Context:

- This article is based on the news “The price of persistent federal frictions” Which was published in the Hindu. In recent years, disputes between the Centre and States over economic policies have intensified, evolving into persistent frictions in Indian federalism.

Issues in India’s Fiscal Federalism

- In recent times, three issues have emerged as major discussion points in India’s fiscal federalism, leading to back-and-forth exchanges between the Centre and States.

- First is a set of issues related to Goods and Services Tax (GST) such as the rate structure, inclusion and exclusion of commodities, revenue sharing from GST, and associated compensation.

- Second, State-level expenditure patterns are especially related to the welfare schemes of States.

- GoI spends only a fifth of its total expenditure on the social sector. State governments, conversely, devote a higher share to social sector spending.

- In FY 2020-21, 41% of states’ expenditure was on the social sector.

- Third, the conception and the implementation of central schemes.

- Two States, West Bengal and Odisha, and the Union Territory of Delhi are still not on board the Ayushman Bharat scheme leading to a conflict between the centre and States.

About Indian Federalism

- Indian Federalism is a system of government in which the power is divided between a central authority and various constituent units of the country.

- Usually, a federation has two levels of government.

- One is the government for the entire country which is usually responsible for a few subjects of common national interest.

- The others are governments at the level of provinces or states that look after much of the day-to-day administering of their state.

- Both these levels of government enjoy their power independent of the other.

What are the characteristics of Indian federalism?

- Dual Nature of the Indian Constitution: Federal with Unitary Features

- Federal Features: Two governments, division of powers, written Constitution, the supremacy of Constitution, the rigidity of Constitution, an independent judiciary, and bicameralism.

- Unitary Features: Strong Centre, single Constitution, single citizenship, flexibility of Constitution, integrated judiciary, appointment of state governor by the Centre, all-India services, emergency provisions, etc.

- Absence of the Term ‘Federation’ in the Constitution: ‘Union of States’ Concept

- The Constitution avoids using the term ‘Federation.’

- Instead, Article 1 describes India as a ‘Union of States.’

- Implies that the Indian Federation is not a result of state agreement, and no state has the right to secede.

- Descriptions of the Indian Constitution: Balancing Act

- Described as ‘federal in form but unitary in spirit.’

- Coined as ‘quasi-federal’ by K C Wheare, ‘bargaining federalism’ by Morris Jones, and ‘cooperative federalism’ by Granville Austin.

Reason for Conflict:

- Resource sharing:

