Gig workforce in India to grow to 62 mn by 2047, according to study by the labour ministry.

- The study by the labour ministry-affiliated VV Giri National Labour Institute (VVGNLI) used estimates from a 2022 NITI Aayog report on gig workers.

About Gig Economy

- A gig economy is a labor market that relies on independent contractors and freelancers rather than full-time permanent employees.

- In recent years, the global job market has witnessed a transformative shift with the rise of ‘gigification’ or adoption of the gig model – reshaping how we work. They include the following:

- freelancers who get paid per task;

- independent contractors who perform work and get paid on a contract-to-contract basis;

- project-based workers who get paid by the project;

- temporary hires who are employed for a fixed amount of time; and

- part-time workers who work less than full-time hours.

- Gig worker: Individual who engages in short-term, flexible, or task-based work, typically as an independent contractor or freelancer, rather than as a full-time employee with a traditional employer-employee relationship.

Classification of Gig Economy

- Platform-Based: They use online apps or digital platforms to find and perform work, such as ride-hailing, food delivery, e-commerce, online freelancing, etc.

- Non-platform-based gig workers: They work outside the traditional employer-employee relationship, such as casual wage workers and own-account workers in sectors like construction, domestic work, agriculture, etc.

Benefits of Gig Economy

- For Workers: Gig economy can provide more flexibility, autonomy, income opportunities, skill development, and inclusion.

- For Employers: It can enable access to a large and diverse pool of talent, lower fixed costs, higher scalability, and better customer satisfaction.

- For Customers: It can offer more choice, convenience, quality, and affordability.

Estimates and Projections for the Gig & Platform Sector

- Gig Workforce:

- The Niti Aayog study estimates that in 2020- 21, 77 lakh (7.7 million) workers were engaged in the gig economy.

- Over 3 million workers employed by roughly 11 platform companies in 2020.

- At present about 47% of the gig work is in medium skilled jobs, about 22% in high skilled, and about 31% in low skilled jobs.

- Gig Workforce Growth (Labour Ministry Study):

- The gig workforce is expected to expand to 2.35 crore (23.5 million) workers by 2029-30.

- By 2047, the gig workforce is projected to reach 61.6 million, forming 14.89% of the non-agricultural workforce (up from 2.6% in 2020-21).

- Alternative scenarios:

- Conservative Estimate: 32.5 million by 2047 under external constraints (e.g., technological disruptions, regulatory changes, economic shocks).

- Aspirational Estimate: Potential to generate 90.8 million gig jobs by 2047 with favorable conditions.

- Economic Impact:

- By 2030, the gig economy’s transaction volume could reach $250 billion, contributing 1.25% to India’s GDP.

- By 2047, expected to contribute up to 4% to GDP, driven by sectoral diversification and technological advancements.

- CAGR: The Associated Chambers of Commerce and Industry (ASSOCHAM) reports that India’s gig economy is growing at a Compound annual growth rate (CAGR) of 17 per cent annually.

Key Drivers of Gig Economy Growth

- Technology and Digital Infrastructure:

- 4G/5G and Smartphones: Affordable internet and devices connect workers to platforms like Ola, Uber, Zomato.

- India to have over 900 million internet users in 2025, according to a report.

- AI and Machine Learning: AI optimizes task allocation and service delivery, scaling ride-sharing, delivery, and freelancing.

- Platform Growth: Web-based (e.g., Upwork) and location-based (e.g., Swiggy) platforms rose from 142 (2010) to 777 (2020) globally, boosting India’s job options.

- Flexible Work Demand:

- Autonomy: Workers choose hours and tasks, appealing to those needing flexibility.

- Non-Traditional Jobs: Task-based work suits multi-apping, reducing income risks.

- Economic Resilience: Gig jobs provided income during 2008 crisis and COVID-19.

- Low Entry Barriers: Minimal skills needed for roles like delivery, attracting diverse workers.

- Demographic Advantage:

- Youth Workforce: 65% of India’s population is 15-64 years, median age 29; youth (51% under 30) embrace gig work.

- Women’s Participation: Flexible roles in caregiving, beauty, and education empower women, with 81% of educated female freelancers in developing nations.

- Educated Workers: 73% of highly educated individuals in developing countries work on web platforms due to scarce formal jobs .

- Inclusivity: Gig work suits marginalized groups, including physically abled and rural youth.

