Context:

This editorial is based on the news “Green Hydrogen: Enabling Measures Roadmap for Adoption in India” which was published in WEF. The Report, Green Hydrogen: Enabling Measures Roadmap for Adoption in India has been released by the World Economic Forum.

Accelerating Green Hydrogen Adoption: A Strategic Roadmap for India’s Energy Transition

- The report recommends public-private interventions in expediting the adoption of green hydrogen in India.

- It provides pathways for establishing green hydrogen as a viable energy source in India.

Hydrogen Production in India: Current Status & Environmental Challenges

- Currently, India produces 6.5 million metric tonnes per annum (MMTPA) of hydrogen, predominantly for use in crude oil refineries and fertilizer production.

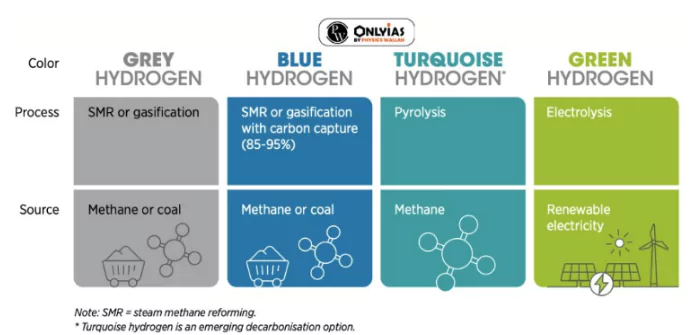

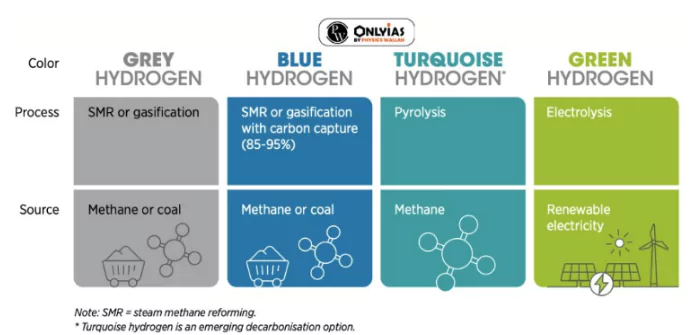

- Most of the country’s current hydrogen supply is grey hydrogen, produced using fossil fuels in a process that creates CO2 gas emissions.

Green Hydrogen: Definition, Production Methods, and Diverse Applications

- The Ministry of New and Renewable Energy (MNRE) has defined green hydrogen as hydrogen produced to emit no more than 2 kg of carbon dioxide per kg of such hydrogen.

- Currently, producing 1 kg of ‘grey hydrogen,’ as it is known, emits 9 kg of carbon dioxide.

- While Green hydrogen is produced by electrolysis splitting water molecules into hydrogen and oxygen through an electrolyzer using renewable energy, grey hydrogen requires carbon combustion.

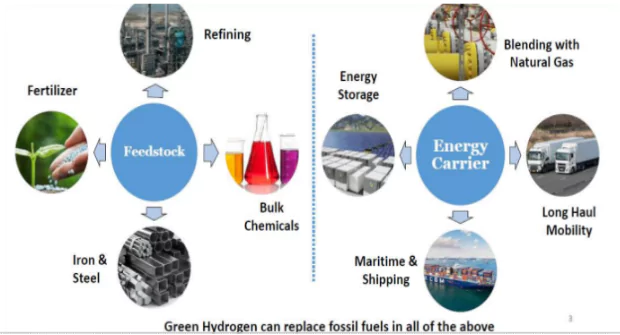

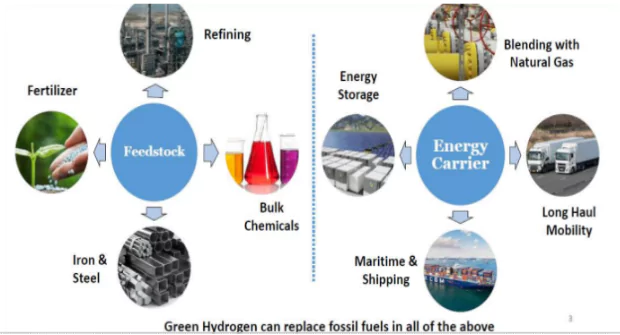

- Applications of Green Hydrogen: It is a key input in fertilizers and refineries, feedstock in the chemical industry to carry out various processes like ammonia production, transport, energy storage, power generation, etc.

