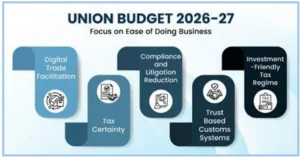

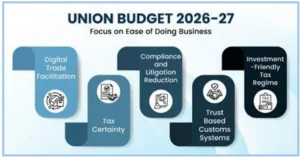

The Union Budget 2026-27 reinforces Ease of Doing Business (EoDB) as a foundational pillar for economic growth. By transitioning from a “clearance-based” model to a trust-based compliance framework, the government seeks to harmonize regulatory efficiency with the broader vision of Viksit Bharat @2047.

About Ease of Doing Business (EoDB)

- Core Definition: EoDB refers to the quality of a country’s regulatory and institutional framework that determines how easily businesses can start, operate, comply, and exit within an economy.

- Regulatory Efficiency: It focuses on reducing procedural complexity, time delays, and compliance costs across the business lifecycle, specifically targeting bottlenecks in licensing, taxation, and contract enforcement.

- Transaction Cost Perspective: From an economic lens, EoDB seeks to minimize transaction costs and information asymmetries, thereby improving market participation and overall economic efficiency.

- Institutional Nature: It is not merely about deregulation; rather, it reflects the predictability, transparency, and consistency of state institutions in enforcing the “rules of the game.”

- Global Measurement Context: The concept was globally operationalized through the World Bank’s Doing Business framework (2003–2020), evaluating indicators like getting credit, protecting minority investors, and resolving insolvency.

- India’s Reform Orientation: In the Indian context, reforms have prioritized digitization (e.g., NSWS), de-licensing, time-bound approvals, and legal reforms (e.g., IBC 2016) to bolster investor confidence and drive economic formalization.

- Competitive Federalism Angle: At the sub-national level, EoDB is driven by the Business Reform Action Plan (BRAP), which leverages State-led competition to improve regulatory performance at the grassroots.

- The B-READY Transition: Post-2021, the focus has shifted to the Business Ready (B-READY) framework, which moves from “De Jure” (laws on paper) to “De Facto” (actual practice), incorporating digital adoption and environmental sustainability.

- Success Metrics:

- Enterprise Growth: The impact of these reforms is evident in the 27% growth of active registered companies (rising to 1.98 lakh as of Feb 2026).

- Historical FDI Surge: India’s long-term regulatory transformation has resulted in a total FDI inflow of USD 748.38 billion (2014–25), representing a 143% increase over the preceding 11-year period.

Why Ease of Doing Business is Necessary ?

- Investment Mobilization and Global Integration: A stable, predictable, and transparent regulatory environment serves as a “Green Flag” for global capital.

- Attracting FDI: Sustaining the momentum of Foreign Direct Investment requires a stable policy environment.

- Example: The PLI (Production Linked Incentive) Schemes have attracted global giants like Apple’s ecosystem partners, turning India into a major mobile export hub.

- Global Supply Chain Integration: Strategic reforms allow India to leverage shifting international supply chains, particularly in electronics and specialty chemicals.

- Allocative Efficiency: Mechanisms like the Insolvency and Bankruptcy Code (IBC) ensure that capital isn’t trapped in “zombie firms.”

- Example: The successful resolution of cases like Bhushan Steel allowed distressed assets to be acquired by productive players, returning thousands of crores to the banking system.

- MSME Empowerment and Economic Formalization: Small and Medium Enterprises are the backbone of the economy but are the most vulnerable to “Regulatory Cholesterol.”

- Boosting MSME Competitiveness: Simplifying filings and providing ready industrial infrastructure allows small firms to focus on scaling rather than administrative survival.

- Formalization of the Economy: Reducing the cost of registration encourages informal enterprises to enter the formal sector.

- Example: The Udyam Registration portal simplified the process to a single-page digital form, bringing millions of small businesses into the formal fold to access credit.

- Expanding the Tax Base: Formalization leads to increased GST collections, providing the government with more resources for public infrastructure.

- Socio-Economic Impact and Job Creation: EoDB is the most effective engine for social mobility and absorbing India’s demographic dividend.

- Mass Employment Generation: A vibrant ecosystem enables firms to scale up, which is the primary driver for absorbing millions of youth into the workforce annually.