- Policy Support:

- Code on Social Security, 2020: Recognizes gig workers, offers benefits via e-Shram Portal.

- State Laws: Rajasthan (2023) and Karnataka (2025) bills promote worker welfare .

- Vision 2047: Government aims to leverage the gig economy for job creation, improving youth and women’s lives .

- Skilling: Training programs boost digital and technical skills for high-skill gigs.

- Urbanization and Consumer Demand:

- Urban Growth: Rising middle class drives demand for delivery, ride-hailing, e-commerce.

- Tier-2/3 Cities: Gig work expands to semi-urban areas, creating jobs where formal work is scarce .

- Sector Expansion: Growth in healthcare, education, creative services, and consulting meets diverse needs

- Global Market Access:

- Global Share: India supplies 27% of global gig/freelancers (2024), driven by English-speaking, tech-savvy workers .

- Demand from Developed Nations: US, UK seek India’s software, writing, multimedia skills.

- Micro-Entrepreneurship: Platforms like Uber, Airbnb enable workers to monetize skills with low costs.

Advantages of the Gig Economy in India

- Massive Employment Generation: India’s gig economy is projected to employ 62 million workers by 2047, constituting 15% of the non-agricultural workforce.

- Low Entry Barriers and Democratization of Work: Gig work allows people from various socio-economic backgrounds, especially youth, women, and persons with disabilities, to participate due to minimal qualifications and digital access needs.

- Female Labour Force: Female gig workers benefit from the income-generating potential, choice and the flexible work modalities of the gig economy.

- Women’s participation in the gig economy has increased from 18% to 36%.

- Sectoral Diversification: Gig work is expanding beyond transport and delivery to include education, healthcare, finance, insurance, creative services, and IT consulting.

- As of 2019–20, 2.7 million gig workers were in retail and sales, 1.3 million in transportation, and over 0.6 million each in finance, insurance, and manufacturing.

- Potential for Skill Upgradation and Technological Integration: Although current trends show limited skill growth, there is high potential for platform-led skilling to enhance productivity and match India’s vision of a $5 trillion economy.

Gig Economy Regulatory Framework in India

- Central Legislation:

- Code on Wages, 2019: A universal minimum wage and floor wage should be provided to all organized and unorganized sectors, including gig workers.

- Code on Social Security, 2020: Under this, the gig workers are provided with recognition as a new occupational category.

- It has not been implemented as the government has yet to frame the rules.

- Motor Vehicle Aggregator Guidelines, 2020: Under this, gig workers are entitled to get a term insurance of Rs 15 lakh, and health insurance of Rs 10 lakh, with 2020-21 as the base year and with an increase of 5% each year.

- To curb excessive working hours of gig workers, the guidelines recommended that each driver should not be logged in for more than 12 hours in a calendar day including all aggregators apps they are integrated with.

- A break of 10 hours was mandatory if workers are logged in for 12 hours.

- PM Jan Arogya Yojana (PM-JAY): Union Budget 2025–26 announced health coverage under PM Jan Arogya Yojana (PM-JAY).

- ₹5 lakh per family per year for gig workers.

- e-SHRAM Portal (2021): A national database of unorganized workers, including gig and platform workers.

- As of early 2025, over 30.58 crore workers were registered.

- Rajasthan: First State Gig Workers’ Law

- Rajasthan Platform-Based Gig Workers (Registration and Welfare) Act, 2023

- Key Features:

- Mandatory registration of gig workers and aggregators on a state portal.

- Creation of a Welfare Board and a Welfare Fund (financed by a 1–2% cess per transaction).

- Provisions for grievance redressal, transparency in payments, and rights awareness.

- State government grants and contributions by gig workers will also be pooled into the fund.

- Karnataka Gig Workers (Conditions of Service and Welfare) Bill, 2024: The draft is modelled on Rajasthan’s legislation, but it has more provisions for the safety and welfare of workers.

- It is planning to have a provision for charging aggregators gig workers’ welfare fee, which will be a percentage of the pay of the gig worker per transaction.

Key Concerns Associated with the Gig Worker in India

- Lack of Social Security Coverage: Most gig workers lack basic protections like health insurance, provident fund, or pension benefits.

