A total of 134 countries and currency unions, representing 98% of the global GDP, are currently investigating the potential of Central Bank Digital Currencies (CBDCs).

India’s Initiative

- The Reserve Bank of India (RBI) has been proactive, launching a pilot project for the ‘digital rupee’ in late 2022.

- Types of Digital Rupee

- CBDC-W (Wholesale): For settling secondary market transactions.

- CBDC-R (Retail): A digital version of fiat money, serving as a direct liability of RBI, unlike UPI, which involves commercial banks.

About Central Bank Digital Currencies (CBDCs)

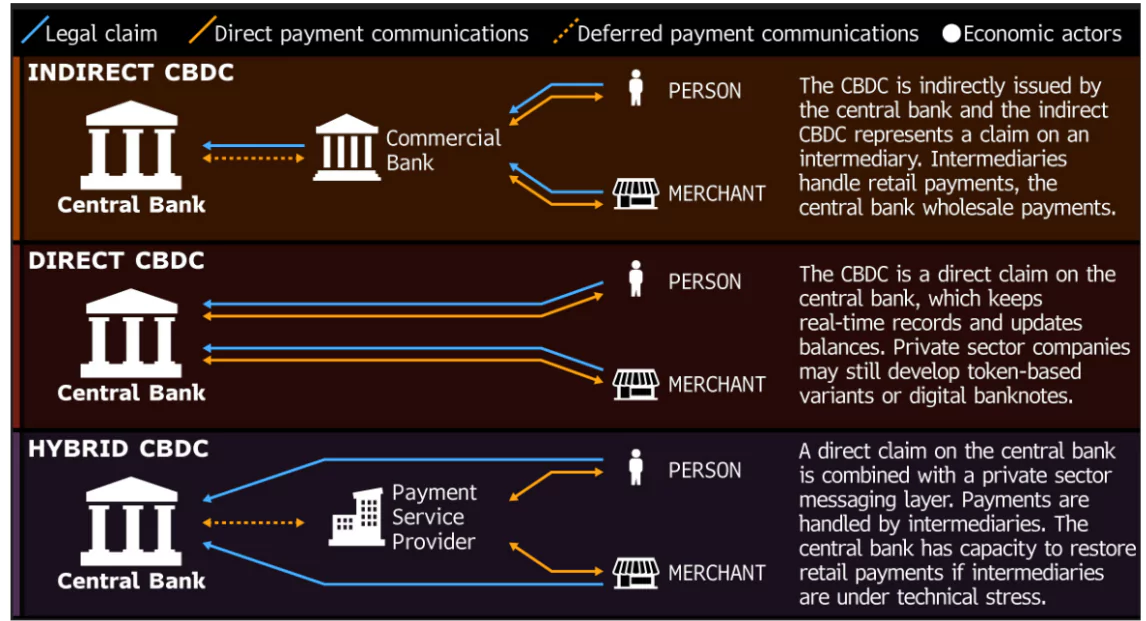

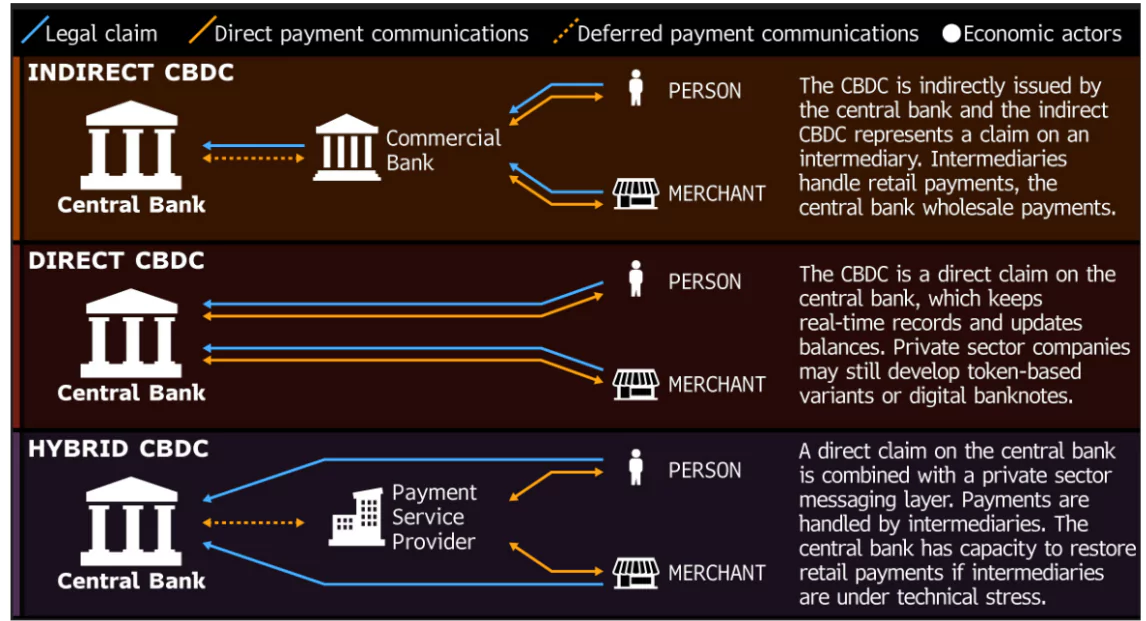

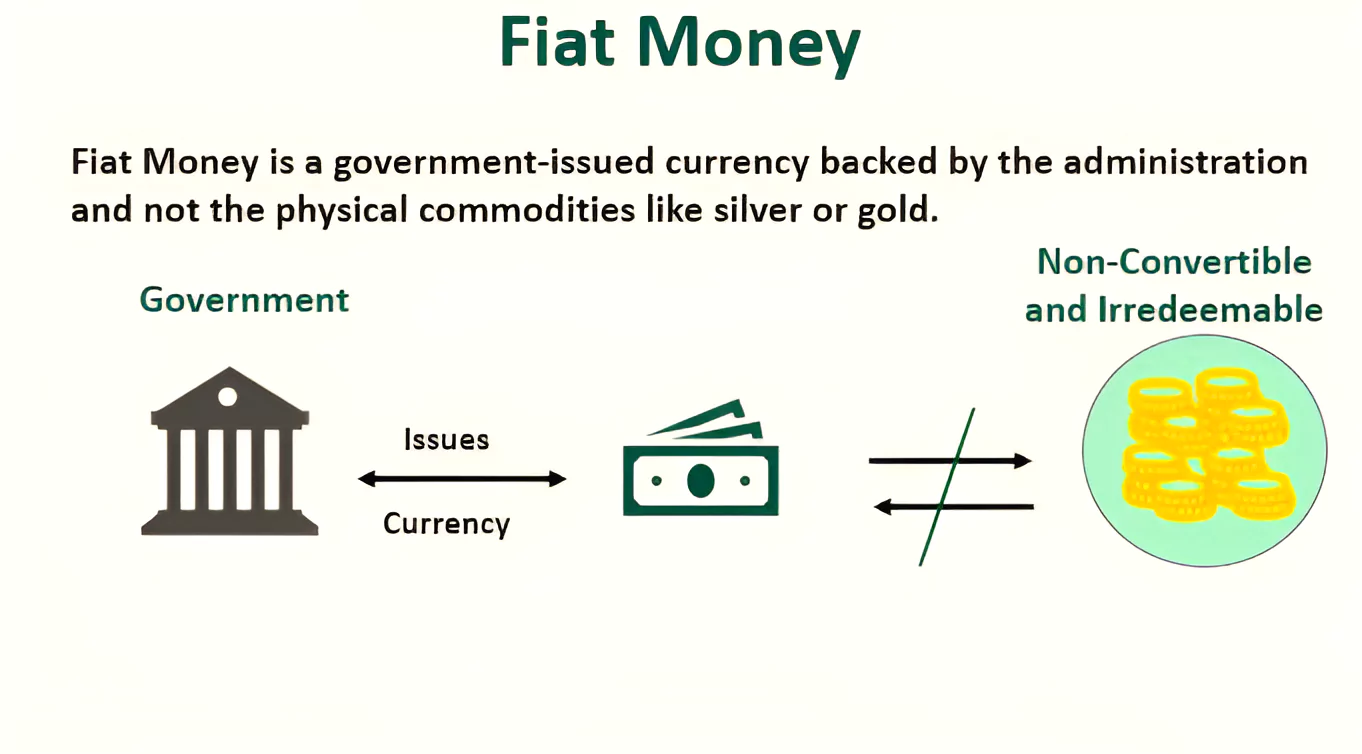

- A Central Bank Digital Currency (CBDC) is a digital form of fiat money issued by a central bank.

