India’s current account deficit (CAD) widened marginally to $9.7 billion (1.1% of GDP) in Q1 FY25 from $8.9 billion (1% of GDP) in the year-earlier period and a surplus of $4.6 billion (0.5% of GDP) in Q4FY24, as per Reserve Bank of India (RBI) data.

Key Highlights of the RBI Data

- Merchandise Trade Deficit: The primary reason for the CAD widening was the rise in the merchandise trade deficit to $65.1 billion in Q1 FY25 from $56.7 billion in Q1 FY24.

- Services Receipts Growth: Net services receipts rose to $39.7 billion from $35.1 billion a year ago, with increases in exports of computer, business, travel, and transportation services.

- Private Transfer Receipts: Remittances by Indians abroad increased to $29.5 billion in Q1 FY25, up from $27.1 billion in Q1 FY24.

- Primary Income Outflows: Net outgo on the primary income account rose to $10.7 billion, reflecting higher payments on investment income.

- Foreign Direct Investment (FDI): FDI inflows increased to $6.3 billion in Q1 FY25, compared to $4.7 billion in Q1 FY24.

- Foreign Portfolio Investment (FPI): FPI inflows moderated significantly to $0.9 billion, down from $15.7 billion in Q1 FY24.

- External Commercial Borrowings (ECBs): ECB inflows decreased to $1.8 billion from $5.6 billion a year ago.

- Non-Resident Deposits: Net inflows from NRI deposits increased to $4.0 billion, compared to $2.2 billion in Q1 FY24.

- Foreign Exchange Reserves: Foreign exchange reserves saw an accretion of $5.2 billion in Q1 FY25, lower than $24.4 billion in Q1 FY24.

Enroll now for UPSC Online Course

What is the Current Account Deficit and Its Trends?

- Current account deficit is the difference between exports and imports of goods and services.

- It is a key indicator of the country’s external sector.

- Components: It is the sum of Balance of Trade (Export minus Imports of Goods and Services) + Net Factor Income from Abroad (Interest income and Dividends, etc) and Net Transfer Payments ( Eg- Foreign Aid)

- Formula: Current Account = Trade Balance+Net factor income+Net transfer payments

- “Twin deficit”: The situation in which one nation has a current account deficit (trade deficit) and Fiscal deficit at the same time.

- Fiscal Deficit= Total Expenditure- Total Receipts (excluding borrowings).

