India’s energy sector is undergoing a profound transformation with a focus on self-reliance,

energy security, and climate leadership and is poised to play a pivotal role in achieving the goal of a USD 5 trillion economy by 2025.

About India’s Energy Sector Landscape

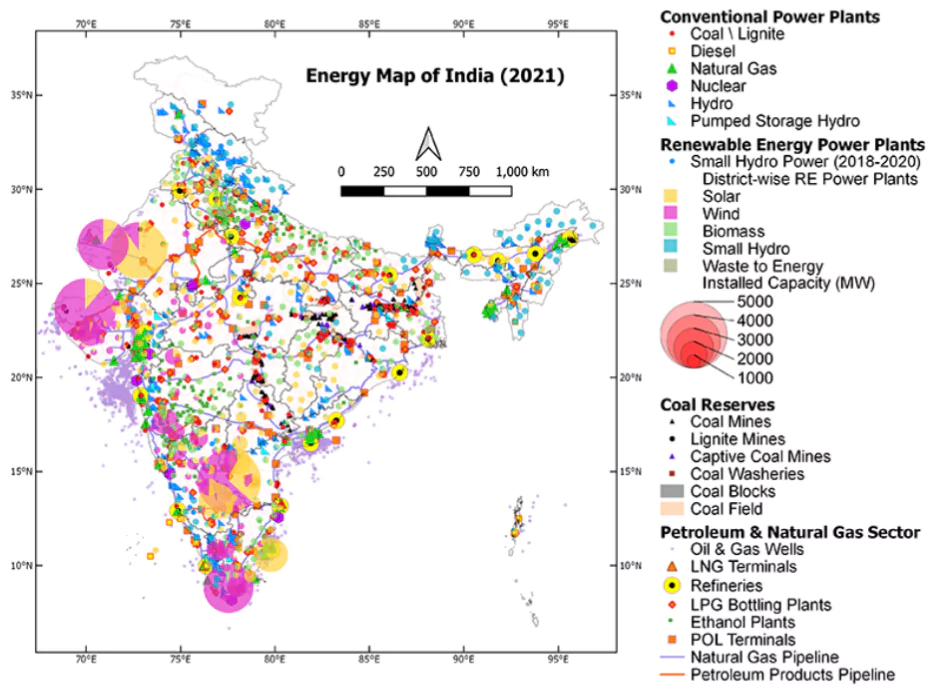

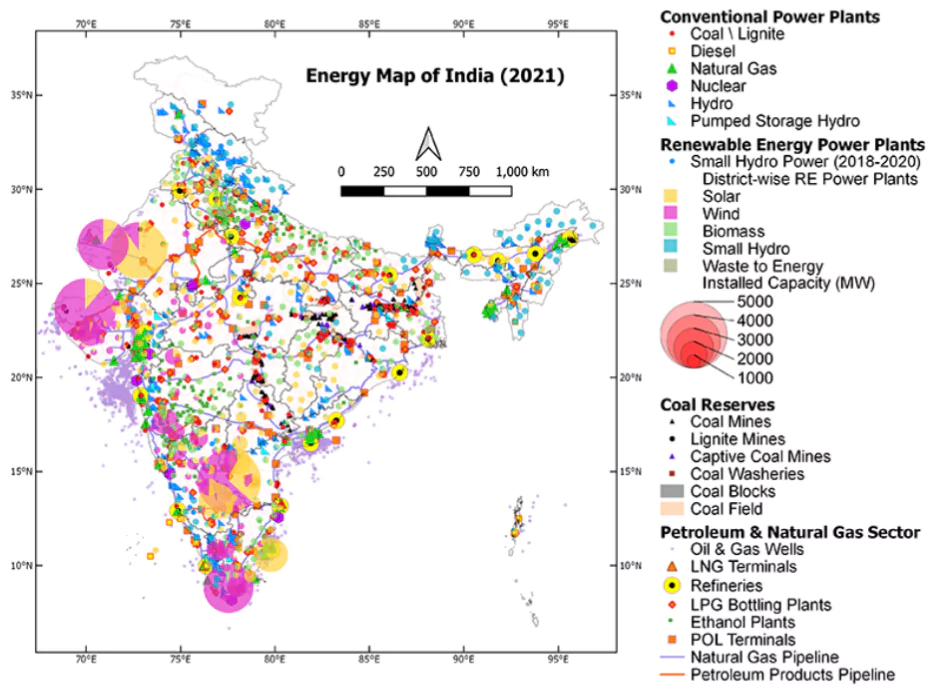

- Energy Mix: India’s energy landscape is shaped by its reliance on traditional fossil fuels sources (Coal, oil and natural gas ) and growing renewable sources like solar, nuclear and bio power.

