Context: This article is based on the news “Food versus Fuel: What’s happening with Centre’s ethanol blending scheme” which was published in the Indian Express. The government recently restricted the sweetener’s diversion for ethanol production to increase domestic supply after banning sugar exports.

| Relevancy for Prelims: E20 Petrol, Sugar (Control) Order 1966, India Sugar Mills Association (ISMA), Global Biofuels Alliance (GBA), National Policy on Biofuels 2018, RUCO Project and Food Security.

Relevancy for Mains: Ethanol Blending Programme (EBP): Targets, Advantages, Challenges, and Wayforward. |

Government Bans Sugarcane for Ethanol Production

- Ban on Sugarcane Use for Ethanol Manufacturing: The Ministry of Consumer Affairs, Food, and Public Distribution earlier directed all mills and distilleries to stop using sugarcane juice or syrup to make any ethanol with immediate effect.

Sugar (Control) Order 1966

- It provides power to the Government to regulate the production of sugar, restrict the sale, etc. of sugar by producers conferred by the Sugar (Control) Order, 1966 to any officer or authority of the Central or State Government.

|

-

- Thus, concerns have arisen among the producers about the adverse impact on the ethanol blending programme (EBP) because of the ban.

- Sugar (Control) Order 1966: The directive was issued as per clauses 4 and 5 of the Sugar (Control) Order 1966.

- However, the government has allowed the use of ‘B-molasses’ for ethanol production in 2023-24.

- Curbing Price Rises: This move is expected to release 1.8-2 million tonnes (MT) of sugar in the domestic market which would help curb the rise in prices amidst reports of a fall in Sugar production in Maharashtra and Karnataka this season.

Must Read: Global Biofuel Alliance: Advancing Sustainable Energy

Why was the decision made to ban sugarcane for ethanol production?

- Estimated Fall in sugar production: The decision comes in the backdrop of an estimated fall in sugar production in the 2023-24 marketing year (October-September).

- The sugar stocks at the end of the 2022–2023 sugar year were significantly lower than the record 143.3lakh tonnes (lt) of 2018–19 and the lowest since 39.4 lakh tonnes of 2016–17.

- It aims to maintain adequate sugar availability for domestic consumption and to keep prices under check.

What concerns have been raised about the Ethanol Blending Targets?

- Impact on Ethanol Blending Targets: The Oil-marketing companies (OMCs-BPCL, HPCL, IOCL, etc) published a tender for the delivery of about 825 crore liters of ethanol for 2023–2024 to meet their 15% blending objective.

- They got offers for about 559 crore litres in the first round of bids, of which 135 crore litres were made of ethanol made from sugarcane juice or syrup.

- The recent restrictions will impact further supply of ethanol impacting the Ethanol blending targets of OMCs.

- It might cause the blending objective for the ethanol supply year 2023–24 (ESY24), which runs from 1 November 2023 to 31 October 2024, to be missed.

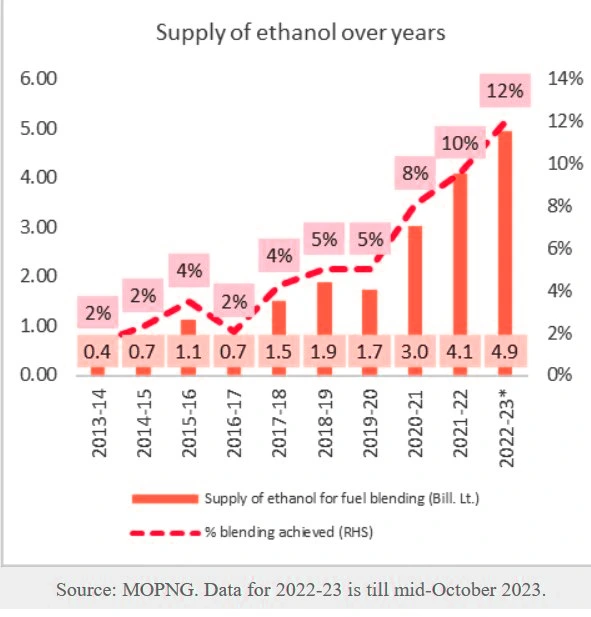

- The 12% ethanol blend goal for ESY23 was accomplished. The goal is 15% ethanol for ESY24 and 20% ethanol for ESY26.

- Setback for Companies: It will prove a setback for the industry as the companies have set up capacities to produce ethanol directly from cane juice/syrup.

- However, the government decision may impact the supply of feedstock, creating stranded capacities.

- Impact on revenue of Sugar Mills: Ethanol distillation provides large listed sugar mills with additional revenue sources however the current restriction has limited the revenue generation of the companies.

