The conclusion of the India-European Union Free Trade Agreement (FTA) on January 27, 2026, marks a historic pivot in India’s trade strategy.

- Often called the “mother of all deals,” it creates a unified market for 2 billion people and serves as a critical strategic counterweight to rising U.S. trade protectionism.

More on the News

- The 16th India–EU Summit, held in New Delhi in January 2026, marked a major milestone with the conclusion of negotiations on the India–EU Free Trade Agreement, aimed at deepening bilateral strategic and economic ties.

- The FTA pact was finalized by Prime Minister Narendra Modi and European Commission President Ursula von der Leyen, who attended as the Chief Guest for India’s 77th Republic Day.

- Watershed Moment: The conclusion follows nearly 20 years of intermittent talks (started in 2007, resumed in 2022).

- Diversification: The deal is seen as a strategic hedge against global trade volatility and the “China-plus-one” strategy.

- Ratification: The agreement now moves to “legal review” and translation, with expected entry into force by late 2026 after parliamentary approvals on both sides.

About the Towards 2030 Agenda

- The “Towards 2030: Joint India-EU Comprehensive Strategic Agenda” is a five-year roadmap designed to transition the relationship from a trade-focused partnership to a deep strategic alliance.

- Adopted at the 16th India-EU Summit, it provides a “Plan Action” to navigate a world of geopolitical uncertainty and economic protectionism.

- Pillar One- Prosperity and Sustainability:

- FTA Implementation: Full operationalization of the India-EU Free Trade Agreement to unlock a $24 trillion market.

- Green Transition: Creation of the India-EU Green Hydrogen Task Force and the 2026 Wind Business Summit to lead global decarbonization.

- Carbon Compliance: Mutual alignment of India’s Carbon Credit Trading Scheme (CCTS) with the EU’s CBAM to ensure Indian exports remain competitive.

- Pillar Two- Technology and Innovation:

- TTC Centrality: The Trade and Technology Council (TTC) becomes the core platform for Economic Security and Research Security.

- Deep-Tech Collaboration: Joint development of Semiconductors, 6G, and Quantum Computing to build “trustworthy supply chains.”

- Horizon Europe: Exploratory talks for India to join the Horizon Europe research fund as an Associate Member.

- Pillar Three- Security and Defence:

- Security Pact: The launch of a formal Security and Defence Partnership to tackle maritime threats in the Indo-Pacific.

- Industrial Co-production: Moving from “buyer-seller” to Joint R&D and co-development of defense hardware (e.g., drones and sensors).

- Cyber & Space: Enhanced cooperation through the CBI-Europol pact and the ISRO-ESA joint space exploration mission.

- Pillar Four- Connectivity and Global Challenges:

- IMEC Corridor: Fast-tracking the India-Middle East-Europe Economic Corridor as a strategic alternative to non-transparent infrastructure projects.

- Global Gateway: Utilizing the EU’s €300 billion Global Gateway fund for “quality infrastructure” in India and trilateral projects in Africa.

- Pillar Five- Enablers (Skills and Mobility):

- European Legal Gateway: Opening the first dedicated office in India to facilitate legal labor mobility for ICT and healthcare professionals.

- Mutual Recognition: A 2030 target to ensure Indian professional qualifications are automatically valid across all 27 EU member states.

|

About India–European Union Free Trade Agreement

- Background: The relationship was upgraded to a Strategic Partnership in 2004. The FTA is the economic cornerstone of the new “Towards 2030: Comprehensive Strategic Agenda” which replaces the 2025 Roadmap.

- Framework Shift: Moves from purely advisory cooperation to a binding, rules-based regime with mandatory dispute settlement and sustainability chapters.

PWOnlyIAS Extra Edge:

The “US Factor”

- Strategic Hedging: The FTA acts as a geopolitical buffer against US trade volatility.

- With Washington imposing 50% “reciprocal” tariffs on Indian goods (Aug 2025), the EU provides a stable, rules-based alternative.

