There is high anticipation among the Multi-National Enterprises (MNE’s) and tax professionals of a roadmap for India’s approach to adopting the Global Minimum Tax, also known as the ‘Pillar Two’ global tax in the upcoming Budget.

Global Minimum Tax (GMT)

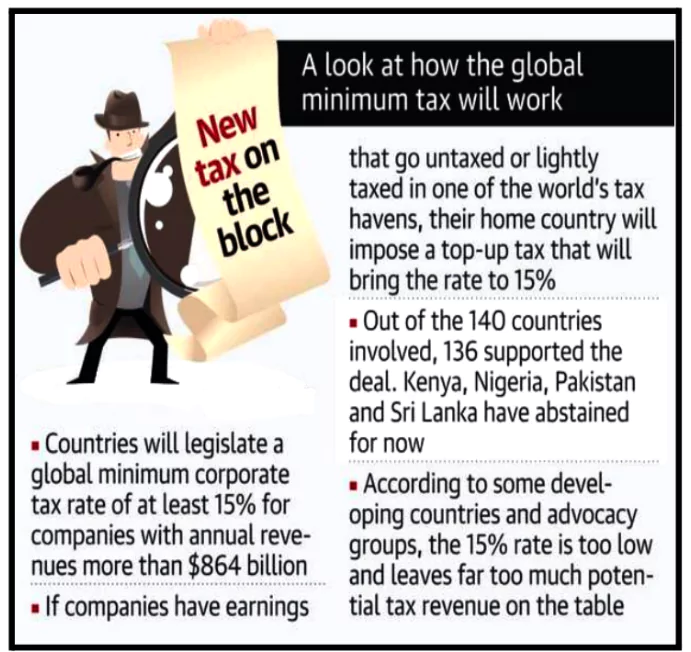

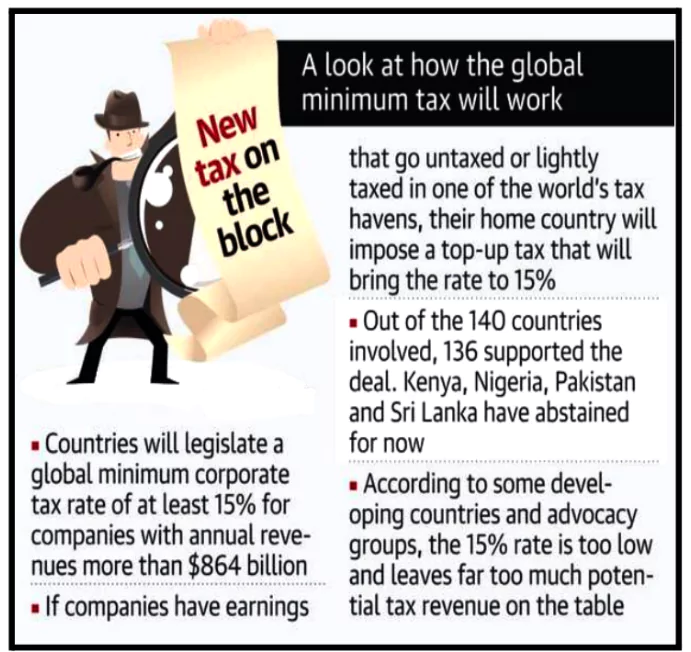

- About: The Global Minimum Tax (GMT) is an agreement reached by 136 countries, including India, to ensure that large multinational corporations pay a minimum tax rate of 15%.

- It is one of the most significant reforms of international tax regulations in a century.

- Based on: It is an agreement based on the Global Anti-Base Erosion (GloBE) Model Rules.

- OECD’s Inclusive Framework: It is prepared under the Organisation for Economic Co-operation and Development’s (OECD’s) Inclusive Framework.

- Involves over 140 countries.

- Two Pillar Plan:

- Pillar 1: primarily deals with the reallocation of income to market jurisdictions.

- Pillar 1 repeals digital services taxes and similar measures, with unclear identification and timetable.

- Pillar 2 focuses on establishing a global minimum taxation framework and preventing tax avoidance.

- Pillar 2 aims to ensure income is taxed at an appropriate rate and establish a GMT of 15% for multinationals with €750 million turnover.

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.- Objective: GMT aims to address the low effective tax rates paid by major corporations, including tech giants like Apple, Alphabet, and Facebook.

- These companies often use complex subsidiary structures to shift profits to low-tax countries or tax havens such as the Bahamas, Panama, British Virgin Islands etc.

- GMT ensures that large multinational enterprises pay a minimum level of tax on their income in each jurisdiction where they operate

- Key Benefits:

- Reduces the incentive for profit shifting.

- Places a floor under tax competition.

- Ends the race to the bottom on corporate tax rates.

- Economists expect the deal to encourage multinationals to repatriate capital to their home countries, benefiting those economies.

- It also aims to end decades of tax competition.

Enroll now for UPSC Online Course

Mechanism of Global Minimum Tax

- Applies to: The Minimum Tax Rate applies to multinational enterprises (MNEs) with global revenues above €750 million annually.

- MNEs must pay a minimum effective tax rate (ETR) of 15% on a country-by-country basis.

- Provision of a Top-Up Tax:

- If an MNE’s effective tax rate (ETR) falls below 15% in any country, a top-up tax is imposed.

- This tax is payable to the nation where the MNE’s parent company is based.

Example Case to understand the Global Minimum Tax

- An Indian multinational has subsidiaries in the UAE and Germany. With Tax Rates of: UAE: 9% and Germany: 30%

- Top-Up Tax

- India: India would impose a 6% top-up tax for the UAE’s shortfall if the UAE doesn’t meet the minimum tax rate.

