The Economic Survey highlighted that India is moving up the global value chains (GVCs), with the share of GVC-related trade in gross trade rising to 40.3% in 2022 from 35.1% in 2019.

- Asia is the primary beneficiary of shifting supply chains and India has received the most interest from firms (28 out of 130 firms) regarding setting up or expanding production facilities, followed by Vietnam, Mexico, Thailand, Malaysia and Indonesia.

About Global Value Chains (GVC)

It is international production sharing, where operations are spread across national borders (instead of being confined to the exact location), producing a complex product.

- Refers: According to the World Bank, a GVC is the series of stages in the production of a product or service for sale to consumers. Each stage adds value, and at least two stages are in different countries.

- Example: A bike assembled in Finland with parts from Italy, Japan, and Malaysia and exported to the Arab Republic of Egypt is a GVC. Hence, a country, sector, or firm participates in a GVC if it engages in (at least) one stage in a GVC.

Global Trend of GVC: Following trend has been observed:

Global Trend of GVC: Following trend has been observed:

- Hyperglobalisation: It includes the period of early 2000s that saw rapid GVC expansion worldwide. This led to exponential gains in trade, reductions in supply chain costs and deep interlinkages in trade across nations.

- Slowbalisation: A dramatic shift from “hyperglobalisation” to “slowbalisation” occurred following the 2008 global financial crisis (GFC).

- Recent Instances of Risks and Uncertainties surrounding GVCs: China-US trade war, the COVID-19 pandemic, and the Russia-Ukraine conflict.

- Reversal of Trend: WTO’s GVC Development Report 2023 showcases recovery in GVCs, underscored by a rise in the share of foreign export inputs and enhanced participation rates of economies worldwide.

- Need for GVCs:

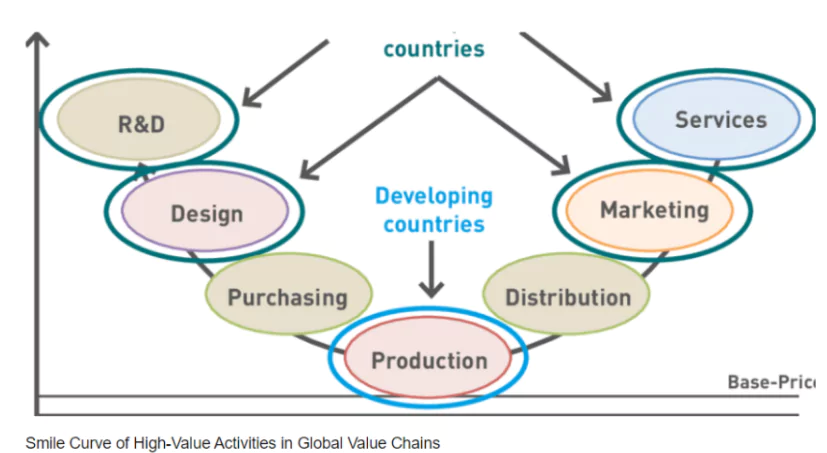

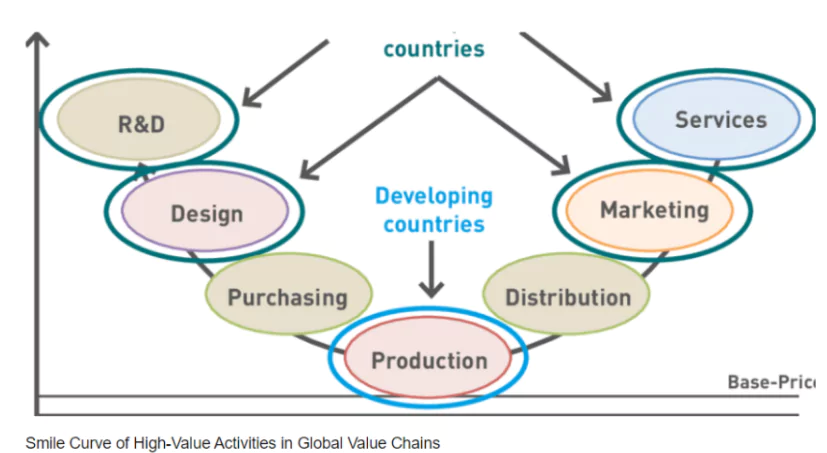

- Better Development: With GVC-driven development, countries generate growth by moving to higher-value-added tasks and by embedding more technology and know-how in all their agriculture, manufacturing, and services production.

- Better Living Standards: GVCs are a powerful driver of productivity growth, job creation, and increased living standards. Countries that embrace them grow faster, import skills and technology, and boost employment.

Enroll now for UPSC Online Course

India’s Rising Global Value Chains (GVC) Participation

The WTO’s World Integrated Trade Solutions (WITS) database shows that India’s GVC related trade increased nearly four times from USD 62.9 billion in 2010 to USD 233.1 billion in 2022.

- Trend in India’s GVC Participation: India’s GVC participation rose steadily through the 1990s and 2000s before the GFC, after which it started declining. Example, the foreign value added content of India’s exports rose from 10% in 1995 to 22% in 2009 (the second highest amongst BRICS nations, after China).