- The “Trump Factor” Catalyst: Aggressive “America First” protectionism and the US-EU Greenland dispute served as the “final push” that broke a 20-year negotiation deadlock.

- Market Diversification: India is reducing its over-dependence on the US market (where it holds a $45.8B surplus at risk of sanctions) by pivoting toward the €22.5 trillion EU market.

- Regulatory Sovereignty: By aligning with EU standards, India and Europe are creating a “Third Pole” in global trade, ensuring they aren’t forced to choose between US transactionalism and Chinese coercion.

|

Key Outcomes of the India–European Union Free Trade Agreement

- Landmark Tariff Elimination and Market Access: The agreement removes duties on over 90% of bilateral trade, creating a near-transparent border for goods.

- EU Commitments: The European Union will eliminate Customs Duties on 99.5% of Indian export value.

- This includes a $33 billion boost for Labour-Intensive Sectors such as Textiles and Apparel, Leather and Footwear, and Gems and Jewellery, which will now enter the EU at 0% duty.

India’s Commitments: India will phase out duties on over 90% of EU goods.

India’s Commitments: India will phase out duties on over 90% of EU goods.

- Prohibitive tariffs on Machinery (up to 44%), Chemicals (up to 22%), and Pharmaceuticals (up to 11%) will be mostly abolished, saving European exporters approximately €4 billion annually.

- Calibrated Opening for Automobiles, Wines, and Spirits: To balance “Make in India” interests with EU export demands, these high-value sectors follow a phased reduction:

- Luxury Vehicles: For cars priced above €15,000, India will slash Import Tariffs from 110% to 10% over five years.

- This is capped at a Tariff Rate Quota (TRQ) of 250,000 units per year.

- Wines and Spirits: Tariffs on Wines will drop from 150% to a range of 20%–30% for premium labels.

- Spirits will see a reduction to 40%, significantly lowering prices for European brands in India.

- Services Sector and Global Professional Mobility: The pact secures a future-ready framework for “Mode 4” (movement of natural persons):

- Binding Access: India gains access to 144 EU sub-sectors (including IT, R&D, and Finance), while the EU gains access to 102 Indian sub-sectors.

- Talent Mobility: The deal provides uncapped mobility for Indian Students and simplified visas for Independent Professionals and Intra-Corporate Transferees (ICTs), including entry rights for their dependents.

- AYUSH Recognition: In a niche win, Traditional Medicine Practitioners gain legal certainty to practice in EU states where regulations do not currently exist.

- Sustainability and the CBAM Framework: The Trade and Sustainable Development (TSD) chapter links commerce to environmental and labor standards:

- Green Transition: The EU has pledged €500 million in financial support to help Indian industries decarbonize and align with the Paris Agreement.

- CBAM Assurance: While India did not receive a total exemption from the Carbon Border Adjustment Mechanism (carbon tax), it secured a “Most-Favored-Nation” (MFN) assurance and a technical cooperation group to help exporters verify their carbon footprints.

About Carbon Border Adjustment Mechanism (CBAM)

- Refers: A European Union climate-linked trade instrument that levies a carbon cost on imports based on their embedded emissions, aimed at preventing carbon leakage.

- Objective: Creates a level playing field between EU producers regulated under the EU Emissions Trading System (ETS) and foreign exporters with weaker carbon constraints.

- Coverage & Timeline: Applies to iron & steel, aluminium, cement, fertilisers, hydrogen, electricity;

- Transition phase (2023–25) with reporting only; full implementation from 2026.

|

- Strategic Exclusions and Protections: Sensitive sectors are shielded to protect rural livelihoods and domestic food security:

- Agriculture: Both sides have rigorous “negative lists.” India has excluded Dairy, Wheat, Rice, and Poultry from any tariff cuts. Conversely, the EU has excluded Beef, Sugar, and Rice to protect its own farmers.

