The European Central Bank (ECB) is in the process of developing a digital euro. The “preparation phase” of this project began in November 2024.

Digital Euro

- Digital euro will allow people to pay directly from a digital wallet on smartphones or computers, eliminating the need for a bank or payment gateway.

- The Reserve Bank of India (RBI) is exploring collaborations with the US and the EU for the digital rupee’s development.

- India also plans to extend its partnership with the UAE for a cross-border pilot of Central Bank Digital Currency (CBDC).

Enroll now for UPSC Online Course

Key Features and Differences from Current Digital Payment Options

- Direct Issuance by ECB: Unlike other digital payment methods that rely on bank-managed systems, the digital euro would be directly issued and managed by the ECB, functioning as a digital equivalent of cash.

- Microtransactions and Cost-Effectiveness: The ECB envisions the digital euro as a cost-neutral option for processing microtransactions, which are currently costly with traditional banking fees.

- This could enable new digital business models and reduce reliance on intermediaries.

- Offline and Anonymous Transactions: The digital euro is designed to support offline payments, potentially offering a level of anonymity similar to physical cash.

- Depending on the end device, the money can be transferred via Bluetooth, a browser extension or a smartphone contact.

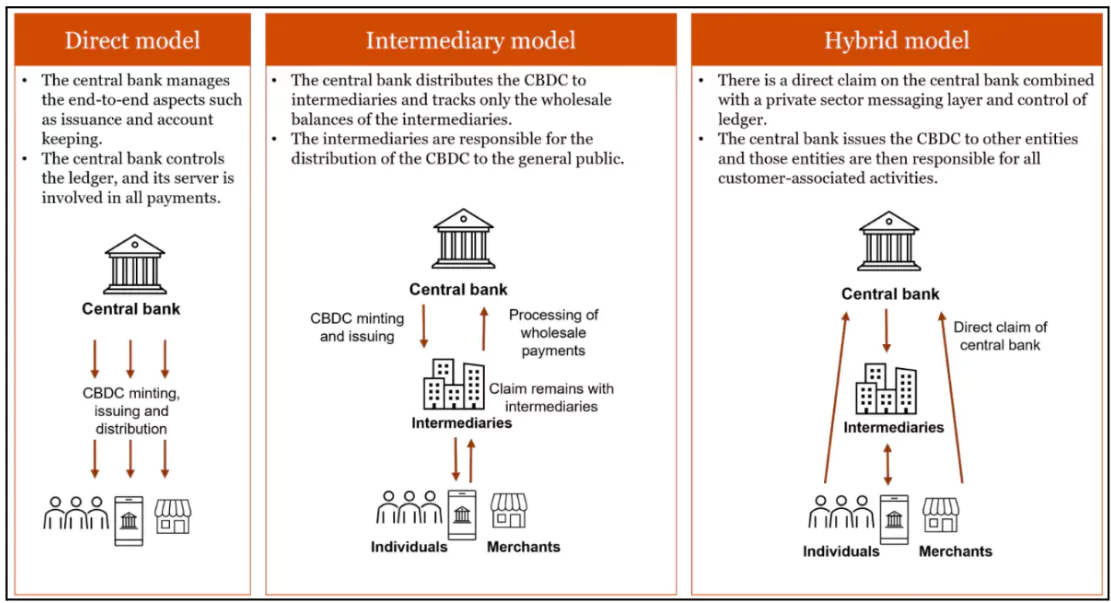

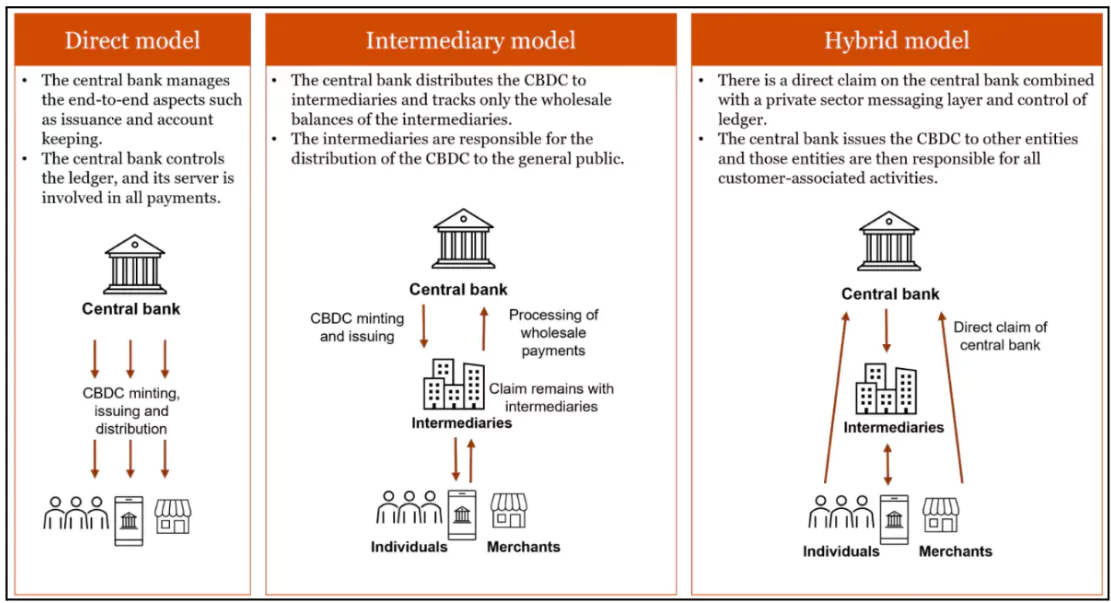

Models Of Issuance of Digital Currency

About Central Bank Digital Currency (CBDC or e-Rupee)

- It is a legal tender issued in digital form and was launched by RBI in 2022.

