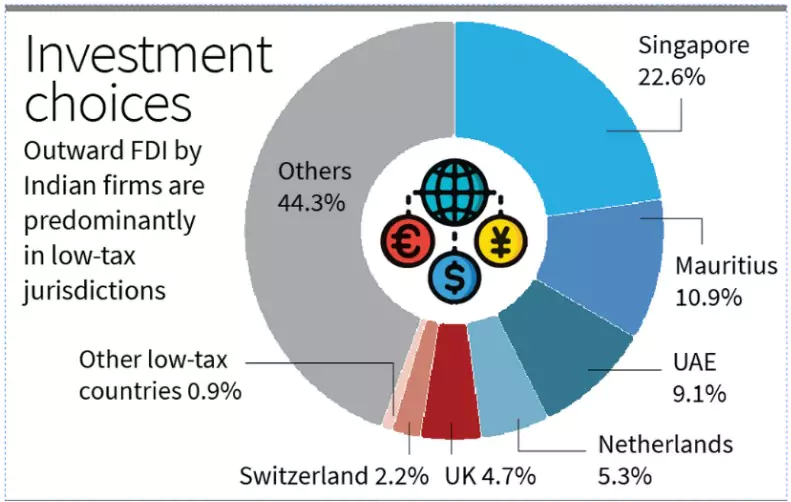

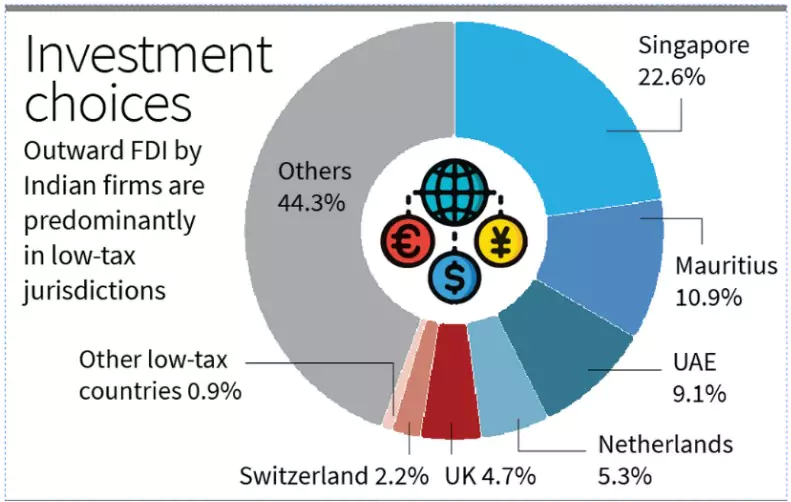

According to a RBI data, nearly 56% of India’s outward FDI in 2023–24 went to low-tax jurisdictions (commonly called tax havens) such as Singapore, Mauritius, UAE, the Netherlands, U.K., and Switzerland.

- In the first quarter of 2024–25, this figure rose to 63%.

- Foreign Direct Investment (FDI): Investment made by an individual/entity of one country into a business in another country, either by establishing business operations or acquiring business assets.

- Outward FDI: Investment made by Indian companies in foreign enterprises (through subsidiaries, joint ventures, or acquisitions) to expand globally.

- Tax Haven: A country/territory with very low or zero taxation, financial secrecy, and relaxed regulations, attracting foreign investors for tax efficiency.

- Examples: Mauritius, Singapore, Cayman Islands, Netherlands.

|

Outward FDI Trends

- Share of Tax Havens: In 2023–24, ₹1,946 crore of the total ₹3,488.5 crore outward FDI went to low-tax jurisdictions (56%).

- Key Destinations: Singapore (22.6%), Mauritius (10.9%), and UAE (9.1%) together accounted for more than 40% of total outward FDI.

Reasons Behind Preference for Tax Havens

- Intermediate Jurisdictions: Act as Special Purpose Vehicles (SPVs) for global expansion.

- Tax Efficiency: Lower tax liability in case of stake dilution or fund transfers.