- Geographical Indications (GI): A parallel agreement ensures enhanced protection for iconic products like Darjeeling Tea and Champagne, preventing unauthorized imitations in either market.

Significance of India-EU FTA

- Economic Transformation and Market Dominance: The FTA provides a massive stimulus to India’s manufacturing and agricultural sectors by removing long-standing trade barriers.

- Unprecedented Market Access: The European Union will grant Preferential Access (zero or reduced tariffs) to 99.5% of Indian exports by value.

- This is expected to accelerate exports worth over ₹6.4 lakh crore ($75 billion).

- Revival of Labour-Intensive Sectors: Industries such as Textiles and Apparel, Leather, Footwear, and Gems and Jewellery—which previously faced duties of 10–12%—will now enter the EU at 0% duty.

- This levels the playing field against competitors like Vietnam and Bangladesh.

- Agricultural Breakthrough: Preferential access for Tea, Coffee, Spices, and Marine Products (with shrimp tariffs cut from 26% to zero) will directly bolster rural incomes and strengthen India’s role as a global food supplier.

- Industrial Modernization: By eliminating duties on European Machinery and Chemicals, Indian manufacturers gain access to cheaper, high-tech inputs, fostering domestic industrial upgrading.

- Strategic Resilience and Geopolitics: Beyond balance sheets, the deal acts as a critical buffer in an increasingly volatile global trade environment.

- Trade Diversification & Hedging: The FTA serves as a Strategic Hedge against global uncertainties and shifting United States Tariff Policies.

- It reduces over-reliance on any single trading partner by diversifying India’s export basket.

- “China-Plus-One” Anchor: By aligning regulatory standards, the pact positions India as a trusted, Rules-Based Manufacturing Alternative for European supply chains, particularly in sensitive sectors like Semiconductors and Green Technology.

- The “Quality Overhaul”: Adopting EU standards (the “Brussels Effect”) acts as a catalyst for Indian goods to meet global benchmarks, making them more competitive in other high-standard markets like Japan and the US.

- Developmental Impact- Viksit Bharat @2047: The agreement is a core engine for India’s long-term vision of becoming a developed nation.

- Service and Talent Mobility: India gains access to 144 EU Services Sub-sectors (IT, Healthcare, R&D).

- A landmark Mobility Framework simplifies visas for professionals and grants 9-month post-study work rights for Indian students across all 27 EU nations.

- Green Transition Support: To navigate the Carbon Border Adjustment Mechanism (CBAM), India secured a €500 million support package and “Most-Favored-Nation” status, ensuring technical and financial aid for a just green transition.

- Safeguarding the Vulnerable: India successfully maintained Negative Lists for sensitive sectors like Dairy and Cereals, ensuring that small-scale farmers are protected from import surges.

Challenges & Concerns Associated with the India–EU FTA

- Regulatory “Green Protectionism” as Non-Tariff Barriers: The EU is increasingly embedding environmental and labor standards into its trade architecture. Many in India view these not as neutral global norms, but as de-facto trade barriers designed to protect European industries.

- Carbon Border Adjustment Mechanism (CBAM): Starting in 2026, this “carbon tax” targets high-emission sectors.

- Indian Steel, Aluminium, and Chemicals could face a tax equivalent of 20–35%, potentially erasing all financial advantages gained from the removal of import duties.

- EU Deforestation Regulation (EUDR): This mandates that imports like Coffee, Rubber, and Wood must not originate from land deforested after 2020.

- For India’s millions of Smallholder Farmers, the requirement to geotag plots and provide end-to-end traceability is an unaffordable compliance burden that risks excluding them from the European market.

- Corporate Sustainability Due Diligence (CSDDD): Effective from 2027, this directive requires companies to audit their entire value chains for environmental and human rights risks.

- Indian manufacturers are wary of Sharing Sensitive Supplier Data, which they perceive as a significant Business and Confidentiality Risk.

- Industrial Accelerator Act (IAA): This proposed legislation may introduce “Local Content Norms” (minimum domestic value addition) within the EU.