- India’s GVC trade grew at a CAGR of 14.6% between 2018 and 2022. This is higher than the CAGR of 13.3% between 2014 and 2018 and 6.9% between 2010 and 2014.

- Evidence of India’s enhanced GVC Participation: It is reflected in increased investment by foreign firms in electronics, apparel and toys, automobiles and components, capital goods and semiconductor manufacturing in India.

- India’s large domestic consumer market is an added attraction.

- Examples: Apple assembled 14% of its global iPhones in India in FY24. Foxconn invested in Karnataka and Tamil Nadu to set up new manufacturing plants for components.

- Essential products driving India’s GVC Participation: It include coal and petroleum, business services, chemicals, and transport equipment.

- Change in the Sectoral Composition:

- Within the manufacturing sector, the share of low-technology manufacturing has declined, while the share of medium and high-technology manufacturing has been rising.

- Exports of IT and technology-enabled services lead India’s GVC services exports. Further, GVC participation in services has gradually matured from low-value-added business process outsourcing (BPO) services to high-value-added services, such as those provided by global capability centres (GCCs).

Rising backward GVC Participation: Previously, India’s GVCs involved a higher level of forward participation, which resulted in lower value-addition for exports within the country. However, in recent years, India has begun to move downstream and export finished goods to the rest of the world.

Rising backward GVC Participation: Previously, India’s GVCs involved a higher level of forward participation, which resulted in lower value-addition for exports within the country. However, in recent years, India has begun to move downstream and export finished goods to the rest of the world.

- Forward GVC participation is producing and shipping inputs that are further re-exported and backward GVC participation is using imported inputs to produce goods that are shipped abroad.

- Supportive Data: This can be seen in the rise in the share of pure backward GVC participation from 13.8% in 2019 to 16.3% in 2022.

- The share of pure backward participation in gross trade increased from 12.1% in 2019 to 14% in 2022. In contrast, the share of pure forward GVC participation (or upstream participation) in trade has declined from 19.1% in 2016 to 17.6% in 2022 in sectors such as retail trade, coke, refined and nuclear fuel, chemicals and primary and fabricated metals, among others.

- Gained Sectors: Food and beverages, electrical and optical equipment, and financial intermediation, among others, have witnessed a remarkable increase in backward GVC participation.

Significance: Greater backward GVC participation results in higher absolute levels of gross exports, domestic value-added, and employment.

Significance: Greater backward GVC participation results in higher absolute levels of gross exports, domestic value-added, and employment.

- Supportive Programs: India’s GVC participation has started to pick back up again after the dip observed in the years following the global financial crisis, due to incentives offered by programs like the Production Linked Incentive Scheme (PLI) and the Districts as Exports Hub (DEH) initiative.

Factors for India’s Emergence as an Attractive Supply Chain Hub

Following factors are responsible for India’s emergence as an attractive supply chain hub:

- Competitive Factors:

- Lower Costs in Southeast Asia: India, like Southeast Asian countries, offers cost advantages to foreign companies, including cheap labor and fiscal incentives.

- Potential Complement to China: India can complement China as a manufacturing hub, benefiting from technology transfers and creating value-added jobs.

- Sophisticated Manufacturing Sectors: India’s automotive, pharmaceutical, and electronics assembly sectors are already advanced, positioning them as potential winners in the global supply chain landscape.

- This is seen in early technology transfer in the product cycle of the technologically advanced Mercedes Benz EQS to India, and Foxconn Technology Group developing a chip-making fabrication plant in Gujarat.

- Global Perspective:

- Shifting Perception: India’s ranking as the fifth-largest importer of intermediate goods in 2022 Q4 suggests a changing perception of its supply chain potential.

- Export Growth Potential: India has the potential to double its 1.5% share of world exports of intermediate goods, indicating its growing role in global supply chains.

- The countries ahead of India are China (23.4%), the US (16.2%), Germany (9.1%), and Hong Kong (6.0%).

- Service Sector Opportunities: India’s service sector, including IT, back-office operations, financial services, and logistics, holds growth potential.

- Trade Policy Initiatives: The Indian government’s emphasis on preferential trade through bilateral agreements with partners like the UAE and Australia.

Government Initiatives to Boost Manufacturing and Supply Chains

Following measures have been taken by the Indian Government to boost manufacturing and supply chains in India:

- Production Linked Incentive (PLI) Schemes: Introduced in sectors like automobiles, electronics, and medical devices to incentivize both multinational enterprises and domestic manufacturers.

- Indian Districts as Export Hubs: It was launched in August 2019 to foster balanced regional development across all districts of the country. India’s Foreign Trade Policy 2023 reiterated the role of DEH in India’s export efforts.

- Objective: To select, brand, and promote the sale of products from each district in the domestic and international markets.

- Through the DEH initiative, the Government aims to boost manufacturing and exports from urban areas while focusing on generating interest and economic activity in the rural hinterland.

- Significance: The DEH initiative provides a broad base to promote financial inclusion and facilitate logistical and infrastructural support to engage all districts of the country in developing at least a commodity for the global market and thus promoting exports.