- As of 2024, 90% of India’s gig workers had no savings to fall back on in emergencies. Unlike salaried employees who contribute to EPF (which could yield ₹50–60 lakh in retirement), gig workers risk retiring with nothing.

- Precarious Income and Long Working Hours: Gig workers often work long hours for relatively low and unstable pay.

- A 2023 Fairwork India study found that delivery and ride-hailing workers earn around ₹15,000–20,000/month, often working 10–12 hours a day — below minimum wage when adjusted for time worked.

- Absence of Formal Employment Status: Gig workers are legally classified as independent contractors, excluding them from labor law protections.

- This classification means no minimum wage, no overtime pay, no protection from unfair dismissal, and no grievance redressal under existing laws.

- Algorithmic Management and Lack of Transparency: Workers are managed by opaque algorithms that allocate tasks and determine pay without human oversight.

- Workers face account deactivation based on customer ratings or cancellations — often without a chance to appeal or know why.

- Gendered Risks and Safety Concerns: Women face safety risks and discrimination in gig roles, especially those involving entry into private homes or working late hours.

- Most platforms lack maternity benefits or robust systems to address gender-based violence.

- No Pathway to Skill Development or Upward Mobility: Most gig jobs are repetitive (driving, delivery, etc.) and offer no training or skill upgradation.

- A 2023 World Bank report found that only 5% of gig workers in India gain transferable skills, compared to 40% in sectors like IT or manufacturing.

- Weak Enforcement of Existing Laws and Benefits: Though laws like the Code on Social Security 2020 mandate platform contributions, enforcement is poor.

- Benefits under e-Shram or PM Jan Arogya Yojana exist in theory but are not fully accessible due to lack of awareness, digital literacy, or platform cooperation.

Global Best Practices for Protecting and Empowering Gig workers

Spain: Legal Reclassification as Employees

- In 2021, Spain passed the Rider Law, reclassifying gig delivery workers as employees rather than independent contractors.

France: Mandatory Social Security Contributions

- Gig platforms must register with authorities and contribute to social security funds on behalf of their workers.

Canada: Portable Benefits Pilot Projects

- Provinces like British Columbia and Ontario are experimenting with portable benefits schemes:

- Gig workers retain benefits like health insurance and retirement savings across platforms.

California, USA: AB5 and Proposition 22

- California initially passed AB5 to classify many gig workers as employees.

- Prop 22 (2020): A counter-ballot supported by companies like Uber and Lyft created a hybrid status:

- Workers get minimum earnings guarantee,

- Subsidized health insurance,

- Injury compensation.

EU Directive on Platform Work

- Aims to improve the working conditions of people who work through digital labour platforms, often referred to as gig workers.

- Shift the burden of proof onto companies (they must prove a worker is self-employed).

|

Way Forwards for India’s Gig and Platform Economy

- Comprehensive National Legislation: Enact a dedicated law to define gig workers’ rights, ensuring minimum wages, maximum working hours, and protection against unfair termination.

- Strengthen Social Security Implementation: Ensure universal access to social security benefits like health insurance, pensions, and maternity coverage under the Code on Social Security, 2020.

- Regulate Algorithmic Management: Promote transparency and fairness in platform algorithms to prevent exploitation and discrimination in task allocation or deactivation.

- Mandate platforms to disclose algorithmic criteria and provide appeal mechanisms, drawing from EU’s Platform Work Directive.

- Enhance Safety and Gender-Inclusive Policies: Improve worker safety by addressing physical and mental health risks, particularly for women, to boost participation (currently 36% female gig workers).

- Promote Skill Development and Career Mobility: Transform gig work into a stepping stone for formal employment by offering platform-led training programs.

- Expand skilling initiatives under Vision India@2047 to focus on high-skilled gigs (22% of jobs), partnering with platforms like Urban Company.

- Enable Collective Bargaining Rights: Grant gig workers the right to unionize and access effective grievance redressal to negotiate better wages and conditions.

- Establish tripartite boards with workers, platforms, and government, inspired by Denmark’s collective bargaining model.

- Harmonize State and Central Policies: Create a cohesive regulatory framework by aligning state-level initiatives (e.g., Karnataka’s 2025 Bill) with national policies.