- Investor Preference: Easier to attract global partners via Singapore/Mauritius than directly into India.

Regulatory Shield: Reduces exposure of Indian parent companies to domestic compliance/regulatory risks.

Regulatory Shield: Reduces exposure of Indian parent companies to domestic compliance/regulatory risks.- Ease of Operations: Flexible laws & fast fund movement compared to India.

- Fundraising Advantage: Capital raising is easier in such jurisdictions.

- Global Norm: Multinationals worldwide also use similar hubs.

Implications

Positive Implications

- Facilitates Global Expansion of Indian Firms

- Routing investments through Singapore or Mauritius allows Indian companies to set up Special Purpose Vehicles (SPVs) that serve as international hubs.

- Example: Infosys and Bharti Airtel use Singapore-based subsidiaries for Asia-Pacific operations.

- Helps in Joint Ventures & Access to Foreign Capital

- Tax havens with bilateral investment treaties and stable legal frameworks make it easier to attract foreign partners & venture capitalists.

- Example: Many Indo–U.S. or Indo–European joint ventures are structured through Singapore due to smoother legal processes.

- Provides Competitive Parity with Foreign Companies

- Since MNCs from other countries also use low-tax jurisdictions, Indian firms would be at a competitive disadvantage if they did not.

- Example: Global giants like Google and Apple use Ireland, Netherlands, Luxembourg, similarly Indian companies follow a similar path to remain globally competitive.

India’s Steps to Address Challenges of Tax Haven–Linked FDI

- Renegotiation of Tax Treaties: Double Taxation Avoidance Agreements (DTAAs) with countries like Mauritius (2016) and Singapore (2017) have been renegotiated to tighten capital gains exemptions.

- General Anti-Avoidance Rule (GAAR) – 2017: Introduced to check tax avoidance through complex arrangements and ensure fair tax practices.

- Transparency Mechanisms: Adoption of the OECD’s Common Reporting Standard (CRS) to improve information exchange.

- Profit Shifting Controls: Implementation of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan to reduce artificial profit transfers.

- Global Minimum Tax: Adoption of OECD’s Pillar 2 initiative to ensure a minimum effective tax rate on multinational enterprises.

- SEBI Regulations on Round-Tripping: SEBI has tightened norms for Foreign Portfolio Investors (FPIs), especially from Mauritius, restricting opacity in beneficial ownership.

- Black Money (Undisclosed Foreign Income & Assets) Act, 2015: Provides for strict penalties & prosecution for undisclosed foreign assets; Allows confiscation of assets and imprisonment up to 10 years.

|

Concerns

- Profit Shifting and Tax Base Erosion

- By booking profits in Mauritius or Singapore subsidiaries, Indian firms minimise domestic tax liability, reducing India’s corporate tax revenues.

- Example: Past misuse of the India–Mauritius Double Taxation Avoidance Agreement (DTAA) for “round-tripping” investments.

- Regulatory Arbitrage and Weak Oversight

- Firms exploit gaps between Indian rules and foreign jurisdictions, making it harder for Indian regulators (RBI, SEBI, ED) to monitor flows.

- Example: PMLA and ED cases often involve complex layering through overseas shell entities.

- Tariff Impacts & Value Addition Abroad

- With U.S. tariffs on Indian exports, companies may relocate part of their manufacturing or processing abroad via these SPVs to bypass tariffs.

- Implication: Loss of domestic value addition and employment.

- Policy Challenge – Balancing Competitiveness with Tax Revenue

- Over-regulation may deter global competitiveness; under-regulation risks loss of tax income & illicit flows.

- Example: Debate over GAAR (General Anti-Avoidance Rules) and India’s renegotiation of tax treaties with Mauritius, Singapore, and Cyprus to plug misuse.

![]() 16 Sep 2025

16 Sep 2025

Regulatory Shield: Reduces exposure of Indian parent companies to domestic compliance/regulatory risks.

Regulatory Shield: Reduces exposure of Indian parent companies to domestic compliance/regulatory risks.