- Currency Type: It is equivalent to fiat currency and can be exchanged one-to-one with it.

- Fiat Currency is a national currency not tied to commodities like gold or silver.

- Holders have the freedom to convert Digital Rupee into physical cash through commercial banks

- Its issuance follows the central bank’s financial policies.

- Block chain-based: CBDCs are transacted using blockchain-backed wallets.

- Backed by Central Bank: Unlike private cryptocurrencies, CBDCs are stable and trustworthy as they are backed by the central bank.

- Programmable Money: CBDCs can have programmable features, such as smart contracts, enabling automated, self-executing financial agreements.It can be programmed to expire, incentivizing consumers to use it by a specific date.

- Categories: The RBI has classified the digital rupee into two categories:

- General Purpose (Retail): Accessible to the public for regular use.

- Wholesale: For specific functions and accessible to financial institutions.

Significance of Central Bank Digital Currency

- Direct Bilateral Exchange: Countries could directly exchange digital currencies bilaterally without needing SWIFT or other settlement systems.

- Cost Reduction: CBDC can lower currency management costs by enabling real-time payments without inter-bank settlement.

- Cash Replacement in India: Given India’s high currency-to-GDP ratio, CBDC can reduce reliance on cash, minimising costs associated with printing, transporting, and storing paper currency.

- Additional Benefits:

-

- Reduced cash dependency.

- Higher seigniorage due to lower transaction costs.

- Lower settlement risks for transactions.

