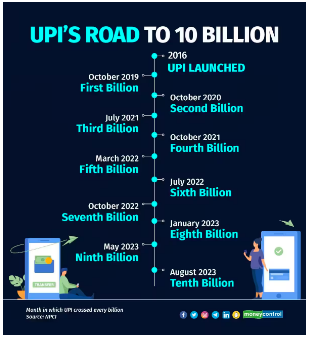

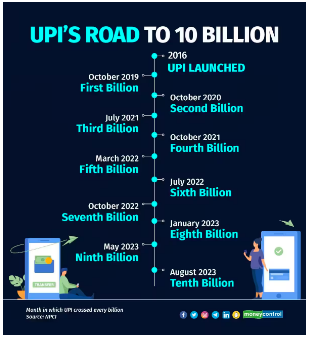

10 billion UPI Transactions

Context:

Unified Payments Interface (UPI) recorded over 10 billion transactions in August, a historic milestone.

Consistent Month-on-Month Growth:

- In July, UPI saw 9.96 billion transactions, indicating a steady month-on-month growth.

- In August, UPI averaged around 330 million transactions per day, potentially reaching 10.5 billion transactions for the month.

Expected Transaction Value Record:

- The transaction value for August is estimated to surpass July’s record of Rs 15.33 lakh crore, settling around Rs 15.4 – 15.6 lakh crore.

National Payments Corporation of India (NPCI’s) Ambitious Target:

- NPCI aims to achieve 30 billion transactions per month, equivalent to one billion transactions daily, in the next two to three years.

- NPCI is an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007,

UPI’s Evolution and Growth Factors:

- UPI has evolved from a person-to-person money transfer system to a major driver of commerce, with 57 percent of transactions now being merchant transactions.

- QR code adoption by millions of merchants, along with popular UPI apps like PhonePe, Google Pay, Paytm, Cred, and Amazon Pay, contributed to this rapid growth.

- Factors like demonetization and the pandemic accelerated the digitization of payments in India, supported by proactive policies.

About Unified Payments Interface (UPI):

- It is a system that powers multiple bank accounts into a single mobile application of any participating bank.

- It was launched by the NPCI in 2016 in conjunction with the Reserve Bank of India (RBI) and the Indian Banks Association (IBA).

|

News Source: Economic Times

![]() 2 Sep 2023

2 Sep 2023