- Fostering Entrepreneurship: Lowering entry barriers empowers first-generation entrepreneurs, driving the “Start-up India” vision.

- Example: The National Single Window System (NSWS) allows startups to get all necessary state and central clearances in one place, reducing “red tape” to “red carpet.”

- Inclusive Growth: By removing structural barriers, EoDB enables broader participation from rural and semi-urban areas.

- Institutional Integrity and Governance: Reforms focus on removing the human bottlenecks that hinder progress.

- Reducing Corruption and Rent-Seeking: Digitization and Faceless Assessments eliminate the physical interface between businesses and bureaucrats.

- Example: The Income Tax Faceless Assessment scheme has significantly reduced the scope for bribery and harassment by anonymizing the audit process.

- Contract Enforcement: A robust legal framework for dispute resolution ensures the sanctity of contracts, which is vital for long-term Public-Private Partnerships (PPPs).

- Competitive Federalism: State-level rankings promote a “race to the top,” improving last-mile regulatory delivery.

- Efficiency and Innovation: Administrative friction acts as a “hidden tax” that stifles creativity.

- Lowering Transaction Costs: Reducing compliance management acts as a fiscal stimulus, allowing firms to reinvest capital into R&D and innovation.

- Lowering the Cost of Doing Business: Efficient logistics and quick utility connections reduce input costs.

- Example: The PM Gati Shakti master plan integrates departmental data to speed up infrastructure approvals, lowering the high logistics costs that currently plague Indian manufacturing.

Budget 2026-27- Strengthening India’s Business Climate

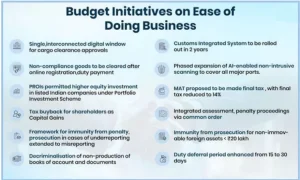

The 2026-27 Budget introduces structural shifts to enhance the investment climate:

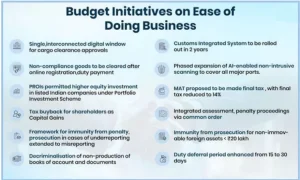

- Structural Tax Reforms- Certainty & Simplification: The budget introduces the Income Tax Act, 2025, which effectively sunsets the 65-year-old 1961 Act to provide a modern, litigation-free framework.

The New Income Tax Act, 2025: Effective from April 1, 2026, this landmark legislation simplifies tax language and reduces the number of sections. A new slab structure under the New Tax Regime (FY 2025-26) makes income up to ₹12 lakh (or ₹12.75 lakh for salaried) tax-free.

The New Income Tax Act, 2025: Effective from April 1, 2026, this landmark legislation simplifies tax language and reduces the number of sections. A new slab structure under the New Tax Regime (FY 2025-26) makes income up to ₹12 lakh (or ₹12.75 lakh for salaried) tax-free.- Rationalization of MAT: The Minimum Alternate Tax (MAT) has been reduced from 15% to 14%. Crucially, it is now proposed as a final tax, ending the complex “credit accumulation” era.

- MAT Credit Flexibility: To prevent financial clogging, companies can now set off existing MAT credit up to 1/4th (25%) of their tax liability in the new regime. Non-residents paying on a presumptive basis are now exempt from MAT.

- Litigation Relief: The pre-payment requirement to appeal before the CIT(A) has been halved from 20% to 10% of the core tax demand, with no interest liability on penalties during the appeal period.

- MSME “Champion” Strategy: To transition MSMEs from survival to scale, the budget shifts from debt-heavy support to Equity and Liquidity.

SME Growth Fund: A ₹10,000 crore fund providing equity capital to help high-potential firms scale.

SME Growth Fund: A ₹10,000 crore fund providing equity capital to help high-potential firms scale.- TReDS Institutionalization: Mandating the Trade Receivables Discounting System (TReDS) for all CPSE purchases ensures immediate liquidity.

- Professional Support Network: In collaboration with ICAI/ICSI, the government will create a network of trained para-professionals to help MSMEs in Tier-II/III cities with compliance at standardized costs.

- Customs & Trade- The “Factory-to-Ship” Era: Trade facilitation is being overhauled through automation and a trust-based accreditation system.

- Customs Integrated System (CIS): A two-year roadmap to launch a single, automated platform for all customs processes. By April 2026, processes for food, drugs, and wildlife (70% of interdicted cargo) will be live on CIS.

