Context:

- Recently ‘FATF’ released a report titled, ‘Crowdfunding for Terrorism Financing’, stating that ’Violent extremist organizations’ in India collected funds through well-structured networks.

FATF Report – India

- India’s onsite assessment by the Financial Action Task Force (FATF) is slated for November, while the assessment is likely to come up for discussion in the plenary discussion in June 2024.

- Due to the COVID-19 pandemic and the pause in the FATF’s assessment process, the mutual evaluation of India, which was last carried out in 2010, had been postponed to 2023.

What are the key findings of the FATF report?

According to the report’s findings, over 3,000 bank accounts and informal value transfer systems were used by the Popular Front of India (PFI).

- The group’s fundraising tactics included resorting to solicitation at mosques and public places, offline and online mechanisms, such as circulating QR codes and account details.

- Funds were used to procure arms and ammunition and for training the cadres of the violent extremist organisation, among other purposes.

- A portion of the funds was also invested and parked in businesses and real estate projects to generate regular income for terrorism activities.

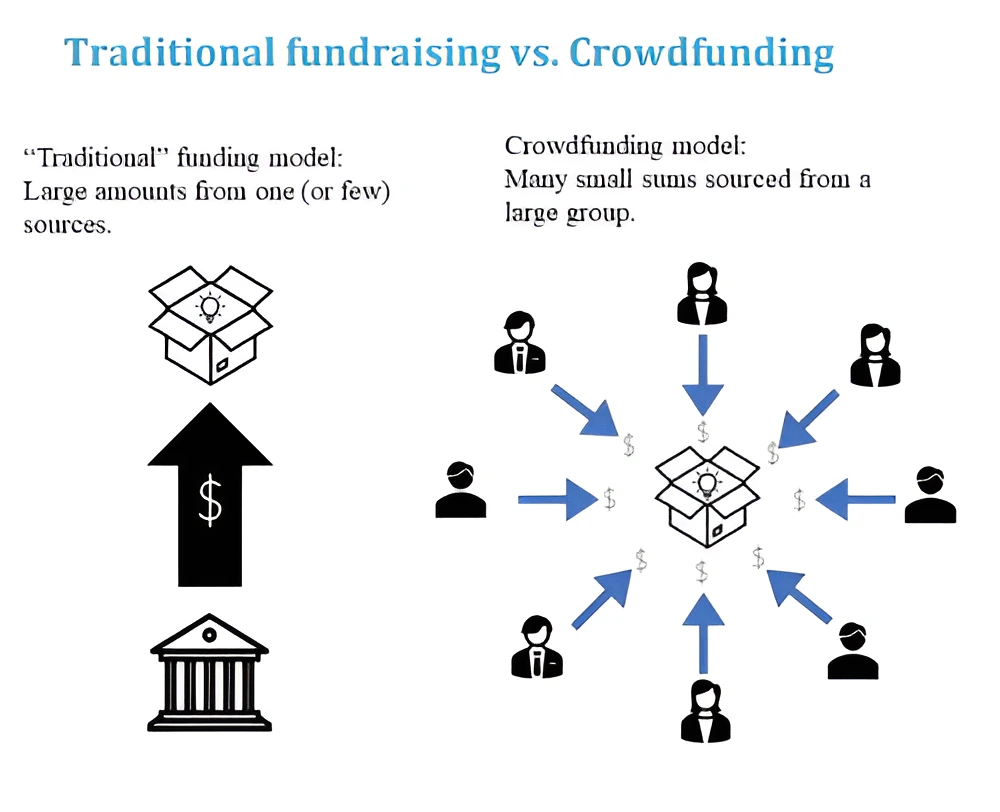

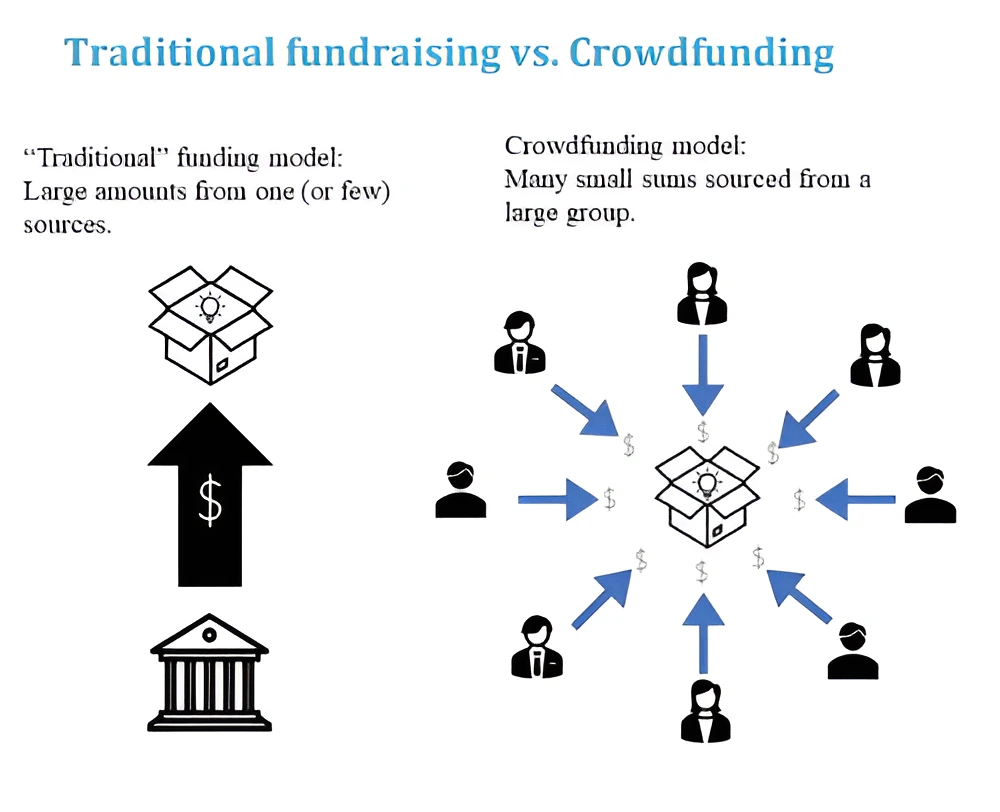

Crowdfunding for Terror Financing

“The possibility of quickly and easily reaching a global audience can make crowdfunding an attractive method of fundraising for Terror Financing”.

- The FATF report notes four main ways in which crowdfunding platforms can be abused for terrorist financing purposes:

- Abuse Of Humanitarian, Charitable, Or Non-Profit Causes.

- Use Of Dedicated Crowdfunding Platforms Or Websites.

- Use Of Social Media Platforms And Messaging Apps.

- Interaction Of Crowd-funding With Virtual Assets (Cryptocurrency).

- For Example: The Islamic State of Iraq and the Levant (ISIL), Al-Qaeda, and ethnically or racially motivated terrorist (EoRMT) individuals and groups have exploited it to raise money for terrorist financing purposes.

- In 2022, there were over 6 million crowd-funding campaigns around the world, some estimates have valued the global crowdfunding market at $17.2 billion in 2020 and it is expected to reach $34.6 billion by 2026.

