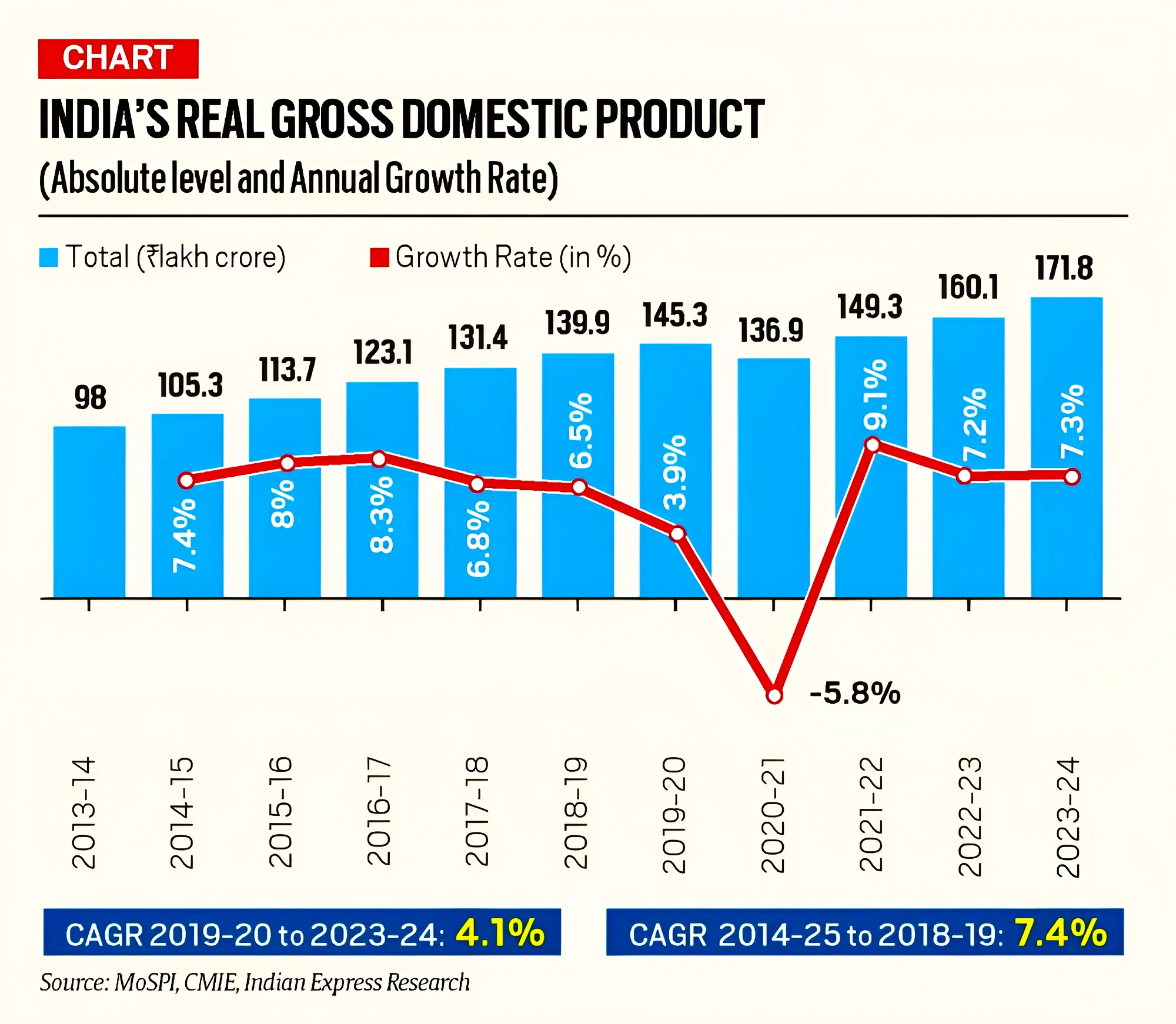

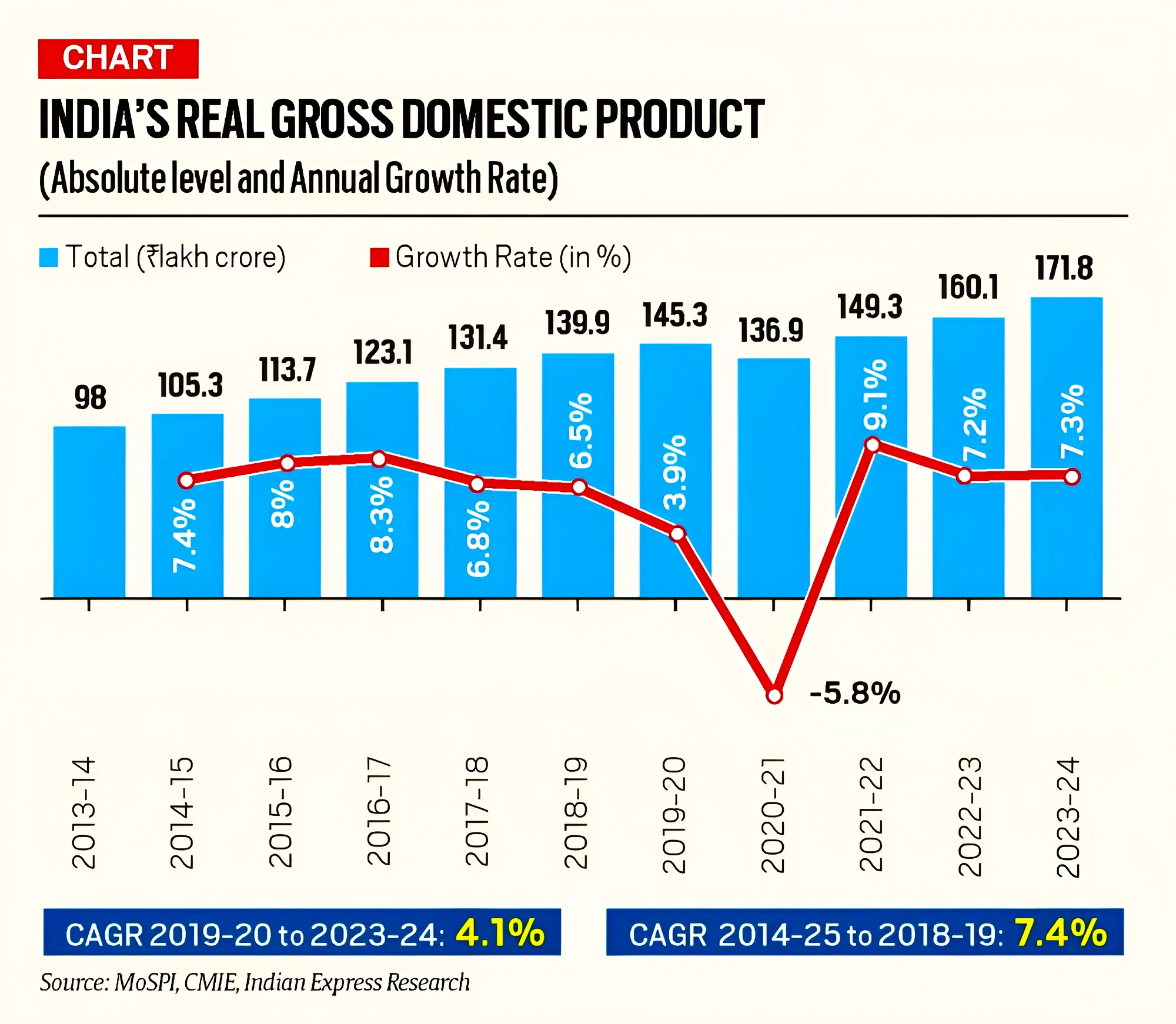

Context: The First Advance Estimates (FAEs) released by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoS&PI) showed that India’s GDP will grow by 7.3% in the current financial year (2023-24).

