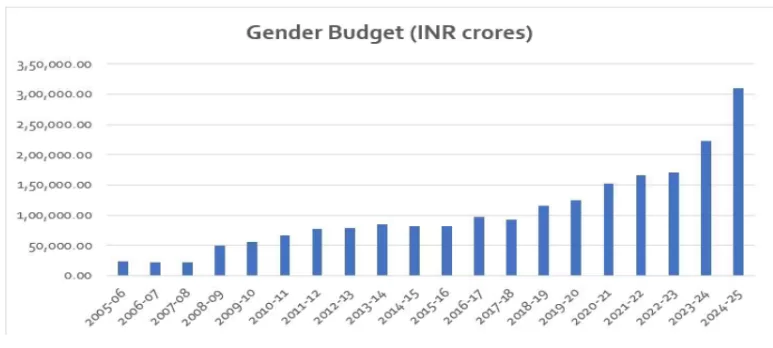

The Gender Budget 2024-25 has the highest financial allocation for schemes designed to promote women-led development since 2005.

About Gender Budgeting

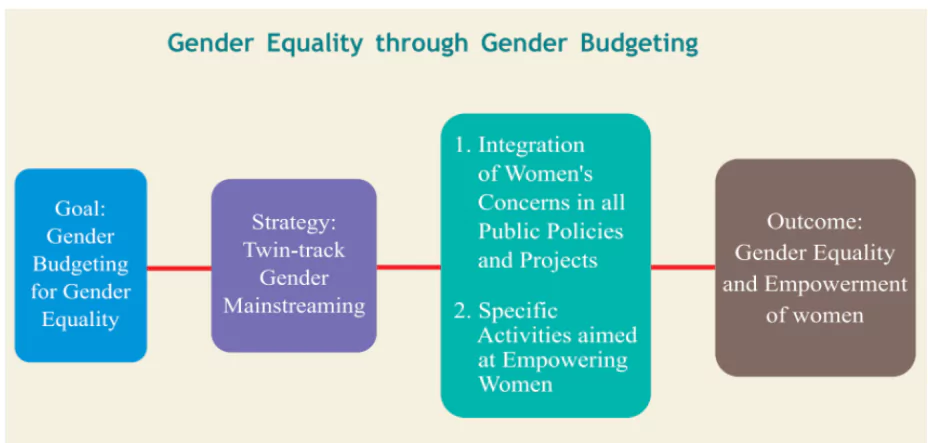

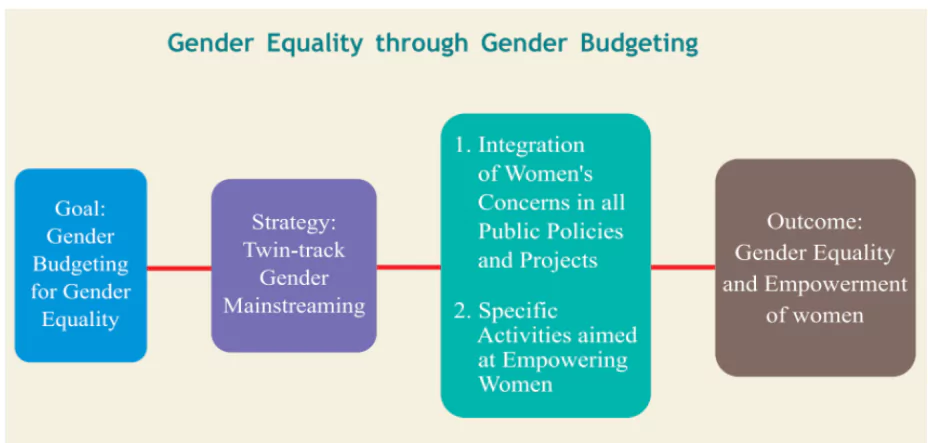

As per OECD, Gender Budgeting is a tool that governments can use to help close gender gaps.

- Refers: It is a tool for gender mainstreaming which uses the Budget as an entry point to apply a gender lens to the entire policy process.

- Function: It is a separate statement (not a separate budget) of the Union budget, it provides an estimate of budgetary allocations and expenditure targeted towards women and girls.

- It covers analyzing various economic policies of the Government from a gender perspective.

- Rationale behind Gender Budgeting (GB):

- Equality and Efficiency: Apart from the basic principle of promoting equality among citizens, GB can benefit the economy through efficiency gains.