- Such mandates could suppress demand for Indian-made components and finished goods in favor of “Made-in-Europe” alternatives.

- Asymmetry in Market Access and Concessions: A core criticism of the deal is the Disproportionate Liberalization required from the Indian side compared to the marginal gains received.

- Pre-existing Low EU Tariffs: Before the FTA, nearly 75% of Indian exports already entered the EU with less than 1% tariff.

- Consequently, the “unprecedented access” touted in the deal offers limited room for actual growth compared to the status quo.

- High-Tariff Disparity: India’s average tariffs (10–12%) are significantly higher than the EU’s (3–4%).

- To reach a “zero-duty” regime, India must provide deep and painful tariff cuts on European luxury goods, machinery, and agri-products, while the EU’s reciprocal cuts are much shallower.

- Third-Country Competition: Nations like Bangladesh, Vietnam, and Ethiopia already enjoy zero-duty access to the EU through other trade schemes.

- Even with the FTA, Indian exporters will still face intense price competition from these established zero-duty players.

- Lack of Regulatory Parity: Indian negotiators have raised concerns regarding a “Double Standard” in the EU’s environmental enforcement.

- The US Carve-out: The EU has previously granted certain exemptions and carve-outs to the United States regarding environmental regulations.

- The Parity Argument: Indian experts argue that if “large polluters” in the West receive leniency, imposing rigid compliance on a developing economy like India creates an uneven playing field.

- India continues to push for MFN (Most-Favored-Nation) Parity on any exemptions granted to other major powers.

- EU Concerns- Quality Control Orders (QCOs): Conversely, the EU has its own grievances regarding India’s domestic legal landscape.

- Mandatory Standards: The EU views India’s Quality Control Orders (QCOs)—which require mandatory certification and physical facility audits by Indian officials—as deliberate obstructions to market access.

- The Barrier Debate: Brussels argues these standards are technically restrictive and lack transparency, while New Delhi maintains they are essential to ensure the Safety and Reliability of products sold to Indian consumers.

PWOnly IAS Extra Edge:

About India–European Union Relationship

- The India-EU relationship is a comprehensive strategic partnership rooted in shared values like democracy, rule of law, multilateralism, and a rules-based international order.

- It has grown into a multifaceted engagement spanning trade, investment, security, technology, climate action, and more.

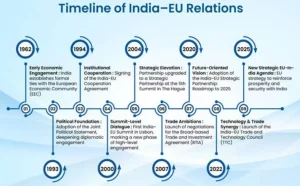

- Historical Background: India established diplomatic relations with the European Economic Community (predecessor to the EU) in 1962, one of the earliest such ties.

- 1993: Joint Political Statement signed.

- 2000: First India-EU Summit in Lisbon, launching regular summit-level dialogue.

- 2004: Upgraded to Strategic Partnership at The Hague Summit.

- Since 2004, 15 summits have been held prior to the landmark 16th EU-India Summit in New Delhi in January 2026.

- The relationship has deepened significantly after 2020 due to geopolitical shifts, supply-chain diversification, and Indo-Pacific focus.

- Key Institutional Mechanisms:

-

- India-EU Trade and Technology Council (TTC): Launched February 2023 (announced April 2022); coordinates on trade, trusted technology, digital, green tech, and security.

- Connectivity Partnership: Launched 2021; covers transport, digital, energy, and people-to-people ties.

- India-Middle East-Europe Economic Corridor (IMEC): Announced September 2023 with partners.

Economic and Trade Ties

- Bilateral trade volume reached approximately, making the EU India’s largest goods trading partner.

- The EU is one of India’s largest trading partners, with bilateral trade in goods with the EU worth $136.53 billion in 2024-25 (exports worth $75.85 billion and imports at $60.68 billion).

- The EU market accounts for about 17% of India’s total exports, and EU’s exports to India constitute 9% of its total overseas shipments.