- Energy Demand: India is projected to contribute approximately 25% of incremental global demand for energy, which is expected to grow two and a half times by 2047.

- India is the third-largest energy and oil consumer, fourth-largest refiner, and fourth-largest LNG importer globally.

- Energy Transition Targets: India has pledged to achieve net-zero emissions by 2070 and targeted a 500 GW of renewable energy capacity by 2030 amounting to 50% cumulative electric power installed capacity from non-fossil fuel-based energy in its NDC.

India’s Energy Strategy

India’s Energy Strategy addresses the energy trilemma of availability, affordability, and sustainability through a four-pronged approach,

- Diversification of Sources and Suppliers:

- Expanding Supplier Base: India increased the number of its crude oil suppliers from 27 countries in 2006-07 to 39 in 2021-22 with new additions like Columbia, Russia, Libya, Gabon, Equatorial Guinea etc.

- Expansion of Domestic Production:

India’s Exploration Acreage: The government aims to unlock 42 billion tonnes of oil and oil-equivalent gas exploration with a goal of covering one million square kilometres by 2030.

India’s Exploration Acreage: The government aims to unlock 42 billion tonnes of oil and oil-equivalent gas exploration with a goal of covering one million square kilometres by 2030.

- India’s exploration acreage has doubled to 16% in 2025.

- Discovery of Oil and Gas Reserves: 25 hydrocarbon discoveries have been made across the Mumbai Offshore, Cambay, Mahanadi, and Assam basins by ONGC

- Transition to Renewables:

- Alternative Fuels: Encouraging the use of ethanol blend, CBG, biodiesel, and bioenergy through initiatives like SATAT and the National Bioenergy Programme.

- Example: The Sustainable Alternative Towards Affordable Transportation (SATAT) Initiative has commissioned over 100 compressed biogas (CBG) plants and aims for a 5% CBG blending mandate by 2028.

- Renewable Energy: Expanding non-fossil capacity with initiatives like PM-KUSUM (solar energy), Green Hydrogen Mission and offshore wind projects