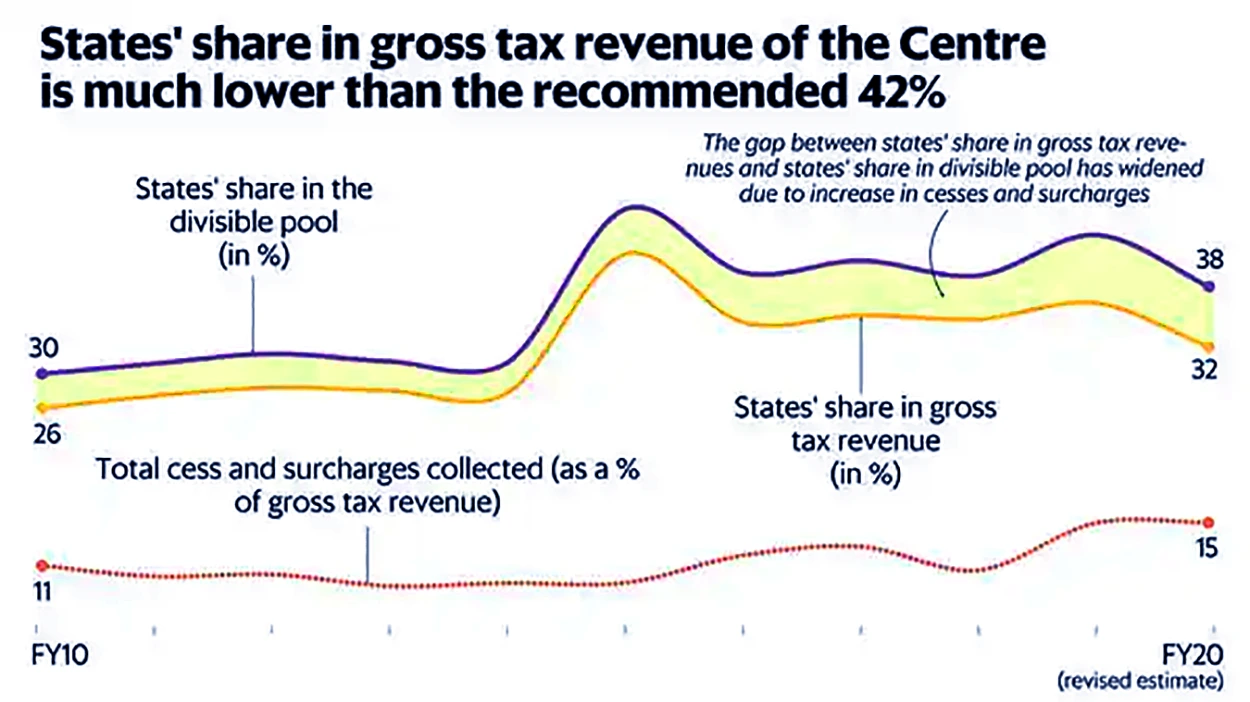

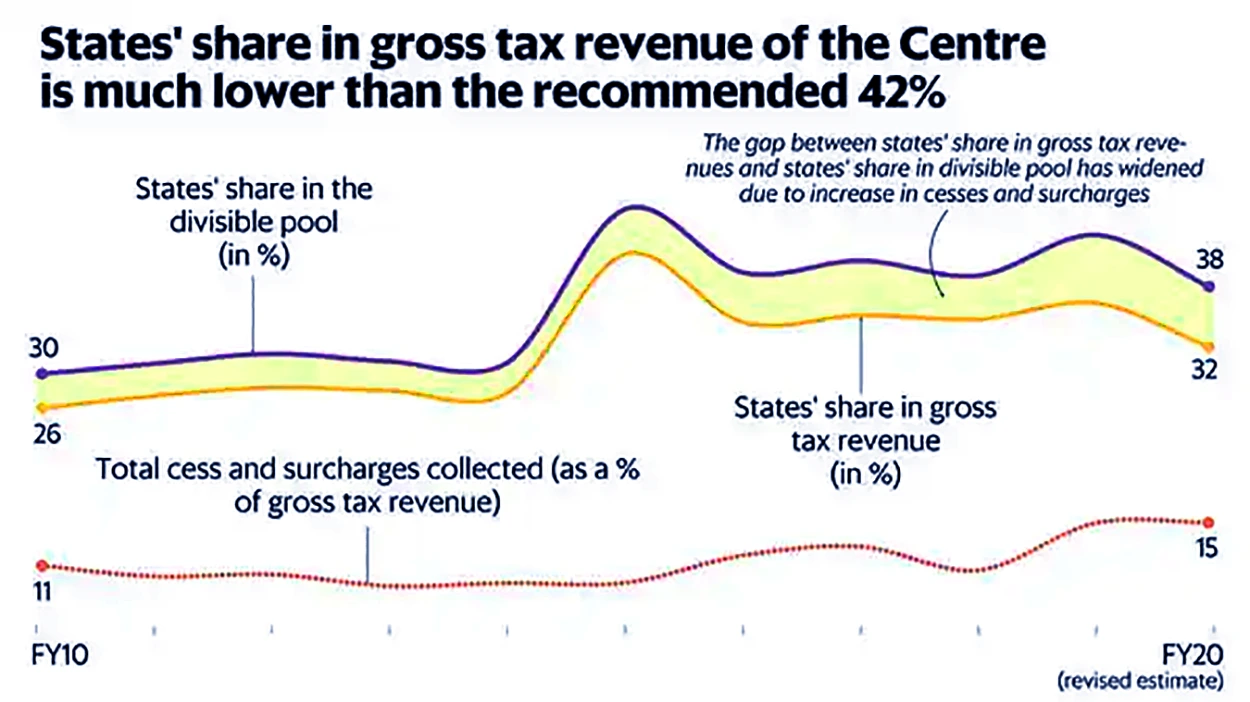

- Continuing economic reforms since 1991 have led to the relaxation of many controls on investments, giving some room to States, but the autonomy regarding public expenditure policies is not absolute as State governments depend on the Centre for their revenue receipts.

