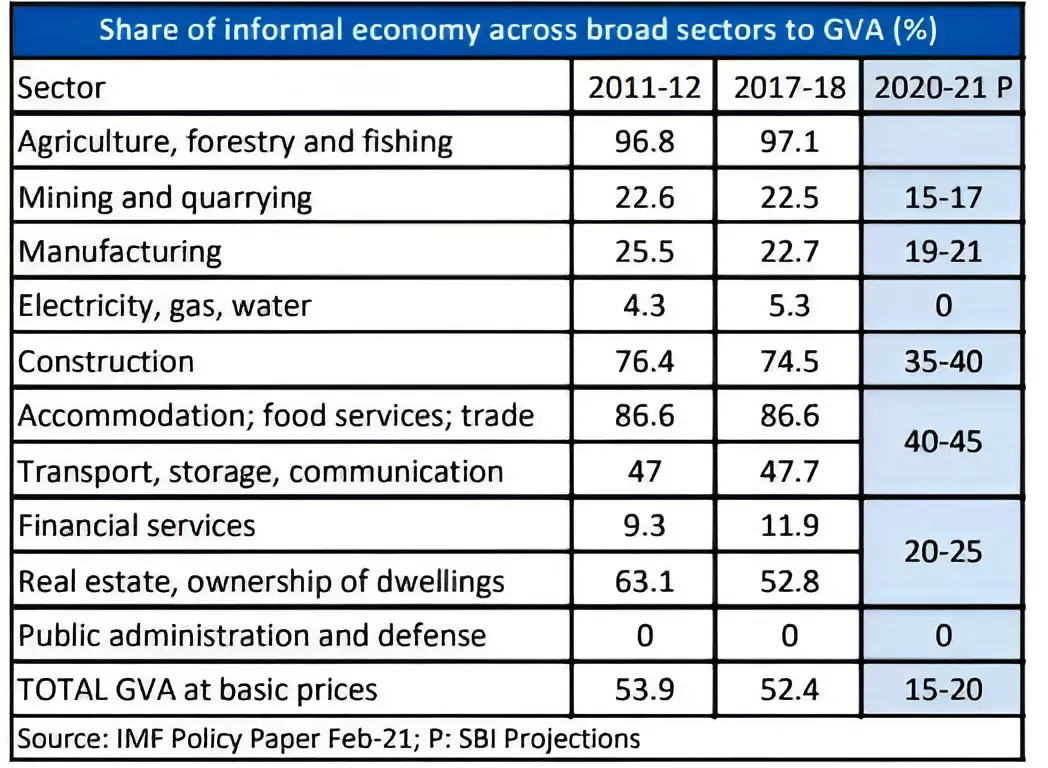

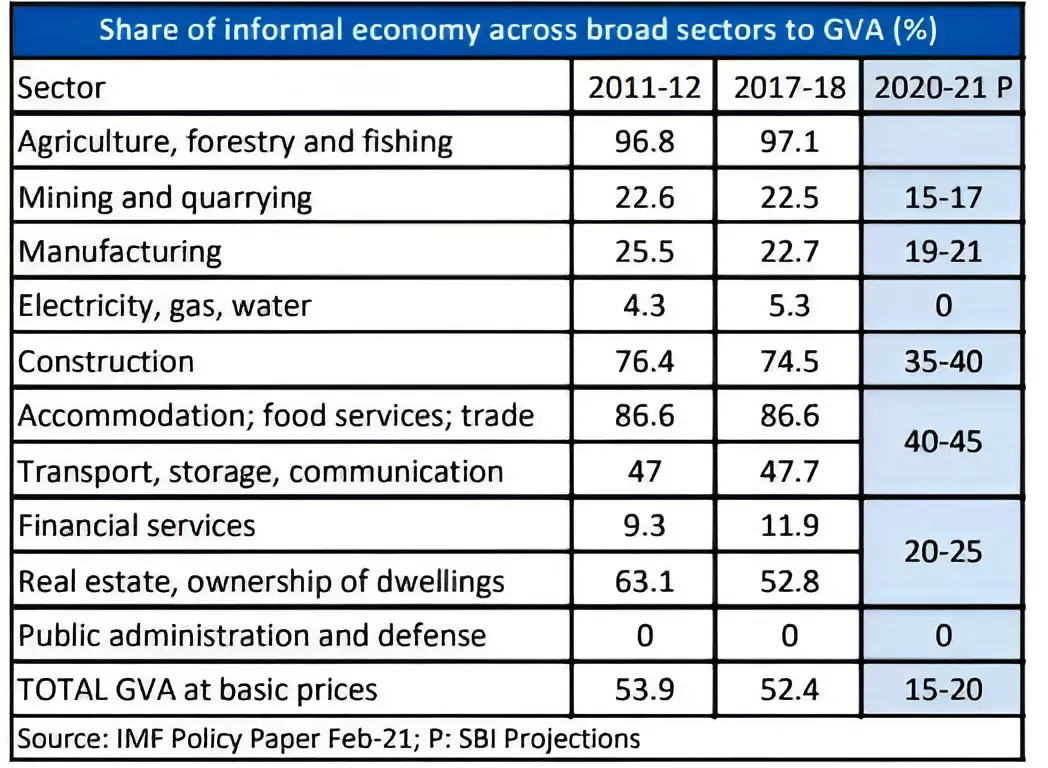

Recently, the Indian Staffing Federation (ISF), said that India with almost 85% informal labor, generating more than half of the country’s GDP, requires a structural shift towards structured and formal employment.

Indian Staffing Federation’s ‘India@Work: Vision Next Decade’ Blueprint Aims to Formalize Informal Workforce and Implement Labor Codes

- The ISF also unveiled “India@Work: Vision Next Decade,” a blueprint for formalization of the informal workforce and implementation of labor codes in the country.

- According to the e-Shram portal, over 94% of the informal sector workers enrolled on the e-Shram platform earn less than Rs 10,000 per month.

- Agriculture ranks first, accounting for 52.11% of all enrolments, followed by domestic and household employees and construction workers.

Enroll now for UPSC Online Course

Insights on the Indian Staffing Federation (ISF)

Indian Staffing Federation (ISF), known as the apex body for flexi staffing, is a platform which provides employment, work choice, compensation, social security and health benefits even for the temporary workforce.

- Purpose: To enhance long-term growth and ensure its continued ability to make positive contributions to the economy as well as the society through the services of the Staffing Industry.

- Focus: The principal focus of the Federation’s activities shall be triangular employment relationships, in which the staffing company is the employer of the temporary worker, who works under the supervision of the user company.

- Concerns Raised:

- Income inequality and poverty levels are rising.

- The plight of lower-income and semi-skilled workers are concerning and underscores the pressing need for concerted action.

- Aspects Considered: The ISF would be looking majorly into three crucial aspects to address the challenges posed: increasing the social security ambit; improving the concept of in-hand wage; implementation of labor codes; to minimize any obstacle to a favorable working condition.

- Actions Taken: As per the document, while the government is trying to address issues for the migrant workers, ISF was going beyond stop-gap solutions, inviting inclusion through formalization in the labor market.