- UAE’s Right to Collect: UAE has the first right to collect the tax if it enacts a compatible domestic minimum tax.

- Backstop Rule:

- Under-Taxed Profit Rule (UTPR): If neither India nor the UAE enacts Pillar Two, Germany can collect the UAE shortfall through UTPR.

- UTPR is set to take effect in several countries from 2025.

- Incentive for Implementation:

- Pillar Two is designed so that if one country legislates it, that country can collect the entire top-up tax.

- Therefore, No country, including India, would want to be left behind in the implementation process.

Implementation Progress

- Current Status: Over 50 countries are at various stages of implementing Pillar Two.

- Countries Already Implementing:

- European nations: UK, Switzerland, Belgium, Netherlands, France, Germany, Ireland.

- Other countries: Australia, Korea, Japan, Canada.

- Upcoming Adoptions:

- Singapore and Hong Kong plan to roll out Pillar Two in 2025.

- The UAE is conducting consultations for its implementation.

Check Out UPSC CSE Books From PW Store

Impact on Multinational Enterprises (MNEs)

- Assessment Required: Businesses need to evaluate how Pillar Two affects their current and future transactions.

- MNEs must evaluate their systems for the new tax regime’s analytical, compliance, and reporting requirements.

- Data and Compliance Challenges: Compliance requires extensive accounting and tax data, which may not be easily accessible.

- MNEs need to manage varying local regulations due to the phased implementation across jurisdictions.

- Pillar Two impacts the corporate race to stay competitive: The new global tax regime will impact existing tax incentives and tax-holiday schemes across the globe, as a low ETR on account of such incentives will result in a top-up tax liability.

- Therefore, several countries are redesigning their tax incentive programmes for their businesses to remain competitive in the post-Pillar Two world.

- MNEs, therefore, would now need to take into account changes in tax-incentive structures as they re-assess their ongoing and proposed investments.

Status of Indian Multinational Enterprises (MNEs)

- Preliminary Assessments: Most Indian MNEs have started or completed initial impact assessments.

- Preparation for Compliance: They are now focusing on ongoing compliance and tax provisioning for potential ETR shortfalls in low-tax countries.

Associated Challenges with the implementation of Global Minimum Tax:

- Varied Jurisdictional Approaches: Different countries may interpret and implement Pillar Two differently, leading to inconsistencies and potential disputes in global tax enforcement.

- Impact on Tax Incentives: Countries may need to overhaul or eliminate existing tax incentives and holiday schemes, potentially affecting local businesses and economic development.

- Complexity of Implementation: The intricate rules and requirements of Pillar Two could create significant administrative and compliance burdens for both governments and multinational enterprises.

- This can discourage foreign investment in some jurisdictions, impacting economic growth.

- Affects Sovereignty: The global minimum tax could limit a nation’s ability to set its own tax policies, removing a key tool for pursuing national interests.

- Effectiveness Concerns: Critics, including groups like Oxfam, argue that the deal may not effectively eliminate tax havens or address all tax avoidance issues.

Suggestions for India’s Introduction of Pillar Two

- Stakeholder Consultations:

- India should consult with various stakeholders before introducing Pillar Two.

- Focus on how Pillar Two interacts with India’s existing tax system and its implications for tax incentives in GIFT City, Gujarat.

- Mindset of the MNE’s: Pillar Two represents a collective move towards global tax fairness.It is the first truly global tax system in a world of increasing business globalisation. MNEs will need to adapt to new technologies and mindsets as they implement Pillar Two.

Enroll now for UPSC Online Classes

Conclusion

India’s adoption of Pillar Two is imminent; it’s a question of when, not if. The countdown has begun, and the focus is now on how the government will implement these global tax reforms effectively.

Organisation for Economic Cooperation and Development (OECD), Base Erosion and Profit Shifting (BEPS) and OECD G20 Project

Organisation for Economic Cooperation and Development (OECD)

- About: The OECD is an intergovernmental economic organisation, founded to stimulate economic progress and world trade.

- Organisation for Economic Co-operation and Development is an official United Nations Observer.

- Members: Most OECD members are high-income economies with a very high Human Development Index (HDI) and are regarded as developed countries.

- Established on: OECD was established on December 14, 1960.

- Headquarters: Paris, France.

- Total Members: 36.

- India and OECD: India is not a member, but a key economic partner.

- Reports and Indices by OECD

- Government at a Glance 2017 report.

- International Migration Outlook.

- OECD Better Life Index.

- Black List of OECD: The OECD maintains a so-called “black list” of nations that are considered uncooperative tax havens.

Base Erosion and Profit Shifting (BEPS) and OECD G20 Project:

- Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to “shift” profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus “eroding” the “tax-base” of the higher-tax jurisdictions using deductible payments such as interest or royalties

- Aim:

- This strategy reduces corporate tax liability by either masking profits or shifting them to low-tax regions with minimal economic activity, exploiting gaps in international tax regulations.

- The OECD G20 Base Erosion and Profit Shifting Project (or BEPS Project): It is an OECD/G20 project to set up an international framework to combat tax avoidance by multinational enterprises (“MNEs”) using base erosion and profit shifting tools.

- India and BEPS: India has signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”) to swiftly implement a series of tax treaty measures to update international tax rules and lessen the opportunity for tax avoidance by multinational enterprises

|

![]() 20 Jul 2024

20 Jul 2024

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.