Asia-Pacific Climate Report shows that India is committed to reducing its dependence on fossil fuels and aims to achieve net-zero emissions by 2070.

About Net zero

- It is the balance between the amount of greenhouse gas produced and its removal from the atmosphere.

- This balance can be established through emission reduction and removal.

- Significance:

- It is important for reducing global warming.

- Reduction of impact of climate change such as extreme weather events and disruptions to ecosystems.

- Supports long term environmental sustainability.

Enroll now for UPSC Online Classes

India’s Shift: From Fossil Fuel Subsidies to Clean Energy Investments

- Transition Goal: India’s focus has shifted from heavy fossil fuel reliance to fostering clean energy through subsidy reforms and renewable investments.

- Fossil Fuel Subsidy Reform

- Key Strategy: India has adopted a “remove, target, and shift” approach, reducing fossil fuel subsidies to support clean energy development.

- Impact: From 2014 to 2018, India reduced fossil fuel subsidies significantly, enabling funds to be redirected towards renewable energy projects like solar power and electric vehicles.

Difference between gross zero and net zero

|

| Aspect |

Gross Zero |

Net Zero |

| Definition |

No greenhouse gas (GHG) emissions are produced. |

GHG emissions are balanced by removals. |

| Goal |

Complete elimination of emissions. |

Balance emissions with removals. |

| Achievement |

Requires significant reduction in all emissions. |

Achieved through reduction and offsetting. |

| Feasibility |

More challenging to achieve. |

More achievable in the short term. |

| Impact |

Ideal end-state target. |

Intermediate step towards reducing overall emissions. |

Key Findings of the Asia–Pacific Climate Report

- Effective Subsidy Reform: India’s “remove, target, and shift” approach has led to an 85% reduction in fossil fuel subsidies.

- Tax-Funded Renewable Energy: Taxes on coal production have played a crucial role in financing clean energy projects and infrastructure.

- Challenges with GST Integration: The redirection of coal Central Excise and Service Tax funds under GST highlights challenges in maintaining funding consistency for clean energy.

- Renewable Energy Growth: The report showcases India’s increased investments in solar energy, electric vehicles, and a resilient energy grid.

Key Recommendations for Climate Adaptation in Asia-Pacific

- Coordinated and Urgent Climate Adaptation

- Implement immediate and unified adaptation efforts across multiple sectors to counter climate impacts in the Asia-Pacific region.

- Improved Climate Risk Assessment and Awareness

- Enhance the processes for assessing and communicating climate risks to support informed decisions in both government and private sectors.

- Climate Adaptation in National Development Plans

- Embed climate adaptation strategies within national development plans to promote resilient growth, prioritising key sectors like water resources, agriculture, and social protection.

- Expanded Climate Adaptation Financing

- Increase climate adaptation funding by using blended finance models, which combine public and private resources, to close funding gaps and support sustainable resilience.

- Strengthened Institutional and Market Support

- Build institutional capacity, reform markets, and encourage public-private partnerships to drive effective and lasting climate adaptation investments.

Check Out UPSC NCERT Textbooks From PW Store

About Asia-Pacific Climate Report

- The Asian Development Bank (ADB) created the Asia-Pacific Climate Report to examine climate change issues specific to the Asia-Pacific region.

- Objective: To provide clear insights and policy recommendations to help address and manage climate challenges.

- Main Focus Areas

- Climate Vulnerability: Analyses the region’s susceptibility to climate impacts and identifies high-risk areas.

- Impact and Cost Projections: Estimates the potential economic and social costs associated with climate change.

- Priority Actions for Adaptation and Mitigation: Proposes urgent actions for reducing climate risks and building resilience in the region.

Key Initiatives for Clean Energy Transition

- Fossil Fuel Subsidy Reform

- Strategic Phasing Out: India gradually reduced petrol and diesel subsidies from 2010 to 2014.

- Tax Adjustments: Incremental tax hikes on fossil fuels from 2014–2017 helped create funding for renewable energy projects.

- Significant Cuts: Between 2014 and 2018, fossil fuel subsidies were slashed, freeing up resources for clean energy investments.

Role of Taxation in Supporting Clean Energy

Role of Taxation in Supporting Clean Energy-

- Coal Central Excise and Service Tax (2010–2017): A tax on coal production and imports helped fund renewable energy initiatives.

- Fund Allocation: About 30% of coal Central Excise and Service Tax collections supported clean energy projects through a dedicated fund.

- GST Changes: After 2017, the Central Excise and Service Tax was absorbed into GST, which redirected these funds for state compensation rather than clean energy.

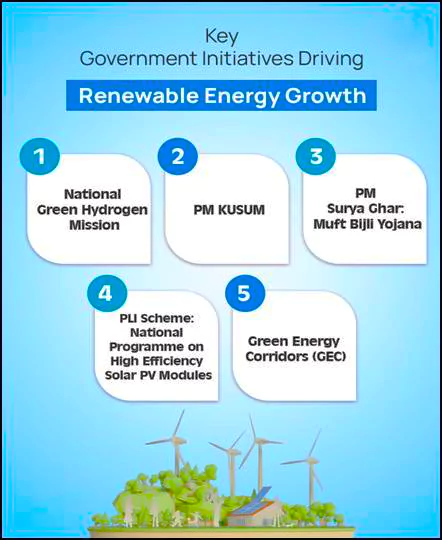

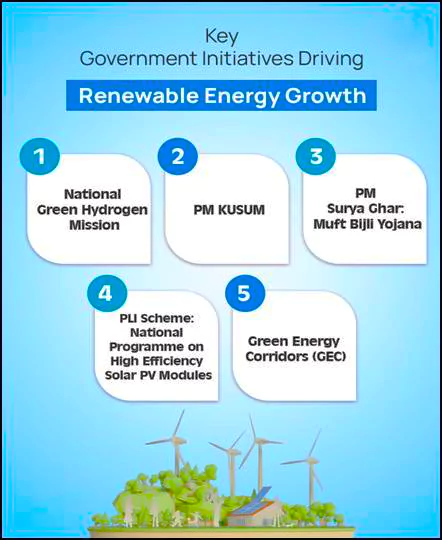

- Major Clean Energy Programs

- National Green Hydrogen Mission: Focuses on promoting hydrogen as a clean energy source.

- PM-KUSUM Scheme: Encourages renewable energy use in agriculture, benefitting farmers and reducing fossil fuel dependency.

- PM Surya Ghar: Muft Bijli Yojana: Expands access to renewable energy and enhances rural energy availability.

Conclusion

- India’s Progress: India’s reforms are driving a shift toward sustainable energy, setting an example for other nations.

- Economic and Social Impact: Reductions in fossil fuel subsidies and new taxation measures have not only supported clean energy but also contributed to economic growth and job creation.

- Commitment to Climate Goals: India’s efforts reflect a long-term commitment to combating climate change while fostering an inclusive energy landscape.

![]() 6 Nov 2024

6 Nov 2024

Role of Taxation in Supporting Clean Energy

Role of Taxation in Supporting Clean Energy