Recently, U.S. President Donald Trump has imposed a 25% tariff on Indian imports, citing India’s trade with Russia (especially oil) as a concern.

- India has strongly responded, highlighting Western hypocrisy and asserting its energy security needs.

India–US Trade Tensions Key Issues Raised

- Tariff Imposition

- Trump’s Allegation: India profiting from reselling Russian oil; ignoring Ukraine war casualties.

- Tariff Decision: 25% tariff plus additional penalties on Indian imports—effective from August 7.

- Tariff Fallacy: U.S. tariffs are technically paid by U.S. importers, not India.

- India’s Oil Imports from Russia: MEA’s Stand

- India’s Russian oil imports began after Western sanctions diverted traditional suppliers.

- Imports were encouraged by the U.S. to stabilize global energy markets.

- Aimed at ensuring affordable, predictable energy for Indian consumers.

India’s Counterarguments

- EU and U.S. continue higher trade with Russia compared to India:

- EU-Russia trade (2024): €67.5 billion (goods) + €17.2 billion (services, 2023).

- U.S. imports from Russia: Uranium hexafluoride (nuclear industry), palladium (EVs), fertilizers, and chemicals.

- Strategic & Economic Autonomy

- India defends its right to independent foreign policy and trade choices.

- Highlights the disproportionate targeting compared to EU and U.S. trade volumes with Russia.

- Global Energy Context

- Post-Ukraine war energy markets became volatile.

- India prioritized domestic economic stability and consumer welfare.

- Russian oil helped cushion global oil price shocks.

Economic Impacts of India-U.S. Trade Tensions

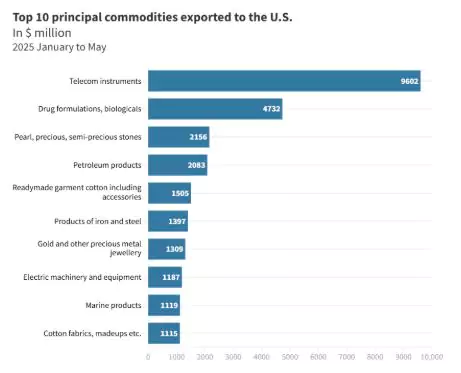

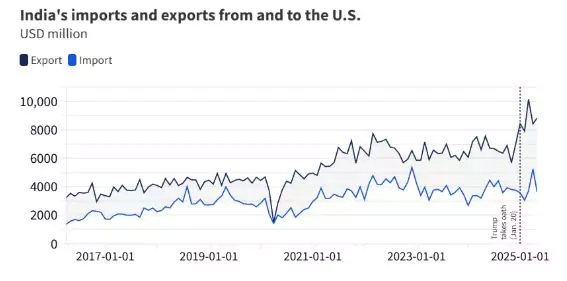

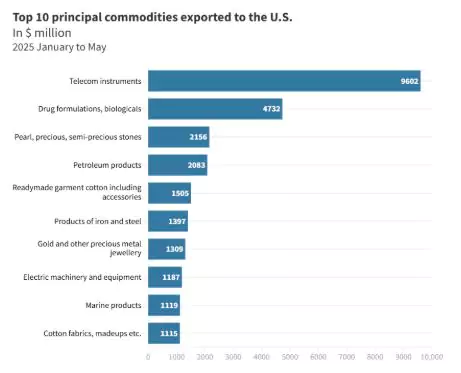

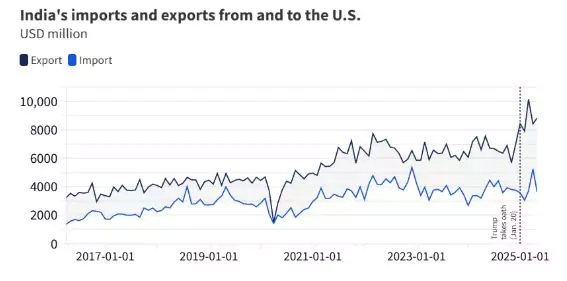

- Disruption of Bilateral Trade Flow: The 25% tariff on Indian goods could reduce India’s $45.7 billion trade surplus with the U.S. in 2024.

- Sectors like garments, jewelry, and electronics may face price hikes, affecting their competitiveness in the U.S. market.

- Export Sectors Vulnerable to Tariff Hikes: India’s aluminum and textile exports to the U.S. could be significantly impacted by tariffs, reducing competitiveness in key sectors.

- The $10.8 billion textiles sector is especially vulnerable.

- Energy Sector Implications: Higher tariffs could increase the cost of U.S. oil imports, which have seen significant growth.

- This will make it difficult for India to maintain energy security without rising costs.

- Economic Growth and GDP Impact: The tariffs are predicted to reduce India’s GDP by 0.3% in FY 2026.