- A noticeable distinction was seen during the pandemic, where the formal workforce, comprising less than 15%, had access to their social security, which aided them in overcoming the challenges.

The Informal Economy

- Refers: It is the diversified set of economic activities, enterprises, jobs, and workers that are not regulated or protected by the state.

- Activities Involved: The informal economy consists of activities that have market value but are not formally registered. Ex, domestic workers, waste pickers etc.

- Difficult to Measure: This is because activities within it cannot be directly observed and most of the participants in the informal economy do not want to be accounted for.

- Need for a Balanced Approach: It is crucial in addressing the informal economy, as it currently represents the only source of income and a critical safety net for millions of people.

Distinction between Formal and Informal Economy

| Basis |

Formal Economy |

Informal Economy |

| Contract |

Has a formal contract with the employer. |

Has no formal contract with his employer. |

| Work Condition |

Has pre-defined work conditions and job responsibilities. |

Has no systematic work conditions. |

| Salary and Wages |

Gets an assured and decent fixed salary with perks and incentives. |

Gets irregularly and unevenly paid. |

| Duration |

Has a fixed duration of work time. |

Has no fixed hours of work and mostly earns hand to mouth. |

| Grievance Redressal |

Is part of an organized group of people working in the same environment and is legally and socially aware about its rights. |

It lacks organized groups and people working in the same environment are rarely aware about their rights and have no forum to express their grievances. |

| Social Security |

Is covered by social security for health and liferisks. |

Is not covered by any kind of social security system and has poor knowledge about the need to protect himself socially and economically. |

| Example |

Companies like TCS, Bajaj, Accenture etc. |

Roadside hawkers and vendors |

Classification of Indian Workforce

The workforce can be classified into two categories: workers in the formal sector (organized sector) and workers in the informal sector (unorganized sector).

