Context:

The Rising Discrepancies in Indian GDP Data Point to a False Growth Story, Say Experts

More on News:

- India clocked in year-on-year GDP growth as of this financial year’s April-June quarter (Q1) at 7.8%, according to the National Statistical Office (NSO) which presents a positive image of economic growth.

- However, several experts have pointed out discrepancy in India’s GDP statistics, while underlying issues such as rising inequalities, job scarcity, and a decline in manufacturing jobs persist.

How GDP is Measured In India:

- India’s GDP is calculated with two different methods –

- one based on Production (at factor cost),

- the second based on Expenditure (at market prices).

- The factor cost method assesses the performance of eight different industries.

- The expenditure-based method indicates how different areas of the economy are performing, such as trade, investments, and personal consumption.

Basically, the GDP figures from the two approaches may not be an exact match.

Basically, the GDP figures from the two approaches may not be an exact match.-

- Discrepancies as a share of GDP have seen a sharp increase from -3.4% to 2.8%, that is 6.2% of the GDP.” which raises questions about the accuracy of the reported economic data.

Trends in GDP growth:

Real GDP:

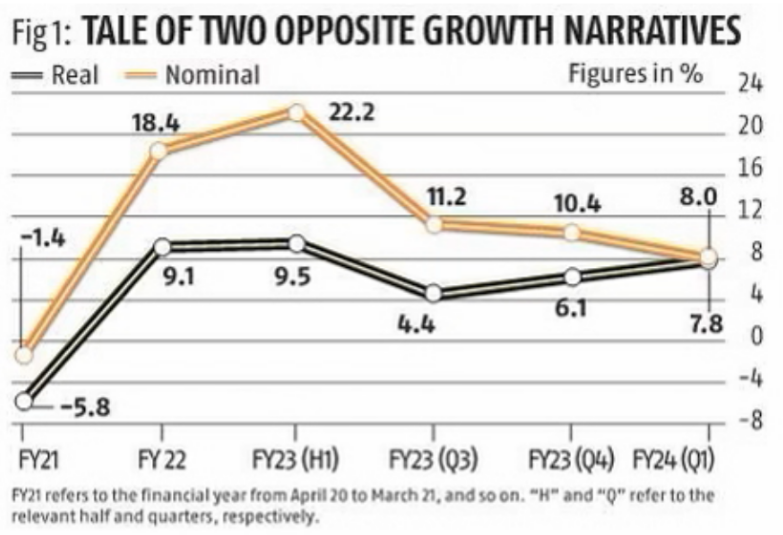

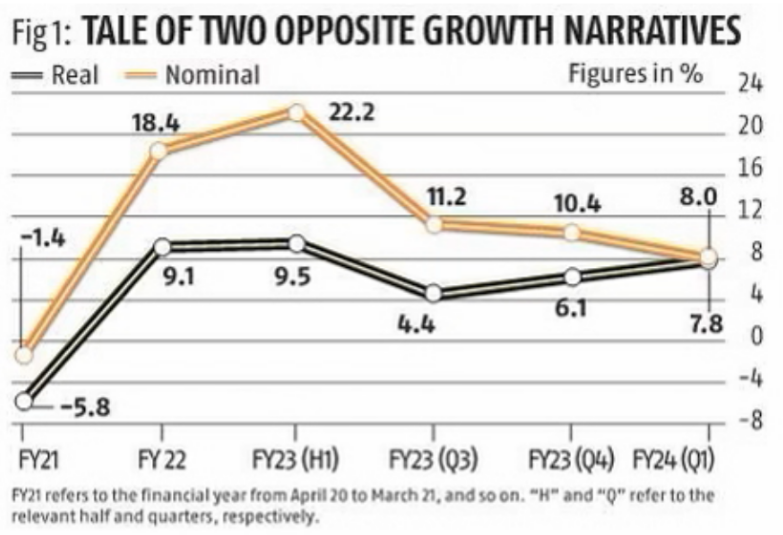

- They show a collapse in the pandemic, followed by a strong recovery which continues through the first half of FY23, a temporary dip and a surge once again.

- This is a narrative of a booming India, one that has recovered strongly from the pandemic and is back to about 8 per cent growth.

Nominal GDP:

- The nominal figures track the real numbers until the first half of FY23, but then decline by a whopping 14 percentage points over the past three quarters.

- This is a narrative of an economy which has decelerated sharply to very modest levels.

