Urban India generates nearly two-thirds of the national GDP, yet its municipalities control less than one per cent of the country’s tax revenue showing a stark imbalance that cripples local governance and service delivery.

About Municipal Corporations (MCs) & Other Urban Local Bodies (ULBs)

- Constitutional Basis: Established under the 74th Constitutional Amendment Act, 1992 (Articles 243Q to 243ZG) to promote democratic decentralisation in urban governance.

- Three-Tier Classification:

- Nagar Panchayats: It must be constituted for a “transitional area” under Article 243Q (1)(a).

- Municipal Councils/Municipalities: It must be constituted for smaller urban areas (Article 243Q (1)(b)).

- Municipal Corporations (MCs): For large urban areas (Article 243Q (1)(c)).

- Governance Structure:

- Municipal Corporations (MCs): Led by an elected Mayor and administered by a Municipal Commissioner.

- Municipalities/Nagar Panchayats: Headed by a Chairperson or President.

- Functional Mandate: Responsible for 18 functions under the 12th Schedule, including urban planning, water supply, waste management, public health, roads, and street lighting.

- Mandated to prepare annual budgets, urban development plans, and local taxation proposals.

- Scale and Distribution: India has about 4,979 ULBs, comprising ~253 Municipal Corporations, ~2,187 Municipal Councils, and ~2,107 Nagar Panchayats.

- Metropolitan Areas: Defined under Article 243P(c); require Metropolitan Planning Committees (MPCs) to coordinate planning among multiple ULBs (e.g., Mumbai, Hyderabad, Delhi NCR).

- “Metropolitan area”: An area with a population of 10 lakh or more, comprised of one or more districts and consisting of two or more Municipalities or Panchayats or other contiguous areas, specified by the Governor.

Constitutional Provisions

- Article 243X: Authorises State Legislatures to empower municipalities to levy, collect, and appropriate taxes, duties, tolls, and fees.

- Article 243Y: Mandates the State Finance Commission (SFC) to recommend measures for distributing State revenues between the State and municipalities and to review their financial position.

- Article 280(3)(c): Empowers the Central Finance Commission (CFC) to recommend measures to augment State Consolidated Funds for municipal finances based on SFC recommendations.

|

Revenue Sources Of Urban Local Bodies

| Own sources |

- Tax Revenue: Property tax, Advertisement tax, Water benefit tax, Electricity tax, Education tax, and Other local taxes etc.

- Non-Tax Revenue: User charges, License fees, Developmental charges etc.

|

| Assigned (Shared) Revenue |

- Entertainment tax (subsumed under GST, except when levied by the local bodies), Professional tax etc.

|

| Grants-in-aid |

- Central and State Finance Commission (SFC) devolution, Grants under programmes like Swachh Bharat Mission (SBM) & Atal Mission for Rejuvenation and Urban Transformation (AMRUT).

|

| Borrowings |

- Loans from state and central governments, banks etc.

|

Benefits of Robust Urban Local Bodies (ULBs) in India

- Efficient Urban Service Delivery: Well-funded Urban Local Bodies (ULBs) can maintain critical services like solid waste management, water, roads, and housing without service breakdowns.

- Example: Indore’s consistent top rank in Swachh Survekshan is attributed to stable municipal funding and user-fee recovery.

- Economic Competitiveness & Investment Attraction: Cities with fiscal autonomy can invest in logistics, transit, and digital infrastructure, reducing business costs and boosting GDP.

- Climate Resilience & Sustainability: Stable fiscal health enables investment in flood control, green mobility, and waste-to-energy projects.

- Example: Kochi’s climate-resilient urban project was co-financed through local revenues and AMRUT grants.

- Citizen Accountability & Trust: Fiscal visibility strengthens democratic accountability; citizens are more likely to pay taxes when they see direct benefits.

- Example: Pimpri Chinchwad Municipal Corporation (PCMC) has announced that it will continue its participatory budget initiative for 2026–27 fiscal following its successful implementation in 2025–26 budget.

Reform Initiatives and Policy Framework

- 74th Constitutional Amendment Act (1992): Empowered municipalities as the third tier of governance

- It has devolved 18 functions (12th Schedule) including urban planning, water supply, and waste management.