- The bottom-up approach helps India establish a direct link between production units and meet national export obligations.

- National Logistics Policy (NLP): In 2022, the central government launched the NLP to ensure the required efficiency in the logistics sector.

- The country has set a goal of raising its LPI score to rank among the top 25 by the year 2030.

- PM Gati Shakti Plan and National Logistics Policy: Focus on developing world-class infrastructure and improving logistics capabilities.

- Aim: To reduce the cost of logistics from 13-14% of GDP to less than 8%.

- Digital Payments and E-commerce Initiatives: Unified Payments Interface (UPI) has encouraged even street hawkers to adopt digital payments.

- The Open Network for Digital Commerce (ONDC) Initiative: It aims to empower small-scale firms in the e-commerce sector, offering various goods and services.

Check Out UPSC CSE Books From PW Store

Challenges in integrating India with the Global Value Chains

Despite so much progress, India’s GVC participation (GVC-related trade as per cent of gross trade at 40.3% in 2022) is still lower not only in comparison to large economies such as the USA (43.7%), UK (47.8%) and Japan (46.6%), but also its Asian counterparts, such as South Korea (56.2%) and Malaysia (60%).

- Domestic Policy Challenges: Enterprises in India grapple with complex tax policies and procedures. The substandard quality of infrastructure poses significant obstacles.

- Uncertainty in trade policy adds to the challenges of scaling up production in the country.

- Quality and Institutional Support: Indian firms struggle to meet international quality standards. They often lack the necessary institutional support.

- Inadequate access to essential information further hinders their integration into GVCs.

- High Logistics Costs: High logistics costs in India, accounting for around 13-14% of GDP, are impacting its competitiveness adversely compared to developed nations where logistics costs are lower (8-10% of GDP).

Way Forward

To further embrace GVCs and enhance participation, there is a need to develop quality trade infrastructure, integrate micro, small and medium enterprises in the GVC network, simplify procedures for entry and exit of small businesses, and work towards trade facilitation measures.

- More Investment: India needs to continue investing in its physical infrastructure to maintain its cost competitiveness, increase productivity, and scale up production, develop capacities, acquire new capabilities, upgrade existing ones, improve trade facilitation, and incorporate MSMEs to increase GVCs integration.

- Policies and Regulations: Geopolitical developments will accelerate the shift in GVCs, and India needs to ensure its policies, schemes, and incentives focus on enabling ease of doing business, providing cost advantages, avoiding delays, and reducing bureaucratic entanglements.

- Import procedures need to be streamlined and hidden trade barriers reduced.

- Encourage the Development of the Research Ecosystem in Educational Institutions: By incentivizing partnerships between industries and educational institutions, facilitating partnerships between leading Indian and foreign education and research institutions, increasing R&D funding in key institutions, and introducing research-intensive education programs.

- On Intellectual Property (IP): India needs to increase R&D funding of its departments, incentivize the private sector to undertake research activities, increase awareness of IP among domestic entities, introduce a framework for IP-backed financing, increase the capacity of enforcement agencies, fast-track applications, and provide faster resolutions to IP disputes.

- Promotion of Export-Oriented FDI: Maintain an open-door policy for foreign direct investment (FDI) in manufacturing.

- Offer competitive fiscal incentives and create modern special economic zones through public-private partnerships.

- Simplify business processes through digitalization of tax, customs, and administration.

- Pursue high-quality free trade agreements to facilitate global trade.

- Smart Business Strategies for Local Companies: Small and mid-sized enterprises should act as industrial suppliers and subcontractors to larger exporters.

- Consider business strategies such as mergers, acquisitions, and alliances with multinationals and large local companies.

- Invest in domestic technological capabilities to meet international standards in terms of price, quality, and delivery.

- Policy Initiatives for South Asia: The Indian government should consider two policy initiatives to promote regional supply chains.

- Make in South Asia Programme: Expand the “Make in India” initiative to a “Make in South Asia” program.

- Offer fiscal incentives to Indian manufacturers to expand into Bangladesh and Sri Lanka, focusing on industries like food processing, textiles, apparel, and automotive.

- Comprehensive FTAs: Establish comprehensive bilateral Free Trade Agreements (FTAs) with Bangladesh and upgrade the Indo-Sri Lanka FTA.

- Strengthen regional rules-based trade and investment to integrate these countries into supply chain activities centred on India.

Enroll now for UPSC Online Classes

![]() 25 Jul 2024

25 Jul 2024

Global Trend of GVC: Following trend has been observed:

Global Trend of GVC: Following trend has been observed:

Rising backward GVC Participation: Previously, India’s GVCs involved a higher level of forward participation, which resulted in lower value-addition for exports within the country. However, in recent years, India has begun to move downstream and export finished goods to the rest of the world.

Rising backward GVC Participation: Previously, India’s GVCs involved a higher level of forward participation, which resulted in lower value-addition for exports within the country. However, in recent years, India has begun to move downstream and export finished goods to the rest of the world.

Significance: Greater backward GVC participation results in higher absolute levels of gross exports, domestic value-added, and employment.

Significance: Greater backward GVC participation results in higher absolute levels of gross exports, domestic value-added, and employment.