Context:

- This article is based on the news “India’s Fiscal Future: Lots done, more to do” Which was published in the Live Mint. The robust performance of the Indian economy in recent times has revived the aspirations of the country to emerge as a developed economy by 2047.

India’s Current Fiscal Progress

- Decreasing Global Growth: The World Economic Outlook update of July 2023 by the International Monetary Fund (IMF) projects that global growth is estimated to fall from 3.5% in 2022 to 3% in 2023.

- Global Headline Inflation: It is expected to fall from 8.7% in 2022 to 6.8% in 2023.

- The report further notes that for most economies, the priority is to achieve the twin goals of sustained disinflation and financial stability.

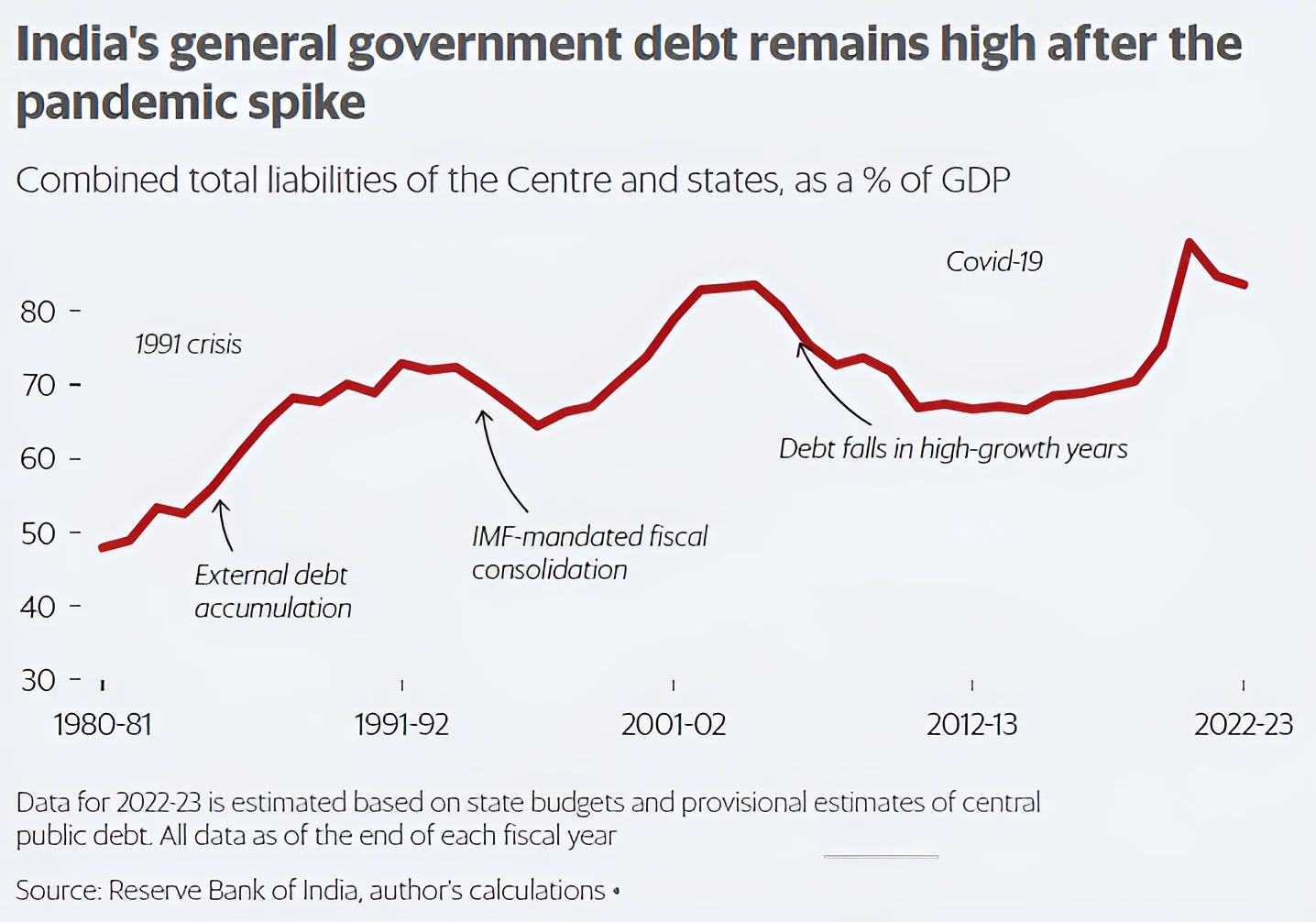

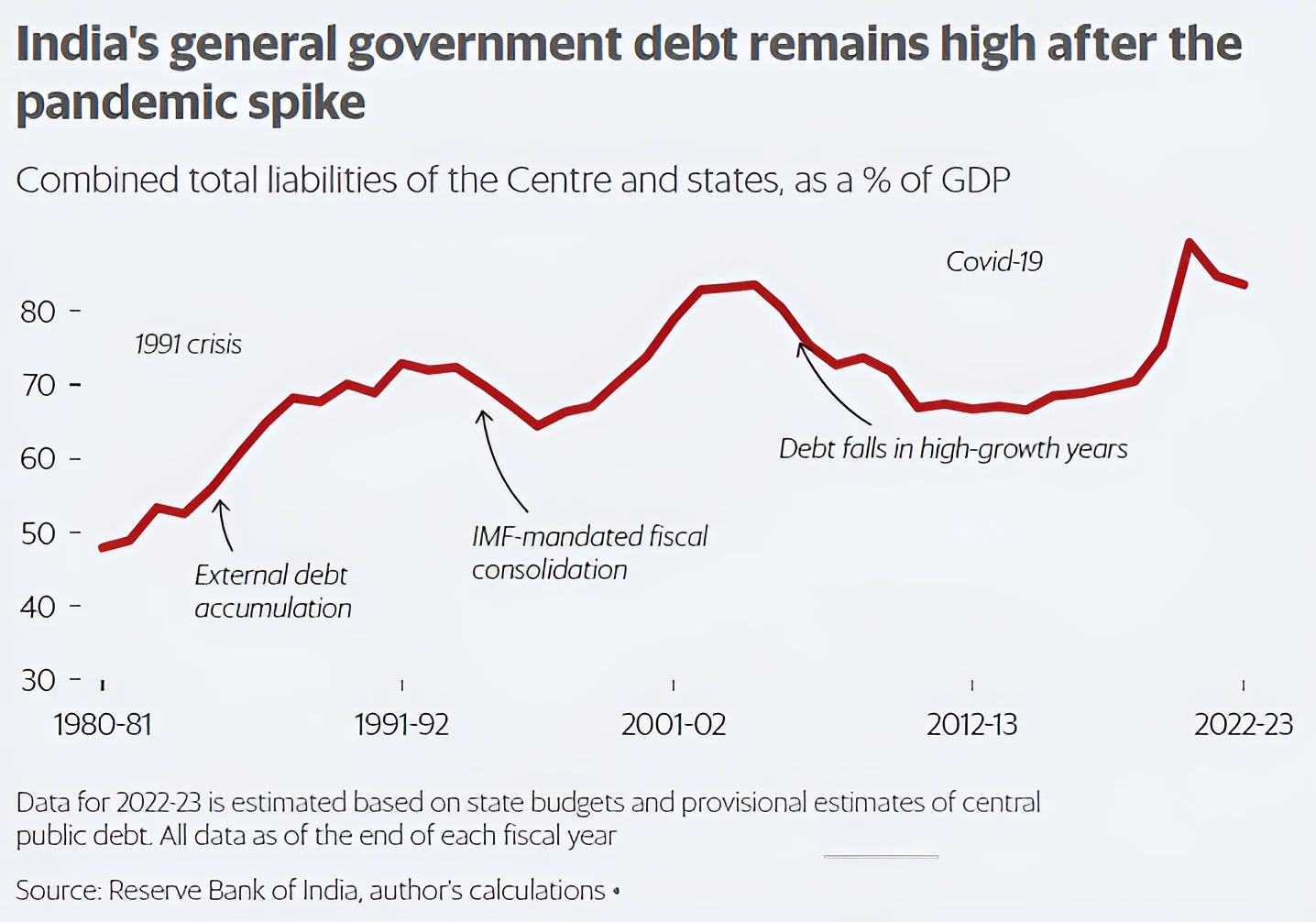

- India’s Central Government’s Debt: It stood at 57.1% of the GDP at the end of March 2023, which has reduced from 61.5% of GDP in 2020-21. General government debt is the total gross debt of the government at the end of a quarter or year.