- It also mandated State Finance Commissions (SFCs) every five years to recommend fiscal devolution between States and Urban Local Bodies (ULBs).

- AMRUT 2.0 (2021–26): With an outlay of ₹2.99 lakh crore, it focuses on universal water supply, sewerage coverage, and urban resilience, strengthening fiscal and service delivery capacity at the city level.

- Municipal Bonds: It is a debt instrument issued by municipal corporations or associated bodies in India.

- Purpose: The funds raised are used to finance socio-economic development projects

- Promoted as an alternative urban financing mechanism, enabling cities to access market capital

- Credit Rating of ULBs: Urban Local Bodies have obtained credit ratings to access debt markets under AMRUT and Smart Cities programmes. (Source: MoHUA Dashboard, 2024)

- Making Panchayats Financially Atmanirbhar:

- OSR Training: Ministry of Panchayati Raj, in collaboration with the Indian Institute of Management Ahmadabad (IIM-A), is developing a training module on Own Source Revenue (OSR) to empower Gram Panchayats (GPs) towards becoming ‘Atma NirbharPanchayats’ (self-reliant and sustainable)

- The initiative aims to help GPs achieve localized Sustainable Development Goals (SDGs) without depending on external support.

- National Institute of Public Finance and Policy (NIPFP) Financial Models: Frameworks for replicable OSR strategies to enhance grassroots fiscal autonomy.

- Samarth Portal: Digital dashboard for real-time OSR collection and monitoring, piloted in Chhattisgarh and Himachal Pradesh.

- Model OSR Rules: Standardised rulebook enabling States to empower Panchayati Raj Institutions (PRIs) to mobilise their own revenue.

|

Challenges of the Fiscal Architecture of Urban Local Bodies (ULBs)

- Low Revenue Generation: Indian municipalities generate only 0.6% of GDP in 2023-24, much lower than the central government’s 9.2% and state governments’ 14.6%, limiting urban development funds.