- Decrease in Crushing Capacity: As per the India Sugar Mills Association (ISMA), this may lead to a supply halt, which will result in decreased crushing capacity and higher costs.

- ISMA is an apex body of private sugar industries in India.

- Crushing capacity means the estimated maximum rate of crushing at which a mill can operate continuously while maintaining a proper level of efficiency.

Know about Sugarcane Production In India here.

Ethanol Blending Programme: Aim, Targets, and Current Status

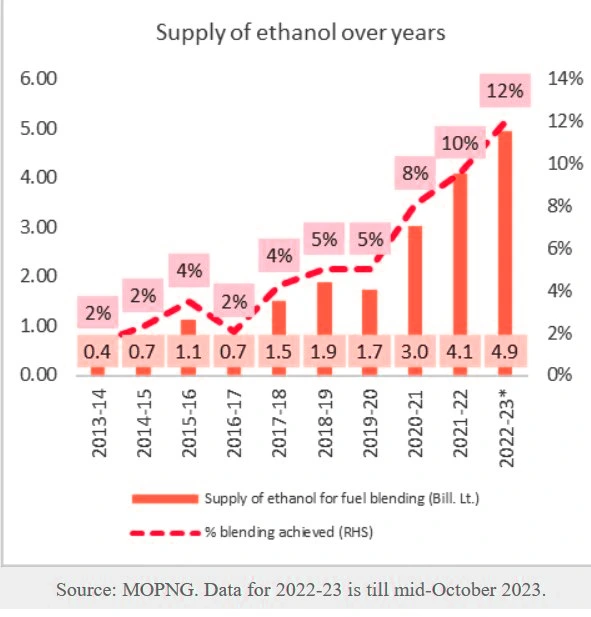

- About: The ethanol blending programme was launched in January 2003.

- Aim: The program sought to promote the use of alternative and environment-friendly fuels and to reduce import dependency for energy requirements.

- Source for ethanol Production: Sugarcane and its by-products like B molasses are the major source of ethanol production in India. Other sources for producing ethanol are corn, rice, and barley.