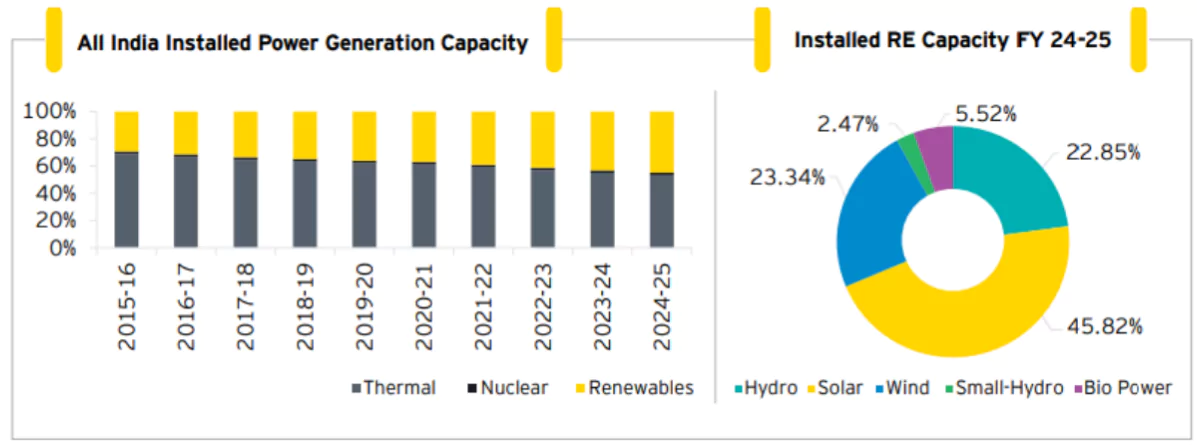

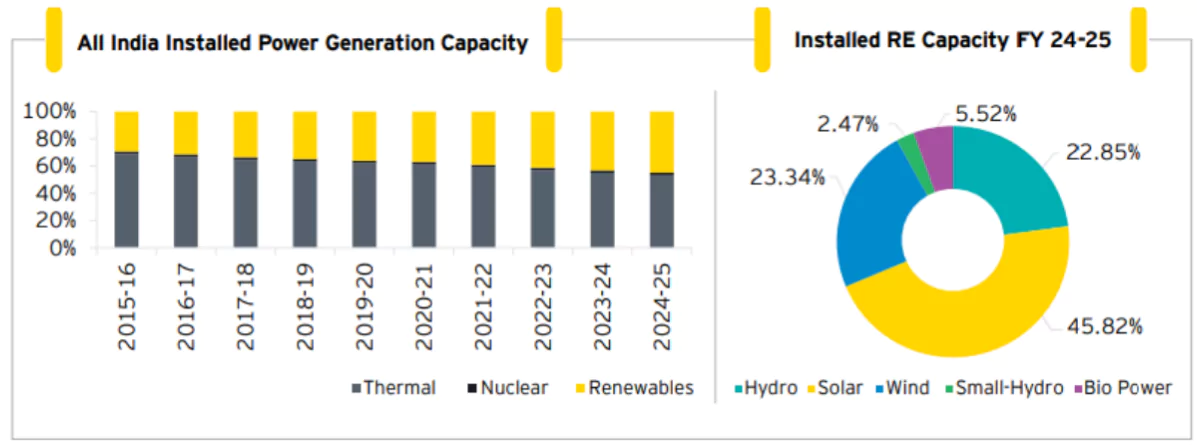

- Example: India’s non-fossil fuel-based generation capacity has significantly increased to 45% of total installed capacity in 2024 from 29% in 2015

- Affordability:

- India is diversifying its sources of imports and making changes in its gas-pricing mechanism along with domestic taxation benefits leading to reduced prices of petrol and diesel in India while the global prices were surging.

- Example: The Pradhan Mantri Ujjwala Yojana (PMUY) beneficiaries pay ₹553 per cylinder, supported by targeted subsidies and compensation to oil companies despite global LPG prices rising by 58%.

Policy Reforms

- Oilfields (Regulation and Development) Amendment Act 2024: It has enabled hybrid leases, allowing renewables alongside hydrocarbons.

- Revised Gas Pricing Mechanism: Linking prices to 10% of the Indian crude basket and offering a 20% premium for new wells has enhanced gas availability for city gas networks and industrial usage.

- Reduction of ‘No-Go’ areas by 99%: 1 million square kilometers of sedimentary basin has been opened up for exploration in India’s Exclusive Economic Zone paving the way for the potential discovery of 42 billion tonnes of oil and oil-equivalent gas.

- Open Acreage Licensing Policy (OALP): It allows OMC to identify and choose specific blocks for hydrocarbon exploration and production based on data available in the National Data Repository (NDR).

|

Opportunities in The Energy Sector

- Infrastructure Modernization: India is taking significant steps to modernize and upgrade its grid infrastructure, including smart grids and smart metering.

- Example: Over 51.62 lakh smart metres have been deployed under the National Smart Grid Mission (NSGM), with a further 61.13 lakh to be deployed as of 2022.

- Energy Storage Capacity: India is actively advancing its energy storage infrastructure by focusing on both standalone and integrated renewable energy storage systems (RE+ESS) incorporating technologies like peak power, renewable energy integration and firm and dispatchable renewable energy (FDRE)

- Green Hydrogen: India is prioritizing green hydrogen production and usage with a mission dedicated to it (The National Green Hydrogen Mission) creating opportunities in research, development, and deployment of green hydrogen technologies.

- Example: Green hydrogen has been given a massive thrust with 8.62 lakh tonnes of production and 3,000 MW of electrolyser tenders awarded.

- Expansion of Gas Network: India’s city gas network with unified pipeline tariffs has grown to 307 geographic areas in 2025, with piped natural gas (PNG) connections up from 25 lakh to 1.5 crore and over 7,500 compressed natural gas (CNG) stations in operation

- Renewable Energy: India is a global leader in renewable energy capacity growth, with a strong focus on solar power assisted by enabling policy interventions.

- Example: The Pradhan Mantri Surya Ghar Muft Bijli Yojana aims to provide rooftop solar installations to 1 crore households, offering 300 units of free electricity monthly.

National Electricity Plan (2022-32)

- The Plan includes the review of the last five years (2017-22), a detailed plan for the 2022-27 period and the prospective plan for the period of 2027-32.

- Prepared by: The National Electricity Plan (2022-32) has been prepared by the Central Electricity Authority as per section 3(4) of the Electricity Act, 2003.

- The National Electricity Plan (NEP) has to be in accordance with the National Electricity Policy and should be notified once in five years.

- Projected Electricity Demand: The projected All India peak electricity demand and electrical energy requirement is 366.4 GW and 2473.8 BU for the year 2031-32 as per 20th Electric Power Survey (EPS) Demand projections

- Objective: Optimum utilization of resources in the country and to provide reliable, affordable, un-interruptible (24×7) and Quality Power for All.