- Formal Sector: It includes public sector establishments and private sector establishments with 10 or more hired workers.

- The workers enjoy social security benefits and generally earn higher wages.

- Informal Sector: This Informal Sector in India encompasses a wide range of workers, including farmers, agricultural laborers, owners of small enterprises, self-employed individuals without hired workers, and non-farm casual wage laborers who work for multiple employers.

Workers in the informal sector do not enjoy the same level of social security, and their income can be irregular.

Workers in the informal sector do not enjoy the same level of social security, and their income can be irregular.- As per the Economic Survey, 2021-22, total number of people working in the unorganized sector is around 43.99 crores during 2019-20.

Problems Associated with the Informal Sector in India

- Low Wages and Exploitation: Informal employment lacks a written contract, paid leave, social security such as healthcare, pensions, and unemployment insurance, provision of minimum wages and appropriate working conditions.

- Working hours generally exceed the labor standards.

- Poor quality of life of unorganized sector workers than their organised sector counterparts also impact on the nutrition intake and resulting in severe health problems.

- Also, agricultural laborers and street vendors face seasonal unemployment and low wages, leading to income inequality and increased poverty.

- Impact on Women: Women are major informal participants but receive the fewest benefits and face lower salary, income volatility, and a lack of a strong social safety net, which in turn, impacts the women’s labor-force participation.

- According to the Periodic Labour Force Survey statistics, female labor force participation fell to 21.2% in March 2021, down from 21.9% the previous year.

- Tax Evasion: Informal economy’s firms are not directly regulated and they typically evade one or more taxes by concealing revenue and expenses from the legal system.

- It is a concerning issue for the government because a large portion of the economy is not taxed.

- Stunted Middle Class: Informal sector destroys workers’ effort to get ahead and become middle class regardless of the capability for hard work and a highly entrepreneurial spirit.

- They often struggle to access formal financial services such as bank loans and credit, in turn hindering their ability to improve their living standards.

- Lack of Policy Making: As there are no official statistics available, it is difficult for the government to formulate policies affecting the informal sector.

- Occupational Hazards: Waste pickers and recyclers face health risks due to poor working conditions and inadequate safety measures.

- Child labour is also prevalent in this sector.

Enroll now for UPSC Online Classes

Initiatives taken by the Indian Government for Informal Laborers:

- Make in India

- PM Vishwakarma Scheme

- E-Shram Portal

- Pradhan Mantri Shram Yogi Maan-dhan

- PM SVANidhi

- Pradhan Mantri Kisan Samman Nidhi

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

- Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM)

- Atal Pension Yojana

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- Deen Dayal Upadhyay Gramin Kausal Yojana

- Deen Dayal Antyodaya Yojana

- Pradhan Mantri Kaushal Vikas Yojana

- Introduction of the Goods and Services Tax (GST)

- Digital Payment System

- Production-Linked

- Labor Codes:

-

- Code of Wages, 2019

- Industrial Relations Code, 2020

- Social Security Code, 2020

- Occupational Safety, Health and Working Conditions Code, 2020

|

Challenges associated with the Formalization of the Indian Informal Sector

- Goods And Services Tax (GST) and Associated Complications: It is assumed that the higher revenue collections mean a more formal economy and vice versa. However, in trying to maximize GST collection, policymakers have made the GST extremely complicated.

- For instance, the productivity gains from the GST unifying the country into a single market have gone almost entirely to large businesses and digital startups whereas the compliance burden has put smaller firms at a disadvantage.

- Lack of Yields from Industrial Policy: A five-year package of $24 billion in production-linked incentives is provided to those who are willing to put up factories.

- High Uncertainty Regarding Job Security: The high insecurity due to a high degree of economic informality is making even some PhDs and engineers graduates to compete for a government office for stability of tenure and retirement benefits.

