Context:

Financial Stability Issues in Urban Cooperative Banks

- The RBI has appointed the former chief general manager of the State Bank of India, as the administrator to oversee the affairs of the urban cooperative bank for the next 12 months.

- According to the RBI, the action was necessary because of concerns arising from observed poor governance standards in the bank.

- Financial Performance:

-

- The bank’s profit declined sharply by 78% to Rs 3.54 crore in the fiscal year ending March 31, 2021, compared to Rs 16.22 crore in the previous fiscal year.

- Deposits stood at Rs 10,952.44 crore as of March 2021, showing a modest increase from Rs 10,838.07 crore in March 2020.

What are the Cooperative Banks?

- Cooperative banks are financial institutions that are owned and controlled by their members, who are also customers of the bank.

- It is an institution established cooperatively to deal with the ordinary banking business.

- Cooperative banks are founded by collecting funds through shares, accepting deposits, and granting loans.

- They are registered under the Cooperative Societies Act of the State concerned or the Multi-State Cooperative Societies Act, of 2002.

- They are governed under:

- Banking Regulations Act, 1949

- Banking Laws (Co-operative Societies) Act, 1955

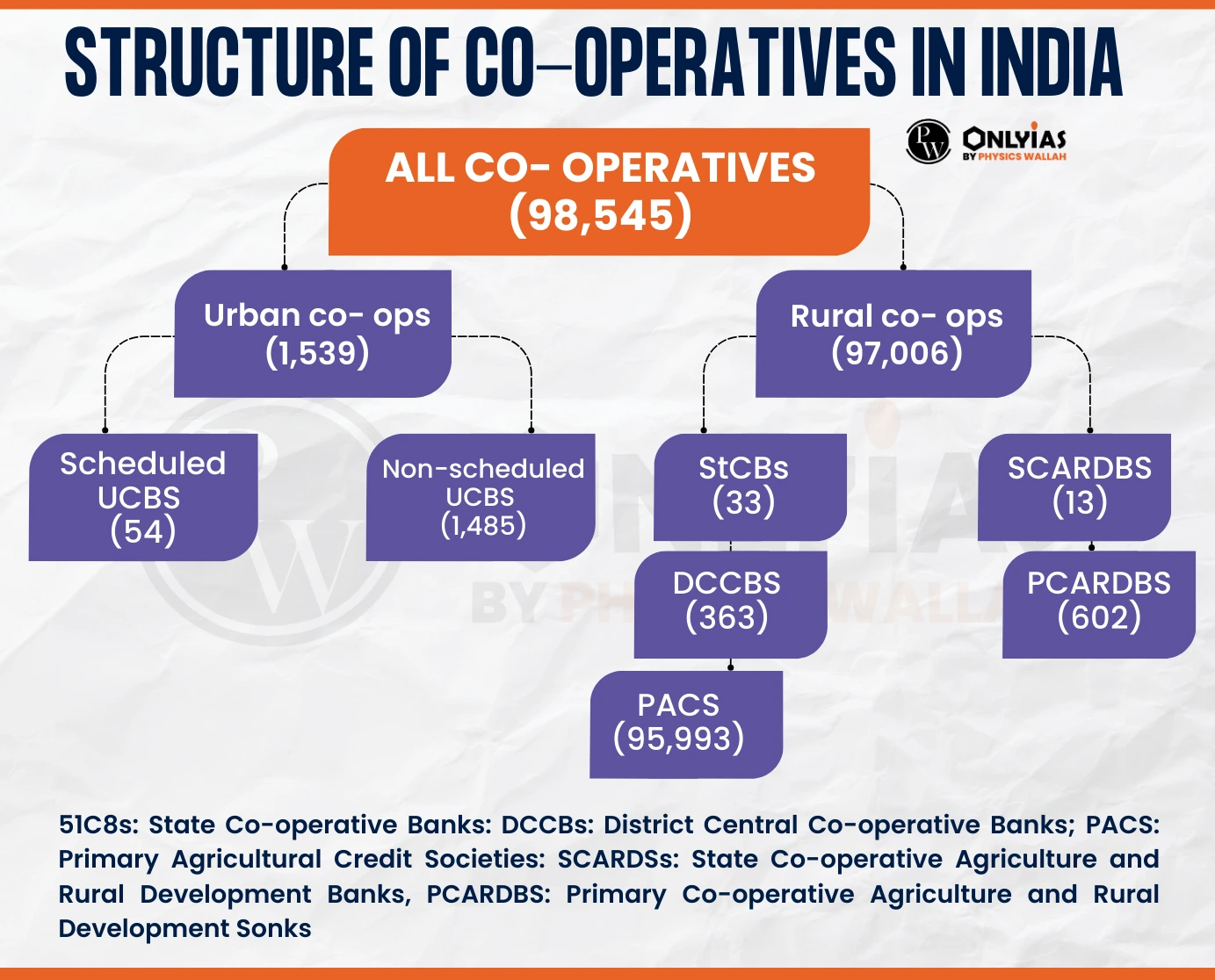

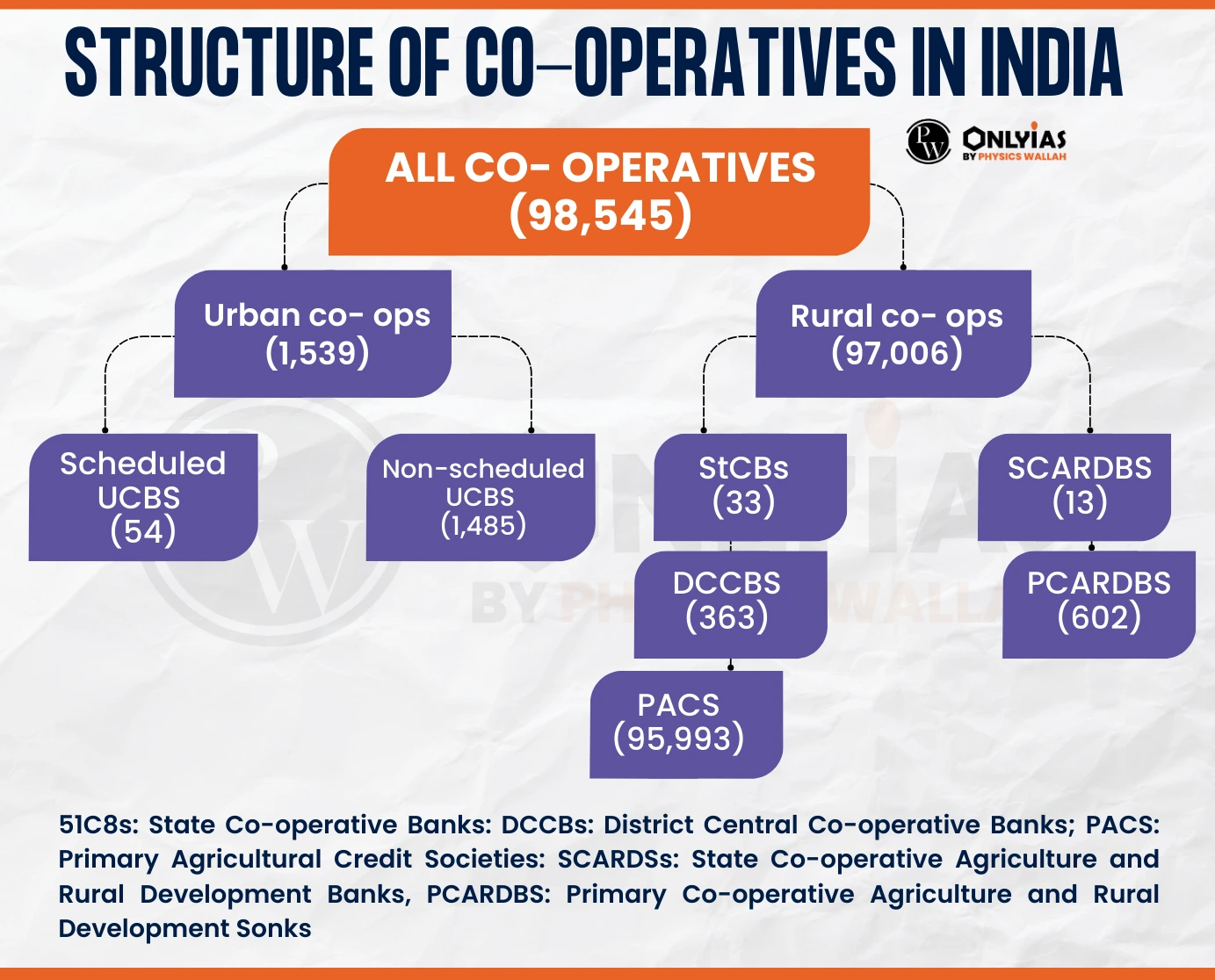

- They are broadly divided into Urban and Rural cooperative banks (Refer Image)

Also Read: Banking Sector of India

What are the characteristics of Cooperative Banks?