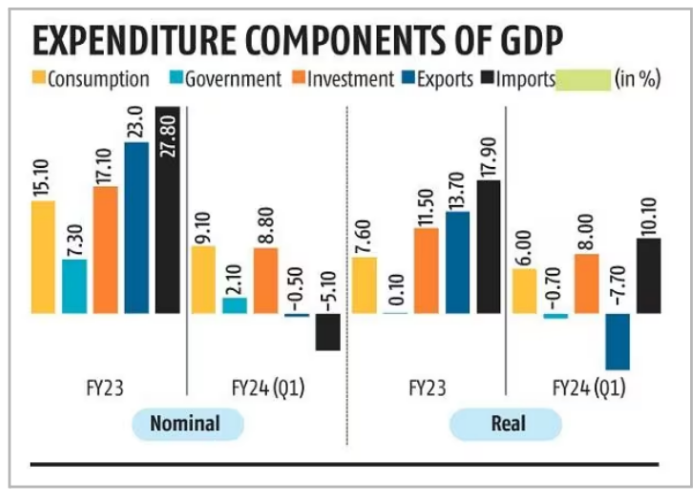

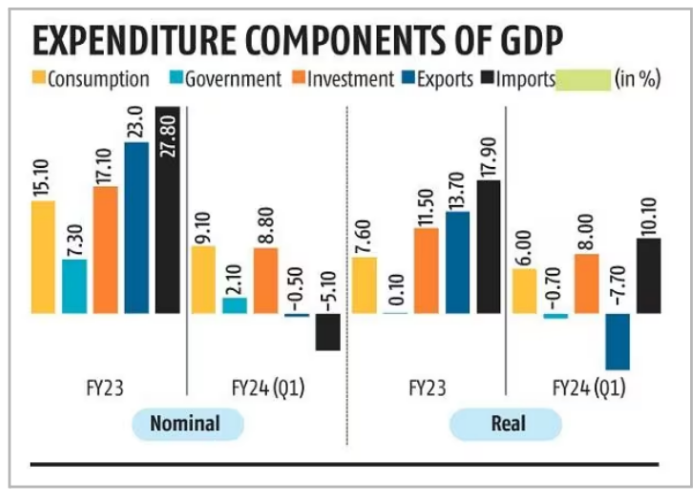

Table 1, shows that all the components of expenditure decelerated between FY23 and the first quarter of FY24, both when measured in nominal and in real terms.

Key Issues:

- The Central Statistical Office (CSO) uses single deflation (deflating the nominal value added in each sector by various price indices) rather than the internationally standard technique of double deflation (deflating output by output prices and inputs by input prices).

- A number of sectors of the economy are deflated by inappropriate indices. In particular, the wholesale price index (WPI) does not include services.

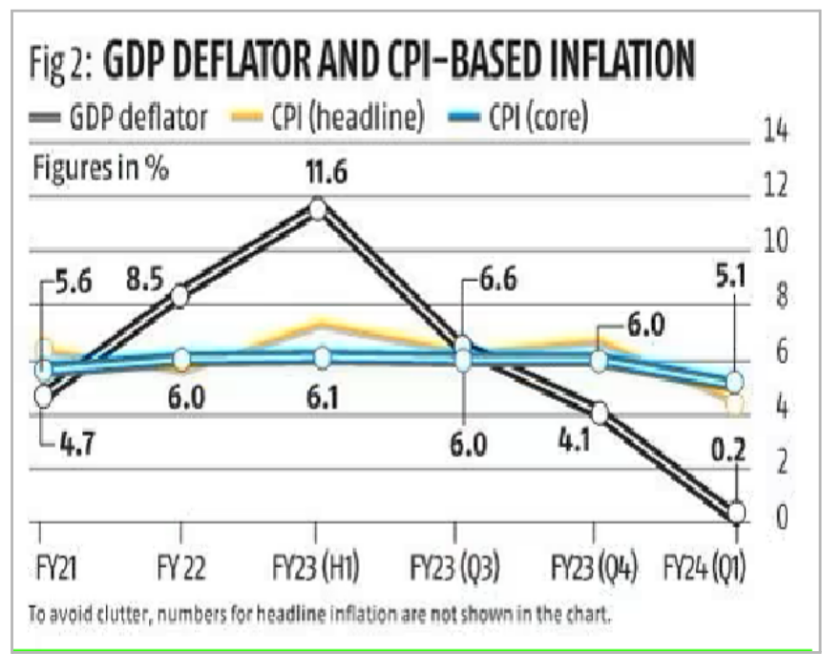

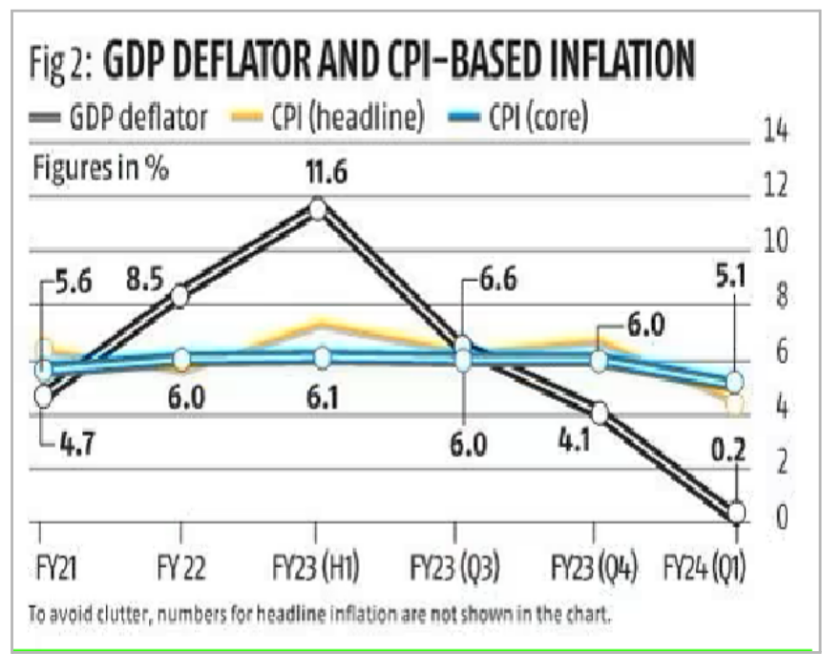

- The GDP deflator will never be the same as CPI, as the former measures producer prices and the latter consumer prices. The difference has been large and fluctuating wildly, swinging from plus 5.1 per cent in the first half of FY23 to minus 4.9 per cent in the first quarter of FY24.

Way Ahead: In sum, a careful reading of the national income accounts suggests that India needs to improve its GDP calculation methods and align it with best international practices to reduce discrepancies and controversies surrounding it.

Source: Business Standard

![]() 15 Sep 2023

15 Sep 2023

Basically, the GDP figures from the two approaches may not be an exact match.

Basically, the GDP figures from the two approaches may not be an exact match.