What is First Advance Estimates (FAEs)?

- Definition: The First Advance Estimates (FAEs) are estimates of GDP based on the performance of the economy over the first seven months, and are presented at the end of the first week of January every year.

- They are the “advance” estimates because they are published long before the financial year (April to March) is over.

- Methodology: They are compiled using the benchmark-indicator method, i.e. the estimates available for the previous year (2022-23) are extrapolated using the relevant indicators of various sectors.

- Indicators like Index of Industrial Production (IIP), Financial performance of Listed Companies and Crop production targets are used.

- Significance: Advance estimates help the government decide on budget allocation and give policymakers more information on the expected trajectory of the economy in the upcoming year.

About India’s GDP Estimate

- By the end of March 2024, India’s GDP is expected to rise to almost Rs 172 lakh crore (Constant Prices 2011-12).

- India’s GDP was Rs 98 lakh crore in 2014, and it reached almost Rs 140 lakh crore in 2019.

Other Estimates for India’s GDP

- Gross Value Added (GVA) in the economy may ease slightly from 7% in 2022-23 to 6.9% this year.

- The fiscal deficit may breach the year’s 5.9% of GDP target to hit around 6%.

- GVA growth for the farm sector is estimated to more than halve from 4% a year ago to 1.8% this year

- GVA in Trade, Hotels, Transport, and Communication is estimated to moderate to 6.3% from 14% in 2022-23.

- GVA provides a rupee value for the amount of goods and services that have been produced in a country, minus the cost of all inputs and raw materials that are directly attributable to that production.

|

- Manufacturing GVA growth is estimated to accelerate to 6.5% in 2023-24 from just 1.3% a year earlier.

- Mining GVA is expected to rise 8.1%, from 4.6% in 2022-23.

- Growth: A 7.3% real growth rate has been estimated for 2023-24.

- Reasons for Growth: The growth has been fuelled by increased state capital spending and an expansion in manufacturing activities.

- S&P Global Ratings anticipates India to retain its position as the fastest-growing major economy over the next three years, is projected to become the world’s third-largest economy by 2030.

- GDP Estimation Using Expenditure Method:

Expenditure Method

- The expenditure method is a system for calculating gross domestic product (GDP) that combines consumption, investment, government spending, and net exports.

- It is the most common way to estimate GDP.

|

-

- Private Final Consumption Expenditure (PFCE) accounts for almost 60% of India’s GDP.

- Gross Fixed Capital Formation (GFCF) is the second-largest factor that typically accounts for 30% of the GDP.

- Government Final Consumption Expenditure (GFCE) is the smallest contributor, accounting for around 10% of GDP.

- Net exports or net spending (a result of Indians’ spending on imports and foreigners’ spending on Indian exports) is negative since India typically imports more than it exports.

India’s GDP Growth: Challenges

- Weak External Demand: India’s exports to GDP ratio has been declining since 2013-14. The ratio was 25% in 2011-12 and declined to 18% by 2019-20.

- Low Capital Investment: India’s investment fell from 39.8% of GDP in 2010 to approx 29.3% in 2021 due to lack of confidence and demand in the economy. However this is improving now.

- Poor Performance of the Manufacturing Sector: Manufacturing sector contributes to value addition, exports, and employment. However, challenges like Demonetisation, GST and global supply chain problems.

Must Read: India To Be A $ 7 Trillion Economy By 2030: CEA

Way Forward

- A Large and Young Population: With the growing population in the country, the huge demographic dividend provides an opportunity for high growth rate through investment in skill and education.

- Maintaining Macroeconomic Stability and Resilience: These macroeconomic factors like inflation are important determinants of growth and investment. Maintaining stable macroeconomic conditions is essential for sustaining economic growth.

News Source: Indian Express

![]() 8 Jan 2024

8 Jan 2024