Green Hydrogen Revolution: India’s Strategic Shift for Energy Security and Global Leadership

- Increasing Energy Demand: India is currently the third-largest economy in the world in terms of energy needs, and the country’s demand for energy is set to surge further.

- As per the report, the demand is estimated to grow 35% by 2030.

Advantages of using hydrogen as a fuel:

- Hydrogen combined with air, produces energy and water vapor.

- It generates more energy per kg than other fuels.

- Hydrogen acts as feedstock in the refining, fertilizer, and chemical industries, and is gradually replacing carbon as a feedstock in the iron and steel industry.

|

- Reducing Energy Import Cost: India’s energy import bill in 2022 was around $185 billion, which is likely to increase if the country continues to supply its growing energy demand through traditional methods.

- According to the MNRE, National Green Hydrogen Mission, India can reduce fossil fuel imports worth Rs 1 lakh crore by 2030.

- Climate Goals and Emission Reduction: India commits to achieve net zero by 2070 at the United Nations Climate Change Conference in Glasgow (COP26), held in 2021.

Green hydrogen can abate at least 50 MMTPA of greenhouse gases by 2030.

Green hydrogen can abate at least 50 MMTPA of greenhouse gases by 2030.

- Enhancing Energy Security: Green hydrogen is critical to help meet India’s energy security needs while reducing emissions in hard-to-abate sectors on the path to net zero.

- India has the potential to produce 210 Mtpa (598 Mtoe) of hydrogen from solar and wind and meet 32% of Asia-Pacific’s (APAC’s) hydrogen demand.

- Forex Earnings: According to the International Energy Agency, there could be a global demand for about 180 million tons of hydrogen by 2030.

- India may utilize this opportunity to transform itself from an energy importer to an energy provider and exporter.

- Geopolitical Implications:

- Growing Global Significance: The growing importance of Hydrogen in the energy space is expected to influence the technological and geo-political trends worldwide.

- Renewable Energy Advantage: Countries with access to abundant low-cost renewable energy could become producers/exporters of green hydrogen.

- This can be witnessed from the signing of MoUs on hydrogen and its derivatives trade. Ex-Japan has signed a cooperation agreement with UAE for production, supply, and trade of green or blue H2/NH3.

- Global Strategies: Many countries/regions around the world like the European Union, Singapore, South Korea, and Japan among others have announced their new strategies to import Green/Clean Hydrogen and its derivatives, thereby providing an opportunity for Indian producers.

Green Hydrogen Challenges in India: Production Barriers, Costs, and Infrastructure Hurdles

- Utilisation of Grey Hydrogen: Most of the hydrogen capacity in India is mainly produced using natural gas within refineries and fertiliser industries.

- Huge production Cost: The production costs of green hydrogen amount to roughly $4-5 per kilogram, equivalent to approximately double the price of grey hydrogen.

- The green hydrogen production costs is dependent upon the:

- Round-the-clock renewable energy electricity costs, which account for approximately 50–70% of green hydrogen costs.

- Electrolyser costs constitute 30–50% of total green hydrogen production costs.

- Water Intensive Nature of Electrolysers: Water consumption by electrolyzers is another issue that needs to be discussed. Electrolyzers consume about 9 liters of water to produce 1 kg of hydrogen.

- Thus, seawater electrolysis may be helpful, it requires further development and research work.

- Lack of Harmonised Standards and Codes: Since the industry is in a nascent stage in India, standards and codes for manufacture and safety for the entire chain of green hydrogen is required to be put in place.

- India’s standards allow the use of biomass which also results in carbon emissions for the production of green hydrogen.

