Retail Inflation reached a 14-month high to 6.2% in October, up from 5.5% in September, driven by a 10.9% increase in food prices.

- This level marks a breach of the RBI’s upper tolerance limit for inflation, with rural inflation higher at 6.7%, compared to urban inflation at 5.6%.

Key Highlights of the Inflation

- Food Price Changes: The rise in food inflation in October was significant across key items such as Vegetables (42.2%), Edible Oils(9.5%) and Fruits(8.4%).

- A global supply disruption in Southeast Asia led to a 27% increase in edible oil prices, contributing to the sharp domestic inflation.

- For Pulses inflation eased to 7.4%, ending a 17-month stretch of double-digit increase

- Spices saw a price decline of 7%.

- Core Inflation Remains Moderate: Core inflation (excluding food and energy) remained stable below 4% for the 11th consecutive month, with a mild rise from September’s nine-month high of 3.8%.

- Consumer Price Index (CPI) Changes: The overall CPI increased by 1.3% from September, with rural areas seeing a slightly higher increase of 1.42%.

- Consumer Food Price Index (CFPI) Changes : The CFPI, which tracks food inflation, rose 2.6% with similar effects in both rural and urban areas.

- RBI’s Inflation Projections: The RBI had projected average inflation at 4.8% for Q3 of FY 2024-25, dropping to 4.2% in Q4.

- However, to meet these projections, inflation would need to significantly soften to around 4.1% in November and December.

- Impact on Monetary Policy: Economists suggest that the sharp rise in inflation rules out any possibility of an interest rate cut in the RBI’s December monetary policy review.

Enroll now for UPSC Online Course

About Inflation

- Inflation refers to the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc.

- It measures the average price change in a basket of commodities and services over time.

- Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency. This is measured in percentage.

- Importance: A certain level of inflation is required in the economy to ensure that expenditure is promoted and hoarding money through savings is demotivated.

Types of Inflation

- Headline Inflation: Headline Inflation is a measure of the total inflation within an economy, including commodities such as food and energy prices (e.g., oil and gas), which tend to be much more volatile and prone to inflationary spikes.

- Wholesale Price Index (WPI) in India is known as headline inflation.

- Core Inflation: Core inflation is the change in the costs of goods and services, but it does not include those from the food and energy sectors.

- This measure of inflation excludes these items because their prices are much more volatile.

- Disinflation: Disinflation refers to a decrease in the rate of inflation, meaning prices are still rising but at a slower pace.

- Stagflation: Stagflation is a unique combination of high inflation and stagnant economic growth, accompanied by high unemployment.

How is Inflation measured?

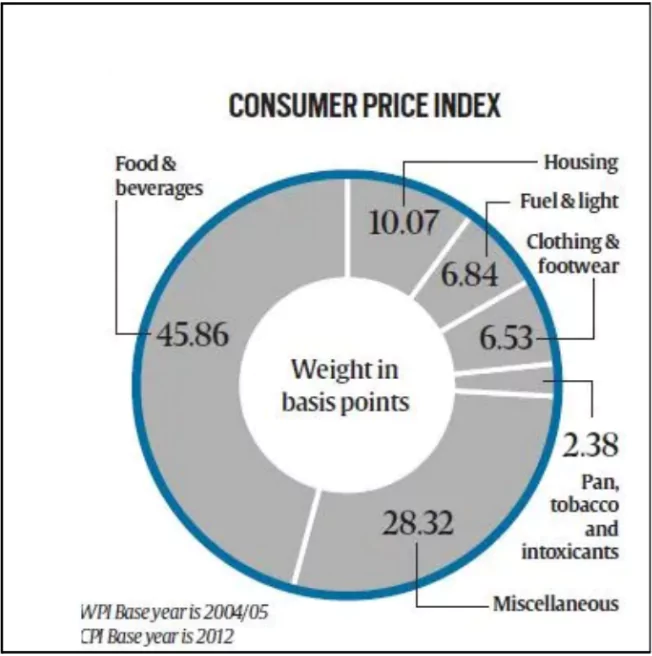

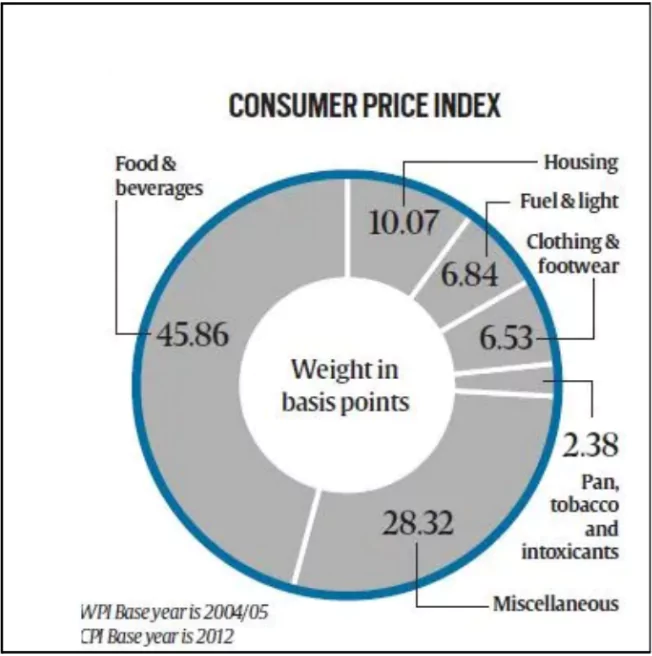

In India, inflation is primarily measured by two main indices WPI (Wholesale Price Index) and CPI (Consumer Price Index), which measure wholesale and retail-level price changes, respectively.

About Consumer Price Index (CPI) – Retail Inflation

- CPI Measures the change in the retail prices of goods and services with reference to a base year.

- Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

- Types of CPI:

- CPI for Industrial Workers (CPI-IW)

- Compiled by the Labor Bureau.

- Base year: 2016.

- CPI for Rural Laborers and Agricultural Laborers (CPI-AL & CPI-RL)

- Compiled by the Labor Bureau.

- Base year: 1986-87.

- New CPI (Rural, Urban, and Combined):

- Base year: 2012.

- Compiled and published by the Central Statistical Organisation (CSO) for all-India levels.

Check Out UPSC NCERT Textbooks From PW Store

Consumer Food Price Index (CFPI)

- CFPI: It is a sub-component of CPI, measuring changes in retail prices of food items consumed by the population.

- Focus: Tracks price changes of food staples such as cereals, vegetables, fruits, dairy, meat, etc.

- Compiled by: Central Statistical Office (CSO), MoSPI (from May 2014), now under NSO (formed in 2019).

- Base year: 2012.

- Methodology: Calculated monthly, using the same methodology as CPI.

Wholesale Price Index (WPI)

- WPI : It measures the average change in wholesale prices before the retail level.

- Coverage: It covers only goods, excluding services.

- Compiled by: Office of Economic Advisor, Ministry of Commerce and Industry (on a monthly basis).

- Base year: 2011-12.

- Weightage: Weights assigned to commodities are based on production value adjusted for net imports.

Impact of Food Inflation

- Psychological Stress: Rising prices, especially for essential items like vegetables and fruits, can lead to significant stress and anxiety among consumers.

- Impact on Health: Increased food prices can lead to reduced food consumption, particularly among vulnerable populations, impacting nutritional intake and overall health

- Impact on Economy: Food Inflation distorts overall inflation target of RBI limiting its ability to use monetary measures.

Government Measures to Control Food Inflation

- Subsidised Sales: Government-subsidised sales of essential commodities like onions, tomatoes, wheat, and sugar to control prices.

- Import Duty Reduction: Reducing import duties on pulses to increase domestic supply.

- Export Bans: Temporary bans on exports of wheat and broken rice to ensure domestic availability.

- Stockpiling Restrictions: Limits on stockpiling by traders to prevent hoarding.

- Operation Greens: A government initiative to stabilise the supply and prices of tomatoes, onions, and potatoes.

- Minimum Export Price: Imposing a minimum export price on food items to curb exports and maintain domestic supply.

Monetary Policy Measures to Control Inflation

- Increasing Interest Rates: This reduces borrowing and spending, cooling down demand.

- Cash Reserve Ratio (CRR) Hike: Banks are required to hold more funds with the central bank, reducing lending capacity.

- Open Market Operations (OMO): Selling government securities to absorb excess liquidity.

Fiscal Policy Measures to Control Inflation

- Reduced Government Spending: Cutting back on public expenditure to lower aggregate demand.

- Increased Taxes: Raising taxes to reduce disposable income and consumption.

- Supply-Side Measures: Promoting domestic production, improving infrastructure, and streamlining regulations to boost supply and reduce inflationary pressures.

Enroll now for UPSC Online Classes

Way Forward

- Investment in Agriculture: Investing in infrastructure, markets, and supply chains to improve food production and reduce price volatility.

- Risk Management Tools: Implementing effective risk management strategies to protect farmers, traders, and consumers from price fluctuations and climate-related risks.

- Climate-Smart Agriculture: Adopting sustainable agricultural practices to mitigate the impact of climate change on food production.

- Institutional Forecasting: Establishing a robust forecasting mechanism to provide accurate information to farmers and policy-makers.

- Supply-Side Reforms: Addressing structural issues in the agricultural sector to improve productivity and efficiency.

![]() 13 Nov 2024

13 Nov 2024