About Financial Action Task Force:

- FATF is an inter-governmental body established in 1989 during the G7 Summit in Paris.

- The FATF leads global action to tackle money laundering, terrorist, and proliferation financing.

- India became the 34th country member of FATF in 2010.

- The 39-member body sets international standards to ensure national authorities can effectively go after illicit funds linked to drug trafficking, the illicit arms trade, cyber fraud, and other serious crimes.

- The FATF researches how money is laundered and terrorism is funded, promotes global standards to mitigate the risks, and assesses whether countries are taking effective action.

- If a country repeatedly fails to implement FATF Standards then it can be named a Jurisdiction under Increased Monitoring or a High Risk Jurisdiction. These are often externally referred to as “the grey and black lists”.

|

About Popular Front of India(PFI):

- The PFI emerged in 2007 in the aftermath of the ban on the Students Islamic Movement of India (SIMI), and has projected itself as an organization that fights for the rights of minorities, Dalits, and marginalized communities.

- The Ministry of Home Affairs had declared the PFI along with its “associates or affiliates or fronts as an “unlawful association” under the provisions of the Unlawful Activities (Prevention) Act, 1967.

|

Challenges

- The Anti-money laundering and counter-terrorist financing (AML/CFT) regulation is not consistent across the globe.

- Failure to systematically assess the risks related to crowdfunding activity by countries.

- Lack of comprehensive data about its misuse.

Recommendation of FATF Report

- Countries should assess the nature, size, and risks associated with all types and methods of crowdfunding in their particular jurisdiction.

- The countries should also take note of the risk analysis of the sector more globally given the cross-border nature of crowdfunding campaigns and associated financial transfers.

- The countries should recognize that even if their jurisdiction does not have significant terrorism activity domestically, their jurisdiction can still be used as a pass-through for financial flows.

Source: Indian Express

![]() 4 Nov 2023

4 Nov 2023