- This will primarily affect inflation and industrial output in the short term.

- Shifting Supply Chains and Market Diversification: India may look to diversify its trade partnerships with China, Brazil, and the EU due to U.S. tariffs.

- The shift will help reduce reliance on the U.S. market.

- Short-Term Economic Imbalance: The MSME sector and industries like agriculture will bear the brunt of the tariffs.

- This could lead to job losses and reduced growth, especially in rural areas.

Strategic Implications of India-U.S. Trade Tensions

- Geopolitical Strain Over Energy and Defense Ties: The U.S. views India’s energy purchases from Russia and defense ties as problematic, increasing tensions.

- India’s strategy of strategic autonomy by engaging with both the West and Russia has strained its relations with the U.S..

- India’s Strategic Autonomy and Global Positioning: India continues to maintain its strategic autonomy, engaging with Russia, Iran, and the U.S. simultaneously.

- This balancing act often causes friction, especially as the U.S. views such engagements as undermining its position in global geopolitics.

- U.S. Concerns About India’s Global Role: The U.S. has expressed concerns over India’s rising global influence, particularly within BRICS and its dealings with Iran and Russia.

- India’s increasing global assertiveness challenges the U.S.’s vision of global order and its own regional dominance.

- Impact on India-U.S. Defense and Strategic Cooperation: While defense ties between India and the U.S. have grown, these tensions may slow down military collaborations or introduce new barriers to arms trade.

- Tariffs could disrupt existing defense agreements or procurement of key U.S. defense platforms.

- The $20 billion defense trade may face delays or higher costs for key military systems like Apache helicopters

- Risk of Economic Coercion and Global Trade Alignment: The tariffs signal U.S. attempts at economic coercion, aiming to force India to align more closely with its policies on Russia and trade practices.

- This could lead to India reconsidering its broader trade alignments, potentially seeking new trade partners outside the U.S. sphere.

- China-U.S.-India Triangular Relations: As the U.S. grows closer to China and Pakistan, India’s role as a counterweight to China becomes more significant.

- This evolving triangular dynamic complicates India-U.S. relations as India’s strategic interests in the Indo-Pacific and beyond clash with U.S. policies.

- Influence of Domestic Nationalism on Foreign Policy: The rise of nationalist sentiments in both the U.S. and India shapes foreign policy, leading to trade and defense tensions.

- Domestic politics in both countries may continue to fuel such strategic clashes, limiting diplomatic flexibility.

Previous Sanctions and Tax Impositions on India by the USA

- 1974, Peaceful Nuclear Explosion (PNE): India conducted its first nuclear test, “Smiling Buddha,” in 1974, prompting U.S. concerns over nuclear proliferation.

- Sanctions:

- Suspension of U.S. economic and military aid under the Foreign Assistance Act.

- Pressure from the U.S. led to the formation of the Nuclear Suppliers Group (NSG) to control nuclear exports.

- 1998, Pokhran-II Nuclear Tests: India conducted five nuclear tests in May 1998, triggering global condemnation.

- Sanction imposed under the Glenn Amendment of the Arms Export Control Act, targeting economic, military, and technological cooperation.

- Section 232 (Trade Expansion Act of 1962) Tariffs (2018): U.S. imposed tariffs on steel (25%) and aluminum (10%) imports globally, including from India, citing national security.

-

- Affected India’s steel and aluminum exports, worth ~$1 billion annually.

- Withdrawal of Generalized System of Preferences (GSP) (2019): In June 2019, the U.S. terminated India’s eligibility for the Generalized System of Preferences (GSP).

- The GSP allowed duty-free entry for certain Indian goods, but the U.S. cited India’s trade barriers and lack of market access for U.S. products as the reason for its revocation.

- Sanctions on Indian Entities: In 2018, the U.S. imposed sanctions on Indian entities like Indian entities purchasing defense systems from Russia under the Countering America’s Adversaries Through Sanctions Act (CAATSA).

- These sanctions were triggered by India’s purchase of S-400 missile defense systems from Russia.

India-U.S. Trade & Economic Relations

- Bilateral Trade Overview

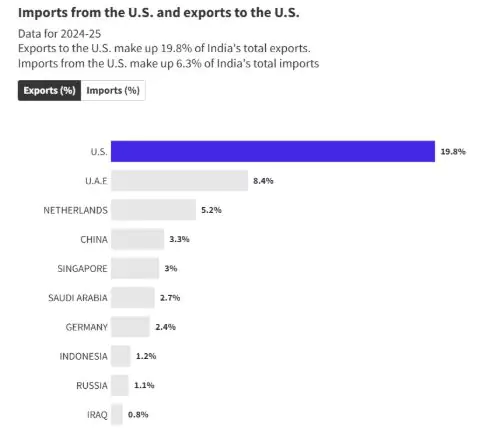

- Total Trade: $190.1 billion in 2023, making the U.S. India’s largest trading partner.