- Aging Population: By 2050, India’s elderly population would more than double to 350 million. This low-productivity work offers less chance to save for old age or medical emergencies.

- Social Challenge: Social norms and safety concerns curbs physical mobility of women who make up the majority of informal participants, yet they face lower salary, income volatility, and a lack of a strong social safety net.

- Meanwhile, Dalits, the caste groups at the bottom of a repressive, hierarchical ladder, are stuck in casual, daily-wage work.

- Manufacturing and Service Sector: A significant proportion of the manufacturing sector is fragmented and carried out mostly by small and micro enterprises, which do not possess the competitive efficiency to grow and create formal jobs.

- Access to Financing: The domestic credit-to-GDP ratio compares credit to people and businesses to the economy.

- The World Bank reports that India’s private sector domestic credit at 55% of GDP in 2020 is well below the global average (148%) and below China (182%), South Korea (165%), and Vietnam (148%).

Transformation in Asia:

- Defining Characteristic: The movement of low- productive informal (traditional) sector workers to the formal or modern (or organized) sector-known as structural transformation.

- East Asia: It witnessed rapid structural change in the second half of the 20th century as poor agrarian economies rapidly industrialized, drawing labor from traditional agriculture.

- India’s Case Study:

-

- Informality reduced at a very sluggish pace, manifesting itself most visibly in urban squalor, poverty and (open and disguised) unemployment.

- Despite witnessing rapid economic growth over the last two decades, 90% of workers have remained informally employed, producing about half of GDP.

- The share of formal workers in India stood at 9.7% (47.5 million) according to International Labour Organization’s (ILO) and India’s definitions.

- Periodic Labour Force Survey (PLFS) data shows that 75% of informal workers are self-employed and casual wage workers with average earnings lower than regular salaried workers.

- About half of informal workers are engaged in non-agriculture sectors which are spread across urban and rural areas.

|

Way Forward

- Creation of Database: There are no official statistics available that reflect the true state of the informal economy making it a sector with “invisible workforce”.

- As part of the National Data System, a comprehensive statistical base on many elements of the informal economy is required to enable policymakers to make informed decisions.

- Equal Wages and Salaries: Equal compensation for equal effort is a directive principle of state policy (Article 39(d)), but women farm laborers typically earn less than their male colleagues.

- Through appropriate legislative support and its proper implementation, the government should enhance and enforce this DPSP.

- Rationalizing Regulations: There is a need to relax restrictions for formal business conduct in order to pull informal work into the fold of formality.

- There is also a need to simplify registration processes that can help integrate the informal sector into the formal sector.

- A self-help group effort that gathers informal employees can help to foster self-sufficiency and address concerns linked to their working conditions.

- Collective Working: There is a need for workers to collaborate with others with complementary skills so that they can collectively perform and benefit from complex and high value-added tasks that none of them could do on their own.

- Universal Coverage: Leverage the eShram portal and collaborate with industry associations to gradually enrol all informal workforce of over 400 million into social security schemes.

- Schemes should be designed according to the needs of the informal workers.

- There is also a need to extend maternity benefits, accident and death compensation, etc.

- Strict Implementation of Labour Codes: These are required to to address current challenges of the informal sector and their workers.

- Skill Development and Upgradation: The time has come to equip informal workers with relevant skills to enhance employability and potentially transition them into the formal sector.

- Grievance Redressal Mechanism: Grievances from informal workers should be heard and redressed periodically through an accessible and officially monitored mechanism.

- Follow Recommendations of the Indian Staffing Federation (ISF):

- Need to initiate a structural shift towards formalization of the country’s informal workforce of over 400 million to ensure equitable opportunities and sustainable livelihoods for all.

- Need for removing employment bottlenecks

- Urgent implementation of the four labor codes in India, policy changes and encouraging schemes.

- Consideration of employment services as ‘merit services’, with lower GST slab tax rates at 5% with ICT benefits instead of the current 18% and linking of skilling initiatives to employment.

Enroll now for UPSC Online Course

![]() 30 May 2024

30 May 2024

Workers in the informal sector do not enjoy the same level of social security, and their income can be irregular.

Workers in the informal sector do not enjoy the same level of social security, and their income can be irregular.