- Poor property tax revenues, which account for only 0.12% of GDP

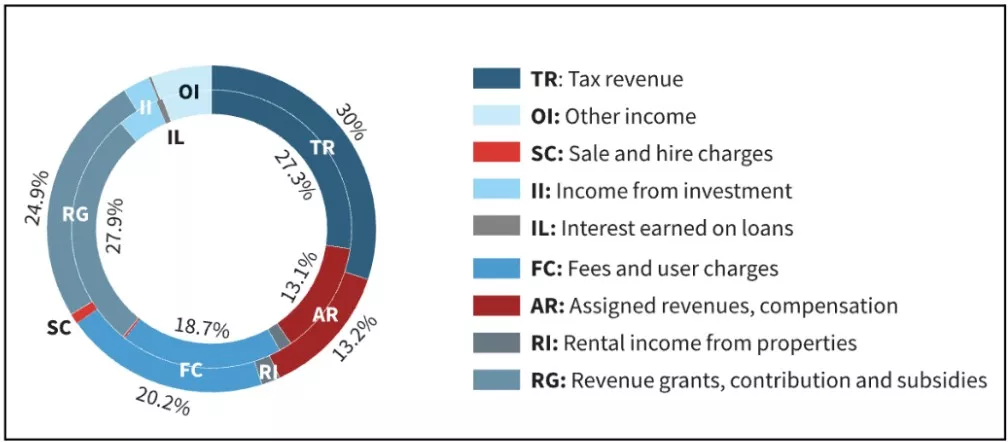

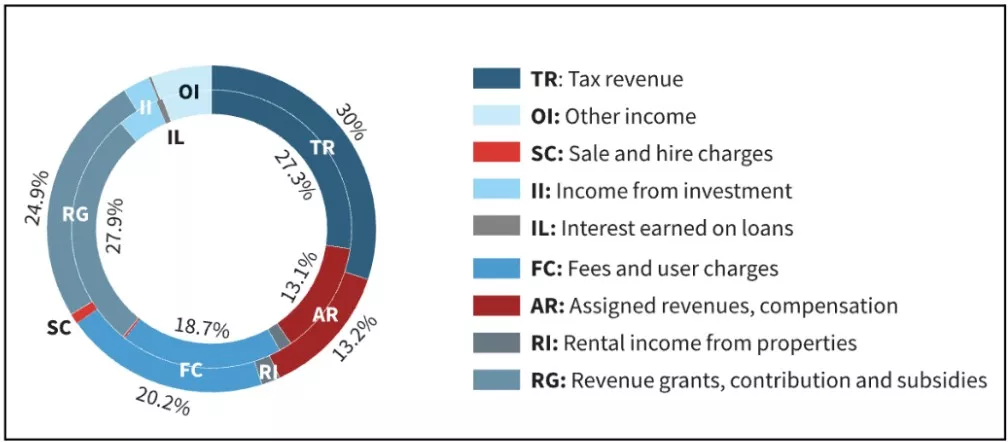

Revenue sources of municipal corporations: In FY17, 43% of municipal corporations’ revenue receipts came from their own tax revenue compared to only 30% in FY24.

Revenue sources of municipal corporations: In FY17, 43% of municipal corporations’ revenue receipts came from their own tax revenue compared to only 30% in FY24.-

- In FY24, own tax revenue was highest in: Karnataka (53.8%), followed by Telangana (50.3%), Tamil Nadu (44.3%), and Jharkhand (44.0%).

- Revenue–Responsibility Mismatch: Cities perform ~18 statutory functions but control <1% of taxes.

- Municipal corporations depend on state and central transfers for the majority of their annual budgets, creating fiscal dependency.

- Bengaluru’s municipal body faces an estimated ₹3,000 crore annual fiscal gap between its assigned responsibilities and available revenue.

- Weak Implementation: The 74th Constitutional Amendment (1992) envisaged empowered Urban Local Bodies (ULBs) for 18 functions under the 12th Schedule, but fiscal devolution remains partial and inconsistent across States.

- Octroi: A local tax levied by municipalities on goods entering their jurisdiction for consumption or sale

- Entry Tax: A levy imposed by States or ULBs on goods brought into a local area from outside the state

- Local Surcharges: Additional taxes or cesses imposed by municipalities on existing state or central taxes (like property or entertainment tax) to augment local revenues

|

- Post-GST Erosion of Local Tax Base: The introduction of GST subsumed Octroi, Entry Tax, and local surcharges, eliminating nearly 19% of pre-GST municipal revenues.

- Mumbai’s tax revenues are declining post-octroi abolition, with property tax collections down.

- Weak Fiscal Autonomy: The devolution of financial powers to ULBs has been inadequate.

- Urban bodies cannot revise property or professional taxes without state approval, restricting dynamic revenue mobilisation.

- No structured mechanism exists for direct municipal GST compensation, despite recommendations by the Fifteenth Finance Commission.

- The 74th Constitutional Amendment remains weakly implemented in terms of financial devolution.

- Irregular State Finance Commissions (SFCs): Only 10–12 States have established State Finance Commissions regularly, leading to uneven fiscal decentralisation.

- Tied and Unpredictable Grants: Over 70% of Smart Cities Mission funds are centrally monitored, leaving little local discretion.

- Low Fiscal Transparency: Only 11 of the 35 States/Union Territories have enacted the Public Disclosure Law that mandates publishing of key civic data.

- Only 28% of them disseminate their annual audited financial statements. The number goes down further to 17% if only the mega cities are considered.

- For Example: A massive accountability crisis has exploded in Gujarat as eight major Municipal Corporations have not been audited for several years, leaving a budget worth over Rs 2 lakh crore unaudited and unverified.

