100% imported from countries such as Sweden, China, and Indonesia.

- Vanadium: Fully imported, mainly from Kuwait, Germany, and South Africa.

- Germanium: Entirely imported from China, South Africa, and France.

- Rhenium: India relies on imports from Russia, the UK, and China.

- Beryllium and Tantalum: Fully imported, with no domestic reserves reported.

- Silicon: India produces limited quantities and relies heavily on imports from China, Malaysia, and Norway.

Government Initiatives for Production of Critical Minerals

- National Critical Minerals Mission (2024): The National Critical Minerals Mission, announced in Union Budget 2024-25, is aimed at reinforcing India’s Critical Mineral value chain across all stages – from exploration and mining to beneficiation, processing, and recovery from end-of-life products.

- The mission’s goal is to ensure self-sufficiency in fulfilling the industrial demands for critical minerals.

- The mission focuses on boosting domestic exploration and incentivizing private sector participation.

- Amendments to the Mines and Minerals Act (2023): The government has amended the Mines and Minerals (Development and Regulation) Act, 1957 to allow the auction of critical mineral blocks. The first auction was held in November 2023 for 20 blocks.

- These amendments aim to enhance private sector involvement in exploration and mining.

- The streamlined auction process and introduction of Exploration Licenses aim to facilitate tapping into deep-seated and untapped mineral reserves.

- Strengthening Refining and Processing Capabilities: India has initiated efforts to build domestic refining and processing infrastructure to reduce its reliance on imports for downstream processes.

- During 2024, under the R & D Component of Science and Technology Programme of the Ministry of Mines, 10 R & D Projects related to extraction, recovery and recycling of critical minerals have been approved for taking up through various Indian Institutes and research laboratories.

India’s Mineral Diplomacy Strategy

India is actively involved in building partnerships with resource rich countries to secure critical minerals.

- Bilateral Partnerships:

- Australia: In March 2022, KABIL signed a Memorandum of Understanding with Australia for a critical mineral investment partnership and established the Australia-India Critical Minerals Research Hub.

- These initiatives focus on lithium and cobalt projects and research on sustainable mining.

- Latin America (Argentina, Chile, Bolivia): India signed a $24 million lithium exploration pact with a state-owned enterprise in Argentina in January 2024 for five lithium brine blocks.

- KABIL is actively working on securing mineral supplies by facilitating the acquisition of assets in Bolivia and Chile.

- United States: India is negotiating a pact to enhance supply chains for cobalt, lithium, nickel, and rare earth elements under the U.S.-led Mineral Security Partnership (MSP).

Check Out UPSC NCERT Textbooks From PW Store

About Minerals Security Partnership (MSP)

- It is a global initiative to bolster critical mineral supply chains also known as the critical minerals alliance.

- Establishment: The Minerals Security Partnership (MSP) was officially announced at the annual Prospectors and Developers Association of Canada (PDAC) convention in Toronto, Canada in June 2022.

- It is the largest mining event in the world.

- Founding Members: The United States, Australia, Canada, Finland, France, Germany, Japan, the Republic of Korea, Sweden, the United Kingdom, and the European Commission

- India joined the initiative in June of 2023

- Aim: To accelerate the development of sustainable critical energy minerals supply chains via a public-private partnership to facilitate targeted financial and diplomatic support for strategic projects along the value chain.

|

- Canada and Brazil: India is exploring cooperation in mining and critical mineral supply chains through bilateral engagements.

- Collaboration with Central Asia: In November 2024, India and Kazakhstan formed a joint venture called IREUK Titanium Limited to produce titanium slag in India.

- India has proposed the establishment of an India-Central Asia Rare Earths Forum to leverage the region’s rich resource base.

- Multilateral Partnerships:

- Mineral Security Partnership (MSP): India joined as the 14th member in June 2023 to promote resilient and responsible critical mineral supply chains globally.

- Quad and Indo-Pacific Economic Framework (IPEF): India participates in these frameworks to strengthen clean energy technologies and critical mineral supply chain resilience.

- G20 and G7: India has actively advocated for principles ensuring equitable and resilient supply chains for critical minerals through these platforms.

About KABIL

- KABIL stands for Khanij Bidesh India Limited, a joint venture company that was formed to ensure a reliable supply of critical minerals to India.

- KABIL was incorporated in 2019 under the Companies Act of 2013.

- It is a joint venture between three government enterprises:

- National Aluminium Company Ltd. (NALCO), Hindustan Copper Limited (HCL), and Mineral Exploration & Consultancy Limited (MECL).

|

-

- International Energy Agency: India’s Ministry of Mines signed a Memorandum of Understanding with the International Energy Agency to streamline policies, regulations, and investment strategies for the critical minerals sector in line with global best practices.