- AI-Enabled Port Scanning: A mandate to scan every container across major ports using non-intrusive imaging and AI-risk assessment.

- Trusted Importer Scheme: Recognized firms can now benefit from “Factory-to-Ship” clearance, drastically reducing physical verification and port-side delays.

- Frontier Technology Missions (ISM 2.0 & SHAKTI): Strategic investments in “future sectors” are designed to create global manufacturing leadership.

- India Semiconductor Mission (ISM) 2.0: With a fresh outlay, ISM 2.0 focuses on manufacturing chipmaking equipment, materials, and creating Full-stack Indian Semiconductor IP.

- Biopharma SHAKTI Mission: A ₹10,000 crore initiative over 5 years to build a biologics ecosystem, including 3 new NIPERs and a network of 1,000+ clinical trial sites.

- Electronics Component Scheme: The outlay for the scheme launched in 2025 has been nearly doubled to ₹40,000 crore to capitalize on the “China+1” momentum.

- Capital & Global Integration:

- Portfolio Investment (PROI) Liberalization: The individual investment cap for a Person Resident Outside India (PROI) has been doubled from 5% to 10%, with the aggregate aggregate limit raised to 24%.

- Safe Harbour for GCCs: IT, KPO, and R&D services are consolidated into a single category with a uniform safe harbour margin of 15.5%, making India the global hub for Global Capability Centres.

- Jan Vishwas 2.0: This next phase of decriminalization targets minor procedural lapses across 17 additional laws, replacing criminal trials with monetary penalties to foster an entrepreneurial culture.

India’s Initiatives & State-Led Innovations

- National-Level “Digital Gateways”: Flagship initiatives have centralized the regulatory experience, moving from fragmented approvals to a “Whole of Government” approach.

- National Single Window System (NSWS): Acting as a “Digital Gateway,” this platform now integrates over 32 Central Departments and 32 State Governments.

- Know Your Approvals (KYA): A standout feature where a business owner enters their sector and location to receive a customized list of every required license.

- Secure Document Repository: Provides a “upload once, use everywhere” system, eliminating physical visits to multiple ministries.

- India Industrial Land Bank (IILB): Solves the historic “land bottleneck” via a GIS-mapped national portal with real-time data on over 5 lakh hectares of industrial land across 4,000+ parks.

- Geospatial Clarity: Investors can identify available plots, viewing nearby raw materials and connectivity nodal points without dealing with local bureaucratic delays.

- PARIVESH 3.0: This digital hub for environmental clearances now integrates AI-enabled support and afforestation land banks, providing a virtuous cycle for post-approval compliance monitoring.

- Decriminalization & Labor Reforms: The focus has shifted toward “Trust-based Governance,” specifically targeting the Ease of Doing Business (EoDB) and Ease of Living.

- Jan Vishwas Bill 2025: Comprises 355 provisions, specifically targeting 288 provisions for decriminalization and 67 provisions to enhance the Ease of Living.

- Jan Vishwas 2.0: A critical step in Legal Rationalization, expanding to 17 additional laws and converting punishments (imprisonment) for technical defaults into monetary penalties (Shift to Civil Penalties).

- The 30-Day Labor Mandate: Under the new Labor Codes, a strict 30-day time limit is prescribed for granting permission for factory construction or expansion, down from the previous 90-day window.

- Taxpayer Protection: Removes prosecution for certain minor tax defaults (e.g., TCS defaults), protecting entrepreneurs from criminal trials for administrative errors.

- Competitive Federalism & State Innovations: The Business Reform Action Plan (BRAP) drives state-level change through a 489-point, fully feedback-based framework (2024–26) evaluating real user experience.

- Leading Reformers & Models:

- Top Achievers: Haryana, Uttarakhand, and Uttar Pradesh recognized for 100% implementation of priority reforms across land, labor, and construction permits.

- Uttar Pradesh (The Scale Champion): Achieved a “Triple Crown”—15-minute business registrations, 40% reduction in labor compliance, and 50% faster land transactions.

- Negative Lists for Land Use: Assam, J&K, Odisha, and Tripura pioneered “Negative Lists” for mixed land-use zones, where all business activities are permitted by default unless expressly prohibited.

- Third-Party Safety: Chhattisgarh, Rajasthan, and Uttar Pradesh moved to third-party building plan approvals, while Telangana and Tripura accredited third-party professionals for fire safety norms.

