The GST Council has set up a 13-member Group of Ministers (GoM) to suggest the GST rate on premiums for various health and life insurance products.

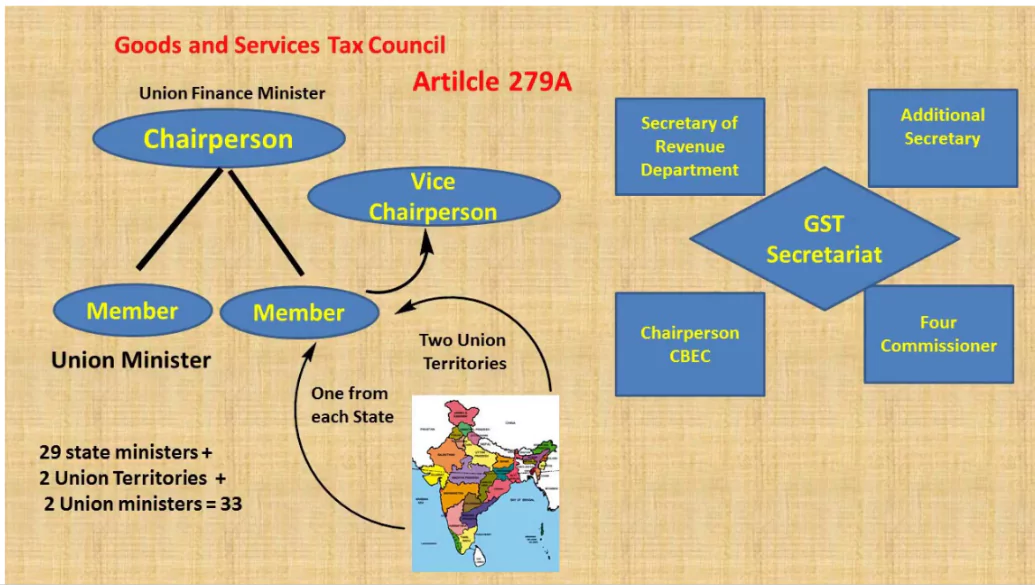

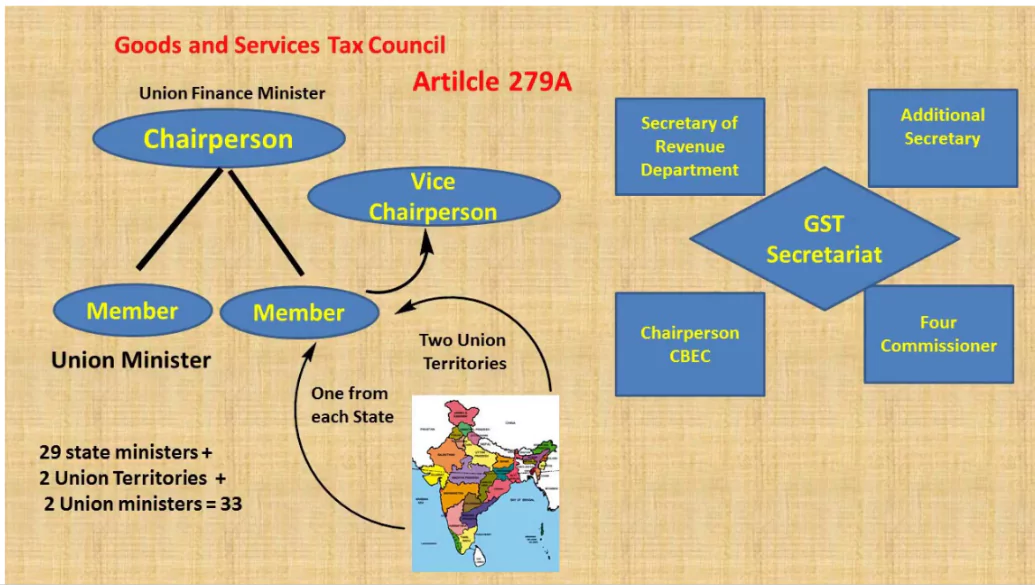

What is the GST Council?

- The GST Council is a constitutional body in India that oversees all aspects of the Goods and Services Tax (GST).

- Chaired by the Union Finance Minister, it includes finance ministers from all Indian states.

- Key Responsibilities:

- Tax Rate Decisions: Determines GST rates for goods and services.

- Law Amendments: Reconciles and enacts laws and regulations related to GST.

- Compliance: Sets deadlines for GST returns and compliance requirements.

- Special Provisions: Considers special rates and provisions for different states.

- Uniformity: Ensures consistent tax rates across the country.

Enroll now for UPSC Online Classes

About GoM (2024)

- It was established following the 54th GST Council meeting to examine the existing GST structure for life and health insurance.

- It includes members from 12 other states too .

- Bihar Deputy Chief Minister Samrat Choudhary is the convenor of the GoM.

- Current Tax Rate: Currently, an 18% GST is levied on insurance premiums.

- Terms of Reference (ToR) for GoM

- Health/Medical Insurance:

- Assess GST rates for individual, group, family floater, and other types of health insurance.

- Consider different categories such as senior citizens, the middle class, and people with mental illness.

- Life Insurance:

- Evaluate tax rates for term insurance, life insurance with investment plans, and re-insurance.

- Include both individual and group policies in the review.

State Demands and Concerns

- Complete Exemption: Opposition-ruled states, such as West Bengal, demanded the removal of GST on health and life insurance premiums.

- Lower Tax Rate: Some states advocated for a reduced GST rate of 5%.

- Unfair Taxation: Transport Minister Nitin Gadkari argued against the imposition of GST on life insurance premiums, stating that “levying GST on life insurance premium amounts to levying tax on the uncertainties of life.”

Status of Revenue from Insurance GST

- In 2023-24, the centre and states collected:

- Rs 8,262.94 crore from GST on health insurance premiums.

- Rs 1,484.36 crore from GST on health reinsurance premiums.

- Response from Finance Minister: The Finance Minister noted that 75% of GST collected goes to the states and urged opposition leaders to engage their state finance ministers to present proposals to the GST Council.

Check Out UPSC NCERT Textbooks From PW Store

![]() 16 Sep 2024

16 Sep 2024