- Keep in Mind the Systemic Differences across Gender: Men and women frequently have different priorities for budgetary policies and a Gender responsive budget can be of great help in addressing women’s concerns from a gender perspective.

- Expectations: When implemented effectively, gender budgeting helps expose how gender inequalities may have inadvertently become embedded in public policies so that resources can be allocated more equally.

- It also helps prioritise budget measures that will support the achievement of key gender objectives.

Enroll now for UPSC Online Course

Difference between Women-led development and Women-Centric Development

Women-led development and women-centric development are both approaches to development that focus on women, but they differ in their focus and approach:

- Women-led Development: It focuses on women taking on leading roles and actively participating in shaping the economic, social, and political progress of a community or society.

- Some of its goals include promoting education, skill development, and entrepreneurship, and bridging the gender digital divide.

- Women-centric Development: It focuses on acknowledging women as an important force in society and integrating them into development programs.

- Some of its goals include improving quality of life, reducing hardship, and building capacity.

|

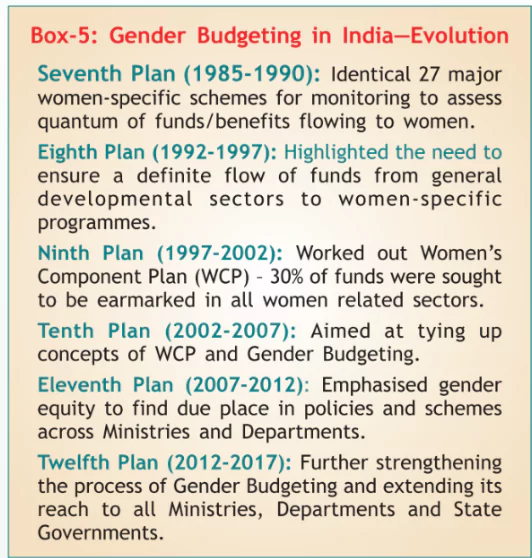

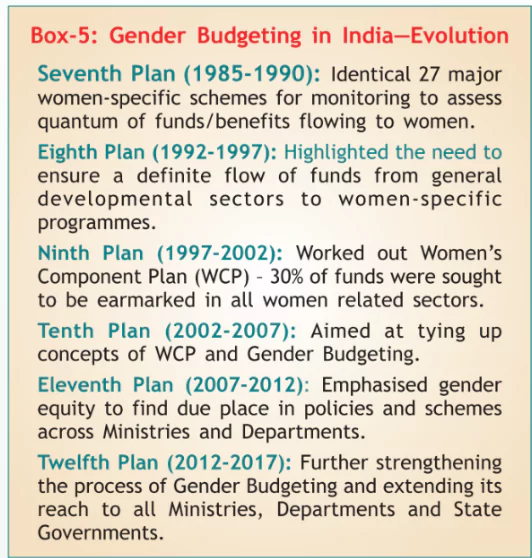

Evolution of Gender Budgeting

It was first introduced in 1984 in Australia to evaluate the impact of the national budget on females and the approach was adopted by other countries including Canada, South Africa and Philippines etc.

- United Nations Beijing Platform for Action: In 1995, it called for integrating a gender perspective into government budget processes.

- United Nations Sustainable Development Goals (SDGs): In 2015, it called for adequate resources and tools to track budget allocations for gender equality (SDG 5).

- Addis Ababa Action Agenda for Development: In 2015, it recognised the importance of tracking resource allocations for gender equality and strengthening capacity for Gender Budgeting.

- G20-Women (an official engagement group to the G20): In 2020, it called for greater investment in Gender Budgeting to ensure that fiscal policies advance gender equality in the recovery from the COVID-19 pandemic.

- Millennium Development Goals (MDGs): The eight MDGs to which the Government of India is a signatory which include “Goal 3: Promote Gender Equality and Empower Women”.

About Gender Budgeting in India

The practice of issuing an annual Gender Budget Statement (GBS) as part of the Union budget began in 2005-06.