- Sustainability & Specialized Focus:

- Andhra Pradesh (Digital Integration): Pioneered the Online Consent Management & Monitoring System for real-time environmental tracking and eliminated land conversion requirements for select categories.

- Tamil Nadu (Sustainable Industry): Integrated Single-Window Industrial Clearances with Decarbonization Plans. Removed gender-based restrictions on manufacturing shifts to expand the electronics sector labor pool.

- Kerala (Green-Tech Focus): Implemented Carbon-Neutral Gram Panchayats and streamlined registration for green-tech startups.

- Chhattisgarh (Entrepreneurial Push): Its Startup Policy 2025–30 provides seed funding, credit risk funds, and interest subsidies.

- Financial Modernization & Feedback Ecosystem: Tackling the two biggest MSME hurdles- liquidity and regulatory voice.

- TReDS Mandate: All Central Public Sector Enterprises (CPSEs) are now mandated to route payments through the TReDS platform, ensuring MSMEs receive instant liquidity by discounting trade receivables.

- SME Growth Fund: A ₹10,000 crore fund providing equity capital to high-potential firms to scale without the burden of debt.

- CII Ease of Doing Business Portal: Facilitates continuous industry feedback via a “real-time resolution dashboard” to bridge the gap between policy intent and ground-level reality.

- Structural Reforms:

- RBI Regulatory Consolidation: Repealed over 9,400 circulars, consolidating the framework into just 238 function-specific Master Directions.

- Insurance Sector Liberalization: The Sabka Bima Sabki Raksha Act, 2025 allows 100% FDI and reduces the Net Owned Fund (NOF) for foreign reinsurers from ₹5,000 crore to ₹1,000 crore.

- Digital Credit Assessment Model (CAM): Public Sector Banks transitioned to a data-driven CAM for MSMEs. In 2025, over 3.96 lakh applications (₹52,300 crore) were sanctioned using digital footprints.

- GST 2.0: Reforms in September 2025 moved to a simplified two-rate structure, correcting inverted duty structures in textiles and fertilizers.

Global Actions & Initiatives

- The World Bank’s “B-READY” Paradigm (2024–2026): As the successor to the “Doing Business” rankings, Business Ready (B-READY) represents a fundamental shift in how national competitiveness is measured.

- The Three-Pillar Approach: Rather than just looking at “laws on paper” (De Jure), B-READY evaluates the Regulatory Framework, the quality of Public Services, and Operational Efficiency (De Facto experience of firms).

- The Firm Lifecycle: It tracks ten core topics covering a firm’s entire journey: from Business Entry and Labor to Utility Services and Business Insolvency.

- Horizontal Themes: In 2026, an economy’s score is heavily weighted by three cross-cutting themes: Digital Adoption, Environmental Sustainability, and Gender Equality.

- WTO and Global Trade Facilitation: International trade bodies are working to harmonize rules to ensure that “procedural red tape” doesn’t stifle global growth.

- Investment Facilitation for Development (IFD): Backed by over 120 WTO members (representing 70% of the organization), this landmark plurilateral agreement aims to create a global benchmark for transparency. It focuses on streamlining administrative procedures and enhancing international cooperation to bridge the $4 trillion SDG investment gap.

- The “Right to Regulate”: While the IFD streamlines processes, it explicitly protects a nation’s right to regulate in the public interest, ensuring that “facilitation” doesn’t mean “deregulation” of essential standards.

- Authorised Economic Operator (AEO) Programs: Under the WTO’s Trade Facilitation Agreement, the AEO program allows “trusted traders” (firms with high compliance records) to receive preferred treatment, such as faster cargo clearance and reduced physical inspections.

- UNCTAD- The “Sustainable FDI” Model: UNCTAD’s Global Investment Facilitation initiatives push for a shift from “any investment” to “Quality Investment.”

- SDG-Aligned Growth: Through the World Investment Forum, UNCTAD encourages nations to align their business climates with Sustainable Development Goals (SDGs).

- Sectoral Focus: In 2025–2026, FDI has become highly concentrated in capital-intensive, technology-driven sectors.

- For example, Data Centers and Semiconductors now attract nearly 25% of global greenfield project values, requiring specialized “fast-track” regulatory windows.