- The N.K. Singh Committee recommended setting a limit of 60% for India’s public debt to GDP ratio (consisting of 40% for the Central Government and 20% for the state government’s debt).

Also Read: Government Preparing to Release Vision India 2047 Document

Current Status of Indian Economy

- High Central Expenditure: Capital expenditure has risen by 1.1% of GDP, and current expenditure has increased by almost double from 2018-19 to 2023-24.

- For instance, the effective capital expenditure of the Centre is budgeted at Rs 13.7 lakh crore, which will be around 4.5% of GDP.

- Limited States Deficit: States deficit hasn’t widened very much since the pandemic. Although revenues of the states fell sharply, they cut expenditure and thereby limited any fiscal slippage.

- Growing Tax Revenue: Tax revenue has been growing at a faster rate than national income this year. For instance, direct Tax collections up to 10th August 2023 show that gross collections are at Rs. 6.53 lakh crore which is 15.73% higher than the gross collections for the corresponding period of last year.

About Fiscal Deficit:

- When the balance of the government’s total receipts (i.e., revenue + capital receipts) and total expenditures (i.e., revenue + capital expenditures) turns out to be negative, it shows the situation of fiscal deficit.

- It indicates that the government is spending more than its income.

|

-

- This may have come from falling commodity prices, which have lowered production costs and raised corporate profits. High Subsidy Burden: India traditionally provided price subsidies for food, fertilizer, and kerosene oil.

- For instance, the Union Budget for 2023-24 allocated ₹1.75 trillion towards the fertiliser subsidy.

- In more recent years, it ventured into direct cash transfers, but this income support was added on to price support, rather than replacing it. As a result, overall subsidies are higher today than they were in 2018-19.

- Other Current Expenditures: After a careful reduction in the number of central government-sponsored schemes, these expenditures have been raised in recent years.

- The Centre has recently made a rule that if the states do not spend the money quickly, they will have to pay an interest penalty.

- With rapidly changing economic conditions, the Indian economy has remained resilient.

What are the reasons for resilience in the Indian economy?

- Sensible Management of Macroeconomic Conditions: At a time when unprecedented inflationary conditions necessitated significant monetary tightening in many large economies.

- India has been able to manage its price rise while ensuring that domestic demand did not collapse and infrastructure construction was escalated through a spike in public capital expenditure.

- Fiscal Consolidation: According to the Controller General of Accounts (CGA), India’s fiscal deficit for April- May 2023 stood at 11.8% of budget estimates as against 12.3% reported in the comparable period last year.

- In the Union Budget 2023-24, the Government has adhered to its fiscal deficit target of 6.4% of GDP for FY23 to promote resilience and macroeconomic stability.

- Once economic recovery strengthens, the Government may go for a large fiscal consolidation of about 1.5% over FY25 and FY26 to meet its medium-term fiscal deficit target of 4.5% by FY26.

- Improving Spending Quality: India’s fiscal finances are in better shape in terms of spending quality as capital spending, like on roads and rails by the central government has risen appreciably.

- At the same time, the state’s fiscal deficit is at pre-pandemic levels and the spending quality by states has also improved this year.

- Controlled Total Expenditure: It touched a lower 13.9% of the budget target in April- May 2023 as against 14.8% in the same period of the last fiscal.

Despite this resilience, it’s essential to note that challenges exist, and the impact of domestic policies and external factors can influence the economic scenario.

What challenges does the Indian economy face?