- Growth: Nearly 90% increase over the past decade.

- Investment: EU is the leading foreign investor in India (FDI stock €140.1 billion in 2023, up from €82.3 billion in 2019); more than 6,000 European companies are currently operating in India.

About the European Union (EU)

- The European Union is an economic and political union of 27 European countries.

- They work together to promote peace, stability, prosperity, and shared values.

- Founded: Began in 1951 (as the European Coal and Steel Community) with 6 founding members; evolved into the modern EU through treaties like the Treaty of Rome (1957) and Lisbon Treaty (2009).

- Member States: 27 countries (United Kingdom left in 2020 via Brexit).

- Currency: The euro (€) is used by 21 member states of the Eurozone (recent addition: Bulgaria adopted the euro on January 1, 2026).

- Key Institutions: The EU has a unique transnational structure with shared decision-making.

- European Commission: Acts as the executive; proposes laws, enforces EU rules, manages the budget.

- European Parliament: Directly elected by citizens; co-legislates and approves the budget.

- European Council: Heads of state/government set overall political direction and priorities.

- Court of Justice of the European Union: Ensures uniform application of EU law.

- European Central Bank: Manages the euro and monetary policy for the eurozone.

|

Way Forward

- Establishing a Dispute Mitigation Framework: To prevent regulatory friction from freezing trade, a Rapid Response Forum will be activated by late 2026.

- Technical Filter: Instead of immediate legal battles, this body will address technical disputes (like Quality Control Orders or food safety audits) at the expert level.

- Conformity Recognition: A priority is achieving Mutual Recognition Agreements (MRAs). This would allow Indian testing labs to be certified by European authorities, ensuring a “tested once, accepted everywhere” system for Indian exporters.

- Harmonizing the “Green Trade” Transition: Rather than fighting the EU’s environmental shift, India is positioning itself to lead the Green Supply Chain.

- CBAM Integration: India is working to align its domestic Carbon Credit Trading Scheme (CCTS) with the EU’s requirements.

- By ensuring carbon taxes paid in India are credited against the Carbon Border Adjustment Mechanism, exporters can avoid double-taxation and maintain price competitiveness.

- Traceability as a Service: To help smallholders comply with the Deforestation Regulation (EUDR), India is deploying Digital Public Infrastructure (DPI).

- This uses satellite imagery and blockchain to provide low-cost, verifiable geotagging for crops like coffee and rubber.

- Deepening Digital and Technological Synergy: The Trade and Technology Council (TTC) will drive the “future-tech” portion of the agreement:

- “Silicon Corridor”: Implementing joint R&D and manufacturing for Semiconductors and Artificial Intelligence, reducing reliance on non-aligned third nations.

- Data Flow Reconciliation: Bridging the gap between India’s Digital Personal Data Protection (DPDP) Act and the EU’s GDPR.

- Achieving a “Data-Secure” status for India would eliminate the “compliance tax” currently paid by Indian IT firms.

- Institutional Support for MSMEs: Small and Medium Enterprises often lack the legal teams needed to navigate complex European directives.

- European Legal Gateway Office: Launched in New Delhi in early 2026, this hub acts as a “single window” to guide Indian firms through the Corporate Sustainability Due Diligence (CSDDD) requirements.

- Financial Catalyst: Utilizing the €500 million EU climate fund to subsidize the technological transition of labor-intensive clusters (textiles, leather), ensuring they meet global sustainability benchmarks without losing their edge.

Conclusion

The India–EU FTA is the “Mother of All Deals” because it represents a choice, a choice for openness over protectionism and collaboration over competition. As implementation begins throughout 2026, the success of the pact will depend on how effectively both sides utilize the newly created Consultation Mechanisms to resolve friction before it becomes a barrier.

![]() 29 Jan 2026

29 Jan 2026

India’s Commitments: India will phase out duties on over 90% of EU goods.

India’s Commitments: India will phase out duties on over 90% of EU goods.