- Components: In India, Gender Budgeting comprises two parts:

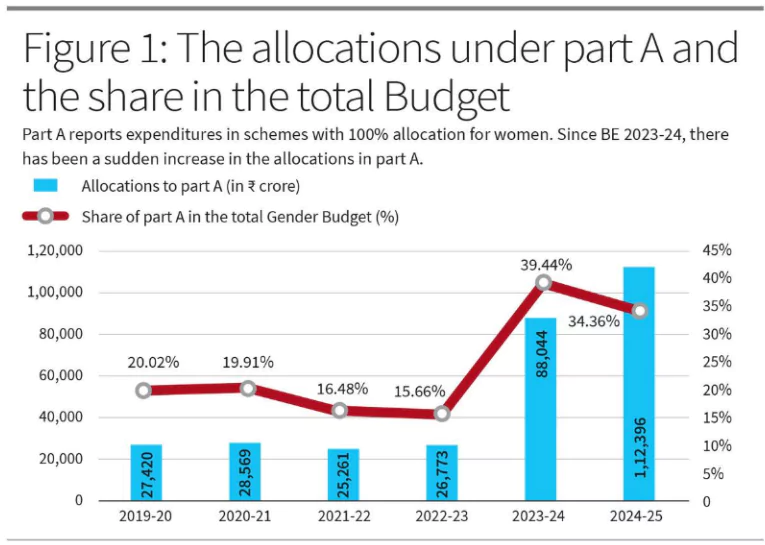

- Part A: Reflects Women-Specific Schemes i.e., those which have 100% allocation for women

- Part B: Reflects Pro-Women Schemes i.e., those where at least 30% of the allocation is for women

- Different Stakeholders: There are a range of different actors who can be involved in Gender Budgeting. Some of them are:-

- Ministry of Finance (both at the Union and State levels)

- Ministry of Women & Child Development/Social Welfare Department

- Comptroller and Auditor General of India/Local Audit Departments

- Role: The gender budgeting framework has helped the gender-neutral ministries to design new programs for women.

- Over the past two decades, India’s GBS has evolved into a comprehensive document that provides item-wise allocation and expenditure details in a clear, predictable format.

- Gender Budgeting Cells (GBCs): The Government has mandated the establishment of GBCs in all Ministries and Departments as an institutional mechanism to implement Gender Budgeting.

- A charter on GBC to be set up across various ministries was issued in 2017.

- Detailed guidelines to establish these calls at the level of the states were issued in 2012-13.

- The Five-Step Framework for Gender Budgeting:

- Step-1: Situation analysis in relation to the condition of women.

- Step-2: An assessment of the extent to which a particular sector’s policy addresses gender issues and gaps described in Step-1.

- Step-3: An assessment of the adequacy of budget allocations to implement gender-sensitive policies and programmes identified in Step-2.

- Step-4: Monitoring whether the money was spent as planned, what was delivered and to whom?

- Step 5: An assessment of the impact of the policies/programmes/schemes and the extent to which the situation described in Step-1 has changed.

Check Out UPSC CSE Books From PW Store

Why Emphasis on Gender?

- Representation: Women represent nearly 49% of the total population in the country.

- Discrimination Facers: Women face disparities in access to and control over services and resources.

- Specific Needs: There are specific needs of women that need to be addressed specifically.

- Bulk of the public expenditure and policy concerns are in the Gender Neutral Sectors.

Difference between Gender Neutral and Gender Sensitive Sectors:

- Certain sectors like defence, power, transport, commerce, etc. are perceived as gender neutral, because of their universal reach and the expenditure and revenue of these sectors cannot be partitioned on the basis of gender.

- Traditionally, gender sensitive sectors are perceived as those sectors where the target beneficiaries are visible and they are primarily women, e.g., health, education, labour, rural development, etc.

|

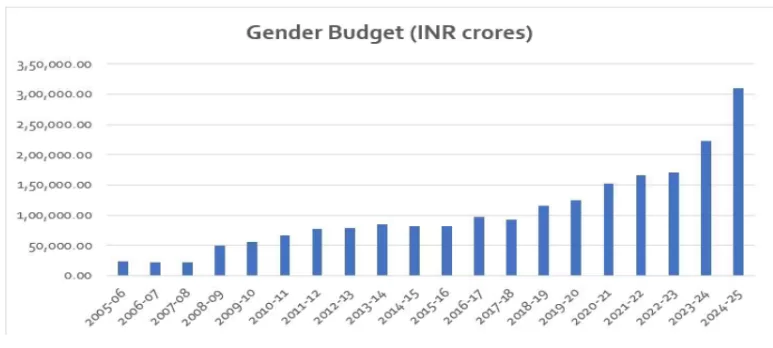

Highlights of Gender Budget 2024-25 in India

Women-led development remains at the core of announcements that was reflected in Budget allocations to pro-women programmes, as reported by the Gender Budget Statement (GBS).