- Moreover, diverting scarce renewable energy capacity towards the production of green hydrogen means inadequate clean electricity being made available for consumers.

- Inadequate Hydrogen Infrastructure: The existing hydrogen infrastructure is insufficient to promote the larger acceptance of fuel cell vehicles.

- Currently, India has only two established hydrogen refueling stations at the Indian Oil R&D Center, Faridabad, and the National Institute of Solar Energy, Gurugram.

Initiatives for Green Hydrogen Production In India: Policies and Alliances Shaping the Future

- National Green Hydrogen Mission (Jan 2023): The mission envisages the substitution of grey hydrogen with green hydrogen in industries such as fertilizer production, petroleum refining, steel, shipping etc.

- Aims: To achieve a green hydrogen production capacity of at least 5 MMT per annum and an additional renewable energy capacity of about 125 GW by 2030.

- Green Hydrogen Policy, February 2022: It has been framed to aid in the reduction in the landed costs of renewal power and to encourage the transition from fossil fuel to green hydrogen/green ammonia

- Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme: It will provide financial incentives for domestic manufacturing of electrolyzers and green hydrogen production.

- Exemption of Inter-State Transmission Charges: The government has exempted inter-state transmission charges for 25 years for producers of green hydrogen and green ammonia for projects commissioned before December 31, 2030.

- Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules, 2022: These facilitate renewable energy supply through open access for green hydrogen production.

- India Hydrogen Alliance: The India H2 Alliance is an industry coalition of global and Indian companies committed to creating a hydrogen value chain and working towards a Net-Zero pathway.

|

Green Hydrogen in India: Navigating the Path to Sustainable Production and Adoption

- Renewable Energy Capacity Addition: India’s renewable energy potential can support its goals for green hydrogen growth but needs rapid capacity addition.

- The country’s solar energy potential is estimated at 748 gigawatts (GW) at full capacity.

- However, currently, the total installed solar capacity in India stands at 72.31 GW as of November 2023, or 9% of its total potential.

- Reducing the Cost of Producing Green Hydrogen: This includes

- Renewable energy incentives and tariffs: For example, the Solar Energy Corporation of India (SECI) recently achieved a cost of INR 2.6 /kWh through standalone solar and wind tender tariffs while tenders for RTC renewable energy stand at INR 4–4.5 /kWh.

- SECI is an organization that facilitates renewable energy capacity development under the Ministry of New and Renewable Energy.

- Scale and Innovation in Electrolysers: This can be done by increasing direct subsidies for early adopters.

- For example, the USA has announced, under the Inflation Reduction Act (IRA), a tax credit of up to $3/kg of hydrogen.

- Supporting long capital investment cycles for technologies with long-term clarity on policies and incentives

- Encouraging the development and testing of indigenous electrolyser technology.

- Disincentivize Carbon-Intensive Alternatives: Local, regional and national governments in India might consider diverting their current spending on fossil-fuel subsidies to projects supporting green hydrogen production and infrastructure-building.

- For example, Europe has included green hydrogen under the Emissions Trading System.

- Reduce or eliminate costs related to green hydrogen conversion, storage, and transport:

- Energy Conversion: In the short to medium term, allow/encourage companies to form clusters and bid for PLIs/other incentive schemes.

- Transports: Investing in long-term infrastructure construction, including pipelines for transporting green hydrogen throughout the country.

- For example, the European Union’s European Hydrogen Backbone program aims to develop a pipeline network in the EU.

- Storage: Storage accounts for roughly 30–40% of total RTC renewable energy costs. This can be reduced by interventions for energy storage systems throughout the country. .

- Developing Harmonised Standards: Work with other countries/global organizations to develop harmonized global standards (and/or the ability to certify green hydrogen made in India according to importers’ norms).

![]() 13 Jan 2024

13 Jan 2024

Green hydrogen can abate at least 50 MMTPA of greenhouse gases by 2030.

Green hydrogen can abate at least 50 MMTPA of greenhouse gases by 2030.