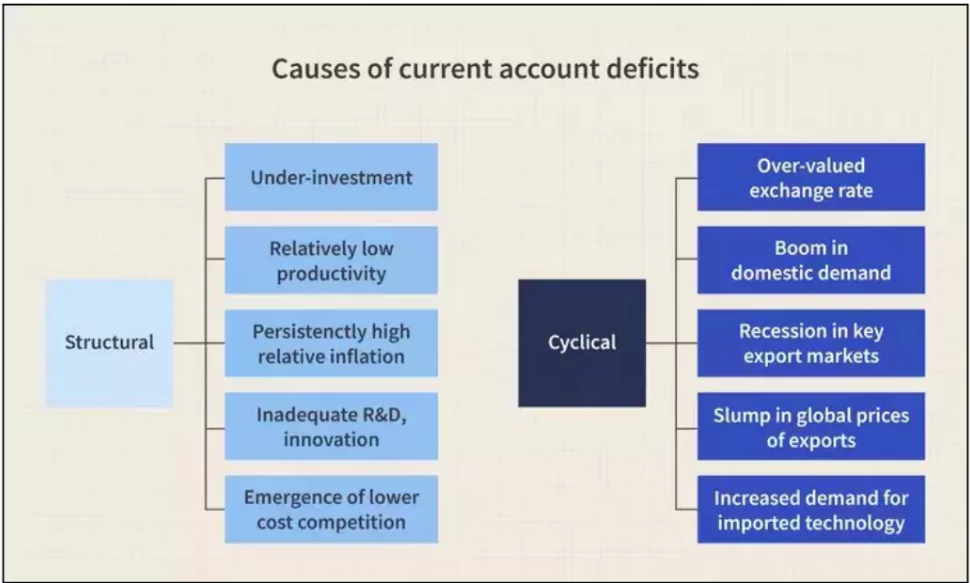

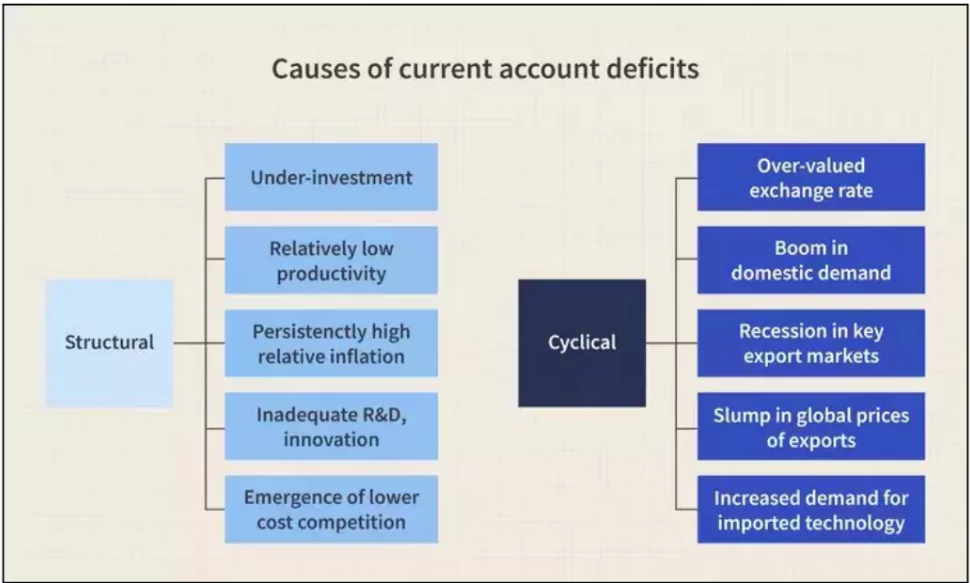

Causes of Current Account Deficit

Implication of Current Account Deficit

- Depreciation of Rupee: A large current account deficit for a continued period of time can lead to depreciation of rupee, and the demand for foreign currency (especially dollars) will see a rise.

- Inflation: Depreciation of rupee, as a result of continued deficit in the country’s current account, will see prices of imported goods becoming costlier, and in turn pushes the country towards inflation.

- Elevated Interest Rates: It will affect the investment & consumption cycle of the economy.

- Economic Growth: Persistent CAD affects economic imbalances which further hinders sustainable growth prospects of the country.

- Trade Balance: Due to Current account deficits Competitiveness & stability of Domestic Industries will get affected.

Ways to Moderate India’s Current Account Deficit

- Reduce the price of commodities.

- Appreciation of rupee.

- Lessen debt taken from developed nations.

- Reduce foreign ownership of assets.

- Improve the quality of imported goods.

- Reduce non-essential imports of gold, mobiles, and electronics.

- Increase value of exports.

Check Out UPSC Modules From PW Store

Balance of Payment and Its Components

- Definition: Balance Of Payment (BOP) is a bookkeeping system that summarises the country’s economic transaction with other countries of the world for a particular period.

- Impact: BoP keeps track of the trade and investments and transfers in a country with the rest of the world.

- Components: The BoP is composed of Capital and Current Accounts.

|

Current Account |

Capital Account |

| Definition |

The current Account is the account that records the goods exports and imports, as well as trade in services and transfer payments. |

Capital Account is the account that keeps track of Borrowing and Lending of Capital assets and non-financial assets between the countries. |

| Components |

The current account is made up of visible trade( Goods), invisible trade (Services), transfer payments, net factor income, and remittances |

The current account is made up of borrowings, lendings and investments. |

| Impact |

The current account of a country keeps track of the country’s transactions with other countries. |

The capital account of a country keeps track of the country’s investment and loans with other countries. |

![]() 1 Oct 2024

1 Oct 2024