- Higher Fiscal Deficit Target: India’s GDP growth has been robust and it is forecasted by the Reserve Bank of India (RBI) to be 6.5% for the current year. However, despite GDP growth being back at pre-pandemic levels, the central government fiscal deficit at 5.9% target for 2023-24 is much higher.

- High-Interest Payment: India stands out for its high-interest bill, deficit, and debt, despite its annual growth being much higher than the world average.

- For instance, India’s interest bill exhausts 45-50% of its annual net tax revenue. The fiscal excesses will be more noticeable when a new private capex cycle begins and competes for funding.

- IMF Decreases India’s Estimated Growth: The IMF has marked down India’s estimated growth rate to 5.9 per cent for FY24.

- Softening global growth is already impacting India in terms of faltering exports and slowing foreign direct investment flows. At the same time declining consumption demand in the domestic market is a concern.

- Declining Tax and Other Revenues: Slower growth is anticipated to impact tax collections resulting in lower fiscal resources to support the economy as visible in a contraction of 9.6% in tax revenues in April-May 2023.

- The total receipts stood at 15.3% of budget estimates in April-May 2023 as against 16.7% in April-May 2022.

- Public Sector Borrowing: Some spending commitments have risen, for instance the extension of the free food scheme. This can negatively impact economic growth and fiscal stability and lead to crowding-out effect of government borrowing on private investment due to higher interest rates.

- External Factors like escalation of geopolitical stress (viz. Israel- Palestine conflict), global inflation, enhanced volatility in global financial systems, sharp price correction in global stock markets, and FDI inflows, etc. may constrain India’s pace of economic growth in the ongoing fiscal.

Way Forward:

- Lowering Fiscal Deficit: A useful goal is to get the fiscal deficit back to the last normal pre-pandemic year’s level of 3.4% of GDP. This would mean almost 2.5% of GDP consolidation from 2023-24 levels.

- Raising Additional Resources from Tax Collections: According to the 15th Finance Commission’s estimates, there is over a 4% gap in tax to GDP ratio between India’s tax collection potential and actual collections.

- For this, the Government could avoid large increases in income tax thresholds which would allow for a broadening of the income tax base further.

- Further, it is important to rationalize multiple GST rates into a simple three-rate GST structure viz. low (for essentials), standard (for most of the products), and high (for demerit and luxury goods) and lower the peak rate of 28%. This will help boost tax buoyancy and improve tax compliance.

- Increasing Non-Tax Revenue: By making renewed efforts to achieve the targets set under disinvestment, asset monetization, and diluting stakes in public sector banks, etc..

- For instance, the Government should fast-track disinvestment of public sector units and meet the revenue target of Rs. 51,000 crore for the current fiscal.

- Monetising idle government assets by the National Monetisation Pipeline (NMP) is yet another avenue for collecting non-tax revenues which can be used for capital creation.

- Expenditure Rationalisation: It would act to free funds available for investment. For this, non-merit subsidies which comprise 5.7% of GDP should be rationalised.

- Further, the Aadhaar-enabled direct benefit transfer for food and fertilizers should be continued so that the subsidy is delivered directly to farmers.

- The Fifteenth Finance Commission suggested to cease funding of Centrally Sponsored Schemes where allocation is small, below a certain threshold.

- Avoiding New Subsidies: Introducing any new subsidy scheme, apart from production-linked incentives, should be avoided unless it is an absolute imperative justified by social and economic considerations.

- A new subsidy scheme would lead to a substantial outgo of revenue expenditure and put further pressure on the fiscal deficit.

- Continue With Capital Expenditure: The Government should continue to focus on augmenting capital expenditure plans to kick-start the virtuous cycle of investment and growth.

- Besides, the targets under NIP and Gati Shakti should be completed on time.

- Independent Fiscal Council: India could also consider setting up an independent fiscal council to strengthen the fiscal responsibility framework, as suggested by the IMF.

Conclusion:

While India’s economy has demonstrated resilience through prudent fiscal management and strategic reforms, addressing challenges such as high fiscal deficit, interest payments, and external uncertainties remains crucial for sustained economic growth and stability.