- OECD- Agile Regulatory Governance: To keep pace with the AI revolution, the OECD advocates for governance that is as adaptive as the technology it regulates.

- Regulatory Sandboxes: The OECD promotes the use of “Sandboxes” where companies can test AI and digital innovations under regulatory supervision without the immediate burden of full compliance.

- Agile AI Governance: The focus has shifted from “static safeguards” to continuous monitoring and live, adaptive policies that can detect “algorithmic drift” or fairness deviations in real-time.

- International Regulatory Co-operation (IRC): This prevents “fragmented rules” from hindering global tech-led growth, ensuring that a startup in one country can scale across borders without facing 190 different sets of digital rules.

- Regional Partnerships and ESG Integration: Large trade blocs like the IPEF (Indo-Pacific Economic Framework) and RCEP are increasingly including dedicated “Ease of Business” chapters.

- Digital Public Infrastructure (DPI): Backed by G20 principles, DPI is being used to bridge the information gap between project sponsors and global financiers through portals like the Global Infrastructure Hub (GI Hub).

- The ESG Mandate: Global capital markets now treat Environmental, Social, and Governance (ESG) reporting as a core business metric. Standardized reporting frameworks from the International Sustainability Standards Board (ISSB) have made “Ease of Green Compliance” a new frontier for global competitiveness.

- India’s Alignment: India is actively synchronizing its domestic reforms with these global benchmarks. By liberalizing sectors (such as allowing 100% FDI in insurance) and digitizing its Customs Integrated System, India is positioning itself as a “top achiever” in the upcoming B-READY 2026 report.

Challenges & Concerns

- The Judicial Paradox and Contract Enforcement: While India has leaped ahead in digital tax filing and business registration, the legal system remains the final frontier of reform.

- The Pendency Crisis: As of 2026, roughly ₹24.7 lakh crore (approx. 7.5% of India’s GDP) remains locked in commercial disputes across various tribunals.

- Time to Resolve: While commercial case disposal times in specialized courts improved from 1,445 days in 2020 to roughly 626 days in recent years, the judicial system still grapples with over 4.6 crore pending cases in district courts.

- Impact: This delay undermines the “sanctity of contracts,” making long-term investors—especially in infrastructure—hesitant to commit capital without expensive third-party arbitration clauses.

- The MSME “Regulatory Cholesterol”: Most Ease of Doing Business (EoDB) gains have disproportionately benefited large corporations. Small enterprises continue to face a staggering administrative burden.

- Compliance Overload: A typical manufacturing MSME operating in a single state must still navigate over 1,450 regulatory obligations annually.

- The Cost of Compliance: These obligations translate to a financial burden of ₹13–17 lakh per year for small units—capital that could otherwise be used for innovation or hiring.

- The “Inspector Raj” Persistence: Despite digitization, MSMEs still deal with up to 59 different types of inspectors and face over 480 imprisonment clauses for what are often minor procedural lapses.

- Implementation Divergence and Asymmetric Federalism: India’s “Competitive Federalism” has created a wide gap between “Top Achiever” states and lagging regions.

- The Performance Gap: States like Andhra Pradesh, Gujarat, and Uttar Pradesh have institutionalized 100% of the Business Reform Action Plan (BRAP).

- However, many states in the hinterland struggle with “last-mile” delivery, leading to an uneven concentration of FDI.

- The “Paper vs. Practice” Gap: While a state might have a “Digital Single Window” (De Jure), ground-level execution (De Facto) often still requires informal “rent-seeking” or physical follow-ups with local officials.

- Land and Labor- The “Soft” Linkage Bottlenecks:

- Land Acquisition: Land remains a complex State subject. Despite the Industrial Land Bank (IILB), the lack of digitized, clear titles in many regions continues to stall large-scale projects.

- The Skill Gap: While physical infrastructure (roads and ports) is being modernized via PM Gati Shakti, “soft” infrastructure—specifically formal skill training—remains low.

- Only a small fraction of the workforce is formally skilled, creating a mismatch between the “Jobless Growth” in capital-intensive sectors (like Semiconductors) and the needs of labor-intensive manufacturing.

- Transition to World Bank B-READY 2026: With the discontinuation of the original “Doing Business” index, India is currently navigating a “benchmark vacuum.”

- New Metrics: The transition to the B-READY framework shifts the goalposts to include Environmental Sustainability and Gender Equality.