Case Study: Scandinavian Fiscal Model vs. India

| Aspect |

Scandinavian Countries (Denmark, Sweden, Norway) |

India (Current Scenario) |

| Local Tax Powers |

Municipalities can levy and collect local income tax (ranging 20–30% of individual income). |

No direct power to levy income tax; rely on property tax and limited user charges. |

| Share in National Taxes |

Defined and formula-based transfers from national to local governments; automatic and predictable. |

Dependent on State and Central grants; transfers are often tied and discretionary. |

| Fiscal Autonomy |

High autonomy: Cities decide rates, budgets, and priorities independently. |

Fiscal decisions require State approval; limited authority on tax revision. |

| Revenue Predictability |

Stable and buoyant revenues through income taxes and shared taxes ensure long-term planning. |

Revenues fluctuate with scheme-based grants; no assured flow of untied funds. |

| Citizen Accountability |

Residents directly see how local income taxes are used, fostering trust and participation. |

Weak link between taxes and service delivery; citizens view ULBs as dependent on higher tiers. |

| Governance Outcomes |

Transparent budgets, strong local services, and equitable welfare distribution. |

Chronic underfunding, service deficits, and weak financial accountability. |

Reform Roadmap: Strengthening Municipal Fiscal Architecture

- Constitutional & Institutional Reforms

- Enforce Time-Bound State Finance Commissions (SFCs): States must comply with five-year constitutional cycles; a digital SFC dashboard can track devolution.

- Direct Fiscal Transfers to ULBs: The 16th Finance Commission should earmark formula-based, untied grants for municipalities

- Municipal Fiscal Responsibility Laws (MFRL): Introduce FRBM-style fiscal rules with deficit limits, disclosure norms, and debt ceilings to ensure sustainability.

- Strengthening Own Revenues

- Property Tax Modernisation: Implement GIS-based mapping, digital valuation, and automated billing.

- Diversify Local Taxes & Fees: Empower ULBs to levy congestion fees, advertisement tax, and tourism cesses.

- Rationalising Grants & Transfers

- Formula-Based, Untied Transfers: Establish a transparent Municipal Finance Authority to allocate performance-linked untied grants.

- Performance-Linked Incentives: Reward cities with better audits, higher OSR, and transparency.

- Capital Finance & Market Reforms

-

- Expand Pooled Finance Development Fund (PFDF): Enable smaller ULBs to jointly raise capital with credit enhancement.

- Recognise Transfers as Collateral: Permit ULBs to securitise a share of GST compensation or State transfers.

- Scale Up Green & SDG Municipal Bonds: Vadodara’s ₹100 crore green municipal bond (2024) funded wastewater treatment and became Asia’s first certified issue.

Are Municipal Bonds the Only Solution?

Benefits

- Municipal bonds (and green bonds) offer a tool for capital raising, particularly for long-term infrastructure.

- They can help decouple capital expenditure from annual tax revenue cycles, allowing more robust planning.

- Credible municipal bonds can attract institutional investors, reducing dependence on grants or state loans.

- For example, Vadodara Municipal Corporation issued Asia’s first certified green municipal bond (₹100 crore) to fund wastewater infrastructure.

- The government also promotes the Pooled Finance Development Fund (PFDF) scheme, which enables credit enhancement and pooled borrowing for ULBs.

Pitfalls & Barriers

- Creditworthiness constraints: Rating agencies often discount grants and transfers rather than treating them as stable revenue, thereby reducing ratings.

- Weak financial management: Many municipal bodies lack timely audits, asset registers, accrual accounting, or debt servicing discipline.

- Legal and institutional obstacles: In some states, ULBs may not have legal backing to pledge or mortgage their revenues.

- Market risk and investor confidence: In absence of a credible, enforceable repayment mechanism or bailout risk, investors may demand high yields, raising cost of borrowing.

- Moral hazard and overleverage: If higher tiers guarantee municipal debt, local accountability may weaken.

- Scale and liquidity issues: Many municipal bonds are small in size, lack secondary market liquidity, thereby limiting investor interest.

Thus, while municipal bonds are a useful instrument, they cannot substitute for structural reforms in fiscal architecture. They must be embedded in a robust framework. |

Conclusion

Fiscal empowerment of municipalities is central to India’s urban transformation and cooperative federalism. Predictable devolution, credible revenue powers, and transparent governance will turn cities from fiscal dependents into engines of sustainable national growth.

![]() 18 Oct 2025

18 Oct 2025

Revenue sources of municipal corporations: In FY17, 43% of municipal corporations’ revenue receipts came from their own tax revenue compared to only 30% in FY24.

Revenue sources of municipal corporations: In FY17, 43% of municipal corporations’ revenue receipts came from their own tax revenue compared to only 30% in FY24.