- Ownership: Cooperative banks are owned by their members, who are also the shareholders of the bank.

- Control: Cooperative banks are controlled by their members, who elect the board of directors and participate in the decision-making process of the bank.

- Profits: The profits of cooperative banks are distributed among the members in the form of dividends.

- Services: Cooperative banks offer a range of banking and financial services to their members, including savings accounts, loans, and insurance.

- Community focus: Cooperative banks often strongly focus on serving their local communities’ needs and promoting economic development.

- Ethical values: Cooperative banks are guided by the cooperative principles of democracy, equality, and solidarity, and they aim to operate ethically and sustainably.

What are the Urban Cooperative Banks (UCBs)?

- Urban cooperative banks (UCBs) are financial institutions that are organized and operated cooperatively in urban and semi-urban areas.

- In 2021, RBI appointed a committee(N S Vishwanathan Committee) that suggested a 4-tier structure for the Urban Cooperative Banks.

-

- Tier 1 with deposits up to Rs 100 crore.

- Tier 2 deposits between Rs 100 crore and Rs 1,000 crore,

- Tier 3 with deposits between Rs 1,000 crore and Rs 10,000 crore, and

- Tier 4 with deposits more than Rs 10,000 crore.

- Status of Urban Cooperative Banks:

- Number and Presence: Currently, there are 1,514 Urban Cooperative Banks in India

- Credit to Agriculture Contribution: Contributing 11% of the total credit to the sector.

- Deposit Base: The total deposit base of Urban Cooperative Banks is at ₹5.26 trillion.

- Sector Share: As of March 31, 2020, an estimated 94% of entities in the banking sector were UCBs, showcasing their prevalence.

- Share in the Banking Sector: 3.24% of deposits and 2.69% of advances.

- Financial Inclusion Impact: Urban Cooperative Banks cater to the financial needs of approximately 85.2 million depositors and 6.7 million borrowers.

What are the issues associated with Urban Cooperative Banks (UCBs)?

- Weak governance: Some Urban Cooperative Banks have been found to have weak governance structures and inadequate internal controls, which has led to financial mismanagement and fraud in some cases.

- For instance, the ‘one-member, one-vote’ policy in cooperative banks may lead to governance challenges, potentially impacting decision-making processes.

- Example: The collapse of Punjab and Maharashtra Cooperative Bank (PMC Bank) in 2019 was primarily attributed to fraudulent activities and financial irregularities.

- Lack of Professional Management: Many Urban Cooperative Banks are managed by amateur and untrained individuals, who may not have the necessary skills and expertise to manage the bank effectively.

- Lack of compliance with regulatory norms: Some Urban Cooperative Banks are non-compliant with regulatory norms, such as rules related to capital adequacy, asset classification, and provisioning.

- In July 2023, the RBI has canceled the banking licenses of Adoor Co-operative Urban Bank of Kerala and Mahalaxmi Cooperative Bank Dharwad.

- Competition from other banks: UCBs face competition from other banks, particularly from larger public and private sector banks, which have a wider range of products and services and better access to resources.

- Limited Access to capital: UCBs have limited access to capital, which limits their ability to expand and modernize their operations.

- Over 50% of Urban Cooperative Banks have less than Rs 100 crore deposits. Most of their problems stem because of their tiny size, which doesn’t allow them to deploy requisite resources in either manpower or in technology.

- Due to their cooperative structure, UCBs cannot raise capital from any other source but their members.

- High Non-Performing Assets (NPA) Ratio: Recently, the RBI Governor highlighted an 8.7% gross non-performing assets ratio in urban cooperative banks (UCBs).

- RBI has revoked the licenses of several UCBs due to their unsatisfactory financial health. The central bank has cancelled licences of 54 Urban Cooperative Banks since FY16 because of poor financial performance.