Check Out UPSC CSE Books From PW Store

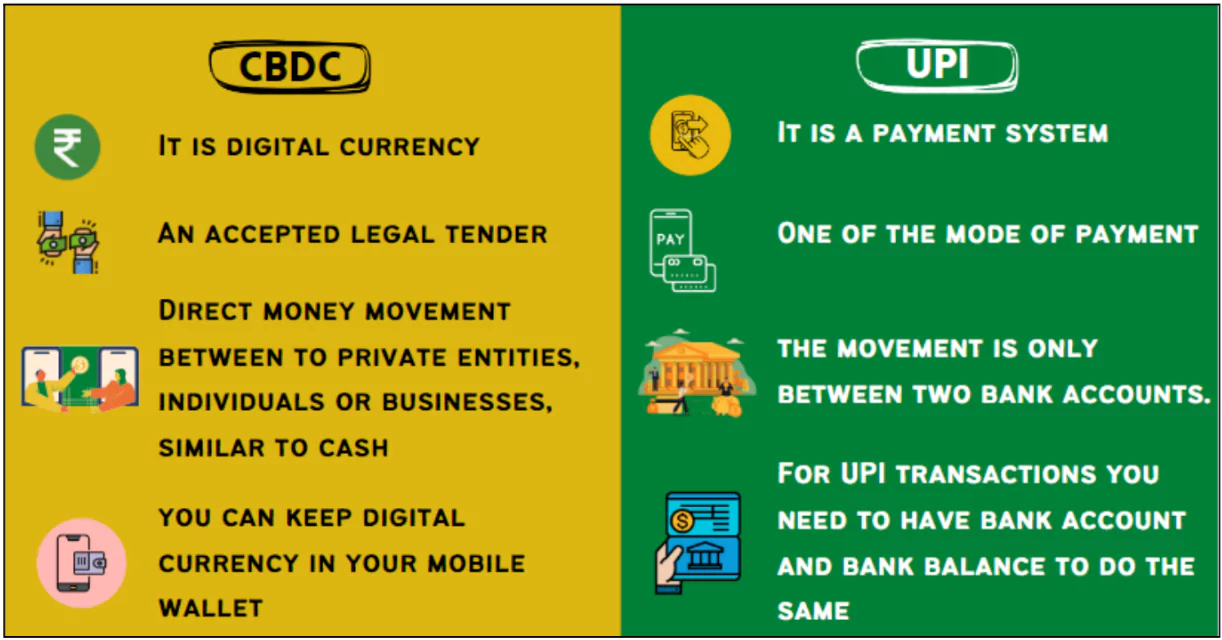

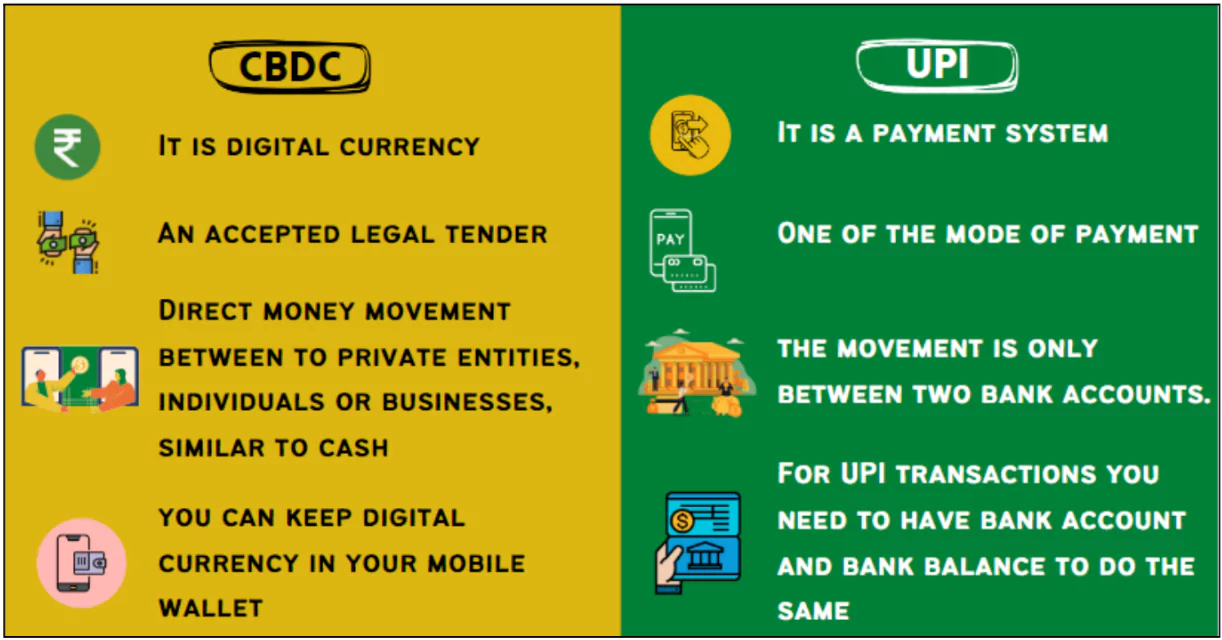

CBDC VS UPI

![]() 12 Nov 2024

12 Nov 2024