- It is also known as the digital fiat currency or digital base money.

- It is distinct from cryptocurrencies and virtual currencies as it is centrally controlled.

- It can be considered a liability of the central bank, similar to physical banknotes and coins.

Enroll now for UPSC Online Course

-

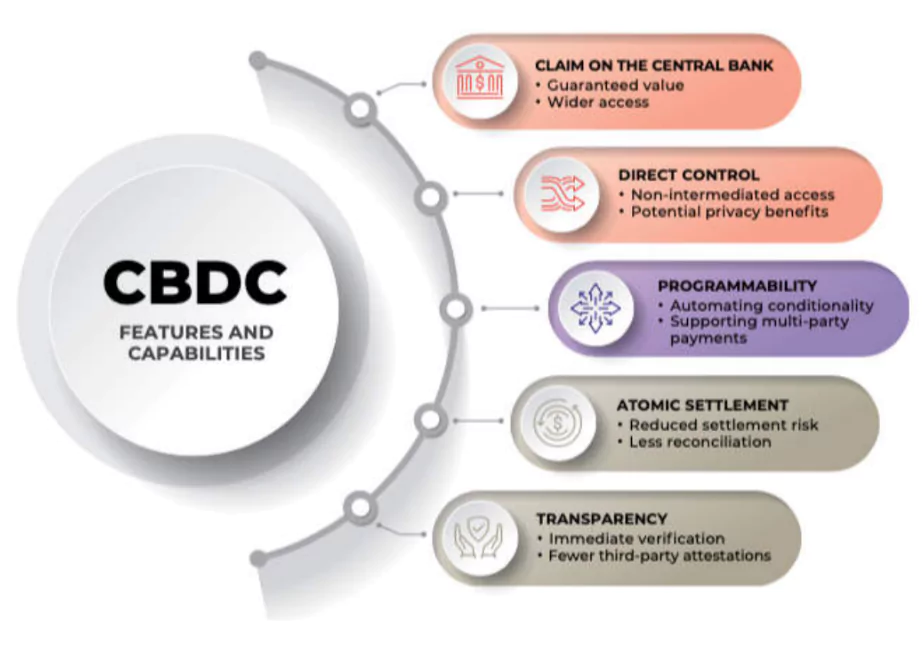

Characteristics of Central Bank Digital Currency (CBDC)

- Digital Counterpart to Fiat Money:

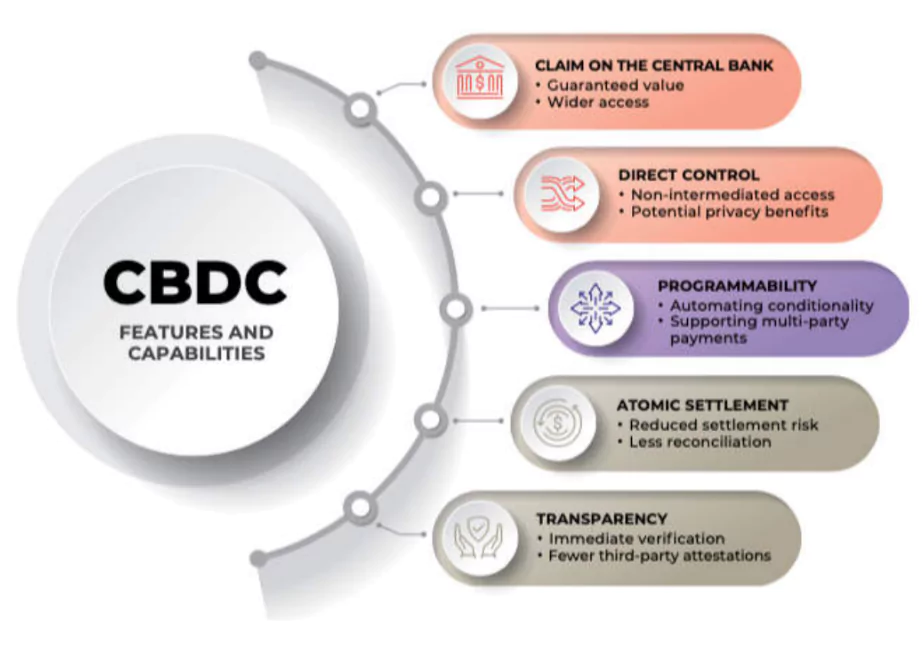

- CBDCs function as digital equivalents to traditional fiat currencies, fulfilling the roles of payment, unit of account, and store of value, similar to paper banknotes.