- Engagement with the Global South:

- India has initiated partnerships with African nations, including Zambia, Congo, and Namibia, for sourcing minerals like copper and cobalt.

- These collaborations emphasize ethical sourcing, fair practices, and diversifying mineral supply chains.

Challenges in India’s Mineral Diplomacy

- Heavy Import Dependence: India is almost entirely dependent on imports for critical minerals like lithium, cobalt, and nickel.

- In FY 2023-24, India spent over ₹34,000 crores on importing lithium, cobalt, nickel, and copper, with 70–80% of lithium imports coming from China.

- India procured 50,000 tonnes of amorphous graphite and 5,300 tonnes of nickel oxide from China between 2017 and 2023.

- China’s Dominance in Supply Chains: China controls approximately 60% of global production and 85% of processing capacity for critical minerals, including rare earths, lithium, and cobalt.

- China processes 59% of lithium and 73% of cobalt globally, dominating the midstream and downstream value chains.

- In 2023, China imposed export restrictions on graphite and other minerals, disrupting global supply chains.

- Lack of Domestic Processing Capabilities: India lacks the infrastructure for refining and processing critical minerals, which are essential for downstream industries.

- Most mineral blocks auctioned in India remain unsold due to insufficient domestic processing technologies.

- Technological and R&D Deficits: There is limited investment in research and development for extraction and refining technologies.

- Deep-seated minerals like cobalt and nickel remain unexplored in India due to the absence of advanced mining techniques.

- Geopolitical Vulnerabilities: Dependence on a few countries for critical minerals exposes India to supply disruptions due to geopolitical tensions.

- During the 2010 China-Japan dispute, China imposed export bans on rare earths, severely impacting Japan’s tech industry.

- The ongoing U.S.-China rivalry has seen tit-for-tat restrictions on critical mineral exports, highlighting the risks of concentrated supply chains.

- Insufficient Private Sector Participation: The private sector’s involvement in exploration and processing is limited due to unclear policies and high risks.

- Despite amendments to the Mines and Minerals Act in 2023, auctions for critical mineral blocks failed to attract sufficient private sector interest.

- Environmental and Ethical Concerns in Sourcing: Global mining practices often face scrutiny for human rights violations and environmental degradation.

- Allegations against Chinese firms in the Democratic Republic of Congo include child labor and forced evictions in cobalt mining operations.

Enroll now for UPSC Online Classes

Way forward

- Policy Reforms and Incentives: India needs to accelerate domestic mining and processing capabilities through viability gap funding and increased R&D investments.

- Policies should provide clear incentives for private sector engagement across the critical mineral value chain.

- Diversification of Supply Sources: India must reduce its reliance on China by strengthening partnerships with countries in Latin America, Africa, and Australia.

- The country should explore alternative sources for synthetic graphite, including Mozambique, Madagascar, and Brazil.

- Strengthening Multilateral Engagements: India should take a leading role in global dialogues for equitable access to critical minerals through frameworks like MSP and Quad.

- Multilateral engagements must focus on building resilient and sustainable supply chains for these vital resources.

- Technological and R&D Collaboration: India should partner with advanced economies like the United States and Japan to acquire cutting-edge refining and recycling technologies.

- Investments in recycling technologies can help reduce dependency on raw material imports and create a circular economy for critical minerals.

- ESG (environmental, social, and governance) compliance: India must ensure ESG (environmental, social, and governance) compliance in its sourcing practices, especially in partnerships with countries like Congo and South American nations.

Conclusion

Mineral diplomacy is essential for India’s economic development and strategic autonomy. Addressing challenges related to private sector participation, diplomatic capacity, and sustainable partnerships is crucial for strengthening India’s mineral security efforts. With a comprehensive and forward-looking approach, India can achieve long-term self-reliance in critical minerals.

![]() 16 Dec 2024

16 Dec 2024

Major Critical Minerals: The Report of the Committee on Identification of Critical Minerals constituted by Ministry of Mines has identified 30 critical minerals,

Major Critical Minerals: The Report of the Committee on Identification of Critical Minerals constituted by Ministry of Mines has identified 30 critical minerals,

Transport and Communications: They are also used in manufacturing fighter jets, drones, and radio sets, Aircrafts and mainly power the transition to Electric Vehicles

Transport and Communications: They are also used in manufacturing fighter jets, drones, and radio sets, Aircrafts and mainly power the transition to Electric Vehicles