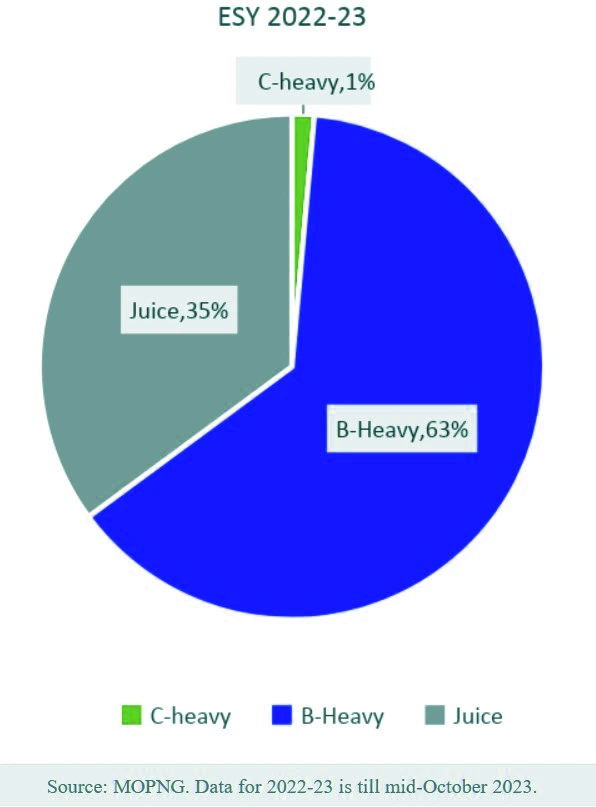

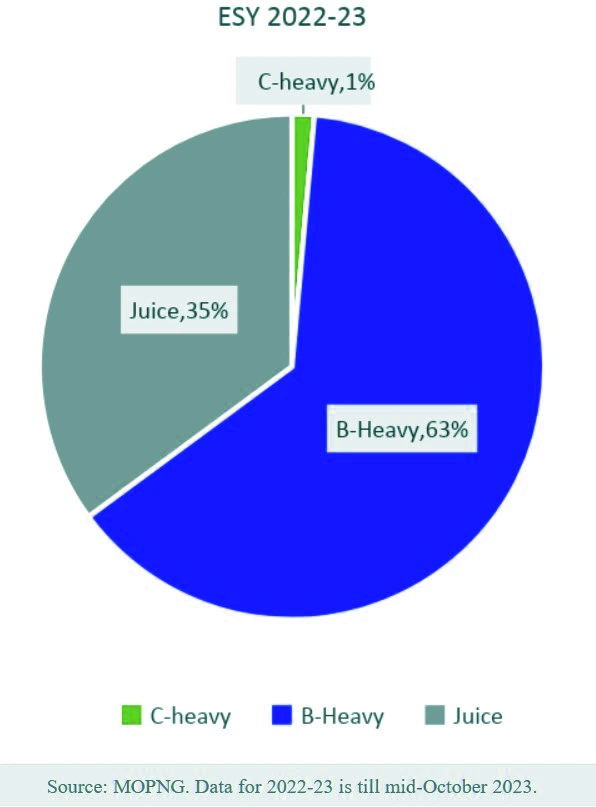

- Around 25-30% of the ethanol supplied from cane for fuel-blending comes from cane juice and syrup.

- Another 45% comes from B-heavy molasses, which is the residue from cane juice after two rounds of sugar processing.

- The rest is from C-heavy molasses, the residue after three rounds of sugar processing. Apart from cane, ethanol is also distilled from broken maize and rice

- Current Ethanol Blending Target: The Indian government has pledged to meet a 20% ethanol blending target by 2025-26.

- This target is referred to as E20, which implies that by 2025, a liter of fuel oil is likely to have 200 ml of ethanol and 800 ml of petroleum in it.

- Current Status: In the 2022-23 ethanol supply year (November-October), the government achieved 12 percent blending of ethanol with petrol.

- The target for the current year is 15 percent for which 690 litres of ethanol would be required.

- The Government has achieved the target of 10 percent average blending of ethanol in Petrol in the country under the EBP Programme in June 2022.

- Significance: India has met the initial target of 10 percent ethanol blending in mid-2022, ahead of the targeted timelines of November 2022.

- This has led to a forex increase of over Rs 41,500 crore, and reduced greenhouse gas emissions of 2.7 million metric tonnes.

Ethanol Blending Programme: Advantages

- Greenhouse gas emissions (GHG): According to the US Department of Energy’s Argonne National Laboratory, grain-based ethanol cuts greenhouse gas emissions by 44 to 52% compared to gasoline.

- Corn ethanol offers an average GHG reduction of 46% versus gasoline.

- Reducing Import Dependency: With E20 (20% ethanol blending with petrol) implementation by 2025, India will save about `45,000 crore in oil imports and 63 MT of oil annually.

- Further Potential: According to the International Energy Agency (IEA), there will be 3.5-5x biofuels growth potential by 2050 due to net zero targets, creating a huge opportunity for India.

- Net-Zero: It means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere, by oceans and forests.

- Growth in Ethanol Market: As per the estimates of the Ministry of Petroleum and Natural Gas, the global ethanol market was valued at $99.06 billion in 2022 and is predicted to grow at a CAGR of 5.1% by 2032 and surpass $162.12 billion by 2032.

Ethanol Blending Programme: Challenges

- Risks of Food security: The EBP diverts foodgrains for ethanol production meant for the poor.

- In the 2023 Global Hunger Index, India ranks 111th out of the 125 countries revealing serious hunger concerns.

- According to the Food and Agriculture Organization, about 209 million Indians, or about 15% of its population, were undernourished between 2018 and 2020.

- Focus on water-intensive crops: Currently, most of the ethanol being produced uses either sugarcane or rice as its raw material. Both these crops are water intensive.

- Rice and sugarcane, along with wheat, consume about 80% of India’s irrigation water.

Government Interventions for Ethanol Blending

- Global Biofuels Alliance (GBA): To promote the development and deployment of biofuels as a low-carbon pathway to sustainable energy.

- NITI Aayog Roadmap for Ethanol Blending in India 2020-25: It suggested an annual roadmap for the production and supply of ethanol till 2025-26, and systems for country-wide marketing of ethanol.

- National policy on biofuels 2018: It aims to:

- Advance the blending target of 20% bioethanol in petrol, from 2030 to 2025-26.

- Make additional feedstocks eligible for the production of biofuels.

- E100 Pilot Project: It aims to set up a network for the production and distribution of ethanol across the nation.

- RUCO project: It aims to convert vegetable oils, animal fats, or restaurant grease that have already been used in cooking into biodiesel for running diesel vehicles, or indeed any equipment that uses diesel.