- Centralizing Impact of Goods and Services Tax (GST):

- The introduction of GST, replacing state-level sales taxes, gave the Centre significant control. The GST Council’s structure, with the Centre holding one-third of voting rights, effectively grants it veto power, undermining the promised cooperative federalism.

- Neglect of Inter State Council:

- Despite the Government’s commitment to revive the Inter State Council for fostering state cooperation, it was convened only once during the first term of the NDA government, indicating a lack of emphasis on inter-state collaboration.

About Inter-State Council:

- It is a mechanism that was constituted “to support Centre-State and Inter-State coordination and cooperation in India”.

- The Inter State Council was established under Article 263 of the Constitution.

- In 1988, the Sarkaria Commission suggested the Council should exist as a permanent body, and in 1990 it came into existence through a Presidential Order.

- Mandate:

- To create a strong institutional framework to promote and support cooperative federalism in the country.

- Activate the council and zonal councils by organizing regular meetings.

|

- Preference for Centrally Sponsored Schemes:

- The current government resented the centrally sponsored schemes initiated by its predecessor, but supports the ones it initiated.

- Centrally Sponsored Schemes are the schemes that the Centre and states jointly fund.

- Funding Pattern – 60:40 (Centre: State), 90:10 for 8 North-Eastern and 2 Himalayan States

- Example: It shows a positive inclination towards the scheme such as the Swachh Bharat Mission, Pradhan Mantri Awas Yojana, Jan Dhan Yojana and Ujjwala Yojana.

- These Schemes are closely associated with the PM’s image display in promotional materials. The issue arises as these initiatives may be perceived as centrally driven, limiting the autonomy of states in shaping their own developmental agenda.

- Lack of Consultation on Major Decisions:

- Decisions on critical matters, such as demonetization and the initial COVID-19 lockdown, were made without consulting chief ministers, showcasing a tendency towards unilateral decision-making by the Centre.

- Control Over Opposition-Ruled States:

- The Centre’s restrictions on Opposition-ruled states, such as denying permission for foreign aid in the Kerala floods and obstructing Delhi CM’s visit to Singapore, demonstrate a pattern of exerting control over states with political differences.

- Politicization of the Office of Governor:

- The office of the governor, meant to establish a “living connection” between states and the Centre, has witnessed increased politicization.

- Instances like the controversial appointment of a BJP-led government in Goa despite Congress having more MLAs indicate a departure from the constitutional mandate.

Consequences of Centre’s Dominance:

- Crowding Out State Investments:

- Central incursions lead to the Center overshadowing States in investments, evident in infrastructure development where State flexibility is curtailed, impacting capital expenditure.

- Example: The Centre’s expansion of activities, exemplified by initiatives like PM Gati Shakti, centralizes planning for infrastructure projects.

- States, while mandated to align with a national master plan, face reduced flexibility in their own planning.

- Consequently, the capital expenditure of 16 major States on roads and bridges plummeted to 0.58% of the gross state domestic product, while the Centre’s expenditure surged at a compound annual growth rate of 32.3%, concentrating spending in a few large States.

- Inefficiencies from Parallel Policies:

- Federal tensions induce a scenario of ‘parallel policies,‘ where either the Centre or States duplicate each other’s initiatives.

- The case of pension reforms, exemplified by the National Pension System (NPS), sees States initially joining but later rolling back due to a trust deficit.

- The emergence of such parallel schemes is mainly due to the trust deficit prevailing in the federal system, the fiscal costs of which have long-run consequences on the economy.

- Political Partisanship:

- Mutual distrust and electoral competition among rival parties at both the Centre and the states hinder political dialogue and consensus-making, impeding seamless federal cooperation.

- Underutilized Inter-Governmental Institutions:

- Despite the presence of institutions like the Inter-State Council, GST Council, NITI Aayog, and Zonal Council, political divide and suspicion limit their effectiveness in resolving crucial Centre-state and inter-state governance issues.

Steps Taken to Strengthen Cooperative Federalism in India:

- Goods and Services Tax (GST) Implementation:

- GST is a unified tax system that replaced various state-level taxes, creating a common market across the country.