- Dual Regulation Challenges Addressed:

- Limited area of operations leads to the issue of dual regulation by the RBI and the state government – there is often a lack of clarity as to who has oversight over these banks.

| N S Vishwanathan Committee Suggestions:

In February 2021, the RBI constituted an Expert Committee on Primary (Urban) Co-operative Banks chaired by N S Vishwanathan, former RBI Deputy Governor.

- Capital to Risk-Weighted Assets Ratio (CRAR) Variation: Suggested a flexible CRAR ranging from 9% to 15% for UCBs, with Basel III norms for Tier-4 UCBs.

- Separate Ceilings for Loans: Prescribed separate ceilings for home loans, loans against gold ornaments, and unsecured loans for different Urban Cooperative Banks categories.

- Consolidation Approach: Recommended that RBI should take a largely neutral stance to voluntary consolidation but suggested mandatory mergers for UCBs not meeting prudential requirements.

- Resolution of Urban Cooperative Banks: Suggested that the RBI, under the Banking Regulation (BR) Act, can prepare schemes for compulsory amalgamation or reconstruction of Urban Cooperative Banks when voluntary actions are insufficient.

- Supervisory Action Framework (SAF): Proposed a twin-indicator approach for the SAF, considering only asset quality and capital (measured through NNPA and CRAR) instead of the current triple-indicator approach.

- Umbrella Organization (UO) Role: Highlighted the crucial role of the Umbrella Organization (UO) in strengthening the sector, suggesting it should be financially strong with a minimum capital of Rs 300 crore.

|

RBI Recommendations for Cooperative Banks:

- Governance Focus: Emphasizes that cooperative banks should prioritize the quality of governance, focusing on the three pillars of compliance, risk management, and internal audit.

- Risk Analysis Report: Urges Urban Cooperative Banks (UCBs) to submit a quarterly risk analysis report before the board to enhance transparency and risk management.

- Democratization of Discussions: Advocates for democratizing board discussions to prevent excessive dominance by a few members, fostering a more inclusive decision-making process.

- Expertise in Board Members: Stresses the importance of board members having adequate expertise, suggesting that diverse skill sets contribute to effective governance.

- Encourages cooperative bank boards to adopt a dynamic structure by facilitating new inductions, welcoming fresh perspectives, and including younger members.

|

Way Forward:

- Strengthening Governance: Urban Cooperative Banks (UCBs) should focus on strengthening their governance structures and internal controls and ensuring they have trained and professional management teams.

- Credit Risk Management: The need for rigorous credit risk management is underscored, including robust underwriting standards, effective post-sanction monitoring, timely recognition and mitigation of potential stress, rigorous follow-up of large Non-Performing Asset (NPA) borrowers for effective recovery, and maintaining adequate provisioning.

- Enhancing compliance with regulatory norms: Urban Cooperative Banks should ensure that they comply with all relevant regulatory norms and requirements, such as rules related to capital adequacy, asset classification, and provisioning.

- Improving access to capital: Urban Cooperative Banks should explore ways to increase their access to capital, such as by raising members’ equity or issuing bonds.

- The RBI’s Financial Stability Report (FSR), released in June 2023, showed that, the consolidated capital adequacy ratio or CRAR of scheduled UCBs and non-scheduled UCBs diminished by 194 basis points (bps) and 345 bps, respectively.

RBI Measures Introduced After Collapse of PMC Cooperative Banks:

- Four-Tier Scale-Based Regulatory Framework: Larger-sized banks are mandated to maintain higher capital under this framework.

- Priority Sector Lending Target for UCBs: Urban Cooperative Banks (UCBs) must achieve a priority sector lending target of 75% by March 2026.

|

- IT and Cybersecurity Infrastructure: Urban Cooperative Banks must establish a robust IT and cybersecurity infrastructure, ensuring the availability of requisite skills at the bank level.

- Collaborating with other banks: Urban Cooperative Banks can consider collaborating with other banks, such as public and private sector banks, to leverage their resources and expertise and expand their reach.

Conclusion:

Addressing governance issues, enhancing financial performance, and embracing regulatory reforms are imperative for the sustainable growth and stability of Urban Cooperative Banks, as emphasized by recent RBI interventions and recommendations.

| Prelims Question (2021)

With reference to ‘Urban Cooperative banks’ in India consider the following statements:

1. They are supervised and regulated by local boards set up by the State Governments.

2. They can issue equity shares and preference shares.

3. They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b) |

![]() 25 Nov 2023

25 Nov 2023