- Rise in Allocation: The GB reached 1% of GDP estimates in 2024-25 for the first time, and overall allocations currently stand at more than ₹3 lakh crore for pro-women programmes.

- Gender Budget at a Glance: In the FY 2024-25, the GB has increased by 38.6% .

- Budget Share: The GB’s share of the total union budget increased from 5% in 2023-24 to 6.5% in 2024-25.

- 43 Ministries/Departments/UTs have reported a total of Rs. 3.09 lakh crore in the Gender Budget Statement 2024-25 (Budget Estimates), as compared to Rs. 2.23 lakh crore in 2023-24.

- 38 Ministries/Departments and 5 UTs reported in either Part A or Part B

- 22 Ministries/Departments and 5 UTs reported in Part A (100% women specific schemes)

31 Ministries/Departments and 4 UTs reported in Part B (30-99% budgetary allocation for women)

31 Ministries/Departments and 4 UTs reported in Part B (30-99% budgetary allocation for women)

- 87% of this increase in Gender Budget over last year is owing to increased allocations for women and girls by 7 Ministries/Departments:

- Ministry of Home Affairs

- Ministry of Electronics and Information Technology

- Ministry of New and Renewable Energy

- Ministry of Micro, Small and Medium Enterprises

- Ministry of Petroleum and Natural Gas

- Department of Drinking Water and Sanitation, and

- Department of Rural Development

- The Ministry of Power and Ministry of Civil Aviation reported for the first time in the Gender Budget Statement 2024-25.

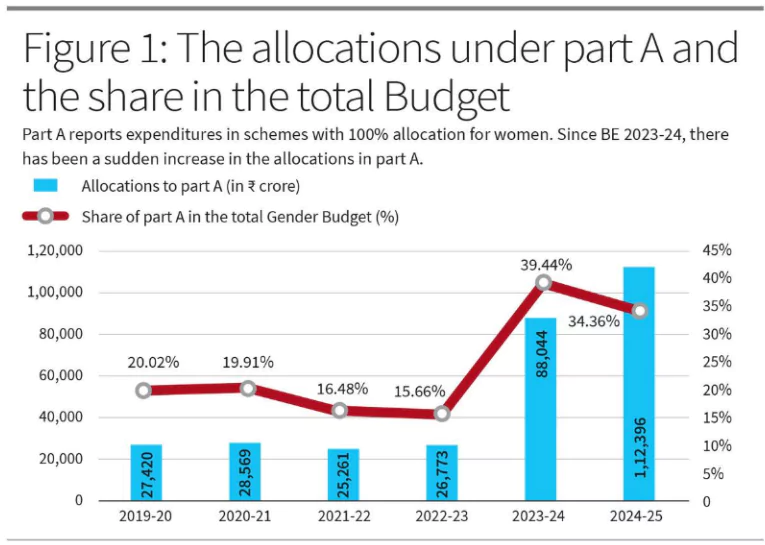

- Change in the Reporting: The Pradhan Mantri Awas Yojana (PMAY) — rural and urban — started getting reflected in part A instead of part B.

- This year the share of allocations to pro-women schemes stands at approximately 6.8% of the total budget expenditure for 2024-25, which is way above the usual trends and marks a positive departure from status quo.

- Part B of the GBS reports programmes with allocations of 30-99% for women. Hence, only a part of PMAY was reported earlier.

- Beginning last year, the entire allocation of ₹80,670 crore in PMAY for 2024-25BE has been reported under part A thus driving the up allocations.

- Such reporting of PMAY may not be entirely accurate as not all beneficiaries are women.

Significance of Gender Budgeting

Gender Budgeting approach leads to better informed policy choices and helps in making the policy makers more aware of the potential impact of policy decisions on gender.

- Better Utilisation of Resources: GB can support efforts to not only design, but re-design fiscal policies, and leads to better utilization of resources to address persistent gender gaps.

- Gender Equality Goals: An IMF Working paper on the impact of Gender Budgeting in G20 countries notes that GB leads to more programmes incorporating gender related goals.

- Wider Societal Outcomes: There are many other factors that impact the achievement of gender equality, including societal attitudes and behaviours and GB practices can make a difference in the way governments consider policy in respect to gender and lead to more conscious and better-informed decision making.

- Combat the Problem of Gender Neutrality in the Budgets: Gender-neutral budgets ignore the gender specific impacts of budgetary policies. However, GB involves looking at all the significant components from the point of view of women as beneficiaries.

- Ensuring Transparency and Accountability: GB ensures transparency in the budgetary allocation for women and accordingly enhances accountability in the utilisation of such allocations.

Check Out UPSC NCERT Textbooks From PW Store

Challenges with the Gender Budgeting

This year for the first time the entire allocation to the National Rural Livelihoods Mission (NRLM) is reflected in part A of the GBS, which should have been done earlier. However, in 2023-24BE, only 50% of the scheme’s total outlay used to be reflected in part B of the GBS.

- Technical Challenges: Implementation of GB faces several challenges like lack of guidance, coordination, expertise among personnel and low quality of gender impact assessments.

- Absence of Gender Disaggregated Data: Lack of such data makes it difficult to formulate effective policies and also limits the ability to accurately measure the effectiveness of the GB policies and initiatives.

- As per the IMF paper, due to lack of budget classifications or failure to incorporate gender classifiers in the financial management information systems (FMIS), governments miss on the implementation part.

- Skewed Implementation: Many sectors/schemes that can have impact on women, do not practice GB.

- Example: NITI Aayog paper on Gender Mainstreaming (June 2022) has noted that only 62 out of 119 centrally-sponsored schemes are practising GB.

- Costly: In resource-constrained settings, gender budgeting can be costly and may not have guaranteed returns.

- Lack of Accountability: There is no mandate to have a minimum allocation with respect to GB. In the absence of any accountability mechanisms regarding Gender Budgeting, monitoring and implementation continue to be inadequate.

- Over-Reporting: It impacts severely such as the PM Employment Generation Programme (PMEGP), which aims to assist entrepreneurs in setting up micro businesses in the non-farm sector. The GBS reported an allocation of ₹920 crore or 40% of the total allocation to PMEGP, without providing any explanation for such reporting.

- Under-Reporting: The GB does not take into account some of the major schemes that benefit women and also, there is lack of clarity on the way schemes allocate at least 30% of their funds for women.

- Examples: The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has the third highest allocation among schemes for women in the GBS, is currently reported under part B with ₹28,888.67 crore which is 33.6% of its total outlay.

- However, women constituted 59.3% of all person days under MGNREGA as of December 2023, and should have received commensurate wages from the total MGNREGA budget, yet only 33.6% gets reflected in the GBS.

- The GBS this year has also correctly reported increased allocations for the Ministry of Electronics & IT. But it missed out reporting pro-women allocations in the schemes for women entrepreneurs such as PM Vishwakarma, SVANidhi, and Stand-Up India.

Way Forward

Gender responsive budgeting is a powerful tool to close the gender gaps in an economy. Following are few suggested measures in this direction:

- Incorporation of Explanations for Allocations: Various anomalies can be minimised by incorporating explanations for the entries made in the GBS.

- It would not only ensure accounting accuracy but will help in gender audits and provide pathways for improved gender outcomes in government programmes.

- It would help in women’s development by ensuring actual spending for women in all government programmes, that are well planned and designed to include women’s needs from its inception.

- Inclusiveness: NITI Aayog has recommended that a Gender Budgeting Act can mainstream gender-based budgeting across all Ministries and States/UTs.

- The Act can also mandate all data collecting institutions to analyse and publish gender-disaggregated statistics.

- Increase of Allocation: NITI Aayog has also recommended that the Ministry of Women & Child Development (MWCD) should encourage State Governments to increase budgetary allocation towards women and child development, protection and welfare schemes to ensure improved fund availability and utilisation of schemes.

- Uniform Guidelines: As per the IMF survey, without guidelines or a common methodology for impact assessments, it is difficult for line Ministries to implement a common approach to GB analysis.

- Better Data Collection: The tools to monitor implementation and collect data must be improved. Better data can help in deeper analysis that can help in accurate measurement of outcomes and designing targeted initiatives for gender equality.

- Bridge the Gaps: The IMF recommends that fiscal policies should focus on areas where gender gaps persist.

- Gender Impact Assessments should be undertaken to help understand the gender impact of current and alternative policies that can be utilised to better redesign the policy interventions.

Enroll now for UPSC Online Classes

![]() 31 Aug 2024

31 Aug 2024

31 Ministries/Departments and 4 UTs reported in Part B (30-99% budgetary allocation for women)

31 Ministries/Departments and 4 UTs reported in Part B (30-99% budgetary allocation for women)