- The GST Council, consisting of representatives from the central and state governments, is responsible for making decisions related to the tax system.

- It enhances economic integration, streamlines taxation, and fosters cooperation between the Centre and States.

- National Institution for Transforming India (NITI Aayog):

- NITI Aayog, dedicated to fostering cooperative federalism and promoting good governance in India, serves as a platform for the Government by uniting States as ‘Team India’ for national development.

- Steps taken include regular meetings between the Prime Minister/Cabinet Ministers and Chief Ministers and subgroups on crucial national subjects.

- NITI Aayog promotes cooperative federalism through initiatives like Development Support Services to States and Union Territories (DSSS) and the Sustainable Action for Transforming Human Capital (SATH) program.

- Inter State Council Reinvigoration:

- Recently, the Inter State Council has been reconstituted with the Prime Minister as Chairman and Chief Ministers of all States, and six Union ministers as members.

- The government has also reconstituted the standing committee of the Inter State Council with the Union Home Minister as Chairman.

Recommendation to Promote Cooperative Federalism:

- Sarkaria Commission Recommendations:

- Coordination and Mutual Consultation: Proposes coordination of policy and action in areas of concurrent jurisdiction through mutual consultation and cooperation for the smooth functioning of the dual system.

- Limitation on Union Government’s Powers: Recommends that the Union government, when exercising powers under the Concurrent List, should limit itself to ensuring uniformity in basic national policy issues.

- National Commission to Review the Working of the Constitution (NCRWC) Recommendations:

- Inter State Council Consultation: Recommends individual and collective consultation with states through the Inter-State Council, established under Article 263 of the Constitution.

- Supreme Court Case:

- S.R. Bommai vs Union of India: Emphasizes that states are not mere appendages of the Union. The Supreme Court underscores the need for the Union government to respect the powers of the states.

- Punchhi Commission (2010):

- National Integration Council: Proposes the creation of a superseding structure, the ‘National Integration Council,’ for matters related to internal security, enhancing coordination and effectiveness.

- Amendment to Article 355 and Article 356: Recommends amendments to Article 355 (Centre’s duty to protect states against external aggression) and Article 356 (President’s rule in case of state machinery failure) to curb potential misuse of powers and protect states’ interests.

- Subjects in the Concurrent List: Advocates consultation with states through the Inter State Council before introducing bills on matters in the Concurrent List, promoting cooperative decision-making.

- Appointment and Removal of Governors:

- Calls for Governors to refrain from active politics for at least two years before appointment.

- Recommends the Chief Minister’s involvement in Governor appointments.

- Proposes a fixed five-year term for governors and their removal only through a State Legislature resolution.

|

Also Read: Strengthening Cooperative Federalism for State Development Goals

Way Forward for Strengthening Indian Federalism:

- Reassess the Role of Governors:

- Conduct a comprehensive review of the governor’s role to ensure it aligns with the principles of Indian federalism, avoiding interference with states for central interests.

- Optimal Utilization of Inter-state Council:

- Ensure effective use of the Inter state Council as an institutional mechanism for fostering political goodwill between the Centre and states, particularly on contentious policy issues.

- Legal Guarantee for Fiscal Capacity:

- Legally guarantee the gradual expansion of states’ fiscal capacity without diminishing the Centre’s share, providing financial autonomy and balanced resource distribution.

- Electoral Reforms for Political Equity:

- Implement necessary electoral reforms to create a level playing field for regional political parties and leaders, fostering healthy competition between national and regional political forces.

- Empowerment of Local Self-Governments:

- Politically empower local self-governments, the third level of Indian federalism, to ensure their active participation and contribution, forming a crucial component for the overall strength of the Indian federalism structure.

Conclusion:

Addressing persistent frictions in Indian federalism requires a comprehensive approach, it’s crucial to work on issues like fiscal policies, institutional mechanisms, and political empowerment, ensuring a more cooperative federalism and effective governance system.

| Prelims Question (2017)

Which one of the following is not a feature to Indian federalism?

(a) There is an independent judiciary in India.

(b) Powers have been clearly divided between the Centre and the States.

(c) The federating units have been given unequal representation in the Rajya Sabha.

(d) It is the result of an agreement among the federating units.

Ans: (d) |

![]() 16 Nov 2023

16 Nov 2023