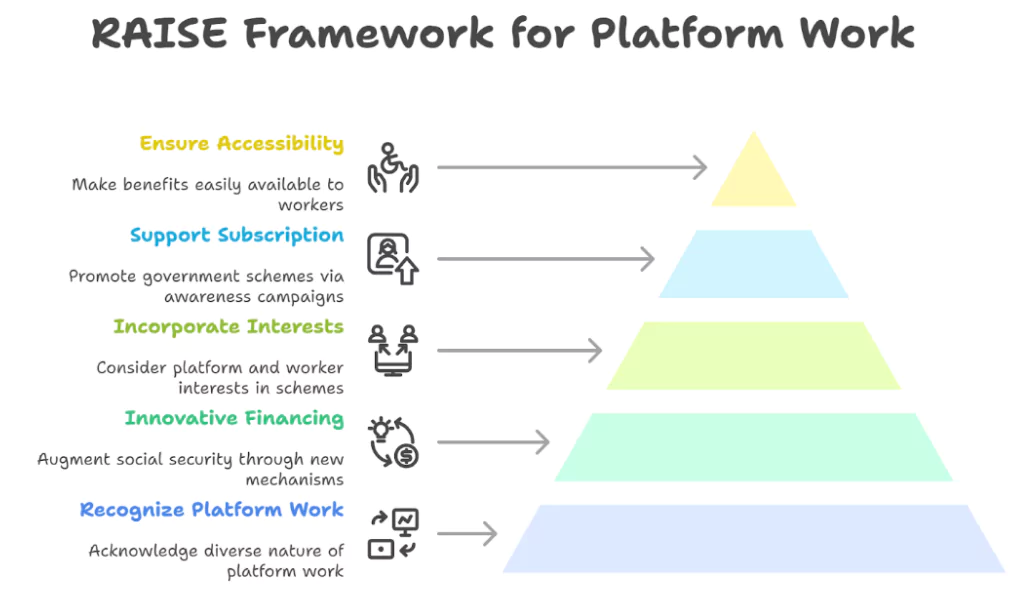

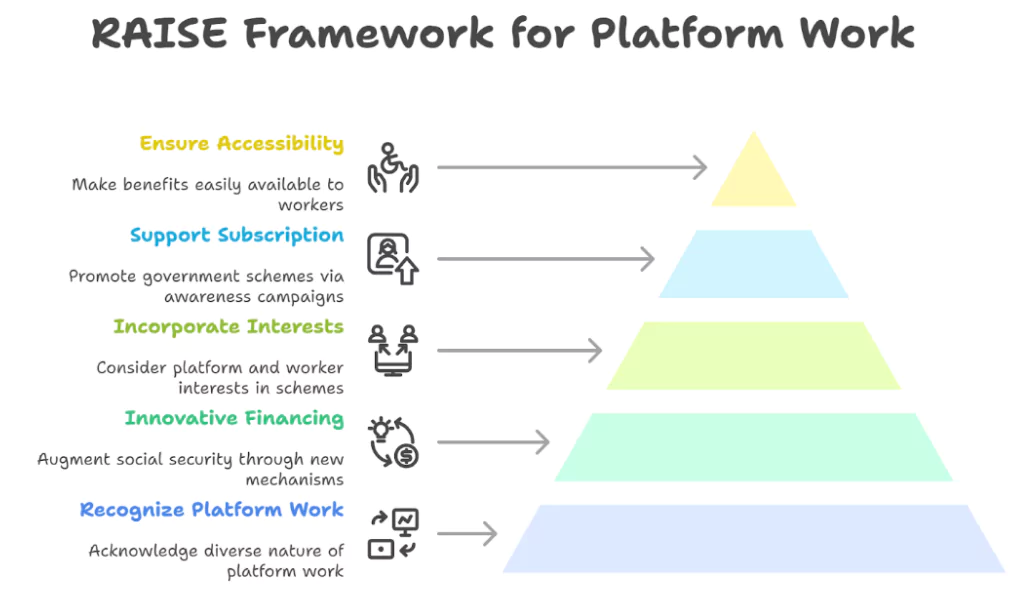

- Adopt NITI Aayog’s RAISE framework to ensure equitable schemes, innovative financing, and accessibility across regions.

Conclusion

India’s gig economy, projected to employ 61.9 million by 2047, holds transformative potential but requires robust regulation to ensure worker protections and sustainability. A balanced approach integrating national legislation, social security, and skill development can position India as a global leader in fair gig work.

![]() 10 Jun 2025

10 Jun 2025