- India’s Pilot Performance: Early pilot data shows India performing well in Digital Adoption (Pillar 3), but lagging in the Quality of Public Services (Pillar 2) related to utility connections and business insolvency.

Way Forward

- Judicial Efficiency & Contract Enforcement: The legal system remains the final hurdle to becoming a global manufacturing hub. The priority is to shift from years to weeks in dispute resolution.

- Specialized Commercial Courts: Rapid expansion of dedicated commercial courts at the district level to handle cases exceeding ₹3 lakh.

- The goal is to bring Indian resolution times (~1,400 days) closer to the global average of 400 days.

- Mainstreaming ADR: Making Alternative Dispute Resolution (ADR), such as mediation and arbitration, mandatory pre-litigation steps.

- AI-Assisted Case Management: Implementing AI tools in the e-Courts Mission Mode Project to automate routine scheduling and reduce “human friction” in the judicial process.

- Localization- The D-BRAP Era: Real business interactions happen at the local level. The District Business Reform Action Plan (D-BRAP), launched in late 2025, shifts the focus from State capitals to Municipalities.

- Last-Mile Implementation: Equipping Urban Local Bodies (ULBs) and District Collectorates with digital infrastructure for construction permits and utility connections.

- U-PIN (Unique Land Parcel Identification Number): Nationwide rollout of “Aadhaar for Land” to create clear, dispute-free digital titles, significantly lowering the risks of industrial land acquisition.

- Startup Cells in Tier-II/III Cities: Establishing dedicated “facilitation units” at the district level to provide a single point of contact for first-generation entrepreneurs.

- MSME-Centric “Trust-Based” Governance: MSMEs require “handholding” rather than “policing.” The focus is on reducing the Compliance Burden which currently consumes 6–8% of their annual turnover.

- Jan Vishwas 3.0: A commitment to Universal Decriminalization of all minor procedural lapses, ensuring that “administrative survival” doesn’t require fear of imprisonment.

- Self-Certification & Risk-Based Audits: Shifting micro-enterprises to a self-audit model with randomized inspections, reducing the physical “Inspector Raj.”

- Corporate Mitras: Training accredited professionals to help MSMEs in smaller towns navigate digital compliance portals at affordable, standardized costs.

- Aligning with Global “B-READY” & ESG Standards: To stay competitive in the World Bank’s new B-READY index, India is integrating sustainability into its business climate.

- ESG Reporting for All: Encouraging standardized Environmental, Social, and Governance (ESG) reporting, making “green compliance” a badge of quality for global investors.

- Digital Public Infrastructure (DPI): Leveraging the “India Stack” (Aadhaar, DigiLocker) to create an end-to-end paperless compliance journey, where data flows seamlessly between tax, labor, and industry departments.

- Innovation and R&D Incentives: Transitioning from a service-hub to a deep-tech leader requires a “Regulatory Reset” for R&D.

- Anusandhan National Research Foundation (ANRF): Scaling private-sector participation in R&D through targeted tax incentives and Regulatory Sandboxes.

- IP Reform: Reducing “pendency” at the Intellectual Property Office to ensure that a patent filing in India is as fast as one in the US or Singapore.

Conclusion

The journey toward a $5 Trillion Economy and Viksit Bharat 2047 depends not just on deregulation, but on better regulation. By marrying Competitive Federalism with Digital Governance, India can transform its “ease of doing business” into a sustainable “ease of living” for its entrepreneurs and citizens alike.

![]() 6 Feb 2026

6 Feb 2026

The New Income Tax Act, 2025: Effective from April 1, 2026, this landmark legislation simplifies tax language and reduces the number of sections. A new slab structure under the New Tax Regime (FY 2025-26) makes income up to ₹12 lakh (or ₹12.75 lakh for salaried) tax-free.

The New Income Tax Act, 2025: Effective from April 1, 2026, this landmark legislation simplifies tax language and reduces the number of sections. A new slab structure under the New Tax Regime (FY 2025-26) makes income up to ₹12 lakh (or ₹12.75 lakh for salaried) tax-free. SME Growth Fund: A ₹10,000 crore fund providing equity capital to help high-potential firms scale.

SME Growth Fund: A ₹10,000 crore fund providing equity capital to help high-potential firms scale.