Unique Identifiability:

Unique Identifiability:

- Each unit of CBDC is uniquely identifiable, ensuring security and preventing counterfeiting.

- Part of the Base Money Supply:

- CBDCs are considered part of the base money supply, similar to physical currency, and represent a liability of the central bank.

- Digital Bearer Instrument:

- CBDCs can be stored, transferred, and transmitted across various digital payment systems and services, independent of the specific system used for transactions.

-

Implications for Commercial Banks

- Lower Commissions: Potentially lower commission fees due to the streamlined nature of digital transactions.

- Reduced Customer Data-Selling: Less opportunity for commercial banks to sell customer data.

- Deposit and Credit Policies: Changes in deposit accumulation and credit policies due to higher funding costs.

Check Out UPSC CSE Books From PW Store

Cryptocurrency vs. Central Bank Digital Currency (CBDC)

| Feature |

Cryptocurrency |

Central Bank Digital Currency (CBDC) |

| Issuance and Regulation |

Decentralized, no central authority |

Issued and regulated by a central bank |

| Value Stability |

Highly volatile |

Stable, equivalent to fiat currency |

| Legal Status |

Not considered legal tender in most countries |

Considered legal tender, backed by government |

| Anonymity and Privacy |

High degree of anonymity (though public ledger) |

Transactions monitored by central bank |

| Purpose and Use |

Investment, trading, alternative payment |

Financial inclusion, reduced transaction costs, efficient payments |

| Technology |

Decentralized blockchain |

Can use centralized or decentralized technology, but controlled by central bank |

Benefits of CBDC

- Financial Inclusion: CBDC aims to expand access to digital financial services, particularly for those without bank accounts.

- Enhanced Payments: Improves the efficiency and speed of digital payments, including cross-border transactions.

- System Resilience: CBDC can operate independently of commercial banks, making the payment system more robust.

- Economic Growth: Increased financial inclusion can contribute to economic growth.

- Global Integration: CBDC can facilitate cheaper and faster international payments, benefiting India as a major remittance recipient.

- International Collaboration: Participation in global CBDC projects can foster interoperability and cooperation.

Challenges in Implementing CBDC

- Security and privacy: Safeguarding user data and preventing unauthorized access to CBDC wallets are paramount concerns. Striking a balance between privacy and security is essential to build trust among users.

- Scalability: CBDCs need to handle a large volume of transactions efficiently, especially during peak times. Ensuring the system can scale to meet increasing demand is vital for its success.

- Lack of perceived value proposition: For users to switch from existing payment methods, CBDCs need to offer clear benefits such as lower fees, faster transactions, or additional features.

- Monetary policy implications: CBDCs could affect the effectiveness of monetary policy tools. Central banks need to carefully consider how to manage these implications.

- Mitigating Cybersecurity Risks: Protecting against hackers trying to steal funds or personal data.

- Building Public Trust and Education: Gaining public trust and informing people about the benefits and security of CBDCs to overcome resistance to digital currency.

Enroll now for UPSC Online Classes

Way Forward

- Address Privacy and Security: The RBI must tackle privacy and security concerns to encourage widespread adoption.

- Establish Regulatory Standards: Uniform standards for security, privacy, anonymity, and grievance redressal are necessary.

- Promote Interoperability: Enhancing interoperability and offering additional functionalities could incentivize users to adopt the digital rupee.

- International Cooperation: To fully leverage CBDCs for cross-border payments and remittances, India must engage in global CBDC projects once a comprehensive regulatory framework is in place.

![]() 5 Aug 2024

5 Aug 2024

Unique Identifiability:

Unique Identifiability: