Context:

- According to a news article published in Financial Express, the Centre’s food subsidy outlay is likely to be pegged at Rs 2.3 trillion in the Budget Estimate (BE) for the next financial year.

Key Highlights on the Food Subsidy in India

- Rise in food subsidy: In the revised estimate (RE) for FY24, the food subsidy is estimated to rise by Rs 17,000 crore to Rs 2.14 trillion due to sharp increases in the minimum support price (MSP) for key crops.

- The food subsidy BE for FY25 is likely to be around 7% higher than the FY24RE.

- Revised Estimates: RE are mid-year reviews of possible expenditures, taking into account the trend of expenditure, New Services and New Instruments of Services, etc.

- Revised Estimates are not voted by the Parliament, and hence by itself do not provide any authority for expenditure

- Budget Estimates: Amount of money allocated in the Budget to any ministry or scheme for the coming financial year.

- Impact on the fiscal deficit (FD): Despite the increase in food subsidy, the government’s goal of limiting the fiscal deficit to 5.9% of GDP will not be impacted given the robust performance of tax and non-tax revenues.

- The difference between total revenue and total expenditure of the government is termed as fiscal deficit

- Increase in MSP: For key rabi and kharif crops, the MSP increases this year have been the highest since 2018-19 as a new policy of 50% profits over computed cost of production was adopted for the price setting.

- The MSP of wheat has been raised by 7.05% to Rs 2,275/quintal for the 2024-25 marketing season (April-June), the sharpest increase since 2014-15.

- The MSP for paddy, the key kharif crop has been raised by 7% this year to Rs 2,183/quintal.

- MSP is the assured price announced by the central government at which food grains are procured from the farmers by central and state governments along with their agencies.

- Extension of PMGKAY: The scheme which was to expire in December 2023 was recently extended by the Prime Minister for another five years.

Also Read: Centre Approves Minimum Support Prices (MSPs) for Rabi Crops 2024-25

About Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY):

- The PMGKAY was introduced in 2020 during the Covid-19 pandemic to provide 5 kg free foodgrains to eligible ration card holders under the National Food Security Act, 2013 (NFSA)

Eligibility for the scheme:

- Families eligible for PM-GKAY include those under the Antyodaya Anna Yojana (AAY) and Priority Households (PHH) categories.

- While the AAY households are entitled to 35 kg of foodgrains per month irrespective of the number of family members, the PHH gets foodgrains depending on the number of family members (each member 5 kg per month).

- The PMGKAY’s free ration was in addition to this.

- In January 2023, the government approved the integration of PM-GKAY benefits with the provisions of the National Food Security Act. This integration will streamline the delivery of free food grains.

Public Distribution System (PDS):

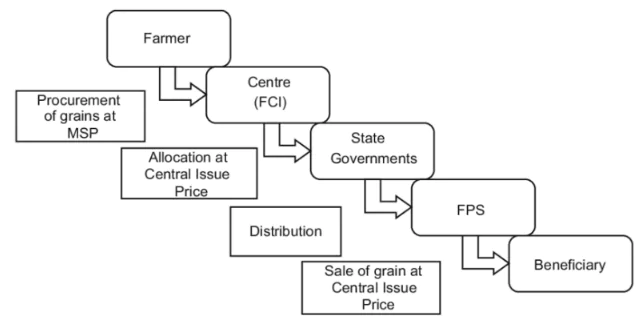

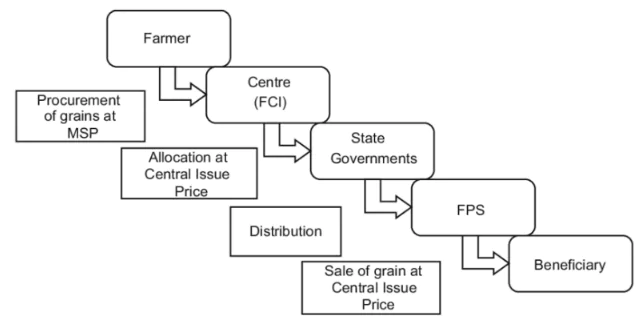

- Role of central government: The Central Government, through FCI, has assumed the responsibility for procurement, storage, transportation, and bulk allocation of food grains to the State Governments.

- Role of state government: The operational responsibility including allocation within the State, identification of eligible families, issue of Ration Cards, and supervision of the functioning of Fair Price Shops (FPSs), etc., rests with the State Governments.

- Commodities under Public Distribution System: Presently commodities like wheat, rice, sugar, and kerosene are being allocated to the States /UTs for distribution.

- Some States/ UTs also distribute additional items of mass consumption through the Public Distribution System outlets such as pulses, edible oils, iodized salt, spices, etc.

Targeted Public Distribution System (TPDS):

- In order to make the Public Distribution System more responsive to the needs of the poor, the TPDS was introduced in June 1997. It attempts to target families below the poverty line (BPL) at subsidized rates.

About the National Food Security Act, 2013 (NFSA):

- The National Food Security Act mandates coverage of 75% of the population in rural areas and 50% in urban areas, and covers 81 crore persons.

- The NFSA entitled beneficiaries to receive subsidised foodgrains (at Rs 3, Rs 2, and Rs 1 per kilogram of rice, wheat, and coarse grains, respectively) through the Targeted Public Distribution System (TPDS).

|

What is Food Subsidy?

- About:. The Department of Food and Public Distribution provides food subsidies to the Food Corporation of India (FCI) and states for procuring food grains from farmers at government notified prices and selling them at lower subsidised prices (known as Central Issue Prices), under the National Food Security Act (NFSA), 2013.

-

- FCI was established by the government of India in 1965 for procurement, distribution, and storage of food grains.

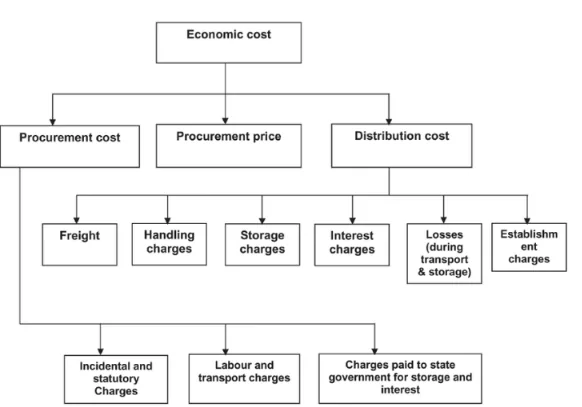

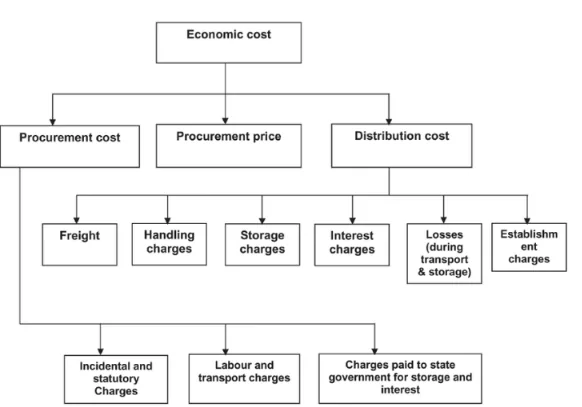

- Economic cost consists of the cost of procurement, storage, and distribution of food grains.

- Nodal Ministry: The Department of Food and Public Distribution under the Ministry of Consumer Affairs, Food and Public Distribution.

What are the components of food subsidy?

- Subsidy to FCI: The government provides a subsidy to FCI for the procurement of food grain from the farmer at a notified price.

- Subsidy to state: The central government provides food subsidy to the state under decentralised procurement scheme.

- Under this, the state may take the operation of procurement, distribution, and storage of food grain on behalf of the Food Corporation of India.

- Sugar subsidy: Under the Antyodaya Anna Yojana, sugar subsidy is given to the poor family by providing one kg of sugar per month at subsidised price.

Sugarcane subsidy:

- The Department of Food and Public Distribution is also responsible for the formulation of policies and regulations for the sugar sector.

- This includes fixing the Fair and Remunerative Price (FRP) of sugarcane which is payable to farmers by sugar factories, training in sugar technology, and regulation of supply of free sale sugar.

- The FRP is fixed based on the recommendations of the Commission for Agricultural Costs and Prices (CACP). It is recommended to take into consideration:

- the cost of production,

- rate of recovery of sugar

- availability of sugar to consumers at a fair price

- returns to farmers from alternative crops and the general trend of prices of agricultural commodities

- realisation from the sale of by-products

- reasonable margins for farmers on account of risks and profits

|

What are the concerns associated with food subsidy in India?

- RIsing Economic Cost of the food Grains: The increase in the MSPs of rice and wheat, high State-level levies, which account for almost 50 percent of the procurement incidentals for foodgrains, and the rising trend in distribution costs have contributed to the increase in the economic costs of foodgrains over the years

- Difference between economic cost and central issue price: The widening gap between economic cost and Central Issue Prices (CIPs) has led to an increase in expenditure on food subsidy.

- While the economic cost for rice has increased from Rs 11 per kg in 2001-02 to Rs 43 per kg in 2021-22, and of wheat from Rs 9 per kg to Rs 30 per kg over the same period, their CIPs have not been revised.

- Faulty cropping pattern: The open-ended procurement of paddy and wheat in states such as Punjab and Haryana increased both the area and production of these crops, displacing crops like pulses and oilseeds.

- Excessive stockholding: The monocropping of paddy and wheat resulted in excessive stockholding beyond the norm required for food security.

-

- About 10 per cent of the procured foodgrains are routinely wasted in post-harvest handling and storage losses.

- As of May 2021, the actual food stock with the government was about 83 million tonnes, against the strategic requirement of only 50 million tonnes.

- Impact on environment: The Economic Survey of 2019-20 noted that the increasing trend in MSPs gives a signal to farmers to opt for crops that have an assured procurement system.

- This shows that market prices do not offer remunerative options for farmers and MSPs act as maximum prices that farmers can realise.

- This puts pressure on the water table as these crops (especially paddy and sugarcane) are water-intensive.

- Sugarcane dues: In years of surplus production, the sugar prices fall impacting the sale of sugar and the liquidity of mills.

-

- As a result, mills are unable to pay farmers leading to delays in payments and accumulation of dues.

- Sugar mills are obligated to purchase sugarcane from all farmers within their specified area at a price fixed by the government. Conversely, farmers are bound to sell to the respective mills.

- As of January 31, 2021, payment of Rs 19,260 crore is pending with sugar mills as dues for 2019-20 and previous years.

- Certain state governments fix their own State Advised Prices at levels higher than the FRP announced by the central government. This causes further strain on the financial health of the sugar mills.

What challenges are associated with the delivery of food subsidy?

- Leakages in the Public Distribution System: Leakages refer to food grains not reaching the intended beneficiaries.

- According to the 2011 data, leakages in the Public Distribution System were estimated to be 46.7%.

- Leakages may be of three types:

- Pilferage or damage during transportation of foodgrains

- Diversion to non-beneficiaries at fair price shops through the issue of ghost cards

- Exclusion of people entitled to foodgrains but who are not on the beneficiary list.

- Exclusion errors: It refers to the percentage of poor households that are entitled to but do not have Public Distribution System cards.

- Exclusion errors had declined from 55% in 2004-05 to 41% in 2011-12.

- Inclusion errors: These occur when those who are ineligible get undue benefits. Inclusion errors had increased from 29% in 2004-05 to 37% in 2011-12.

- Under the National Food Security Act, of 2013, states are responsible for the identification of beneficiaries.

- In 2016, the Comptroller and Auditor General of India (CAG) found that this process had not been completed by the states, and 49% of the beneficiaries were yet to be identified by states.

Way Forward:

- Reforms in targeted Public Distribution System: There is a need for the diversification of the commodities under PDS.

- For this, the government has to focus on sustainable production and economically feasible procurement and distribution of diversified foods.

- For example, Haryana is providing financial incentives of ₹7,000/acre to farmers for shifting from paddy to pulses, oilseeds, and cotton.

- Revisiting National Food Security Act norms and coverage: An official committee in January 2015 called for decreasing the quantum of coverage under the law, from the present 67% to around 40%.

- Voluntary “give up” of subsidies: For all ration cardholders drawing food grains, a “give-up” option, as done in the case of cooking gas cylinders, can be made available.

- While States have the authority to establish criteria for identifying Priority Household (PHH) cardholders, the Centre can nudge them to reduce the number of beneficiaries.

- Slab system of prices: The existing arrangement of flat rates should be replaced with a slab system of prices.

- Barring the needy, other beneficiaries can be made to pay a little more for a higher quantum of food grains.

- The rates at which these beneficiaries have to be charged can be arrived at by the Centre and the States through consultations.

- These measures, if properly implemented, can have a positive impact on retail prices in the open market.

- Direct Benefit Transfer (DBT): A better alternative to support prices is an in-cash subsidy, namely where the government directly transfers money to individual beneficiaries.

- This will increase the purchasing power of the poor and has an indirect bearing on production.

- Further, with recent advances in direct money transfer technologies, like JAM (Jan Dhan-Aadhaar-Mobile), the implementation challenges of DBT have eased with near-zero leakages and logistics costs, especially for paddy and wheat where production is not a problem.

- Rationalisation of sugarcane pricing Linkage of sugarcane prices to sugar prices: As recommended by a Task Force on Sugarcane and Sugar Industry (2020), sugarcane prices must be linked to sugar prices.

-

- Increases in FRP should be kept moderate and the state announcing SAP should bear the additional costs associated with it.

- The Task Force recommended a staggered payment mechanism for sugarcane so that the entire dues to the farmers are cleared within two months.

- The task force had recommended increasing the minimum selling price of sugar to Rs 33 per kg with it being reviewed six months after notification.

- This would aid sugar mills to cover their cost of production and maintenance costs.

- The CACP (2018) recommended that the FRP must be implemented in all states and the announcement of SAP by states should be stopped immediately.

- In case state governments decide to continue with SAP, the difference between SAP and FRP should be paid by the state governments directly to farmers.

Also Read: World Food India 2023: Nurturing Agriculture and Food Processing

Conclusion:

Addressing rising costs, crop patterns, and delivery issues is vital for the long-term success of India’s food subsidy programme.

![]() 20 Nov 2023

20 Nov 2023