- Components: The plan focuses on the following components:

- Installed Capacity: The estimated electricity installed capacity by the year 2031-32 will increase to be 900,422 MW comprising of,

- Conventional capacity of 304,147 MW (Coal-259,643 MW, Gas–24,824MW, Nuclear-19,680MW)

- Renewable based Capacity of 596,275MW (Large Hydro-62,178 MW, Solar-364,566MW, Wind-121,895MW, Small Hydro-5450MW, Biomass-15,500 MW, PSP-26,686MW

- Transmission Infrastructure: To add over 191,000 circuit kilometers of transmission lines and 1,270 GVA of transformation capacity in the period between 2022-2032, with a focus on high-voltage systems (220 kV and above).

- Energy Storage Capacity: The energy storage capacity from the pumped storage plants (PSP) and battery energy storage systems (BESS) will increase by 73.93 GW (26.69 GW PSP and 47.24 GW BESS) by the year 2031-32.

|

Challenges in the Indian Energy Sector

- Fossil Fuels Dependence: India’s energy sector is majorly coal driven with coal dominating India’s electricity generation, accounting for about 70% of total generation posing environmental concerns and contradicting global decarbonization efforts.

- Imports Dependence: India’s energy sector is hugely dependent on fossil fuel imports leading to price volatility and energy insecurity in times of international crisis.

- Example: India import dependence on oil exceeds 87% in 2023-24, meaning domestic production meets less than 13% of the total demand.

- Renewable Energy Challenge: The generation of renewable energy faces three primary challenges ie.

- Inherent Variability: The energy from solar and wind sources fluctuates in real-time

- Uncertainty: Renewable energy sources defies precise forecasting

- Concentration: Renewable energy sources are not available throughout the year as its concentration is limited to specific periods throughout the year.

- Inadequate Transmission & Distribution Infrastructure: India’s aggregate technical and commercial losses average about 32% of electricity as compared to (6-11%) in developed countries .

- Infrastructure and Grid Integration Issues: India currently lacks a transition fuel, which is typically natural gas to maintain grid reliability, which can struggle in the face of a massive increase in the source of renewable energy.

- Investment and Policy Uncertainties: The renewable sector faces hurdles like weak demand for tenders, delays in power purchase agreements, and project cancellations, indicating the need for more robust policy frameworks and investor confidence .

Key Regulatory Bodies in Energy Sector in India

- Bureau of Energy Efficiency (BEE): The organisation promotes energy efficiency and conservation by developing standards and labeling (e.g., for appliances), Implements PAT (Perform, Achieve, Trade) scheme for industries and by supporting state-level energy conservation programs.

- Petroleum and Natural Gas Regulatory Board (PNGRB): It regulates downstream oil and gas infrastructure and markets and ensures fair pricing and competition.

- It also monitors compliance and safety in pipelines and terminals.

- Central Electricity Authority (CEA): It is a Statutory Body under the Electricity Act, 2003 and is an “Attached Office” of the Ministry of Power.

- The CEA is responsible for the technical coordination and supervision of programmes and formulating the national electricity policy for development of the electricity system.

- Central Electricity Regulatory Commission (CERC): It regulates inter-state electricity matters, focusing on generation, transmission, trading, and distribution.

- CERC fixes tariffs for central generating stations.

|

Way Forward

- Policy and regulatory consistency will encourage investors, markets, and other stakeholders to participate and support the energy transition.

- Continuation of the existing regulatory side initiatives like real-time markets (to help balance supply-power demand across India’s grids); the General Network Access (for improved transmission connectivity to solar and wind); and the PLI scheme for solar PV module manufacturing,

- Incentives: To offer financial incentives, subsidies, and tax breaks to encourage renewable energy adoption, including rooftop solar and solarization of agricultural pumps.

- Invest in digitalization: Introducing advanced software solutions can optimize grid-level operations by creation of demand response programmes

- Example: It can prod industries to shift their loads to times during the day when more energy is available on the grid, reducing peak demand.

- To emphasize R&D to accelerate adoption of renewable energy technologies alongside introducing new commercial frameworks including bids for Pumped Hydro, Battery and other forms of Energy-Storage Systems.

Conclusion

India’s energy sector, through policy reforms and initiatives in the last decade is marked by increasing confidence, self-reliance and strategic foresight. Energy is being seen not just as a commodity but a catalyst for sovereignty, security and sustainable development.

![]() 7 Jun 2025

7 Jun 2025

India’s Exploration Acreage: The government aims to unlock 42 billion tonnes of oil and oil-equivalent gas exploration with a goal of covering one million square kilometres by 2030.

India’s Exploration Acreage: The government aims to unlock 42 billion tonnes of oil and oil-equivalent gas exploration with a goal of covering one million square kilometres by 2030.