- India’s Exports to U.S.: $83.8 billion (2023), including merchandise ($83.7B) and services ($36.3B).

- U.S. Exports to India: $69.98 billion (2023), with a drop in exports compared to previous years.

- Foreign Direct Investment (FDI)

- U.S. as India’s FDI Source: Third largest source, contributing $4.99 billion in FY 2023-24, 9% of total FDI.

- Indian Investment in U.S.: Over $40 billion, creating 425,000 direct jobs.

- Investment Cooperation

- DFC Partnership: India signed an agreement with the U.S. Development Finance Corporation for equity investments and technical assistance.

- Small and Medium Enterprises (SMEs): MoU signed in August 2024 to improve global participation through mutual visits and expertise exchange.

- Energy & Clean Energy Partnership

- Climate & Clean Energy Agenda: Focuses on renewable energy, energy storage, and emerging technologies.

- Energy Trade: U.S. is India’s sixth-largest energy partner with a trade worth $13.6 billion in FY 2023-24.

Trade Dialogue Mechanisms in India-U.S. Relations

- India-U.S. Trade Policy Forum (TPF): Established in 2005, the TPF addresses market access and trade-related issues between India and the U.S.

- The 14th TPF was held in New Delhi in January 2024, focusing on resolving trade conflicts and enhancing bilateral cooperation.

- India-U.S. Commercial Dialogue: Co-chaired by India’s Commerce and Industry Minister and the U.S. Secretary of Commerce, the Commercial Dialogue covers commercial cooperation in sectors like standards, ease of doing business, and travel & tourism.

- The 5th Commercial Dialogue was held in New Delhi in 2023, and the 6th took place in Washington DC in 2024.

- India-U.S. CEO Forum: The forum brings together CEOs from both countries to discuss economic opportunities, trade barriers, and key sectors for collaboration.

- The forum meets on the sidelines of the Commercial Dialogue, with the latest meeting held in Washington DC on October 2, 2024.

- India-U.S. Information and Communications Technology (ICT) Dialogue: A working group established in 2005 to foster cooperation in the electronics and IT sectors.

- The latest meeting was held in October 2024 in New Delhi, focusing on technology collaboration and digital trade.

- India-U.S. Economic and Financial Partnership (EFP): This dialogue, co-led by the Finance Minister and U.S. Secretary of Treasury, addresses financial and regulatory matters.

- The 9th EFP Ministerial Dialogue took place in November 2022 in New Delhi, followed by the 11th Financial and Regulatory Dialogue in March 2023.

- Indo-Pacific Economic Framework (IPEF): India joined the IPEF in May 2022, focusing on strengthening supply chain resilience, promoting a fair economy, and advancing clean energy.

- IPEF Ministerial meetings were held in March and June 2024, with India signing IPEF Pillars 3, 4, and the Overarching Agreement.

Way Forward for India-U.S. Trade Relations

- Focus on Trade Negotiations: India and the U.S. need to engage in constructive dialogue to resolve trade disputes, particularly the 25% tariff imposition.

- Bilateral trade agreements can be expanded to ensure fair access for both countries’ markets.

- Diversify Trade Partners: India should diversify its trade relationships with countries like China, Brazil, and the European Union to reduce its dependency on the U.S. market.

- Strengthen Defense and Strategic Ties: Both countries should prioritize defense cooperation despite economic friction.

- Joint military exercises, technology sharing, and defense procurement will help maintain long-term strategic ties.

- Energy Cooperation: Energy security is critical, and India could increase oil and gas imports from the U.S. to reduce trade imbalances.

- Both countries should work on enhancing clean energy cooperation, such as renewable energy technologies and energy storage.

- Resolve Tariff Disputes with Targeted Concessions: India should consider making strategic tariff concessions to address U.S. concerns while protecting vital sectors like agriculture and MSMEs.

- Leverage Multilateral Platforms: India can use forums like IPEF and WTO to advocate for global trade reforms.

- Multilateral cooperation on supply chains and clean energy can also reduce dependency on U.S. tariffs.

- Domestic Economic Reforms: India should continue implementing domestic economic reforms to enhance its manufacturing competitiveness and ensure industries are prepared for any future trade shifts.

- This includes improving infrastructure and expanding value-added exports.

Conclusion

The ongoing India-U.S. trade tensions reflect the complexities of global trade relations shaped by geopolitical and economic interests. To mitigate risks, both nations must engage in strategic dialogue, address mutual concerns, and explore diversified partnerships while ensuring their economic and security priorities are maintained.

![]() 5 Aug 2025

5 Aug 2025