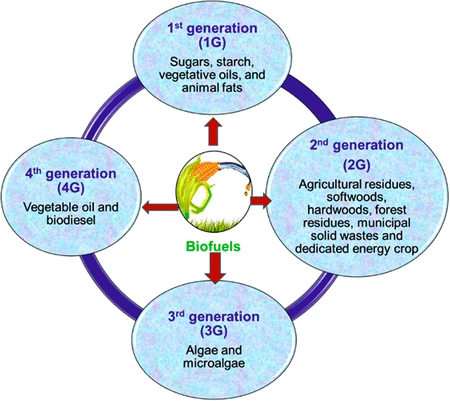

- Pradhan Mantri JI-VAN Yojana, 2019: It aims to create an ecosystem for setting up commercial projects and to boost Research and Development in the 2G Ethanol sector.

|

- Inefficient Subsidy Mechanism: FCI is currently purchasing broken rice for PDS, but is supplying it to distilleries at half the price.

- This process is highly inefficient as the burden of subsidies to distilleries is passed to the taxpayers.

- Competition between the distilleries and the public distribution system for subsidized food grains could have adverse consequences for the rural poor and expose them to enhanced risk of hunger.

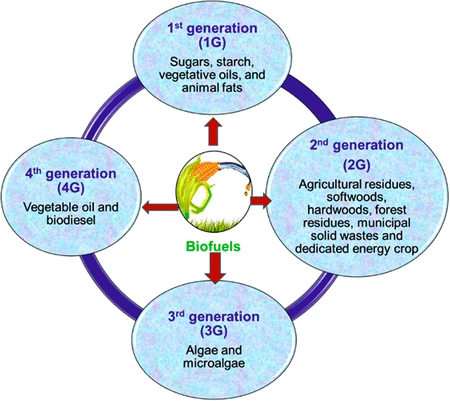

- Priority to Food-based Feedstocks: The ethanol blending target of India primarily focuses on food-based feedstocks.

- This is against the 2018 National Policy on Biofuels, which prioritized grasses and algae; cellulosic material such as bagasse, farm and forestry residue; and, items like straw from rice, wheat, and corn.

- Logistics Issues: Currently, the entire quantity of ethanol is being transported by road on truck tankers.

- This is not only expensive but also requires burning fuel to carry fuel, which releases GHGs into the atmosphere.

- Infrastructural challenges: Need for additional storage tanks for ethanol at marketing terminals/depots

- Need for ethanol-compliant dispensing units

- Need for an additional underground tank, pipes/hoses, and dispensing units for ethanol blended gasoline supply at retail outlets

Way Forward to Achieve Ethanol Blending Targets

- Utilizing nonfood feedstock: Technology for producing ethanol from “Advanced Biofuels,” including second generation (2G), should be promoted to prevent any trade-off with the food production system.

- Focus on B-Heavy Molasses: Conversion of Residual Juice Quantity to B-Heavy Molasses must be permitted for Increased Ethanol Supply with Minimal Impact on Sugar Production.

- Compensatory Increase in price of ethanol: A compensatory increase in pricing for ethanol needs to be derived from B and C heavy molasses as it would ensure sufficient cash flow for sugar mills.

- This will also mitigate potential delays or defaults in farmer payments due to reduced ethanol production from juice and syrup.

- Priority to food crops over fuel: The production of food must take precedence over fuel crops because of the diminishing groundwater reserves, the shortage of arable land, the unpredictable monsoons, and the declining agricultural yields brought on by climate change.

- Biofuels from waste: India can become a global leader in sustainable biofuels policy by focusing on ethanol made from waste.

- This would bring both strong climate and air quality benefits, since these wastes are currently often burned, contributing to smog.

- Departure from water-intensive crops: The ethanol strategy should make sure that farmers are not pushed into water-intensive crops and a water crisis is avoided.

- Alternative means of transport: The government should opt for other means of transporting ethanol, such as specialized pipelines, rail tank wagons, and ferries or steamers in coastal regions.

- The RORO (roll-on/roll-off) model of moving ethanol truck tankers by rail can be considered.

- Adoption of Brazil Model: The movement of fuel and ethanol to the depots in Brazil which has 14 oil refineries and 354 ethanol distilleries is entirely through pipelines, rail, or coastal ships.

Conclusion:

Addressing challenges in the Ethanol Blending Programme requires a balanced approach that prioritizes food security, explores nonfood feedstocks, and embraces sustainable technologies to achieve India’s ethanol blending targets while mitigating potential negative impacts on agriculture and food availability.

| Prelims Question (2020)

According to India’s National Policy on Biofuels, which of the following can be used as raw materials for the production of biofuels?

1. Cassava

2. Damaged wheat grains

3. Groundnut seeds

4. Horse grams

5. Rotten potatoes

6. Sugar beet

Select the correct answer using the code given below:

(a) 1, 2, 5 and 6 only

(b) 1, 3, 4 and 6 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4, 5 and 6

Ans: (a) |

![]() 11 Dec 2023

11 Dec 2023